Why ESG Investment committees need Bitcoin, but Bitcoin also needs ESG Investment committees

There are currently 23 trillion dollars locked up in ESG funds looking for a home, which cannot deploy a higher percentage into Bitcoin based on the current ESG narrative. But what if the ESG narrative was just that; a “narrative” without a solid supporting set of facts? What if Bitcoin mining were in fact a solution, not a problem for the world’s ESG Investment Committees? Investigating whether this is the case or not has been the focus of my last year.

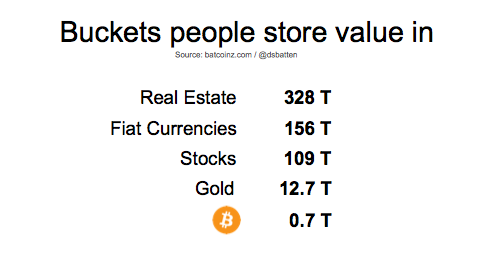

Needless to say, greater ESG adoption of Bitcoin is good for Bitcoin, and good for Bitcoin’s market cap, which is currently 724Bln. Relative to other assets that institutional investors store value in, which are all measured in the Trillions, Bitcoin is thimble-sized. Commentators including Willy Woo have argued that Bitcoin needs to stay above 1 Tr before the institutions that hold the wealth of nation states and/or retirement funds feel comfortable investing in it en masse.

Before we look at why ESG investment committees should consider Bitcoin, let’s look at why Bitcoin-proponents should engage more proactively with ESG Investment committees.

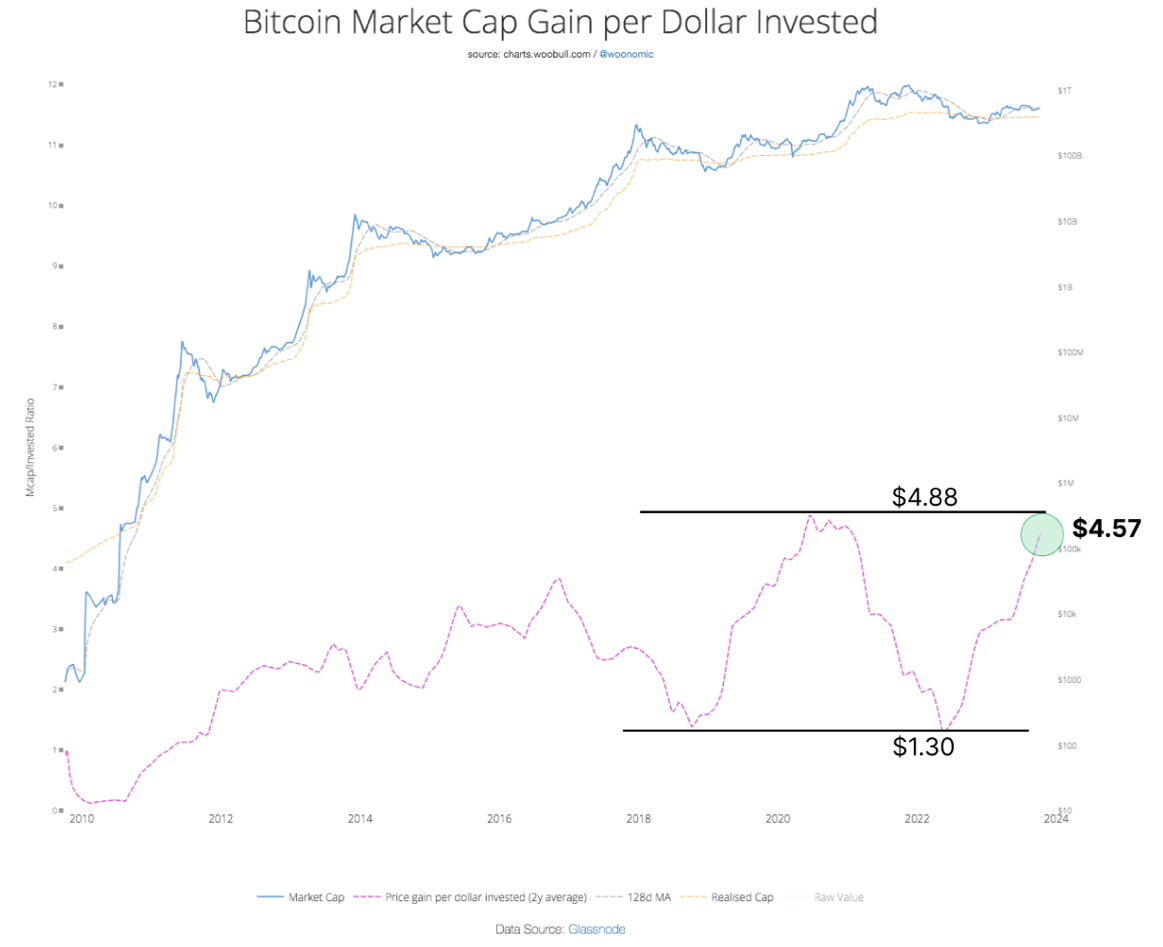

First, let’s ask “What would a 1% deployment of ESG funds into Bitcoin do to market cap?” Thanks to Woo’s analysis, we can forecast that impact within a range.

At today’s market cap increase per dollar invested ratio – If ESG funds were to deploy an additional 1% of AUM into Bitcoin, Bitcoin’s market cap would increase to 1.76 Trillion.

A more aspirational goal, if 2.5% of ESG funds deployed into Bitcoin, it would increase market cap to around 3.3 Trillion. Which really puts it on the roadmap for institutional investors. As institutional investors invest into Bitcoin, this further increases Bitcoin’s market cap, and now we have a positive feedback loop: catalyzed by initial engagement between the Bitcoin and the ESG community.

Background

For 19 years I’ve been doing impact investment. My work involves doing due diligence on technologies that get an economic return while also positively impacting people and planet. I’ve seen over 200 different cleantech propositions. Of those, I have found Bitcoin to be the most fast-acting, far-reaching, and measurable clean tech I have seen.

That matters because right now, ESG investment committees have a problem: demand for solid ESG investment outstrips supply with 30% of investors saying they struggle to find attractive ESG investment opportunities. This means Bitcoin could be in pole position to answer that problem. However, two things must happen first: data and action.

Let’s start by looking at the data.

