How to use this article: Since the original GreenpeaceUSA article uses many of the arguments that are traditionally used by opponents of Bitcoin to argue that it is a net-environmental negative, this article serves as a useful counterpoint to share with any environmentally conscious person who may have encountered negative environmental messaging around Bitcoin, and is curious enough to seek context before forming their own viewpoint.

Context: In July 2023, GreenpeaceUSA published a report “Investing in Bitcoin’s Climate Pollution”. My rebuttal argues that the report recycles many already widely-debunked claims about Bitcoin, uses unsubstantiated fear about “what might happen” rather than evidence to influence readers, and repeatedly avoids important contextualizing information in order to present a skewed and in many cases false appraisal of Bitcoin.

Before we get into the data for why the GreenpeaceUSA report is horribly misguided, and in many cases false some personal context:

I have been a supporter of Greenpeace since 1990. I have participated in direct action campaigns and provided training to Greenpeace. I have supported them and protested alongside them in their fights against Deep Sea Oil Drilling and Genetically Engineering. I have been a climate campaigner since the 1990s, and have frequently written on the subject.

I have never seen an environmental campaign which is so misinformed, unsupported by data, and counter-productive to the aims of the environmental movement. A decade ago, I began investing in climatetech and supporting entrepreneurs who were creating technologies that can reduce climate change. I have seen over 200 different climatetech propositions. Having evaluated Bitcoin mining as I would any other climatetech proposition (by objectively looking at pros and cons), there is no doubt in my mind that Bitcoin has the potential to be a powerful weapon in the fight against climate change. Therefore, it is my opinion that not only are GreenpeaceUSA’s arguments unfair, they are an own-goal for the climate movement.

Let’s debunk the anatomy of misinformation, starting with the framing of GreenpeaceUSA’s report itself.

Highly emotive, unsubstantiated claim in the Report Framing Page

Most people will not have the time to read the article, so will instead rely on GreenpeaceUSA’s framing page with the link to the full article.

The framing for the article is filled with emotive language without evidence such as the unsupported claim that Bitcoin is a “climate catastrophe”

The problem with the GreenpeaceUSA’s framing of Bitcoin is evident in the first sentence, where two claims are made

Bitcoin consumes as much electricity as entire countries, and 62% of the electricity used for Bitcoin mining globally in 2022 came from fossil fuels.

The first claim is true, but misleading. The second claim is false. These claims are repeated verbatim in the main report, so let’s examine each claim

Claim: “Bitcoin consumes as much energy as entire countries”

This has been a familiar catch-cry of Bitcoin antagonists, perhaps because its one of the few claims against Bitcoin that is factually correct. However, it’s also a misleading claim. Let’s examine why

Firstly, Cambridge University on their site discourage such comparisons between industries and nations, because they can make an industry look worse than it in fact is. They call this technique “presenter bias”. It’s easy to see why, comparing an industry to a nation is by definition an apples-to-oranges comparison.

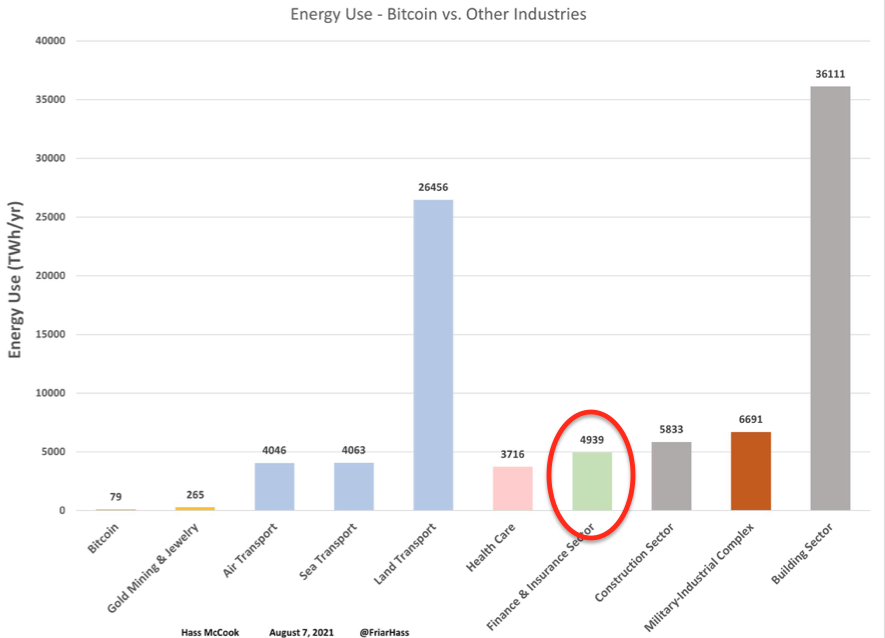

Secondly, it is also true that any number of industries use more energy than a single country. The same is true for example of video gaming, Netflix, traditional datacenters, the banking industry, clothes driers and Christmas lights. Yet it is only Bitcoin that is singled out in this way. In fact, every industry in the chart below uses more energy than entire countries.

Thirdly. Bitcoin actually uses less energy than each of the industries listed below. So if we are going to make a comparison, why not compare industry-to-industry by saying “Bitcoin uses less energy than Christmas lights?”

If Bitcoin truly were causing climate catastrophe, then why is GreenpeaceUSA not also targeting those other industries and lobbying investors and companies to curtail their use of, for example, video gaming?

There is a complete cognitive dissonance between the claim of GreenpeaceUSA and the actions of the organisation.

Either they are making a hyberbolic claim by calling Bitcoin a climate catastrophe, or they are failing to be a good environmental watchdog by turning a blind eye to the numerous industries that, by their own logic must be “climate mega-catastrophies”

Let’s look at the second claim.

Claim: “62% of the electricity used for Bitcoin mining globally in 2022 came from fossil fuels”

This claim is untrue. The truth is

“a 2022 study from Cambridge University, which by Cambridge’s own admission contained less than half of miners, “may not be representative”, and did not include mining activities that could be “reasonably expected” to improve the sustainable energy mix of Bitcoin, claimed that 62% of the electricity used for Bitcoin mining came from fossil fuels.”

