A comparative look at mainstream news reporting on Bitcoin’s environmental impact

30 Nov and 1 Dec 2023 gave us the perfect opportunity to compare and contrast mainstream reporting on Bitcoin environmental impact.

On Nov 30, the Independent ran an pro-Bitcoin mining article Bitcoin Mining could supercharge transition to renewables

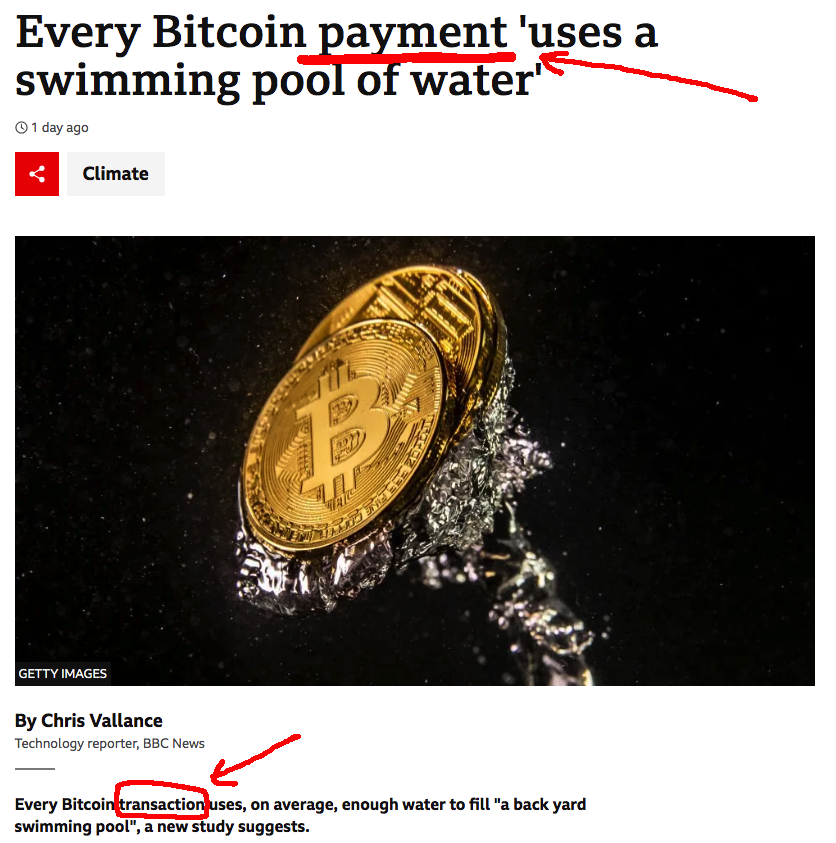

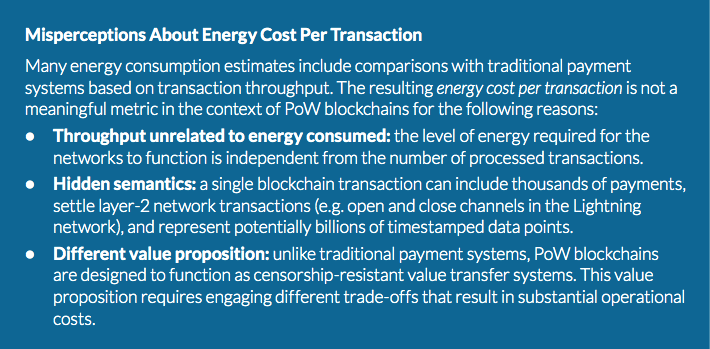

One day later, the BBC and other mainstream news media ran anti-Bitcoin mining articles about Bitcoin and Water Usage. The BBC article contained meaningful factual errors including in the headline which failed to distinguish “payment” from “transaction” (which in a Proof-of-work blockchain can contain thousands, even billions, of payments).

I point out the factual errors blow-by-blow in my Bitcoin and Water post.

The underlying study which re-used a “per transaction” methodology that was debunked by Cambridge back in 2018.

Unequal studies, unequal airtime … but not in the way you’d want from the media

Comparing the academic studies which underpinned each of the two articles side-by-side reveals some fascinating asymmetries that still pervade high-circulation mainstream reporting on Bitcoin.

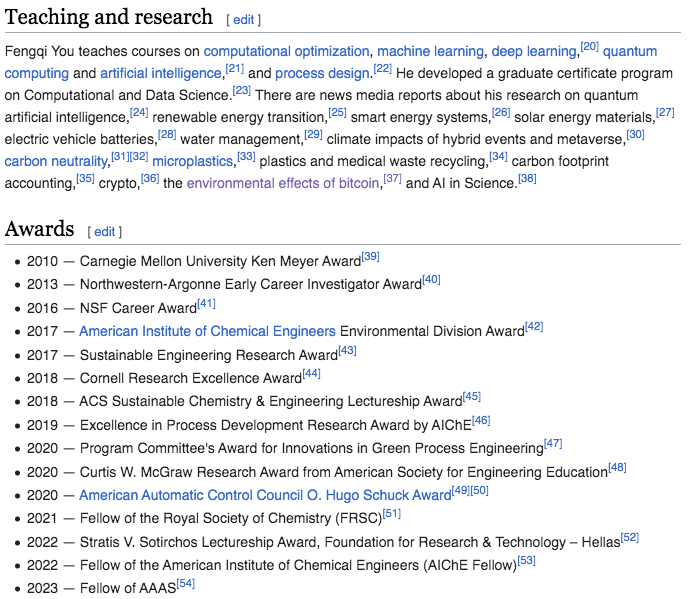

The study covered in the Independent was a peer reviewed article co-authored by Fenggi You, from Cornell University. Here’s what his wikipedia page tells us about him

It was picked up by one news outlet.