Current ESG Investment Committee Perceptions on Bitcoin

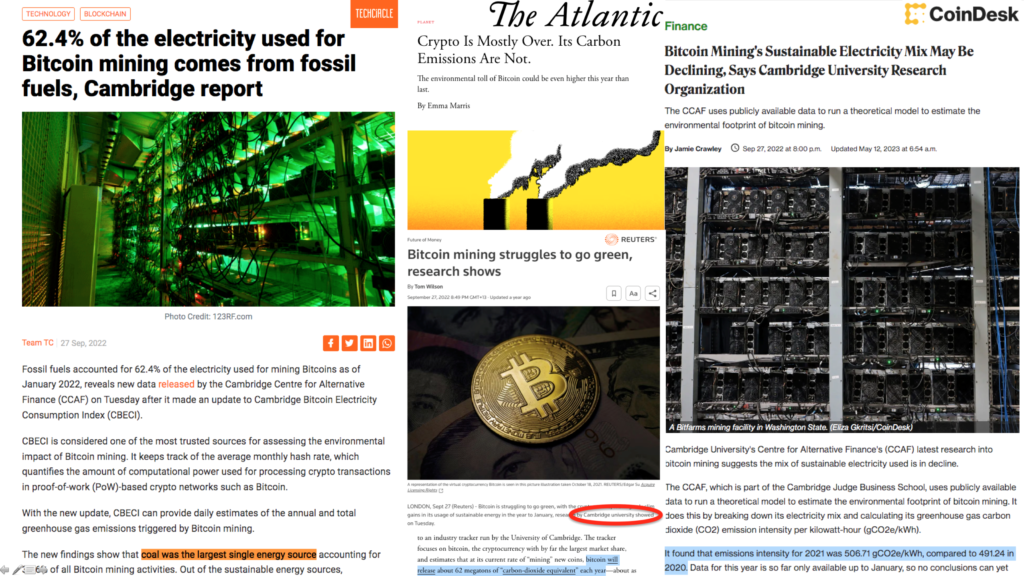

There are four big ESG arguments currently used against Bitcoin preventing widespread institutional adoption.

These are: that Bitcoin

- predominantly uses and proliferates the use of fossil fuels

- has emissions which are large, and likely to grow exponentially

- has growing emissions intensity

- has coal as its largest energy source

Perceptions are informed by media reports. These media reports are in turn informed by studies. It turns out that these 4 article all came from one source: Cambridge Centre for Alternative Finance.

So let’s summarize: 23 Trillion cannot deploy into Bitcoin due to four ESG perceptions. These four perceptions however are built on a single study. That’s a lot riding on one study. Curious to know Cambridge’s results were so different to the Bitcoin Mining Council’s results, I decided to look at this study more closely.

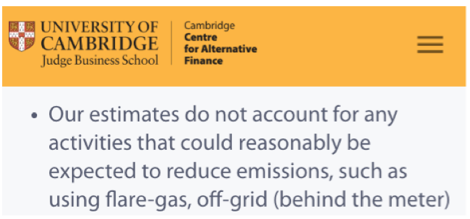

To Cambridge’s credit, they have disclosed their model limitations. Their website acknowledges they may not model the current status quo.

In other words, “it might be out of date”. The heartbeat of a modelling something dynamic like Bitcoin mining is continuously updated data.

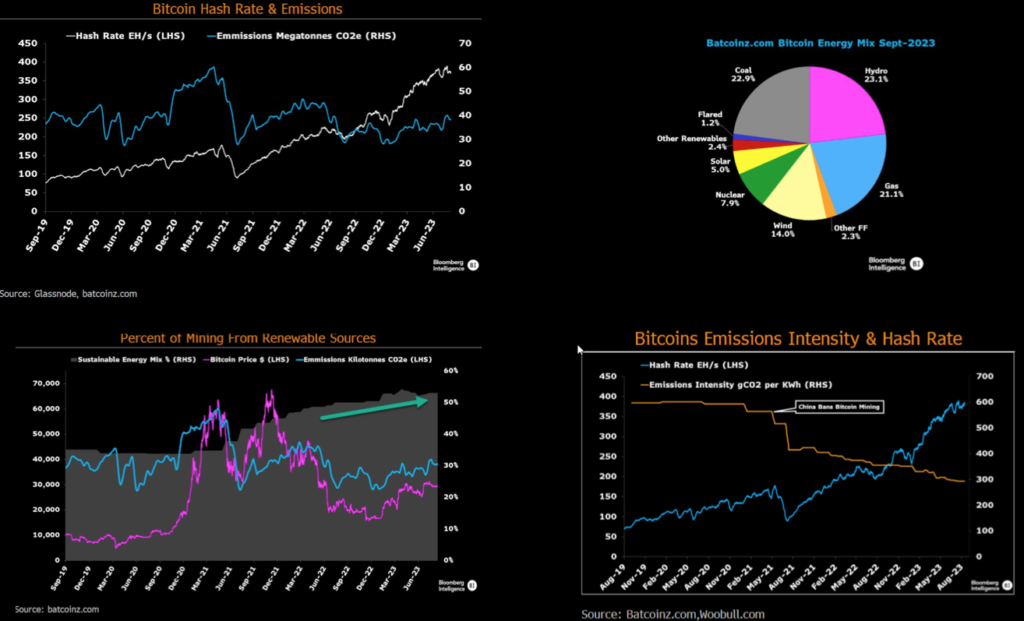

Cambridge’s Bitcoin Emission Intensity chart shows visually what’s happened to the heartbeat of the model.

Their mining map “lost its heartbeat” in Jan 2022. That’s means their model is at the time of writing, 22 months out of date.

So is this significant? 22 months, Kazakhstan, an almost entirely fossil fuel based nation had 13.2% of global hashrate.

Today it’s declined to only 100MW. Since the network consumes over 15,000 MW, this is well under 1% of the total network. That’s significant.

2. There is a bigger issue: the Cambridge model does not include offgrid mining.

Over the last year, I built a ground-up model of Bitcoin mining called BEEST which brought the mining map up to date and calculated the impact of offgrid mining.