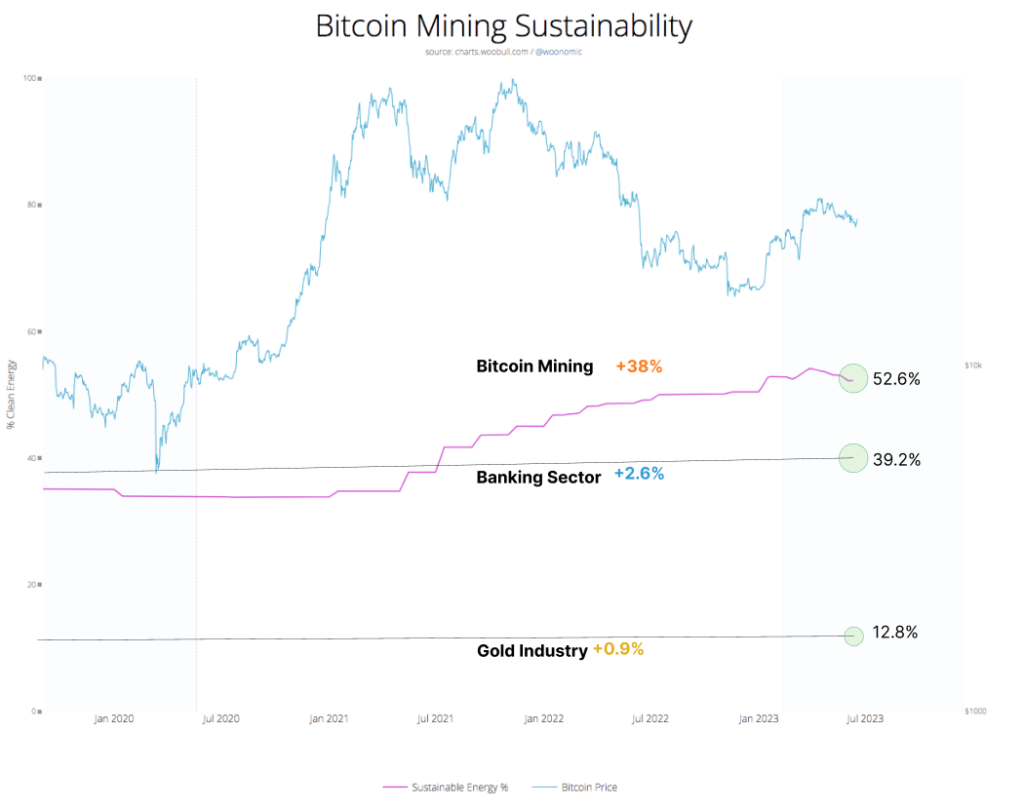

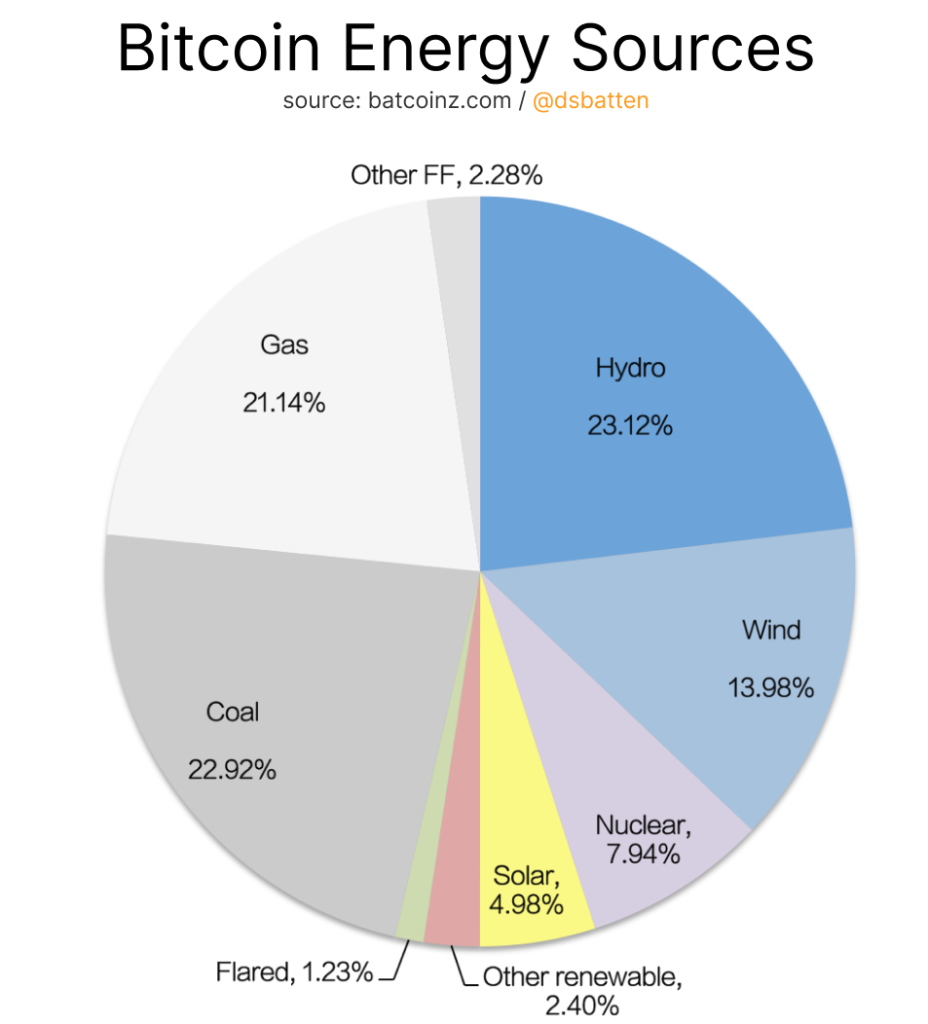

The omissions in the CCAF study have since been addressed in my more recent 2023 study which showed that when off-grid mining, flare-gas mining and the geographic migration of miners since Jan2022 is taken into account, 52.6% of Bitcoin mining globally in 2023 came from sustainable energy sources.