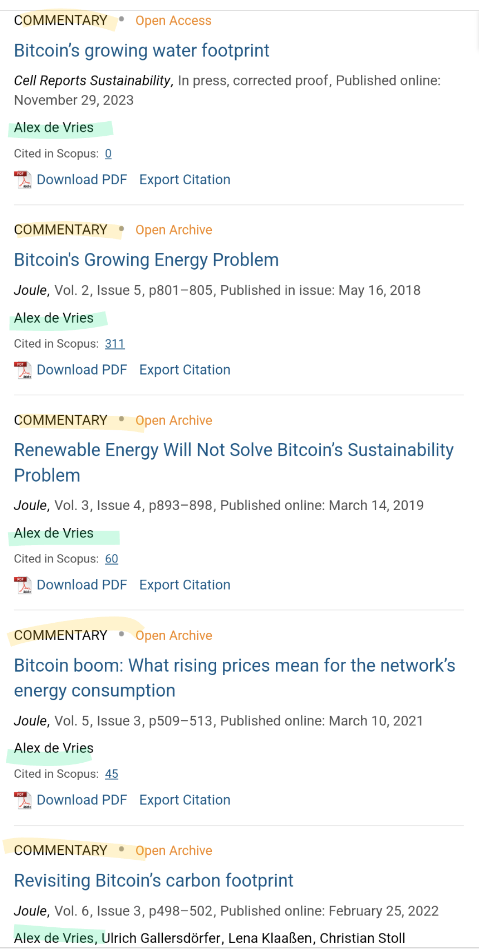

The second study was not technically a study but a commentary that did not need to go through a peer-review process. It was written by Alex de Vries. de Vries does not have a wikipedia entry, but he does have a LinkedIn page, which tells us he is an employee of the Central Bank DNB and a PhD student.

Writing commentaries would appear to be de Vries’ preferred method of commenting on Bitcoin.

One can understand his logic, if your goal is to influence public opinion rather than engage in genuine academic inquiry, why go to the trouble to write a paper if an academic opinion-piece that recirculate a previously falsified method will get so little scrutinized, yet so well circulated?

Fenggi You’s academic background and expertise is in energy, carbon neutrality, and the climate impacts of digital technology, which qualify him to undertake the difficult task of assessing the environmental impact of Bitcoin. By contrast, de Vries does not have a background in energy or carbon neutrality, rather a background in economics and finance.

The two studies are materially different in their rigor, level of review, relative experience of the author, neutrality of the author, and relevance of the author’s qualifications.

Yet the former article was picked up by one mainstream news outlet.

The latter article was picked up by 10 mainstream news outlets: BBCNews, The Independent (again), Fastcompany, The Registry, The Verge, SciTech Daily, New Scientist, EuroNews, NDTV and even The Weather Channel.

It is said “A lie will travel halfway across the world before the truth has a chance to get it’s boots on” (a quote which, as if illustrating the point, is often falsely attributed to Mark Twain. This tale of two articles serves as an example of this. Years earlier Jonathan Swift wrote in The Examiner, Nov. 9, 1710: “Falsehood flies, and the truth comes limping after it.” The same has been true here. While journalists knowledgeable about Bitcoin have since published rebuttals, these rebuttals will be read by a small fraction of the general public.

Rebuttals from within the Bitcoin ecosystem

This is how the game works though. If you have a position of power, it is common for that intrenched power to use the weapons at their disposal to protect that position. If that is what Central Banks are doing, and it appears that they are if we follow the Bitcoin attacks of other Central Banks such as The European Central Bank and the Bank of International Settlements, then we should be utterly unsurprised by this strategy. Similarly, the position of De Vries’ employer, the Dutch Central Bank (DNB), is very clear: “At DNB, one of our core tasks is to ensure financial stability. Cryptos are a potential danger to this stability.”

Every disruptive technology will have to endure this rite of passage because every disruptive technology will be met with false claims from the disrupted. Bitcoin doesn’t just disrupt Central Banks, it threatens to disintermediate them. It is no surprise that Central Banks will do everything in their power to prevent that. It is a high stakes game, and one in which for the Central Banks, truth is of secondary importance to power.

On a positive note during a week where objective reporting on Bitcoin mining took a beating, the fact that provably false content on Bitcoin mining has now been published marks a new phase of the “Bitcoin and the environment” debate. Critics of Bitcoin had previously been content to comment on how Bitcoin revives fossil fuel plants and is mainly powered by fossil fuel. However, these arguments took a beating themselves this year with a sea-change in objective independent reporting, peer reviewed research and data highlighting that this argument is no longer true and may never have been true.

In response, it appears that critics have chosen “Bitcoin uses too much water” as the surrogate attack vector. It’s a risky strategy because critics have now had to use more transparently inaccurate methods and claims to launch this attack. These methods will be spotted more readily, more rebutted more quickly and counter-attacked more confidently. Indeed this is already occurring.