Summary of BEEST results

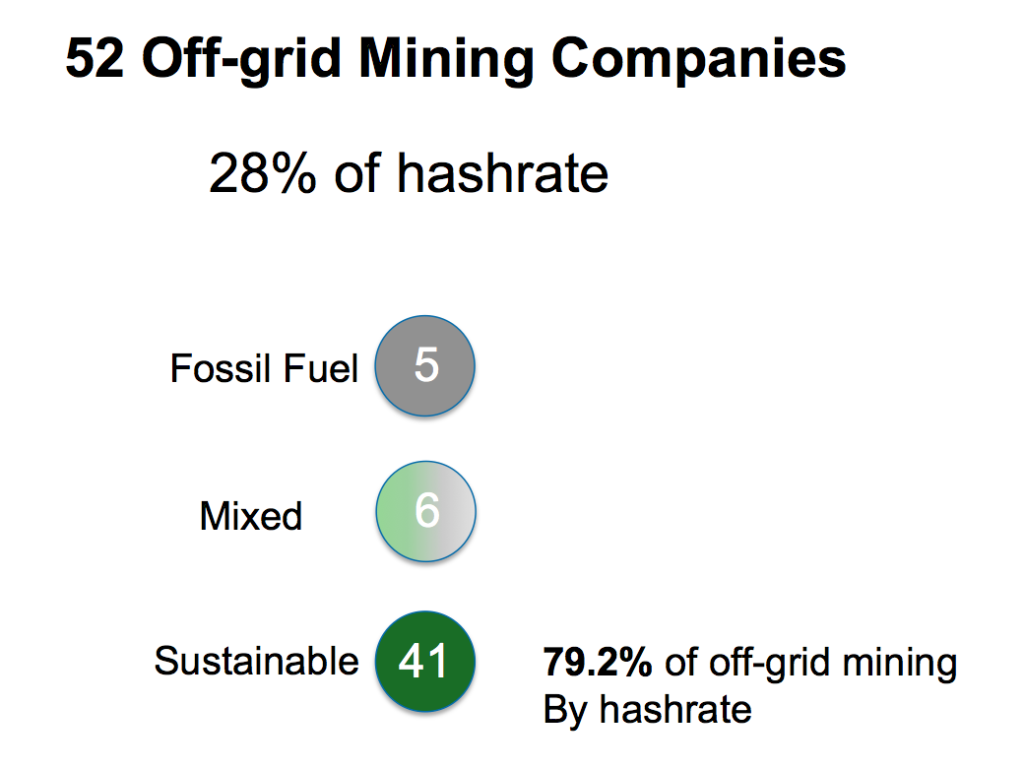

There are 52 offgrid mining companies that we know of. To reiterate, these are the miners that Cambridge model does not include. They represent 28% of all mining by hashrate. They are almost 80% powered by sustainable energy.

This shouldn’t surprise us. After all, the reason they mine off-grid is they are chasing cheap electricity, which is usually renewable.

Excluding a significant minority who use an asymetrically high proportion of sustainable energy from their model is significant. It’s analogous to taking a political opinion poll by only surveying urban voters.

What happens when we add in Cambridge’s two model exclusions?

Before we answer that question, there are two important pieces of context

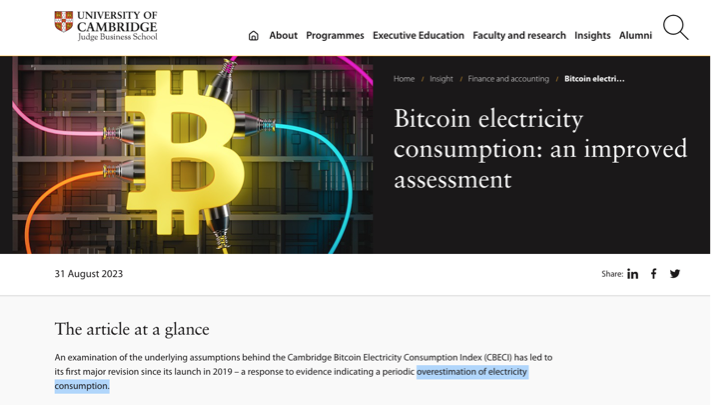

On 31 Aug 2023, Cambridge acknowledged that their model had overstated energy consumption for more than two years, and will still likely overstating emissions.

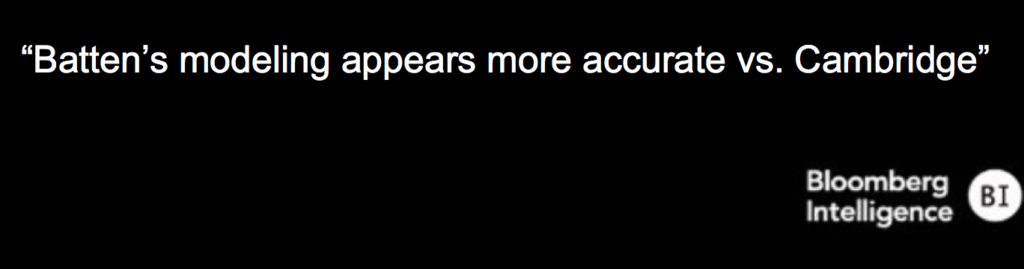

Two weeks later, on 14 Sept, Bloomberg Intelligence dropped the Cambridge model and started using BEEST. Saying:

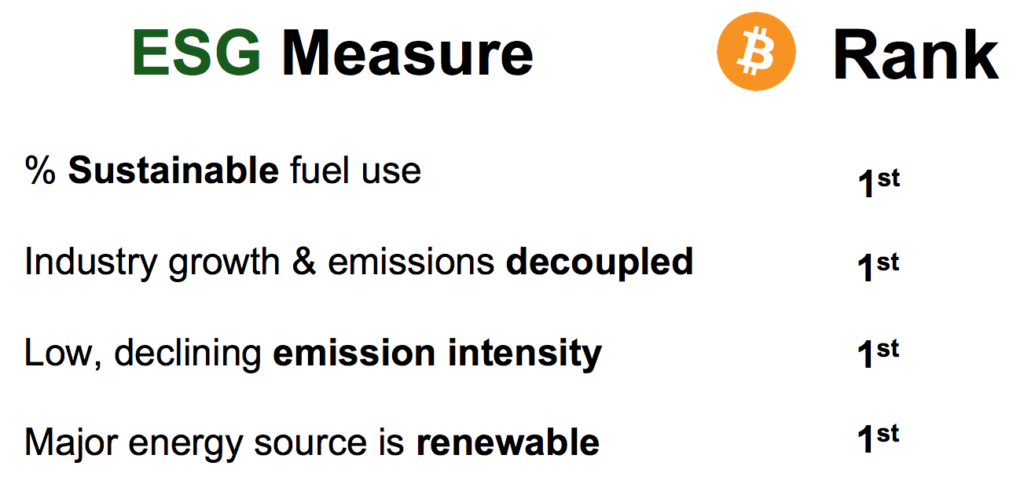

So we now have a up-to-date model of both offgrid and ongrid mining, which is the preferred model of a third part which ESG Investment Committees trust, and which reveal four things

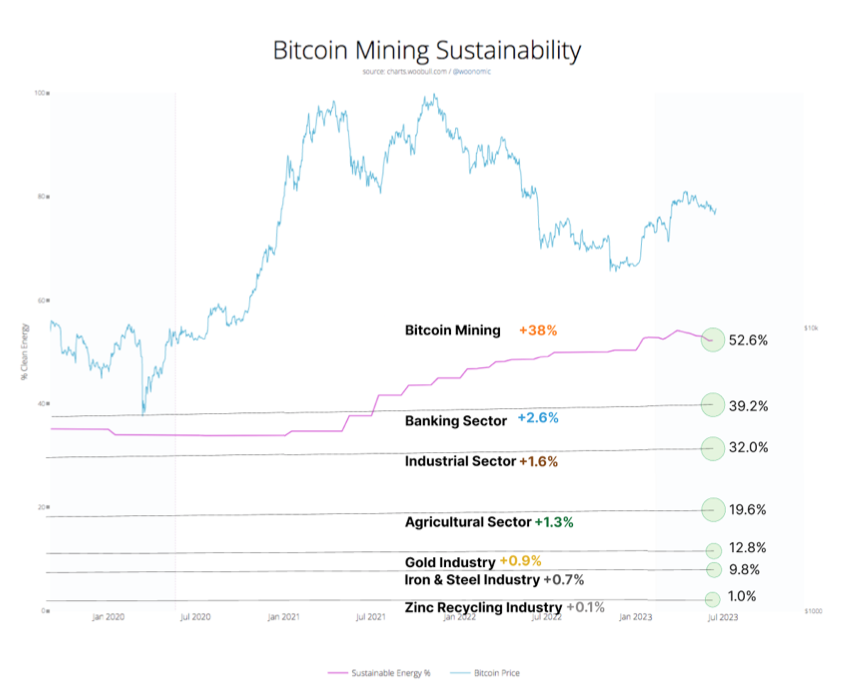

1. The Bitcoin network uses over 50% sustainable energy. This makes it the world’s leading industry user of sustainable power.