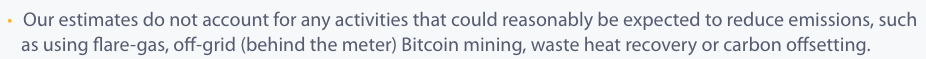

Cambridge’s report, cited by Greenpeace, by contrast did not factor in some of the most important factors in calculating Bitcoin energy mix.

source: Cambridge Methodology Section

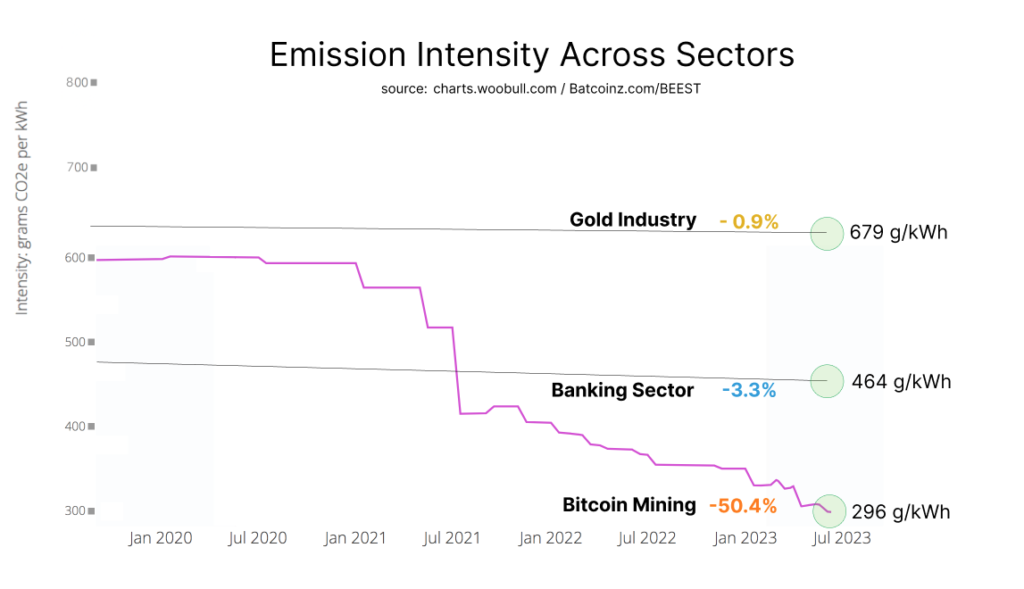

For context, 52.6% sustainable-energy mix is higher than other industries sectors. Bitcoin’s rate of growth in sustainable energy use is also higher than other sectors.

In summary: Bitcoin mining was indeed 62% from fossil fuels in 2021, however since then it has moved at a rapid rate to sustainable energy sources and as of 2023 is 52.6% backed by sustainable energy.

Let’s move on to the second sentence in the report

“Bitcoin’s energy-hungry technology has revived decommissioned coal-fired and fossil fuel power plants and caused substantial environmental and social damage.”

Again let’s break down the 2 claims

Claim: “Bitcoin has revived decommissioned coal-fired and fossil fuel power plants”

This is again untrue.

The fossil fuel plant that GreenpeaceUSA are probably referring to is the Greenidge Energy site at lake Senaca, which was once a coal-plant, but at the time of decommissioning was producing natural gas.

I did some investigation into this, and here’s what I learned:

Greenidge bought a then inactive power facility and spent tens of millions of dollars to permanently end the ability to use the plant for coal fired operations before converting the facility to natural gas operations. Greenidge brought the now natural gas facility to the wholesale energy market in 2017 as a merchant power provider, under newly issued air and water permits. There was no Bitcoin mining operation at this time, it was just a natural gas power plant when Greenidge restarted operations. Later, in 2020, Greenidge began a small Bitcoin mining pilot of approximately 1 MW while continuing to send power to the local energy grid. The Bitcoin operation began to expand in 2021, eventually reaching the level it is at now. Throughout the entire time and to this day, the Greenidge power plant provides power to the local electrical grid every minute it operates, which is mandated by its agreement with the local grid operator. In fact, in 2022 Greendige sent more energy to the local grid than it did when it was just a power plant only without its Bitcoin operations.

This is also very different to the claim that GreenpeaceUSA are making. It is also worth noting that offgrid natural gas has an emission intensity of 429g emissions/KWh. The US grid has an emission intensity of 383g/KWh, so this is in fact a marginally more emissions intense use (46g/KWh) than using the national grid. Greenidge’s Lake Senaca site uses 55 MW of power per year, so this site is using 0.4t CO2e emissions per year more than if they were using the grid. Let’s put this in context: global CO2-e emissions are estimated to be 50 Gt per annum, so this represents a 0.0000000008% additional contribution to global emissions above and beyond using the grid. To put this another way, under $50 invested in legitimate carbon offsetting would be sufficient to cover the additional emissions. Greenidge do in fact offset emissions, not just the delta but their entire emissions.

So a true statement with context would be “There are no examples of Bitcoin mining being responsible for bringing any former fossil-fuel plants back online, either gas or coal.”

As an important additional piecde of context setting, when an objective approach is used such as evaluating Bitcoin’s emission intensity of the entire network rather than the subjective approach of cherry-picking examples which support the author’s narrative, we get a very different picture of Bitcoin’s energy intensity.

Let’s look at the second claim in this sentence

Claim: “Bitcoin has caused substantial environmental and social damage”

Again untrue. Indeed the article makes no attempt to validate the unsubstantiated claim that Bitcoin has caused social damage. But since the claim has been made, let’s look at the actual social impact of Bitcoin, as supported by data.

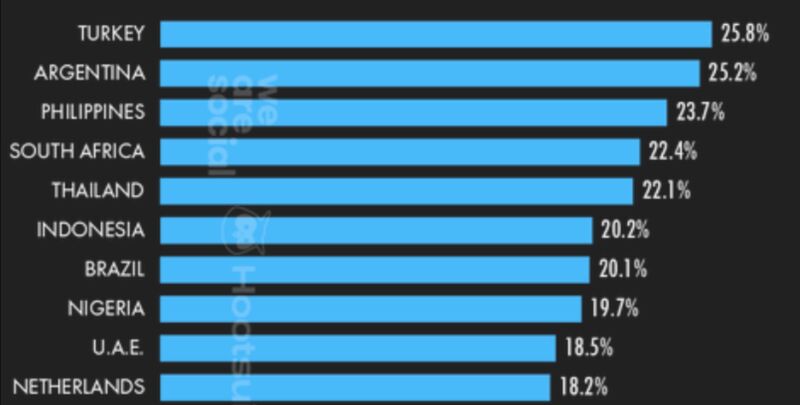

A recent Hootsuite report highlighted some interesting trends about user adoption of bitcoin (currently estimated to be 300M+ and growing exponentially).

