Brussels, 13 December 2023

Response to: https://www.esma.europa.eu/sites/default/files/2023-10/ESMA75-453128700-438_MiCA_Consultation_Paper_2nd_package.pdf

Testimonial of Daniel Batten

My name is Daniel Batten and my background is one of a cleantech investor. From 1996-2007 I was involved, either as an early employee or as a founder, in technology that created disruptive technologies.[1] Since 2004, I have been investing in technology companies, more recently in the climate-tech sector. Over a 10-year period working with New Zealand Govt Agency Kiwinet, I saw and evaluated over 100 technologies and pieces of intellectual property in the climate-tech space. Prior to that, my background was in the environmental movement, where I took part in actions for both Greenpeace Aotearoa and Native Forest Action.

Because Bitcoin is a disruptive technology, and Bitcoin mining like other forms of climate-tech I have seen has both positive and negative environmental externalities, evaluating the current and potential future impact of Bitcoin Mining from an environmental standpoint is a relatively familiar proposition.

Herein, I outline how I arrived at the conclusion that our methods for modeling, collecting data on, reporting on, and evaluating Bitcoin environmental impact have been, as is often the case with emerging technologies, both flawed and skewed negative.

I propose a different rubric for evaluating the environmental impact of emerging technologies, which can be applied to Bitcoin (Mining).

In the paper, there will be a detailed discussion in the following order:

- Setting the scene: a short history of evaluation of the disruptive technology

- Evaluating claims about Bitcoin’s negative externalities

- The positive and negative externalities of Bitcoin

- Acknowledging new data and analysis in 2023

- A rubric for the environmental impact assessment of Bitcoin and other emerging technologies

- Conclusion

- Setting the scene: a short history of evaluation of the disruptive technology

It is worth noting that every technology we have invested in is projected to have a significant carbon footprint before they eventually pay off their carbon debt.

When our investment firm was asked to evaluate Bitcoin as a possible form of “climate tech”, I was skeptical. I had heard only negative things about its energy usage and reliance on fossil fuels. However, my memory of the errors the environmental movement so nearly made in its premature evaluation of solar, plus my experience “zooming out” and considering whether a technology could trend net-positive over a longer time horizon caused me to put prejudice to one side and conduct a neutral due diligence as I would any emerging technology, where I evaluated and quantified both negative and positive environmental externalities.

I was surprised to find a lack of robust modeling, complete datasets, and up-to-date datasets on both the anti and pro-bitcoin sides.

Back in 2022, there were many claims that Bitcoin could make solar and wind operators more profitable, but little quantified evidence. Similarly, there were claims that Bitcoin mining could mitigate emissions, but no quantification of the extent to which this was occurring and could occur.

On the other hand, the most widely used model was from the Cambridge Centre for Alternative Finance. Yet, on examination, Cambridge’s model limitations include the exclusion of methane mitigation and off-grid mining.

Also, at the time of writing using a mining map which is 23 months out of date (which makes a material difference, because mining was predominantly powered by fossil fuel at that time, with Kazakhstan being a significant player).

The image above shows how the Cambridge emission intensity calculations has been impacted by lack of new mining map data since Jan 22.

The exclusion of off-grid mining had a particularly large impact on Cambridge model accuracy, because miners choose power providers based predominantly on the cost of power. When miners are “off-grid” they are not constrained to choose the mix of energy the grid happens to use, so will simply choose the cheapest power available. Had they been mining 15 years ago this would have been coal, but today this is almost always renewable.

Other researchers began to quantify the impact of Bitcoin on the grid. I turned my attention to developing the first Bitcoin mining model that included:

- Methane mitigation

- An up-to-date mining map

- Off-grid mining.

The methodology for this model is available online[2] and in Section 7 – Annex 1: BEEST Model: Bitcoin Energy & Emissions Sustainability Tracker hereto.

