TL;DR summary

Bitcoin could be the most useful asset in a generation. The reason that many in the West do not see it is because we live in a country who does not experience the three problems of hyperinflation, being unbanked, or experiencing autocratic rule that the majority of the world experience at least one of.

To these people, there is mounting evidence that Bitcoin not only can, but already is, making meaningful differences to both freedom of expression and quality of life.

Introduction

My first assessment of Bitcoin was “Speculative asset that does nothing useful but uses lots of energy.”

Sound familiar?

What I learnt was that it was only my ignorance combined with me inability to imagine the lives of others living outside the West that had me believe this.

The reality is that Bitcoin is in the same pantheon as the smartphone and the Internet itself in terms of its utility. But unlike its predecessors, it helps people in the global South first – the West last.

That’s probably why most people (like me) in the West initially fail to see its utility to them, and therefore assume it has no utility to anyone.

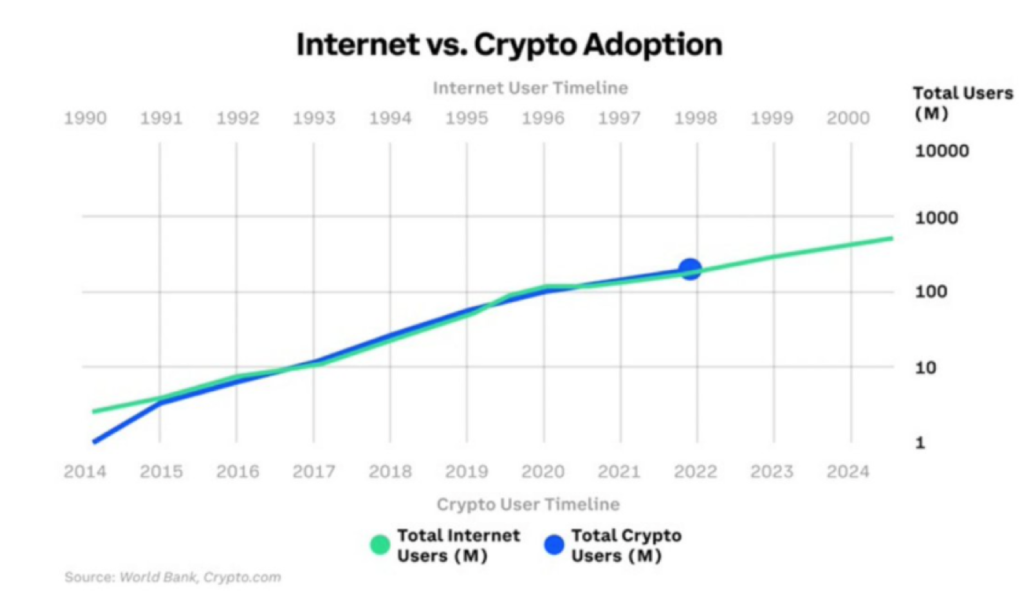

Bitcoin analyst Willy Woo estimates there are 100Million+ users of Bitcoin, rising exponentially.

Here’s a demographic snapshot of who they are and why they use it:

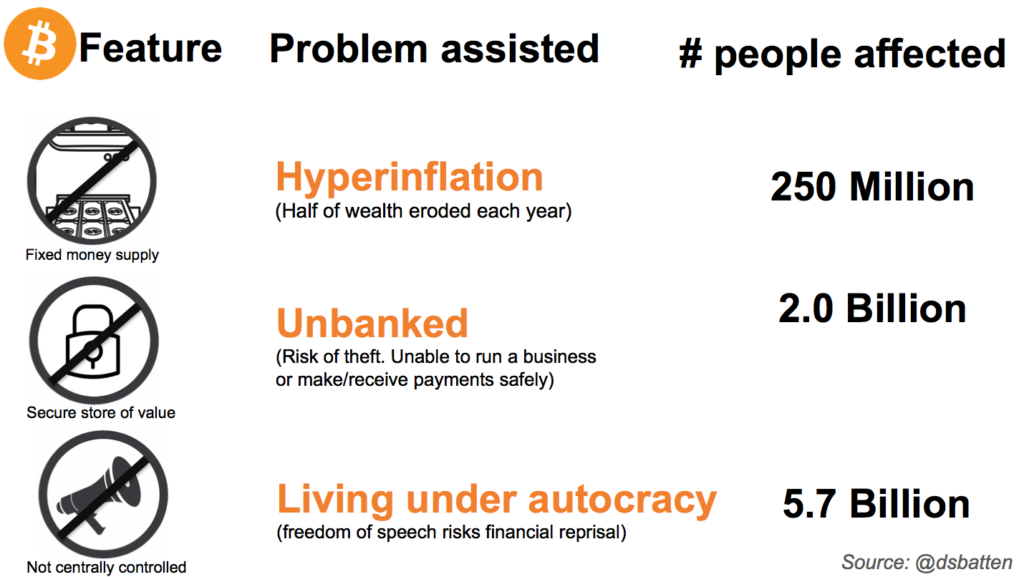

There are 2.0 Billion people who are unbanked – 55% of them are women, and analyzing Business Insider data, it would appear that ~90% are people of color.