3 things are noteworthy in this this chart:

- The top 2 nations are both experiencing hyperinflation

- All of the top 10 except the Netherlands have at least 1-in-7 people who are unbanked

- With the exception of Argentina, Brazil and the Netherlands, the remaining 7 nations all have autocratic or semi-autocratic regimes

Discussions about Bitcoin’s energy usage are often conducted without an examination of it’s social impact. This is a mistake, because we could be biased against the technology based on misconceptions or lack of information about it’s utility. For example, my first assessment of Bitcoin was “Speculative asset that does nothing useful but uses lots of energy.” This perspective proved false, but in lieu of information to the contrary my perspective predisposed me to think negatively about Bitcoin based on my first-glance assessment of its social good.

Here’s a demographic snapshot of who Bitcoin’s adopters predominantly are and why they use it:

There are 1.2Billion people who are unbanked – 57% of them are women, 90% are people of color.

There are 4Billion people living under autocratic or semi-autocratic regimes, where the financial system can be used against them (eg: state freezing of bank accounts, censoring and surveillance of how you spend money).

There are 8.1M adult women in Afghanistan who are prohibited by law from opening a bank account, starting a business or receiving an income because of their gender.

There are >300M people who’s economies are experiencing hyperinflation (including Turkey, Lebanon, Argentina, Venezuela).

These are the people who see the utility of Bitcoin first. Not us in the West who take for granted our privilege, human rights, functioning banking system, 99%+ access to banking, and relatively low inflation.

So what is the social utility to these people?”

It helps the unbanked, because you don’t need a bank. A feature-phone plus some basic Bitcoin education allows users to receive, save and pay. There’s a financial revolution happening in Africa right now: the poorest in the world are leapfrogging the banking sector and going directly to Internet-native money (Bitcoin). This is why the continent of Africa is adopting Bitcoin faster than any other continent.

It helps people in autocratic regimes because they cannot have their money surveilled, censored, de-platformed or frozen by the State. This is why Nigeria is one of the biggest adopters of Bitcoin. It’s driven by human rights activism.

It helps women in Afghanistan, because they can (and do) adopt bitcoin Lightening Wallets, which means state discrimination cannot deny them financial equity.

It helps those living with hyperinflation because it allows them to avoid 10 years of life saving being reduced to 1/2 its value inside a year.

That’s why of the top 10 nations adopting Bitcoin+crypto

1. Top 2 nations are experiencing hyperinflation

2. 7 or the top 8 countries were colonised + have heavy IMF/World Bank loans

3. 7/10 are autocratic or semi-autocratic regimes

4. 7/10 from Africa, Latin America or SE Asia

In terms of social utility, the data suggests strongly that to more than 1/2 the world, Bitcoin is arguably the most useful technology in a generation. For GreenpeaceUSA to claim that Bitcoin causes social damage is to say the least, highly uninformed.

Let’s look at the second claim made in this sentence:

Claim: “Bitcoin causes substantial environmental damage”

Some important context here is that there are now 41 Bitcoin mining operations that use sustainable-energy based operations.

The report does not mention any of these operations. Rather, the entire report documents the one case of where a Bitcoin mining operation could be argued to be causing environmental damage: Stronghold’s Scrubgrass site in Pennsylvania. This is currently the only known Bitcoin mining operation in the world that is still using a coal or coal-related product for power.

Again, some important context. The facility uses 2.4 EH of hashing power (this is a measure of computational power). Global hashrate is at the time of writing 379 EH (source: Glassnode), so this is 0.63% of total network power. If GreenpeaceUSA had said “99.37% of the Bitcoin network does not use offgrid coal plants” they would have been factually correct.

However, even this exception is worthy of further examination. Stronghold does not burn coal, they burn “gob” which is a by-product of the coal industry. The local community has been supportive of Stronghold’s project because they claim it has resulted in tidying up the local environment and removing an environmental hazard. Stronghold have been credited by the community for removing Gob, which is an environmental hazard, that pollutes waterways and soil. It can and does regularly catch on fire causing emissions of carbon monoxide, methane (84 times more warming over a 20-year period than CO2) from partial burning, soot, and other toxic substances. That said, burning either coal or coal byproducts has a high emission intensity, which is a negative environmental externality. It is unclear whether this Bitcoin mining operation is net-positive or net negative to the environment, and would need further analysis to determine this. Either way, this Bitcoin mining operation is highly anomalous with respect to the rest of Bitcoin mining since the 2021 China-ban.

Besides this one example, there is no other evidence in the report to substantiate the claim of “substantial environmental damage”.

Rather, the issue seems to be the report author’s fear of what could happen in the future. This is a legitimate concern. However, if that were the angle, it would be more honest to admit that Bitcoin causes minimal environmental harm today but may be a problem in the future – rather than vilify Bitcoin as a “climate catastrophe” without any substantive evidence to back up such an emotive statement.

Indeed the report’s executive summary states this fear: “Left unchecked, Bitcoin’s climate destruction is likely to accelerate.”

Likely? According to whom? There is again no evidence to support this claim.