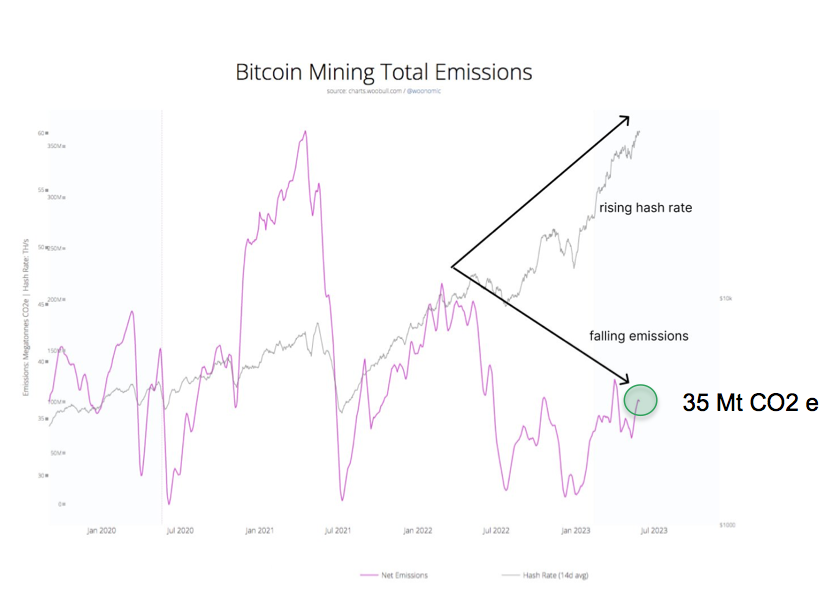

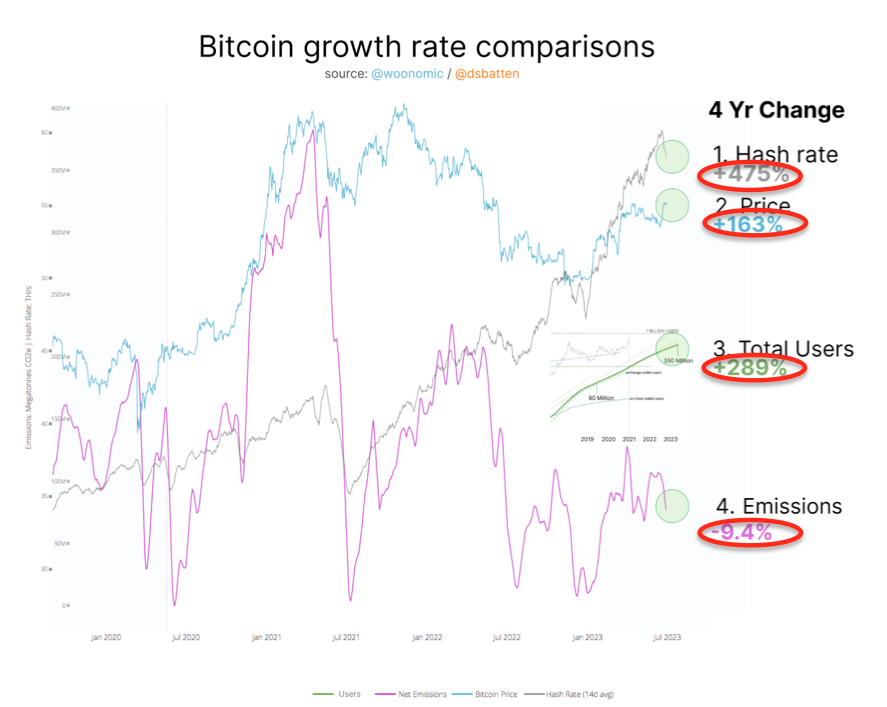

2. Bitcoin’s emission have not increased in the last 4 years.

This doesn’t just impact institutional adoption. This impacts mining policy. Such as the proposed EU POW ban. The Whitehouse said to form favorable policy on Bitcoin mining they need data showing that as the network grows, emissions do not get out of hand.

We now have that data. In the last 4 years, hashrate grew over 400%. Price over 160% Emissions have not grown. This makes Bitcoin the only global industry where industry growth has not led to emission growth.

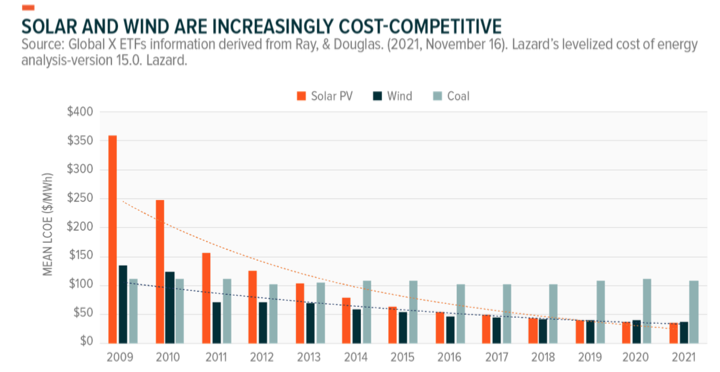

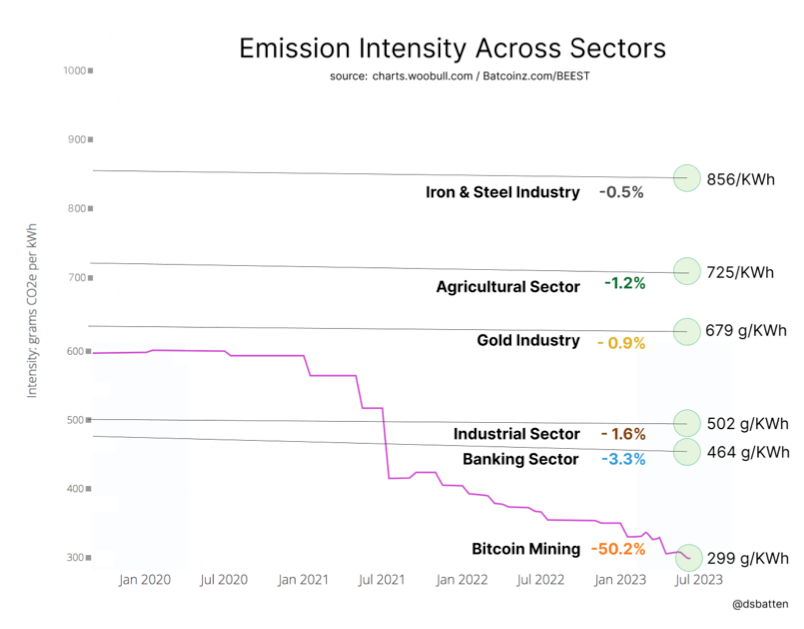

3. Bitcoin emissions intensity has halved. This is a measure of emissions per unit of energy, these and are now lower than other industries.