2. Evaluating claims about Bitcoin’s negative externalities

2.1 Claim: Bitcoin uses mostly fossil fuel

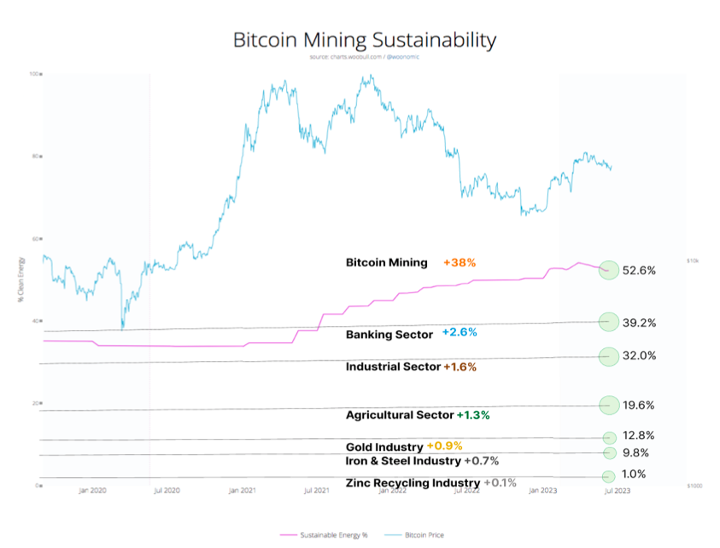

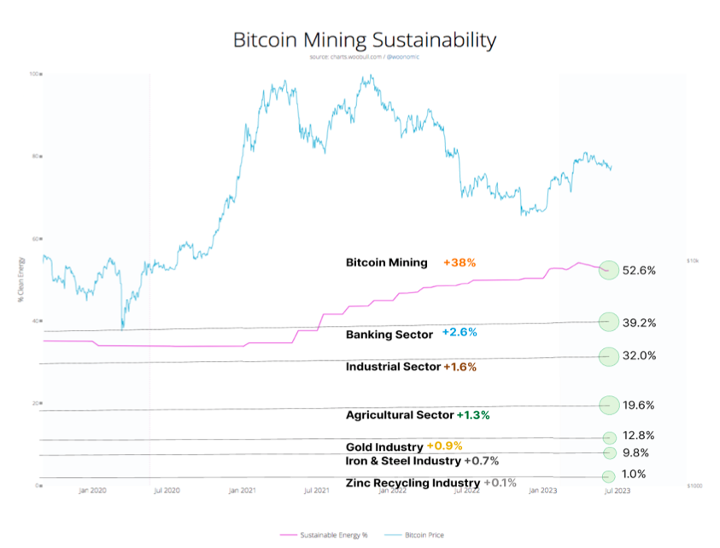

This was indeed true prior to, and even up to six months after the May 2021 mining ban in China. However, as Bitcoin mining companies moved off the predominantly coal-based sources in China and Kazakhstan, to more sustainable-energy based grids, the power-mix changed considerably. While no model can model Bitcoin mining energy source perfectly due to uncertainty about miner location, there is now very strong evidence that Bitcoin has eclipsed other industries in sustainable energy use and is now mostly sustainable-energy based.

2.2 Claim 2: Bitcoin mining encourages the reopening of mothballed fossil fuel plants

The example of this often used is Greenidge Energy, Lake Senaca. I looked into this claim in some detail, because that would unquestionably be a negative environmental externality were it to be true. I also contacted Greenidge Energy. They claimed that they did not open the facility to do crypto-mining, but to supply energy back to the grid, and it wasn’t until two years afterward that they started testing a small pilot because it made more economic sense for them to do crypto-mining when wholesale energy prices were low.

Hearing two different stories, I check the original SEC filings. These supported Greenidge’s version of events, that the natural gas facility was not opened to do crypto-mining.

We can see this evolution in the S-1 form with the SEC,[3] which provides a detailed look at when and how the operation grew. Additionally, we can see Greenidge’s initial press release announcing its exploration into bitcoin mining dated March 5, 2020.[4]