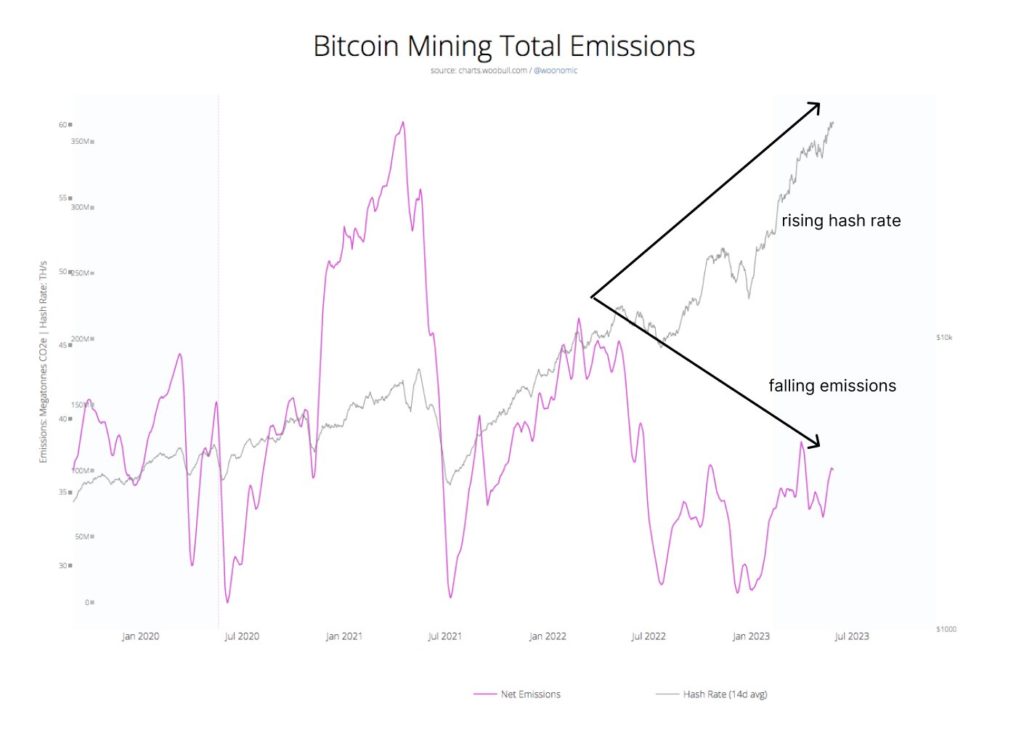

If we look at the data, there is however a growing weight of evidence to suggest that the alternative hypothesis is likely the correct one:

“Left unchecked, Bitcoin’s minimal environmental impact is likely to lessen further, and could in fact become net-positive to the environment before 2030”

The evidence for this claim comes in the form of 3 data-points.

This is a critical piece of information that shows that despite fears that Bitcoin emissions would rise parabolically, over a four-year halving cycle emissions are in fact marginally down. Factors for this are included in the link above.

There is a growing weight of evidence from those most qualified to make the assessment to suggest that Bitcoin mining helps build out the renewable grid. For example, former interim-CEO of the ERCOT grid Brad Jones, who witnessed Bitcoin’s role in providing grid stability firsthand, recently stated the following about Bitcoin mining:

Bitcoin mining

· Makes renewable operators more profitable

· Accelerates the renewable transition

· Does not compete with other users of electricity

· Drives electricity costs for all users down

~ Brad Jones, former interim CEO, ERCOT (aka: the grid operator)

Brad Jones is repeatedly ignored by mainstream media and environmental organizations, presumably because his informed view does not support the narrative of SierraClub et al who claim that Bitcoin’s ability to help the renewable buildout of the grid is a myth perpetuated by the Bitcoin mining community.

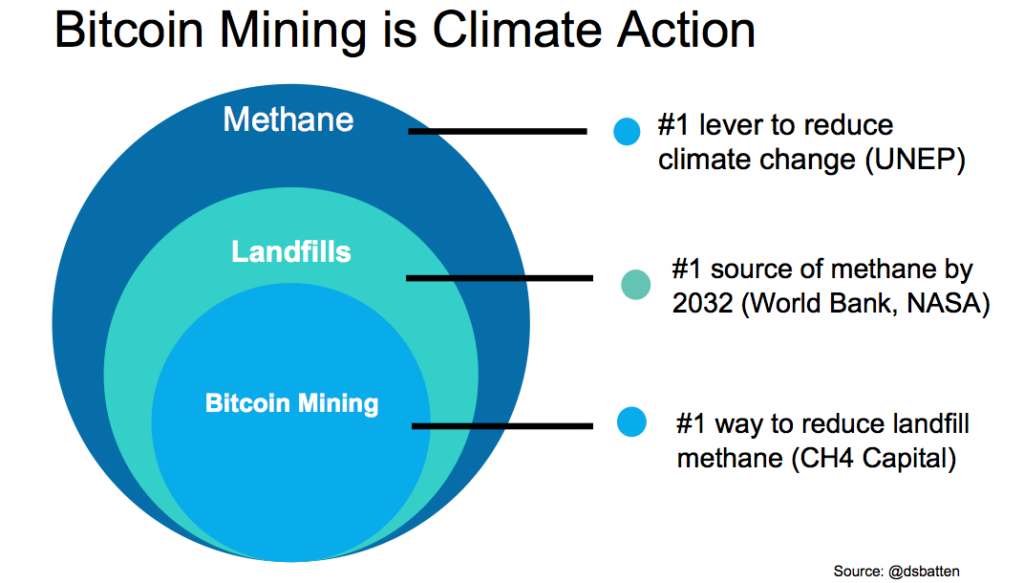

2. Methane mitigation and grid renewable build-out potential

In terms of methane mitigation, particularly when it comes to Landfill Gas, Bitcoin’s ability to be a proactive weapon to fight climate change deserves special mention. This is covered in detail in a special in-depth report I wrote on the subject. Here is the high level summary.