4. We know the major fuel source for Bitcoin is hydropower. Making it the only global industry who’s major fuel source is not fossil fuel.

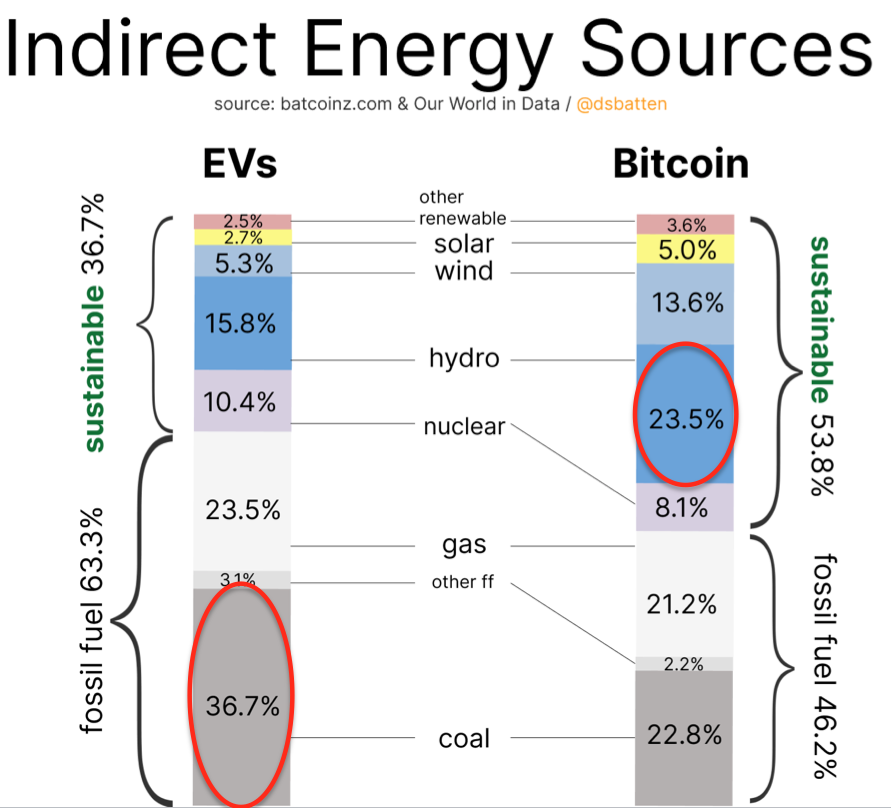

Like eVs, Bitcoin has zero direct emissions. But both have secondary emissions from electricity use. The difference is in Bitcoin’s case it’s mainly hydro, in eVs case it’s mainly coal.

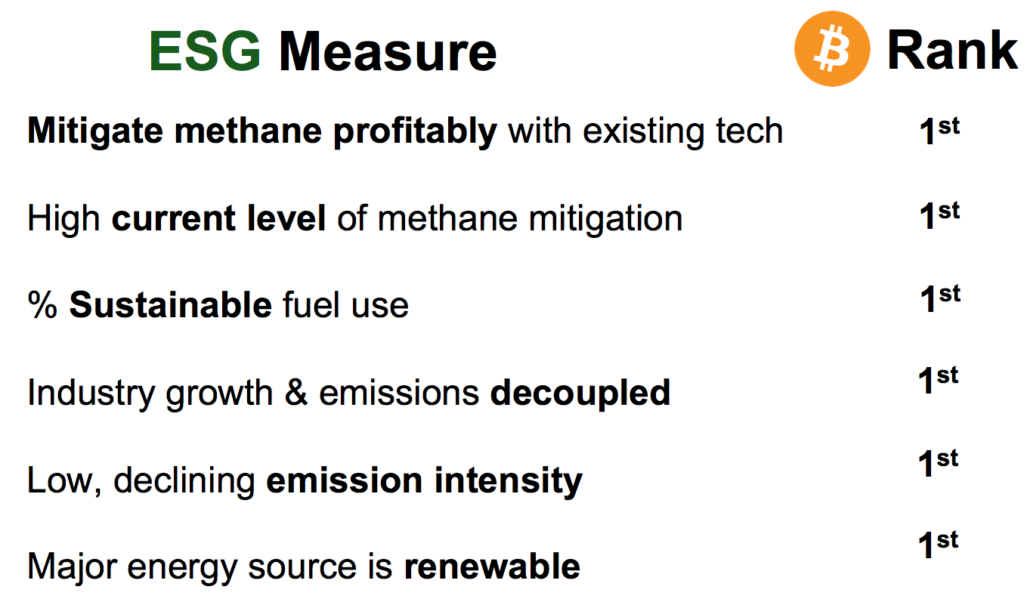

Which means that each of the four articles listed above about Bitcoin are wrong. But they are not just wrong, they have wrongly indicted an industry who has achieved four ESG firsts which remain unique to any industry. They are:

Image shows Bitcoin mining, compared to other global industries

Now is the time for Bitcoin proponents to share this new narrative, backed up with a full and representative data set, with ESG investment committees worldwide.

Re-education will take longer than education, and some ICs (Investment Committees) may succumb to confirmation bias. But for the intellectually curious ICs of this world, they will find that truth is on the side of Bitcoin’s ESG case, and that truth is now a little more transparent.

Without thorough surveying of ESGs its not possible to assess the impact on AUM deployed into Bitcoin through socializing this new Bitcoin ESG narrative, other than to say it’s possible that socializing this data could catalyst ESG funds deploying 1% of their AUM into Bitcoin. Intuitively, I’d anticipate that to go north of 1% will take not just socialization of data but action.

The type of action has already been foreshadowed both ESG ICs and past-critics of Bitcoin

Methane Mitigation

ESG Funds have said “If it was measurably shown that Bitcoin mining could mitigate enough methane to offset network emissions, it would be a no brainer”

The Whitehouse OTSP report on Crypto-asset mining said that Bitcoin mining using vented methane is “more likely to help rather than hinder the US govt’s climate objectives”.

The policy lead IMF stated “The methane mitigation case is by far the most compelling ESG argument for bitcoin.

To put it another way: good data and models can defend Bitcoin against falsehoods, and show Bitcoin is a good ESG investment. But Mitigating methane can cement Bitcoin as the world’s best ESG asset.