There are 5.7 Billion people living under autocratic or semi-autocratic regimes, where the financial system can be used against them (eg: state freezing of bank accounts, censoring and surveillance of how you spend money)

There are 10.97 Million adult women in Afghanistan who are prohibited by law from opening a bank account, starting a business or receiving an income because of their gender. (Source: 19.4 Million women in Afghanistan, 56.57% of whom are of adult age).

There are >250M people who’s economies are experiencing hyperinflation (including Turkey, Lebanon, Argentina, Venezuela)

These are the people who see the utility of Bitcoin first. Not us in the West who take for granted our privilege, human rights, functioning banking system, 99%+ access to banking, and relatively low inflation.

You may be thinking “so what – how does Bitcoin help these people?”

It helps the unbanked, because you don’t need a bank. A feature-phone (yes, like the one you had in 1999) plus some basic Bitcoin education is all you need to receive, save and pay. There’s a financial revolution happening in Africa right now: the poorest in the world are leapfrogging the banking sector and going directly to Internet-native money (Bitcoin). This is one of the reasons that the continent of Africa is adopting Bitcoin faster than any other continent.

Bitcoin helps people in autocratic regimes because they cannot be surveilled, censored, de-platformed or frozen by the State. This, together with the fact that Bitcoin functions like a bank for many Nigerians, is why Nigeria is one of the biggest adopters of Bitcoin. It’s driven by human rights activism. For example, after state Government froze protester bank accounts, Bitcoin provided a way for the Nigerian people to continue their protests against the government’s death squads – SARS. (Source )

It helps women in Afghanistan, because they can (and do) adopt bitcoin Lightening Wallets, which means state discrimination cannot deny them financial equity. Around the world, it helps women to pay, be paid, set up bank accounts and businesses in 75 economies, representing 2.4 Billion women, where women do not have the same economic rights as men.

It helped 1000s of refugees fleeing from Ukraine, who could not take out hard cash with them,

It helps those living with hyperinflation because it allows them to avoid 10 years of life saving being reduced to 1/2 its value inside a year.

It allows people in countries where banks have closed and refuse to return funds such as Lebanon to have a “lifeline” (Yahoo Finance) via a safe store of value.

It allows overseas family members to wire funds to support their family to buy basic needs without the significant bank fees and inconvenience of Western Union money transactions. This is of particular value to citizens in Central, Latin America, Pacific Islands, Africa).

It allows people in rural areas to pay utility bills without a ½ day round trip to a bank to pay in person (as is the case in several nations in Central America, including El Salvador.

It allows people to send money without fear of it being intercepted by Govt (Palestine)

These are not theoretical use-cases these are current-day, well documented, ways that Bitcoin is being used in the world already. As user adoption and education increases, the value as a means of preserving and increasing human rights, particularly in the global south, looks certain to rise even further.