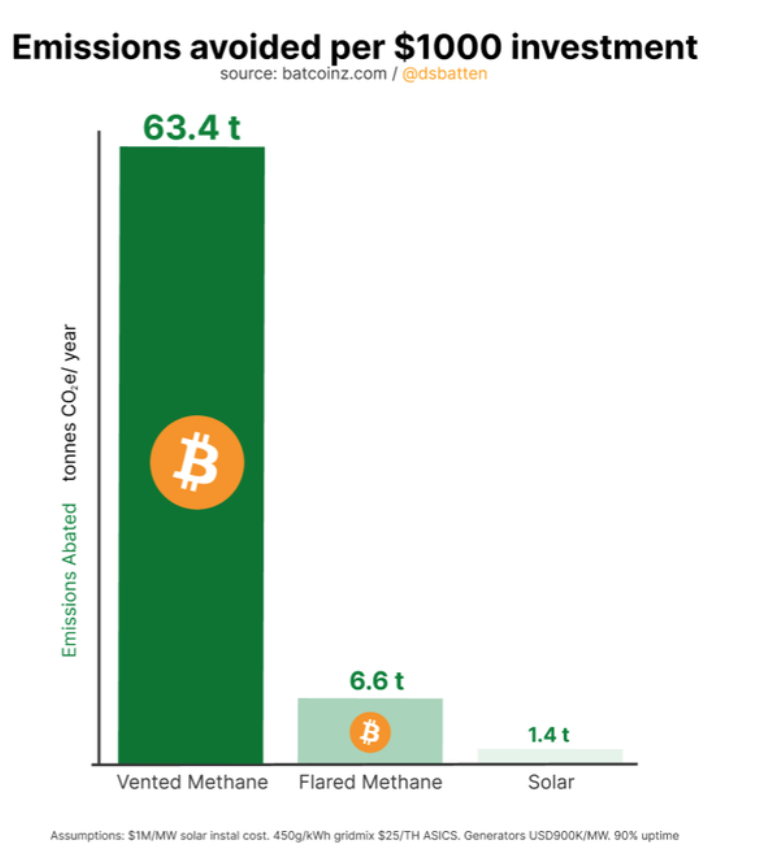

Bitcoin mining, when used on landfills that were previously venting methane also has a favorable rating in terms of its ability to economically offset emissions compared to new solar installations.

For the curious, here is a 10-minute explainer video about how Bitcoin mining facilitates methane mitigation.

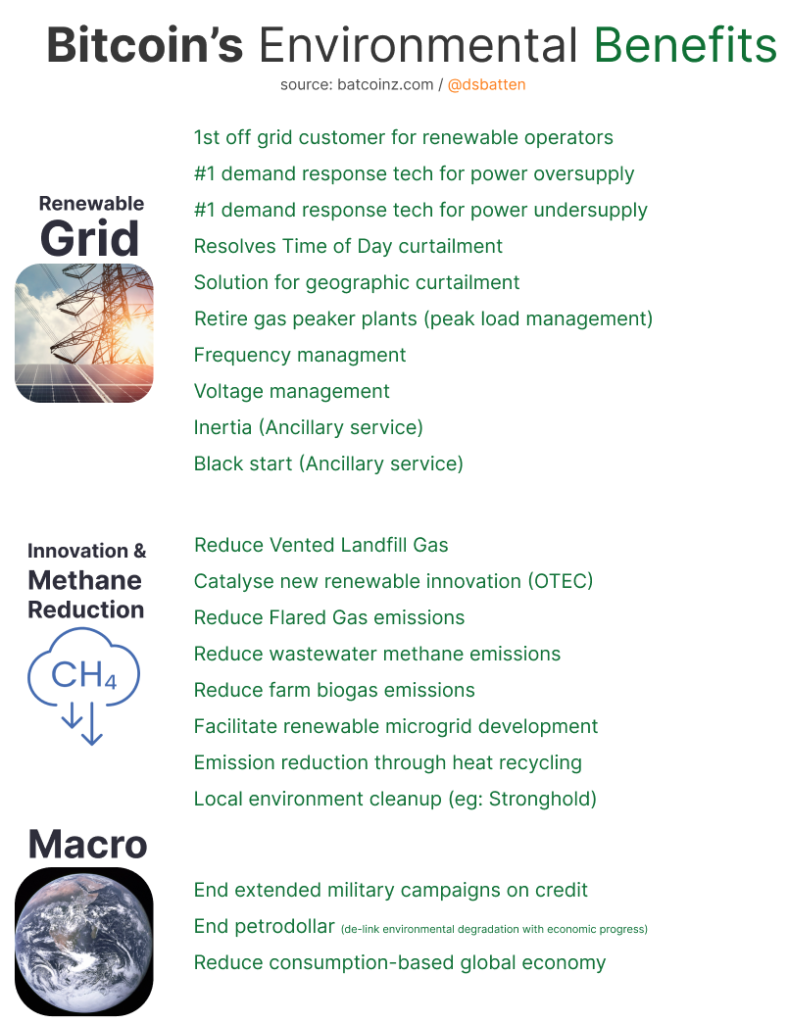

3. An objective assessment of environmental impact of a technology requires an evaluation of both positive and negative environmental externalities. Bitcoin has 21 environmental benefits that have been claimed, with evidence for each claim. The GreenpeaceUSA article does not make mention of these benefits in their analysis of Bitcoin’s environmental impact.

GreenpeaceUSA’s assessment that “Bitcoin as bad for the environment” is therefore an incomplete and biased analysis, precisely comparable to an accountant declaring “this business is in bad shape” after having only examined the liabilities of that business, but without having examined its assets.

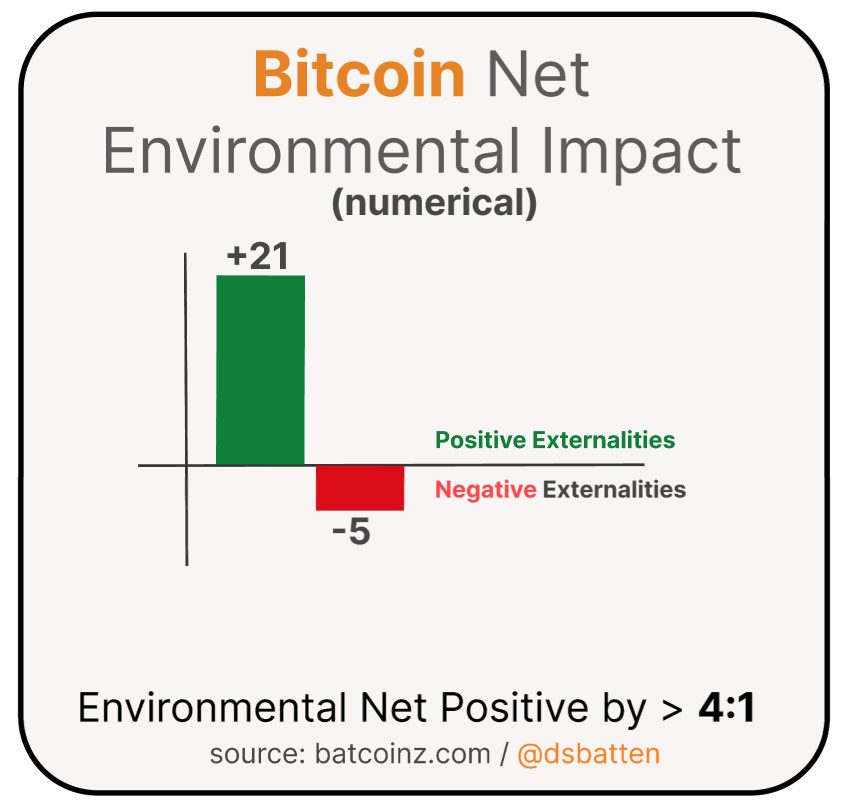

When the positive and negative externalities of Bitcoin are both assessed, Bitcoin mining has an overall 21:5 balance net-positive.