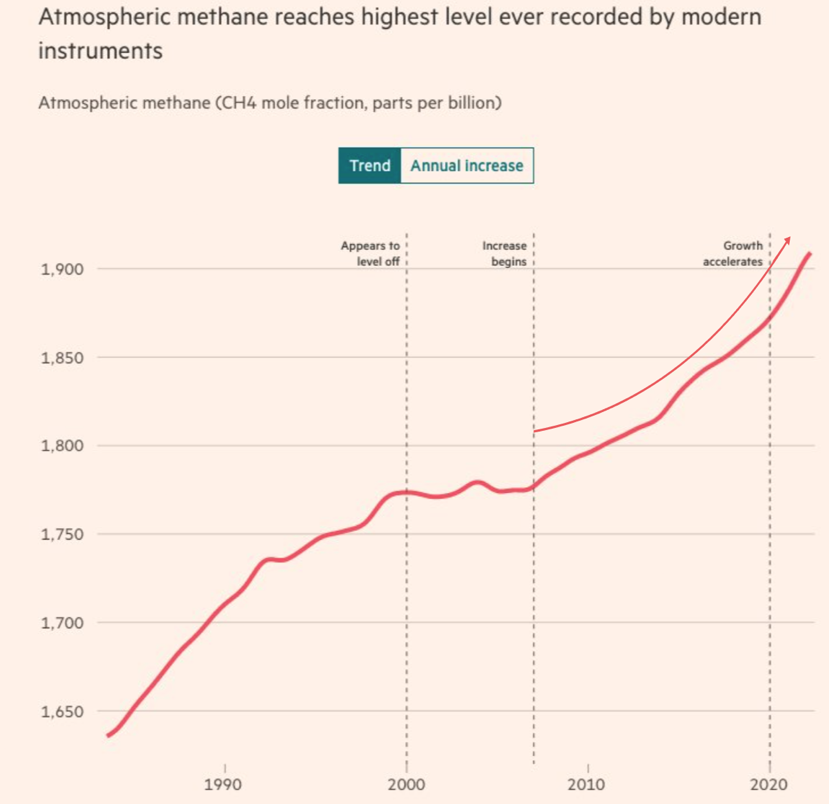

Why methane mitigation is so important

Firstly, cutting methane is according to the UN “the strongest lever we have to slow climate change in the next 25 years”. Methane is 84 times more warming than CO2, growing at an accelerating rate. Yet little is being done about it.

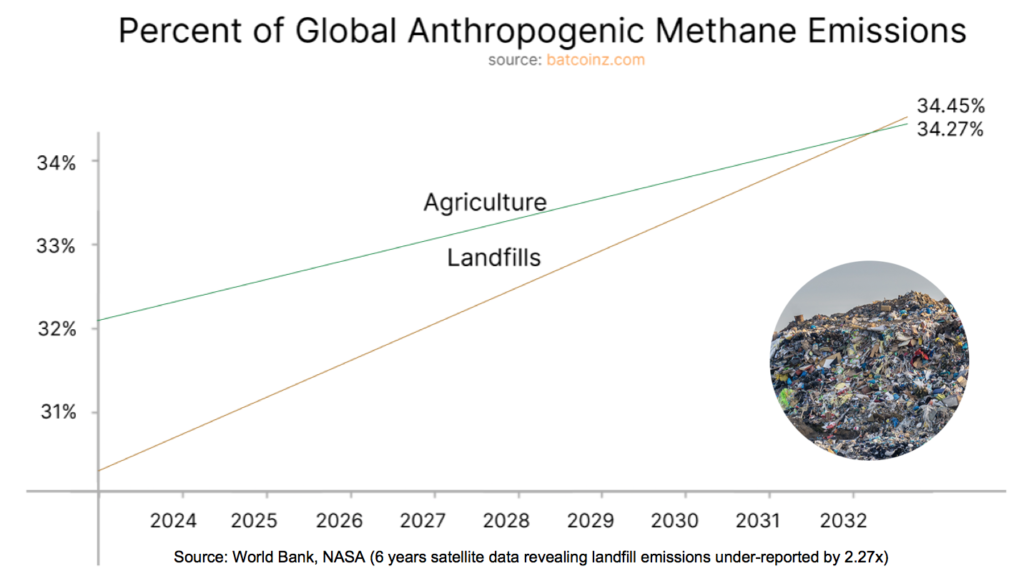

By 2032 our biggest store-house of methane could be landfills.

However, unless we can find ways to mitigate this methane profitably it won’t happen (which is why it hasn’t happened).

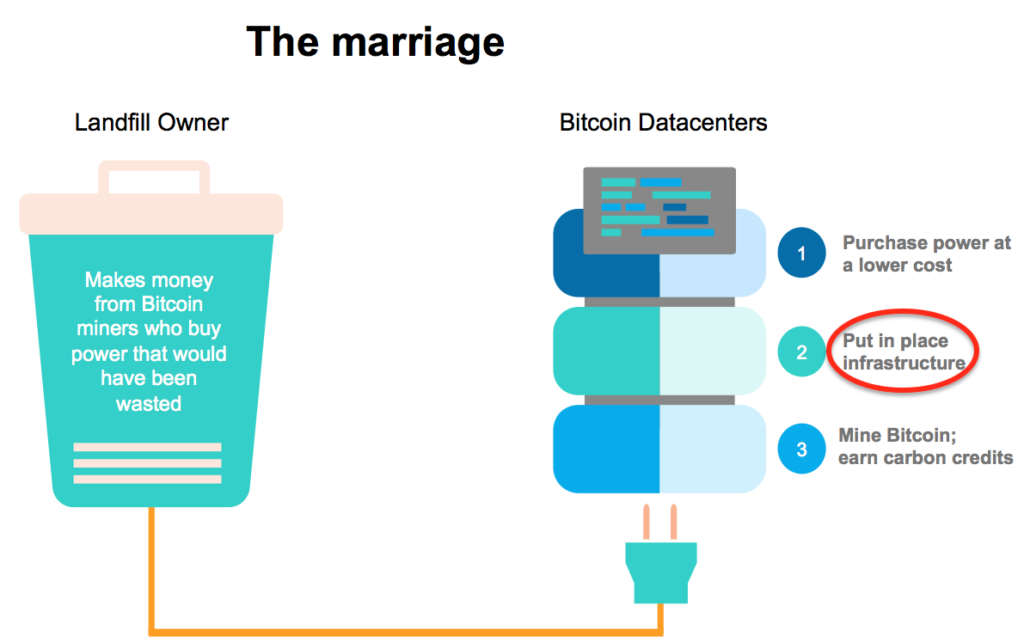

How do you mitigate methane from landfills profitably?

Where possible, you purify that landfill gas and sent it to a generator to create electricity – because that removes almost 100% of methane. You’re turning pollution into an asset.

The problem is for many landfills they cannot sell that electricity back to the grid. Either the grid upgrade costs too much, or government policy prevents it in some cases, such as in Mexico.