2.3 Claim 3: As Bitcoin’s price grows, it will create more and more emissions, and exponentially more energy.

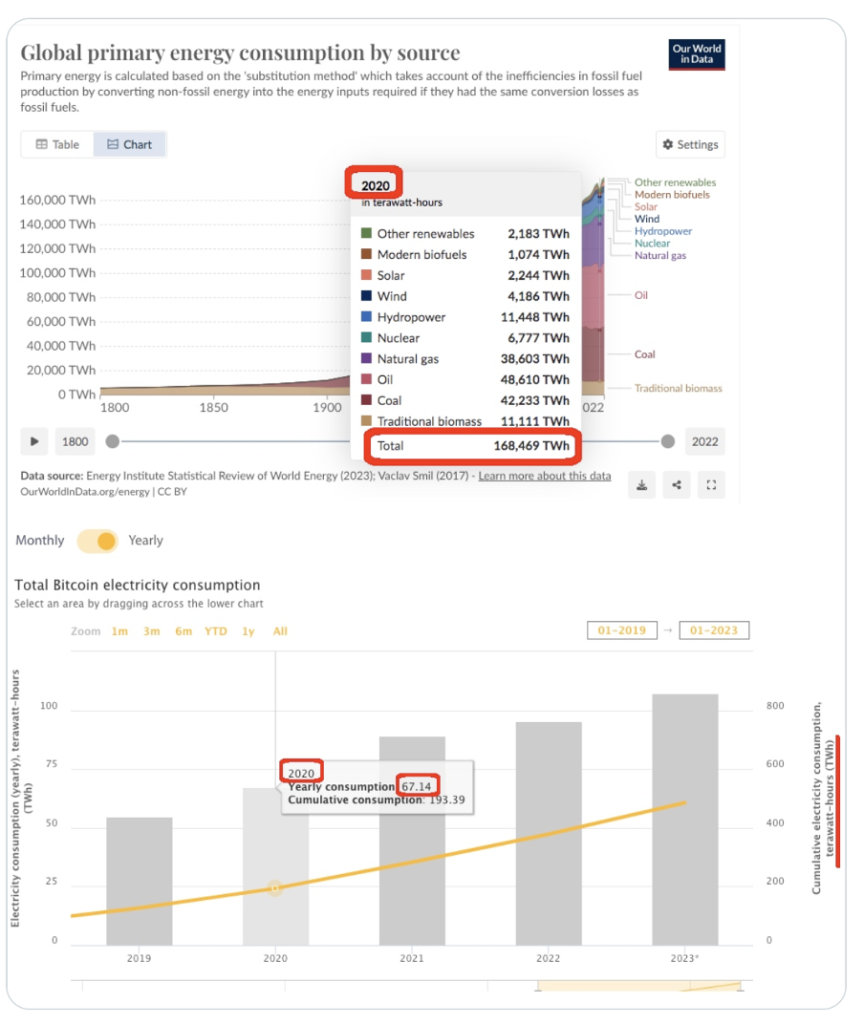

Alex De Vries’ (Digiconomist) model in 2017 predicted a 25% energy increase per month. This contributed to the World Economic Forum headline “In 2020 Bitcoin will consume more power than the world does today” ~ WEF Dec15, 2017.

I checked the accuracy of this modeling. As we can see below, using the Cambridge model of energy consumption, actual consumption was 67 TWh in 2020, which was 0.03985% of global energy consumption. The estimate was incorrect by a factor of 2509x (or 250,900% overestimated).

I will not go into why the modeling was inaccurate to this degree other than to say that this is all-too-common. Predictions about the Internet’s use of energy in the late-90s were similarly inaccurate, and a well-known Forbes article predicted that the Internet would require the firing up of many mothballed and new coal plants to keep it running.

By contrast, a conference paper by Hass McCook[5] predicted that:

– Bitcoin mining emissions have likely peaked, and

– Bitcoin will improve sustainable energy mix faster than other industries.

Summary of Paper:

1. Bitcoin is a non-rival energy user

The characteristic that waste, stranded and curtailed energy sources share, is that they would all remain wasted, stranded, and curtailed if there were no electrical loads as dynamic and flexible as Bitcoin.

These are non-rival energy sources, meaning that Bitcoin miners are not competing with other customers to obtain this power.

2. Bitcoin uses cleaner energy than world and US average

Whilst Bitcoin does use a large amount of energy, it was shown that the use is … far cleaner than the world or US average on a per unit of energy basis.

3. Carbon Intensity and Emissions

As Bitcoin generally relies upon “the grid”, general decarbonisation efforts will positively improve Bitcoin’s carbon intensity profile. However, due to the economic incentives on offer for mining with wasted and stranded energy and acting as a controllable load resource, Bitcoin should improve at a far faster pace than the world grid.

Due to continual improvement in mining equipment efficiency and the Chinese migration, it is likely that Bitcoin’s emissions have already peaked.

For emissions to return to pre-China migration levels, energy expenditure would need to grow three-fold, and one would need to accept a demonstrably false assumption that there will never be any further efficiency gains in mining hardware.