Claim: A “change in the code” will solve the “problem”

False. GreenpeaceUSA suggest a cure that that would kill the host, for a patient that is not sick

The report suggests that Financial Institutions should show “support for a code change to reduce BTC’s pollution”

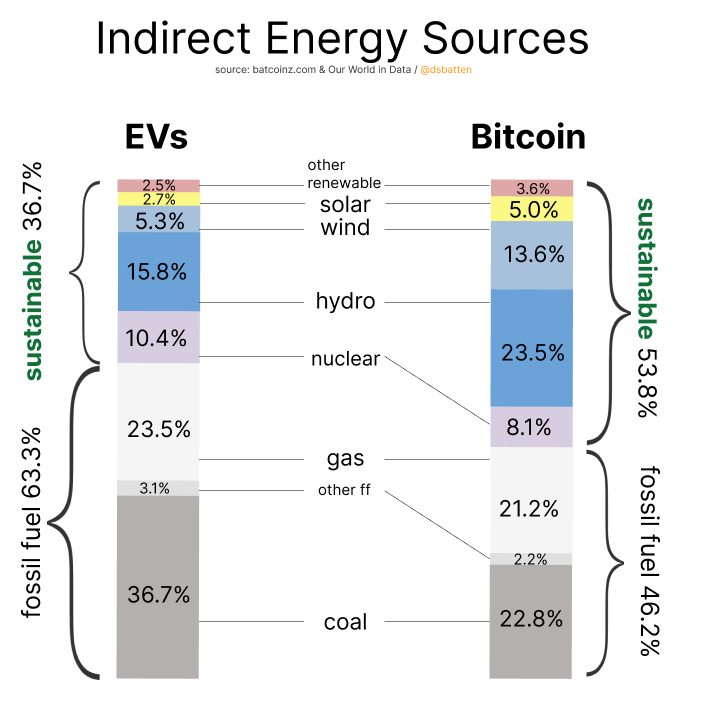

Firstly, it’s important to point out that Bitcoin mining, like electric vehicles (eVs), is a fully electrified technology. As such, Bitcoin does not produce any direct emissions. Like eVs and indeed every other technology being used by humanity at this time in history, Bitcoin does have scope 2 emissions due to the fact that the grids who’s electricity Bitcoin miners use, are reliant on electricity which is often generated using fossil fuels.

Here’s a breakdown that shows Bitcoin’s scope2 emissions, relative to eVs. Because, unlike eVs, Bitcoin miners are able to use offgrid power (mostly renewable sources such as hydro) it has a lower scope2 emission profile than eVs.

This again begs the question, why is GreenpeaceUSA singling out a technology that is fully electrified, has no scope-1 emissions, and has lower scope-2 emissions than other grid-reliant technologies including eVs.

Second, the suggestion that a “change in the code” would be the correct way to lessen Bitcoin’s emissions betrays an ignorance of how Bitcoin’s code base works, and how changes to the protocol work.

Without going into elaborate details about the Proof of Work consensus mechanism, we can summarize this point by saying that Proof of Work is to Bitcoin as the Cerebral Cortex is to humans. The Proof of Work algorithm, among other benefits, makes Bitcoin invulnerable to cyber-attack by colluding nation-states. This is why it offers the broad range of social impact benefits it does, particularly to an exponentially growing community of users in the global south. Without this mechanism it would not be Bitcoin; it would not be a highly secure, decentralized, censorship-resistant form of money: it would just be another altcoin.

The other important point about Bitcoin is that it is an open source peer-to-peer technology. Changes to the code are not governed by central powers, they are decided by the community by consensus. There is a global network of Bitcoin miners, developers and node owners. If anyone feels that they have a code change that would benefit Bitcoin, then the participatory democracy structure that is Bitcoin gives you the freedom to suggest that change, and even make that change.

Of course, being participatory democracy other users are free to use or ignore that change too. GreenpeaceUSA have spent $5Million of Chris Larson’s money (Chairman of Ripple, and the donor behind the Change the Code Campaign) plus whatever money they have used from their own donor base to lobby for a change to the code.

The total number of node owners, developers and miners who have taken up this suggestion so far is zero.

False, and psychologically manipulative, neuro-associations: Bitcoin and Coal

“Coal Kills” says the article, complete with the famous “Skull of Satoshi” emblem complete with coal furnaces in lieu of hair.

Throughout the article, GreenpeaceUSA attempts to neuro-associate Bitcoin with coal: typically through imagery rather than evidence. This association is however false. It’s also psychologically manipulative.

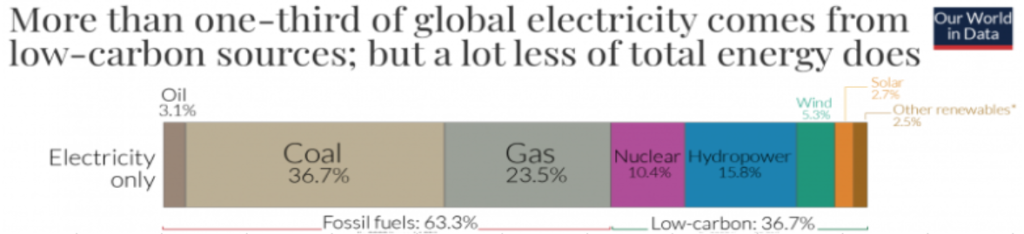

An important context that is not mentioned in the article is that the global electrical grid currently has coal as its major fuel source.

This means that datacenters, eVs, gaming technology, clothes driers, house lighting, electric heaters, Smartphones, computers, electric stovetops and a myriad of other appliances and technology are predominantly powered by coal.

Remarkably and ironically, Bitcoin because of its unique ability to locate onsite and behind-the-meter on a renewable-energy site find itself the only global technology that is not powered by coal.

How did GreenpeaceUSA arrive at such conclusions?

In GreenpeaceUSA’s defence, they are reliant on the quality of the journalism and academic research for underpinning their conclusions.