Recently, I asked Nuno Barbosa, CEO of Unicarbo, who’s been doing landfill power generation for 20 yrs “ how many landfills worldwide have no option to sell power back to the grid. He estimated “50%”.

I then posed him a second question: “What if those landfills had an onsite customer?” to which he replied “that would change everything.”

What is the profile of an onsite customer for landfill gas power generation?

This customer would need to be quite unique. For one thing they’d have to be prepared to set up their business on a remote landfill site. Secondly, their electricity costs would have to be such a high percentage of their total OPEX, that investing millions of additional CAPEX in GCCS (Gas Collection and Control Systems) and Generators simply to chase cheap power would make economic sense.

If it weren’t for Bitcoin mining, this customer profile would simply not exist.

Bitcoin miners have been enthralled by the idea of setting up on a landfill. That’s why there are now four bitcoin mining companies doing it, including recent entrant Marathon, the world’s largest publicly traded Bitcoin mining company.

Both Bitcoin mining companies and landfills owners want to make this happen. All they’ve lacked is the financing to execute this idea on a bigger scale. That’s why I personally decided that our 3rd climatetech fund would provide the infrastructure funding to bridge this gap.

Unless we make methane mitigation profitable, the level of methane reduction our planet needs won’t happen. This means according to the UN that our climate efforts will be in insufficient. Remarkably, Bitcoin mining can make methane mitigation profitable for 50% of the world’s landfills.

In summary:

- reducing methane is our strongest lever to reduce climate change, and

- for vast swathes of that methane – Bitcoin mining is the only technology that can remove it profitably.

This is great for the planet. But it’s also great for Bitcoin. Here’s why.