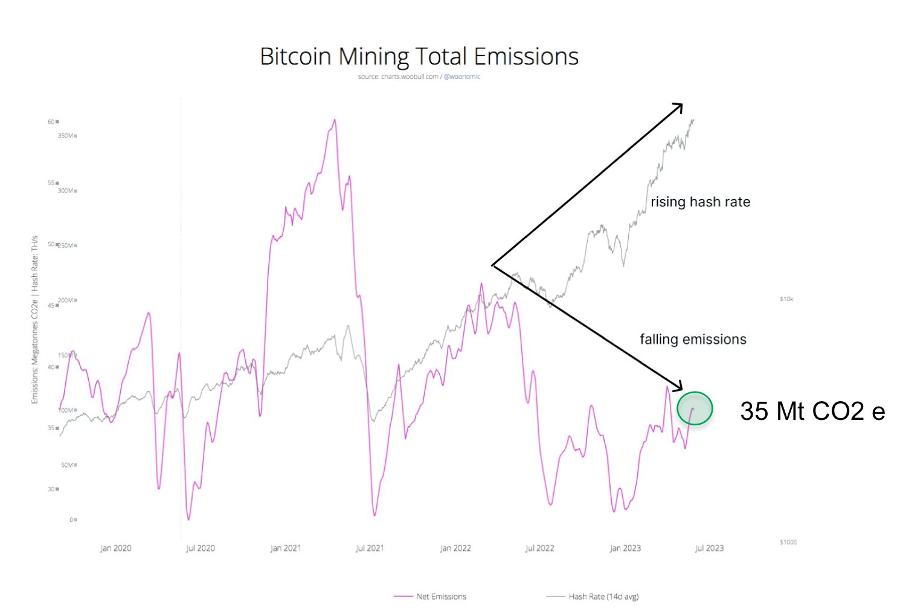

Earlier this year, I used the BEEST model to quantify whether there was evidence to support the thesis that Bitcoin emissions would continue to rise as price rose, or whether as Hass McCook claimed emissions had likely peaked.

The data over the last four years (a full “cycle” in Bitcoin) suggests that McCook’s conclusions are likely correct: Bitcoin’s emissions have not increased over this period. The likely catalysts for this are improvements in machine efficiency, migration to more sustainable energy sources, and the use of power sources which have a net-emission decreasing impact on the network (use of previously flared or vented gas).

2.4 Claim 4. Bitcoin uses a high amount of resources “per transaction”

Examining the parlance of the blockchain, I was immediately struck by a curious fact: the word “transaction” has a completely different meaning than it does in a traditional finance system.

In the blockchain world, a transaction can bundle many thousand payments on the blockchain itself (analogous to a wire-of-fund payment), and even up to tens of billions of payments using so-called “Layer2” technologies such as the Lighting network (analogous to a visa transaction).

So, the use of a “per transaction” metric is highly misleading to a population not familiar with the non-trivial semantic difference.

There is a second issue with this metric however: Bitcoin energy use does not in fact come from its transactions. That means the number of transactions could be substantially higher, with little or no difference to Bitcoin energy usage. A scientist would say “all you have done is divide one independent variable by another, thereby creating the false impression that as one rises – so will the other.”

To give an illustration of how this effect works:

Fact: New Zealand has a GDP of USD 250Billion and 25Million sheep.

True, but misleading conclusion: New Zealand earns $10,000 GDP per sheep.

False Inference: Therefore, New Zealand had 4 times the number of sheep, it would reach GDP of UDS1 Trillion.

Similarly, the inference is false, because the two variables (GDP and number of sheep) are largely uncorrelated – just as are “number of transactions” and “energy use” in Bitcoin mining.

2.5 Claim 5: “Attempts by the Bitcoin mining industry to demonstrate positive environmental externalities are greenwash”.

This claim resurfaced recently in an opinion piece in The Hill,[6] which was countered the following month by Marathon Digital Holdings’s work.[7]

The tenor of the argument was “KPMG has a crypto-assets division therefore they have a vested interest in claiming that Bitcoin has a positive ESG profile. Therefore, their report[8] is greenwash”.

While we are right to look at the conflict of interest as part of evaluating a position on Bitcoin, it is an ad hominem argument to dismiss the reasoning of another party by reference to who they are, rather than the merits of their argument.