As is routinely the case in the first 10-15 years of understanding a novel technology, this quality academic and journalistic work in the main channels is yet to appear, as highlighted in a recent report by the Bitcoin Policy Institute.

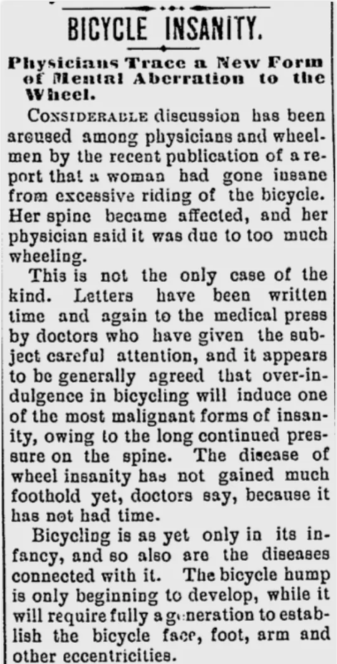

This is it would appear the rite-of-passage that any novel and disruptive technology must go through. It is human nature to fear the unknown, and for both academics and journalists to vilify first, seek to understand second.

This is why the initial inquiry into a novel technology has a history of being incorrect, often farcically so. The Internet for example was famously dismissed as being no more important to the economy than a fax machine by one prominent academic and lampooned by journalists as heralding the need to revive our coal industry (a prediction made in ignorance of the exponential improvement in computer chip efficiency).

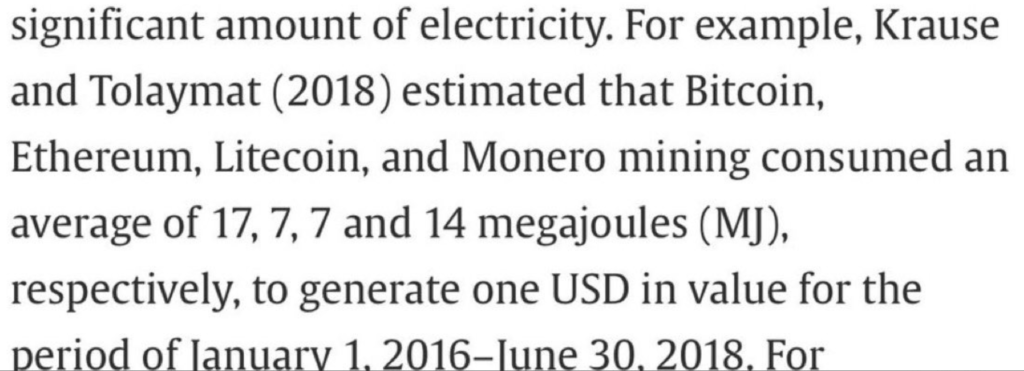

Similarly with Bitcoin, neither academics nor journalists yet have a deep and grounded understanding of what bitcoin is: something that is readily apparent in their work. For example, as recently as July 2023 an academic study used data from 2018 to make the claim that Bitcoin used 17MJ per dollar.

The authors appear unaware that in 2018, the market cap of Bitcoin was 1/3 what it is today and the average J/Th rating of machines were 5-10x higher.

The current MJ/$ based on Bitcoin’s current energy consumption and market cap, and it is 0.72M/$. In other words, the citation is out by a factor of 24x.

Writing about Bitcoin mining without understanding machine efficiency curves is like making projections about the power consumption of the Internet without understanding the impact of Moore’s Law.

It is a rookie’s error: an error made in the first years of the Internet and now repeated in the first years of Bitcoin.

Similarly, the Peer review process has not provided the normal protective rails to prevent flawed scholarship making its way into academic journals, because the peer reviewers share the same lack of domain expertise in Bitcoin and Bitcoin mining as the authors themselves.

It will take time for academic study to become reliable, and for journalism about Bitcoin to become reliable – just as it took a long time for academics and journalists to understand other technological innovations.

These academic studies inform journalists, who also lack understanding about Bitcoin. These journalists inform the perspective of some environmental groups. When all three communities lack a basic understanding of how Bitcoin and Bitcoin mining works, then it is unsurprising that we should come up with conclusions and campaigns that are as eye-raisingly wrong as the first wave of expert conclusions about other technologies.

For example:

“There is not the slightest doubt that bicycle riding, if persisted in, leads to weakness of mind, general lunacy & homicidal mania.”

~New York Times, 1894

Conclusion

Owing to its many inaccuracies, exclusions, use of flawed source data, absence of evidence to support many assertions, lack of objective evaluation of complete environmental impact and evidence of strong presenter bias, this report should be disregarded. We encourage GreenpeaceUSA, other environmental organizations, journalists and academics to start learning about the following subjects

- Proof of Work: what is a consensus mechanism and why is it an important feature of a distributed ledger

- What problems does bitcoin solve

- What communities are using Bitcoin and why

- What role does Bitcoin currently play in enabling the acceleration of renewable energy

- What role can Bitcoin mining uniquely play in methane mitigation

- Trends: What’s happening with hashrate, machine efficiency, and location of miners

- Why do mining companies seek out stranded energy and why is it it normally renewable

- How does Bitcoin mining compare to other technologies in helping grid load balancing, providing a first customer to off-grid renewables, and reducing the curtailment of renewable energy

- What mistakes did the first generation of reports on Bitcoin mining make, and how have subsequent reports improved upon these omissions and mistakes

- Why is wholesale energy price, not Bitcoin price, the biggest driver for the type of mining machines used to mine Bitcoin

- The economics of Bitcoin mining: why Bitcoin mining is called a non-rival energy user

You will find few in the Bitcoin community that will resist a sincere attempt to learn and engage.

These areas are as fundamental to being able to write authoritatively about Bitcoin as an understanding of climate models is to the understanding of climate science.

On a positive note, several University courses are now starting to emerge on Bitcoin, where students will be properly grounded in their understanding of the above subjects. There are three such Universities in Switzerland alone.

There is also evidence that more and more journalists are starting to research at Bitcoin before writing about it. Out of the first 30 articles published in the mainstream media on Bitcoin and ESG during 2023, 24 of them were positive evaluations.

These measures will improve the quality of Bitcoin and Bitcoin mining research, and help end the era of “vilification through lack of understanding” that all novel disruptive technologies seemingly must pass through.