Methane Mitigation & Bitcoin – benefits quantified

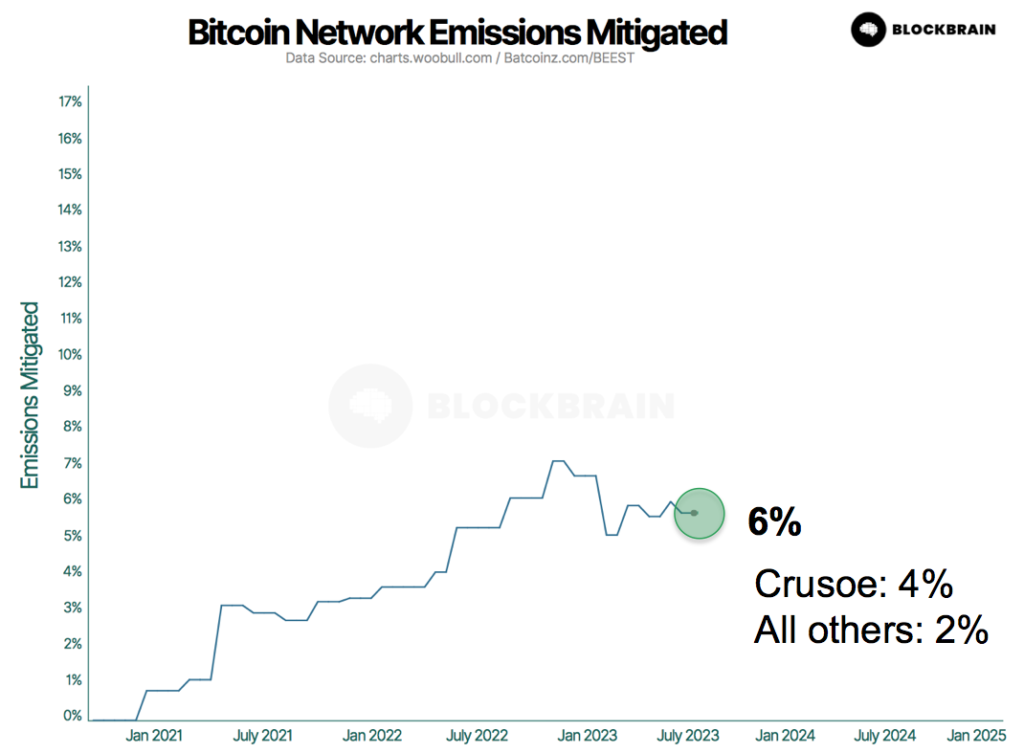

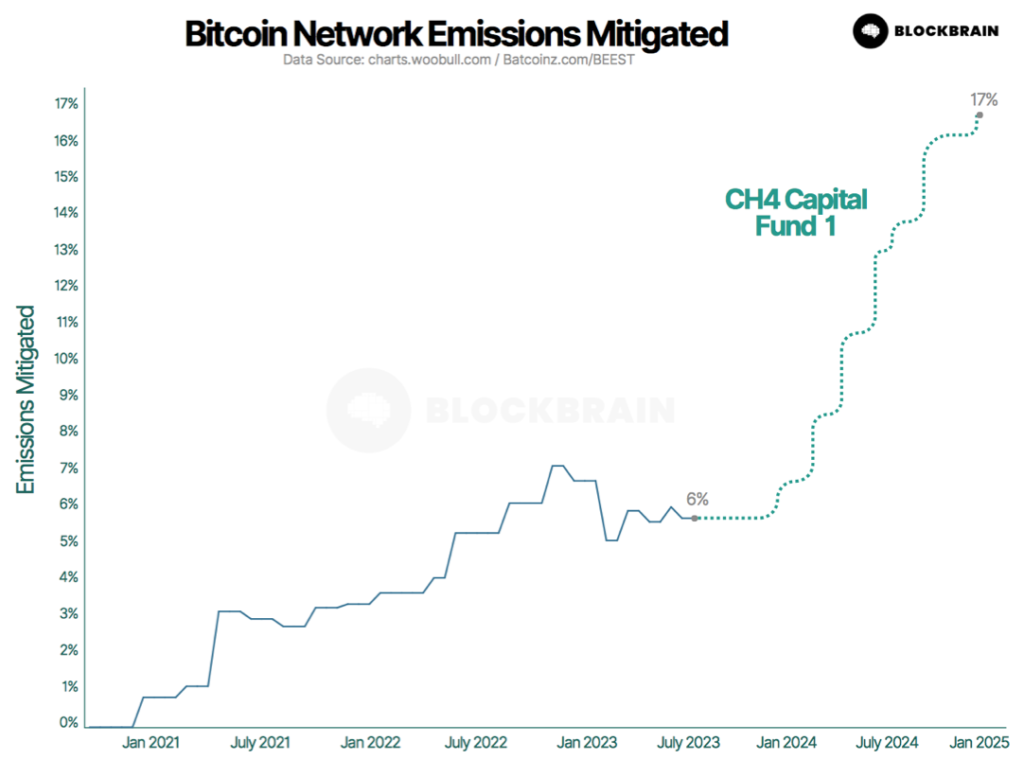

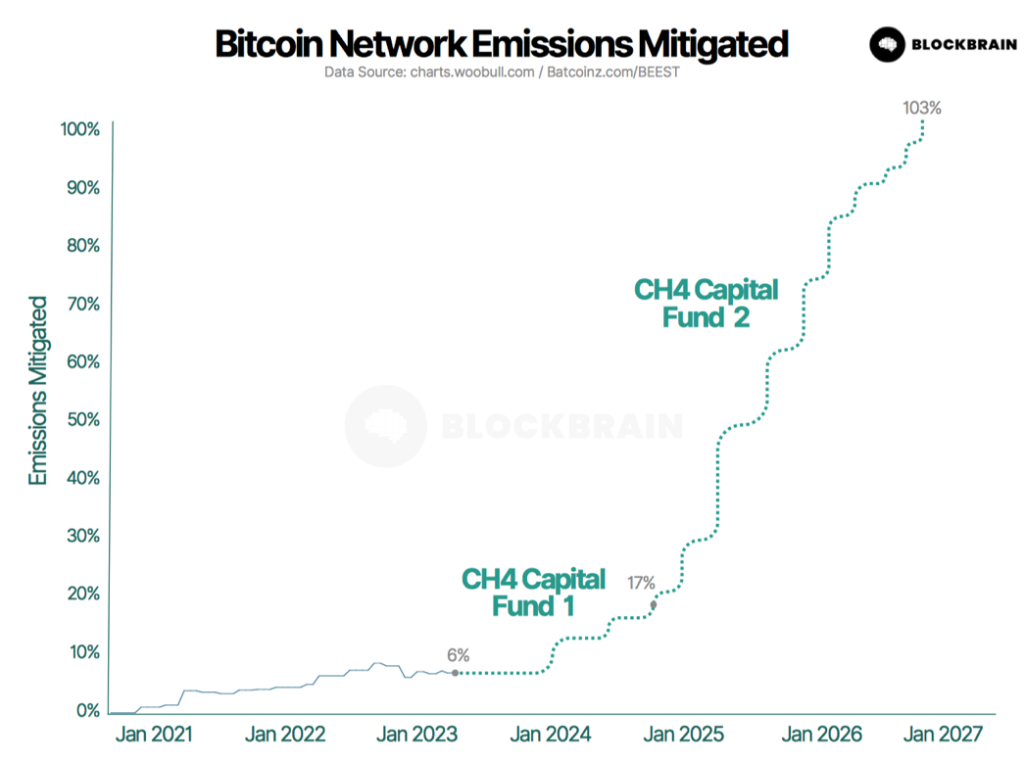

Each year Bitcoin miners are already mitigating 6% of the entire Bitcoin network’s emission. That’s extraordinary. That’s 6% better than any other industry. 2/3 of the reason that number is so high is Crusoe Energy, who use flared methane on oilfields to power a combination of HPC and Bitcoin mining.

However, there is an even better story that beckons to be made true. If Bitcoin mining on four mid-sized landfills that are currently venting their methane, then Bitcoin’s emission mitigation would almost triple.

To put it another way, Bitcoin mining on four of these mid-sized landfills would reduce 4 Million tonnes of CO2e. That’s more than the emissions of Geneva; 1000 times more emission reduction than the largest Direct Air Capture project ever run.

It is possible using existing technology to accomplish this within one year.

If Bitcoin mining projects were financed on 35 mid-sized venting landfills, Bitcoin would become the first industry in the world to go Greenhouse negative, without offsets.

Given that no industry has ever achieved this feat without offsets, Bitcoin would also solve the problem that ESG investment committees around the world are facing when looking for worthy assets to deploy a percentage of their funds into.

How much capital does it take to go greenhouse negative?

Crusoe energy took $505M investment to achieve their 4% emission mitigation. Therefore, by simply scaling up what Crusoe does, it would take $12.1Bln.

However, by targeting venting landfills and Bitcoin mining, then because venting mitigates ten times more emissions than flaring does, it would take only $421Million (investment, not cost) to make Bitcoin the world’s first greenhouse negative industry.

The Human Cost of Waste

But there’s another side to the story: it’s harder to quantify, but it’s no less important. Methane doesn’t just effect the global environment. It affects people

According to the UN, methane is responsible for over one million premature deaths annually. That’s equal to the number of people who died in the last year from suicide (700,000+) and covid (300,000) combined.

The methane-venting landfill in Haiti is an open dump. There are 2-3000 rubbish pickers who spend most of their lives on it, scavenging for trash to resell earning ~$3/day. It’s been called hell on earth.

This photo is of Changlair Aristide. He’s 41 now. He started this work when he was 12.

Men and women do this work, long into the night.

This is Changlier’s wife, Violene. Her dream is to have a “nice home”. When asked to elaborate she said “one where I don’t not need to hold up tarps when it rains.”

The image below shows where the rubbish pickers live. Most of them have respiratory illnesses and chronic headaches from methane inhalation and infections from used syringe jabs they get while scavenging.

Because their homes are right next to the landfill, the children are continuously exposed to the methane too. Babies are more likely to be born with birth defects. The waste from the landfill is not contained, so it seeps into their water supply, which they use for cooking, bathing and drinking

This is the pickers walking directly through the smoke caused when the trash gets burnt releasing dioxins which they inhale.

Remarkably, Bitcoin mining has the unique ability to turn methane that’s killing people into methane that transforms communities. The methane mitigation projects can give the rubbish pickers a living wage doing waste separation with proper tools and protective clothing. Because these projects impact the health and financial wellbeing of whole communities, the carbon credits the project generate can trade for a higher premium which is enough to offset the additional cost of this work.

The Big Picture

In this article, we’ve focused on one of 21 environmental benefits of Bitcoin. We haven’t touched on the environmental benefits of grid de-carbonization or a world without the fuelled malinvestment of a fiat monetary system.

It’s also worth remembering that we have also only addressed the “E” part of ESG. We have only mentioned social benefits of Bitcoin as they pertain one environmental usecase of Bitcoin. Nor have we covered the governance benefits of Bitcoin, which Anita Posch and other commentators have documented in some detail.

In summary, Bitcoin is worth everyone believing in, including the world’s ESG Investment Committees. It can make the legitimate claim to be the #1 ESG asset in the world across not one but 6 highly relevant metrics, with the latest and most representative dataset to back up these claims.

If there is another contender for the world’s #1 ESG asset, please submit your claim with the evidence to back it up. Out of the 200 candidates I’ve seen, Bitcoin has certainly been a clear first.

Resources:

- Keynote in Lugano, Switzerland where I presented these findings. October 18, 2023.

- BEEST model methodology and data

Pingback: Bitcoin Market Cap Poised To Hit $3.3T With ESG Fund Inflows - AI News Nest

Pingback: 随着 ESG 基金的流入,比特币市值有望达到 3.3T 美元 - Ktromedia.com

你是少数看透真相的人。

Pingback: Bitcoin’s ESG Potential: How It Can Attract $23 Trillion and Grow to $3.3 Trillion - cryptoS Report >> BTC, ETH & SOL...