Proponents of Bitcoin also use ad hominem arguments, stating “Alex de Vries is the paid employee of the Dutch Central Bank, and Bitcoin threatens to disintermediate Central Banks, therefore his arguments should be disregarded.”

Both are poor arguments. We must treat the arguments of each on their merits.

To create intellectually honest debate, we should either exclude all arguments from possible vested interests or allow all for prudent evaluation.

It has been my observation that there has been considerable skew both in the media, and in the way nation-states have conducted their evaluation of Bitcoin.

For example, a peer-reviewed Cornell Study on the positive environmental externalities of Bitcoin, published by an award-winning scientist, was picked up by a single large mainstream newspaper. Whereas a commentary that does not appear to have been peer-reviewed on the negative externalities on Bitcoin, written by Alex de Vries, a PhD candidate, was the following week picked up by ten news agencies.[9]

The fact that one was written by a student, and the other by a decorated scientist does not mean that one was “better quality”. Nor should de Vries’, or anyone’s, analysis on Bitcoin be rejected simply because it has not been peer-reviewed. However, the extent to which one article was reported and the other was not suggests that Bitcoin mining, along with other disruptive technologies, may not historically have enjoyed fair and equal reporting of both its positive and negative externalities during its nascent years.

Further, a 2022 WOSTP report on Bitcoin mining had as its most cited source de Vries/Digiconomist, but no obvious source material from those inside the Bitcoin mining industry. This is a clear and obvious asymmetry. Again, either both vested interests should be equally appraised, or both should be discounted.

As to the argument that those within the industry cannot be trusted because of their vested interest in the success of Bitcoin, this is grounds for being cautious to cross-validate claims and ask for robust supporting data, not grounds to shut them out.

We could just as well claim that we should not trust the professional opinion of a doctor, because they have a vested economic interest in making prescriptions; we should instead consult physiotherapists. After all, they understand the human body too. We could claim that we should eschew the professional advice of dentists, because they have a vested economic interest in diagnosing the need for dental work; we should instead consult osteopaths. After all, the tooth is just a bone, and they understand bones too.

Similarly, it has been my observation that we have been too quick to use the same “vested interest” logic to ignore the professional viewpoint that the Bitcoin mining industry has about Bitcoin mining. Are not those who are native to the Bitcoin mining sector the very domain experts we need to consult in order to understand the utility and nuances of a technology?

Have we not already seen ample evidence of what goes horribly wrong when we do not consult the industry in making predictions? Clearly, many people still do not have a basic understanding of (as illustrated by a BBC article that recently erroneously used the word “payment” in its headline about Bitcoin, when it should have said “transaction”).

As part of my evaluation of Bitcoin, I consulted with environmentalists and read the reports of Sierra Club, Greenpeace USA and the Environmental Working Group. But I also talked to grid operators, battery engineers, Bitcoin mining experts, renewable operators, Utility companies and those with a 20-year history in methane mitigation before arriving at an overall assessment of Bitcoin.

This is the recommendation I would make to any government body before arriving at a methodology for the evaluation of Bitcoin mining.