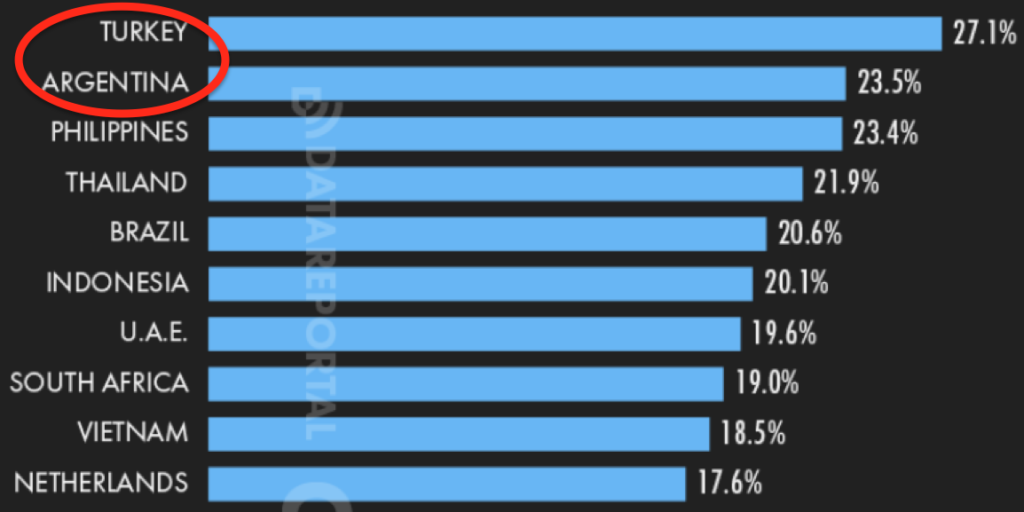

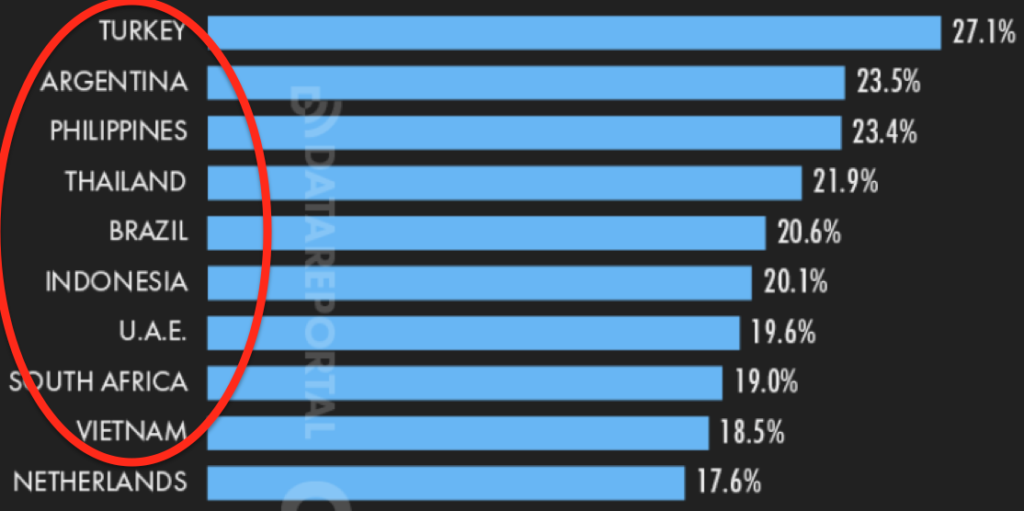

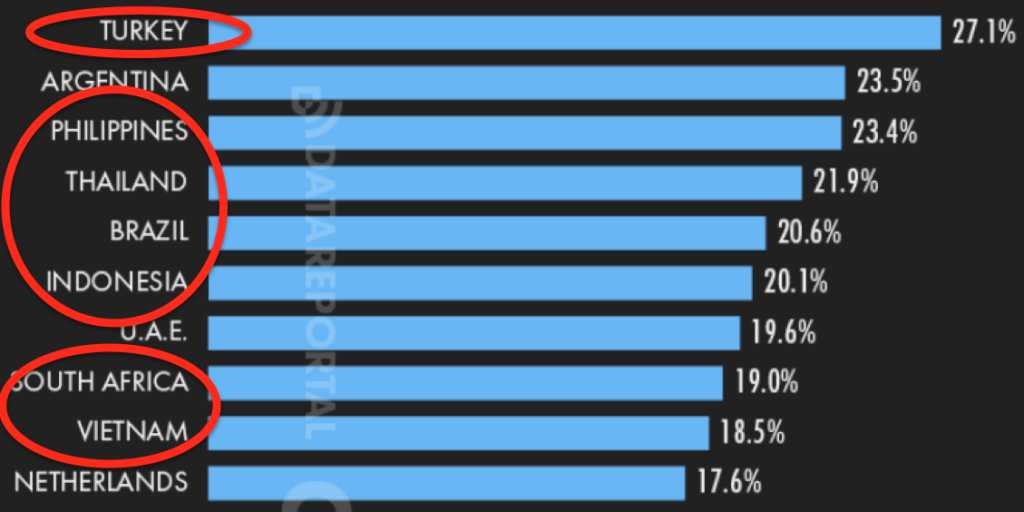

That’s why it is unsurprising that of the top 10 nations adopting Bitcoin

1. Top 2 nations are experiencing hyperinflation

2. 9/10 are autocratic or semi-autocratic regimes

3. 7/10 from the Global South (Africa, Latin America or SE Asia)

Source: Datareportal, Jan 2023

Most technologies (including telephony, the electrical grid, the banking system) roll out in the West first, the developing world first. Bitcoin would appear to be reversing this trend.

To more than half the world’s population, Bitcoin could be the most useful technology of a generation. Yet in the West so many are content to call it “useless” as though unable to recognise that lack of awareness is not a proxy for lack of utility.