- The positive and negative externalities of Bitcoin

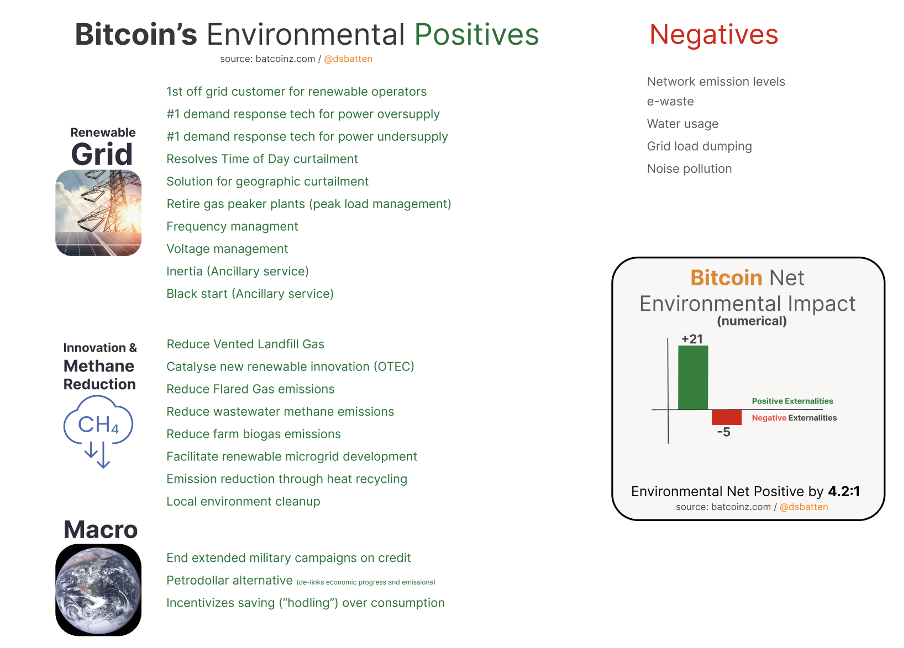

Any evaluation of a disruptive technology must include both positive and negative externalities, and those administering the methodology must take all reasonable measures to ensure that a complete set of positive and negative externalities are evaluated. Otherwise, a methodology is, by definition, not objective.

An accountant would be fired for declaring a business was “in bad shape” if they investigated 100% of that business’ expense ledger, but between 0-10% of its revenue ledger.

Similarly, our evaluation of Bitcoin mining must look equally, fairly, and completely at both the negative and positive externalities of Bitcoin mining.

Whatever public opinion is on Bitcoin mining is irrelevant, and no more grounds for a skewed evaluation than the public opinion on a murder witness is grounds for a trial with no defense attorney present, and where the presupposition is that the witness is “guilty until proven innocent.”

This is particularly true when there is evidence that public opinion may itself have been skewed by both uneven reporting (Cornell study vs de Vries commentary), and highly inaccurate reporting (ie: Bitcoin energy usage in 2020) over many years.

These are the positive and negative externalities we found when evaluating Bitcoin. While there are more positive externalities, this does not mean Bitcoin mining is net positive. It may merely mean that there are more positive benefits, but they are not significant enough to counteract the smaller number of negative externalities. However, neither this nor its opposite can be assumed, and robust investigation of each is required.

In investigating each of the externalities, it is vitally important to consider not only current impact, but potential future impact, lest we be guilty of “premature evaluation”.

It is worth recalling at this point that every established climatetech proposition from solar to wind had a significant negative environmental impact before it became net positive. Similarly, every emerging technology from direct air capture to biochar still has a large negative environmental impact, but we continue to believe in these technologies because there is sufficient evidence that within 20 years we can turn the net negative into a net positive.

- Acknowledging new data and analysis in 2023

Just as new evidence may lead to a new verdict, there is a substantial weight of new evidence that has emerged during 2023 as to Bitcoin’s potential positive environmental externalities.

This evidence includes but is not limited to:

1. Peer reviewed research[10] and working papers (MIT)[11] including a Cornell University Study[12] which suggested that Bitcoin mining could support the renewable transition and climate action (27 Oct).

2. More balanced reporting of Bitcoin ESG impact, including the first pro-ESG Bitcoin mainstream news coverage in a major UK newspaper,[13] and a4:1 ratio[14] of positive:negative environmental reporting in non-Bitcoin press in Q1, 2023.

3. Cambridge acknowledges Bitcoin energy overestimation and states that emission calculations are still “likely overstated” (30 Aug).[15]

4. Bloomberg Intelligence charts show Bitcoin mining is 53% sustainable, that emission intensity is dropping, and emissions are not rising (14 Sept).[16]

5. Independent Consultancy Firms Institute of Risk Management[17] and KPMG documenting[18] how Bitcoin supports the ESG imperative (1 Aug).

However, there is another largely undocumented story about Bitcoin mining that has the potential to eclipse all other positive externalities: methane mitigation.

Methane is 84x as warming as CO2 over a 20-year period, and much of COP28 was dedicated to finding solutions to how to urgently reduce methane emissions.

This is an area where Bitcoin mining could play a major role. While there are many technologies that can do methane mitigation, few of them are ready today, and even fewer of them are able to mitigate methane profitably.

By contrast, Bitcoin mining has the unique ability to profitably mitigate methane in remote locations such as landfills and oilwells where methane mitigation could not otherwise occur. Our own climatetech fund has pivoted its entire focus to supporting landfill-gas powered Bitcoin mining for this reason.

We did not intend to create a Bitcoin mining fund, rather we asked, “How can we maximize the amount of emissions mitigated per dollar invested?”. The result of our analysis was that Bitcoin mining powered by vented landfill gas was the answer.

The 2022 WOSTP report on crypto-mining[19] has also acknowledged the potential for this sort of Bitcoin mining on the climate.

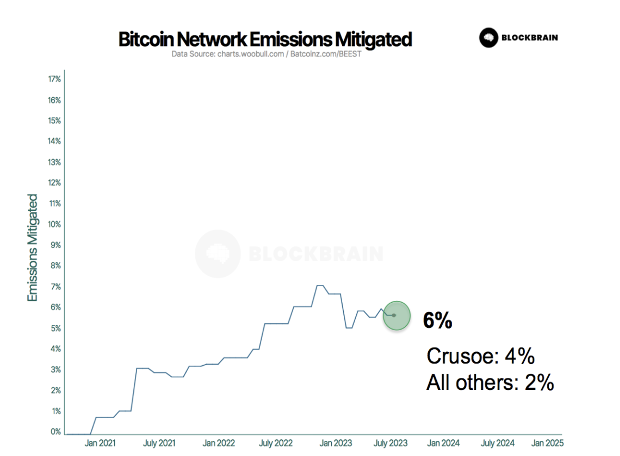

What is encouraging is that this is not a theoretical “one-day” possibility. There is a significant amount of methane mitigation occurring today. An early attempt I made to quantify this suggests that 6% of Bitcoin network emissions is now offset through methane mitigation (see “Quantifying the Emission Negative Component of the Bitcoin Network”).[20]

Source: Quantifying the Emission Negative Component of the Bitcoin Network [21]

To my knowledge, Bitcoin mining is both the only industry to have achieved this degree of emission reduction through methane mitigation, and the only industry in the world I am aware of that has the potential to fully offset its emissions without the purchase of offsets.

In Q4, 2023 I was alerted to several other Bitcoin mining companies who were using previously vented or flared methane as their power source. I am still quantifying and verifying the data, so have excluded these new companies from my reporting, although initial indications are that the true level of methane mitigation could be 7.5% or even higher.

- A rubric for the environmental impact assessment of Bitcoin and other emerging technologies

An objective question-set for evaluating the environmental impact of a new technology should look like this:

5.1. What are the technology’s negative environmental externalities?

- Has this impact been quantified in an objective way that compares it to the impact of existing technologies?

- How do we know that the methodologies and data underlying the models are accurate?

- Do we have an exhaustive list of these negative externalities?

- Are the metrics used to evaluate and measure fit-for-purpose, clear, free from risk of misinterpretation and appropriate to that technology?

5.2. What are its positive environmental externalities?

- Has this impact been quantified in an objective way that compares it to the impact of existing technologies?

- How do we know that the methodologies and data underlying the models are accurate?

- Do we have an exhaustive list of these negative externalities?

- Are the metrics used to evaluate and measure fit-for-purpose, clear, free from risk of misinterpretation and appropriate to that technology?

5.3. Challenge assumption: ask “Could apparent negative externalities have a positive application?”

For example, high energy use is an apparent negative, however could this energy use be able to provide flexibility to the grid that allows grid operators to counterbalance the intermittency of renewable energy? Is this energy use rival or non-rival? Is this energy trending renewable or non-renewable? Can this energy be a stranded or otherwise wasted energy source? Most importantly, could this energy be fueled by emission-negative sources such as vented methane or flared methane, which have a direct emission-reducing impact?

5.4. What is the technology’s likely environmental trajectory?

This is the part of the rubric that guards against the possibility of the type of “premature evaluation” that could have resulted in solar energy being labeled “bad for the environment” in the 1990s due to its high energy use and emission footprint from the coal furnaces required to melt silicon.

- Have we modeled what is likely to happen to emissions and energy use under a range of future scenarios?

- If the technology has the ability to produce emissions (ie: solar), have we also evaluated its potential to reduce emissions, so we are evaluating net emissions?

- Are there additional negative environmental consequences of this technology that could arise in the future? (Can these be quantified?)

- Are there additional positive environmental uses of this technology that could arise in the future? (Can these and have these been quantified?)

5.5. What is the current utility of the technology?

There are many technologies (such as the Internet) that have a considerable carbon footprint and are unlikely to ever mitigate it, however we justify our use of this technology by saying “It’s worth it because of the social utility it provides”.

While it is preferable for a technology to earn its rite of passage based purely on environmental net benefit, in assessing the environmental impact of an emerging technology, it is still necessary to research the current and future potential utility, otherwise there is a risk that in lieu of information, one may assume a technology to be “useless” or “wasteful”. These sorts of adjectives have often accompanied Bitcoin, however there is little data to support these indictments, and a large and increasing body of data to support the thesis that Bitcoin provides life-enhancing value to millions of people, particularly in the Global South.

- Conclusion

Like every disruptive technology, Bitcoin is in the middle of a rite of passage where most people are still asking “What is it?”, “is it good or bad?”, and “Will it have terrible effects on humanity?” While we should ask these questions, we should not ask these questions in lieu of investigating the potential positive impacts of a disruptive technology with equal rigor. We should also make sure that our efforts to understand include talking to people who have a high level of domain expertise in Bitcoin mining.

We propose a methodology for evaluating Bitcoin that is objective, comprehensive, fair, and which would pass the “would this methodology have prematurely labeled the photovoltaic industry as harmful to the environment” test.

There is an increasing weight of evidence that many of the claims, including all the five most common claims, leveled against Bitcoin’s negative environmental impact have been based on incomplete data. There is evidence that Bitcoin mining has also been both historically misrepresented by inaccurate forward projections of energy use, and had alleged environmental harm amplified by negatively-skewed reporting.

2023 has also been the year when high-quality independent research has emerged which quantifies the potentially positive environmental externalities of Bitcoin.

We call on the EC to adopt an evaluation methodology that takes into account these factors and both fairly and objectively measures Bitcoin’s environmental impact, positive and negative.

[1] Our investment fund, Exponential Founders’ Fund, invests into technology that can disrupt entire industry sectors. For this reason, we were the lead-investor in Zincovery, which has the potential to decarbonize the entire Zinc Recycling industry. We also made multiple investments into Hot Lime Labs, which have the potential to wean the global Greenhouse industry off fossil fuel from gas (used for heating and CO2 production).

[2] https://batcoinz.com/BEEST/

[3] https://www.sec.gov/Archives/edgar/data/1844971/000119312521332868/d253482ds1.htm

[4] https://greenidge.com/greenidge-generation-announces-successful-start-of-operations-at-state-of-the-art-data-center-for-digital-currencies/

[5] https://link.springer.com/chapter/10.1007/978-3-031-32415-4_2

[6] https://thehill.com/opinion/energy-environment/4245911-dont-buy-bitcoins-dishonest-attempt-to-paint-itself-green/

[7] https://thehill.com/opinion/energy-environment/4315048-bitcoin-mining-is-energizing-sustainability-through-green-innovation/

[8] https://kpmg.com/us/en/articles/2023/bitcoin-role-esg-imperative.html

[9] Despite this, there is evidence that in 2023 the overall weight of journalist coverage of Bitcoin environmental impact has begun tending net positive: https://batcoinz.com/positive-press-about-bitcoin-esg-outnumbers-negatives-51-so-far-in-2023/

[10] https://twitter.com/DSBatten/status/1726129764224938058?s=20

[11] https://ceepr.mit.edu/wp-content/uploads/2023/06/MIT-CEEPR-WP-2023-11.pdf

[12] https://pubs.acs.org/doi/10.1021/acssuschemeng.3c05445

[13] https://www.independent.co.uk/tech/bitcoin-mining-solar-wind-renewable-energy-b2454666.html

[14] https://batcoinz.com/positive-press-about-bitcoin-esg-outnumbers-negatives-51-so-far-in-2023/

[15] https://www.jbs.cam.ac.uk/2023/bitcoin-electricity-consumption/

[16] https://twitter.com/DSBatten/status/1726129770617073684?s=20

[17] https://twitter.com/DSBatten/status/1726129773473357975?s=20

[18] https://twitter.com/DSBatten/status/1726129761247007020?s=20

[19] https://www.whitehouse.gov/wp-content/uploads/2022/09/09-2022-Crypto-Assets-and-Climate-Report.pdf

[20] https://batcoinz.com/quantifying-the-impact-of-using-stranded-methane-on-the-bitcoin-network/

[21] https://batcoinz.com/quantifying-the-impact-of-using-stranded-methane-on-the-bitcoin-network/