Overview

Cambridge’s analysis should be applauded for its rigor. The analysis is also noteworthy for its absence of fundamental flaws such as “per transaction” metrics that have been common in the research of other commentators on Blockchain technologies. The dataset is also contemporary, which is a major improvement. We hope to see moves to update the Bitcoin mining map in the near future, which is currently based on the network’s geographical spread in January 2021.

There are also some good attempts to delve into the nuances between PoS and PoW blockchains. For example, acknowledgement that Bitcoin and Ethereum are fundamentally different in their intents and uses, and therefore saying “Ethereum has changed to POS therefore Bitcoin can too” is not as straightforward as some in the environmental movement have been suggesting.

There are however things the article gets wrong, chiefly by omission. These omissions are at the layer of presentation, rather than mathematics. However, their omission is no less significant than a mathematical error as the impact is to in some cases create a skewed impression of the potential environmental impact, current and future, of each Blockchain.

Context

This is not the first time that Cambridge’s analysis has had significant omissions. The omission of newer mining rigs causes their model to overestimate Bitcoin energy consumption for two years, an omission they acknowledged on 31 Aug 2023. Their omission of up-to-date mining information has resulted in the overestimation of Bitcoin emissions for two years. Their 31 Aug report acknowledges their model is likely still overestimating emissions. Their model of Bitcoin emissions also omits offgrid miners, an omission that causes significant overestimation of fossil-fuel powered mining: an omission which Bloomberg Intelligence cited as one of the reasons for dropping their use of the Cambridge model on 14 Sept 2023. These omissions led to erroneous conclusions on 4 separate Bitcoin ESG metrics which I presented at PlanB Forum 2023. Cambridge’s conclusions were covered in mainstream news media and which have persisted in the popular consciousness.

So, praiseworthy though the bulk of Cambridge recent analysis is, omissions lead to incorrect inference as we can see. It is therefore important that the current omissions are addressed directly and early.

Errors and Omissions

- Presenting Technological Imperative as Ideological Intransigence.

Cambridge’s statement “Many in the Bitcoin community seem to view PoW as a cornerstone of the network’s identity” comes across as glib, and makes no attempt to educate the reader about the reasons Bitcoin’s core features and value proposition are supported by a PoW algorithm, but not by PoS.

We refer readers to this introduction to PoW that investigates the connection between the core qualities of Bitcoin, and the PoW algorithm

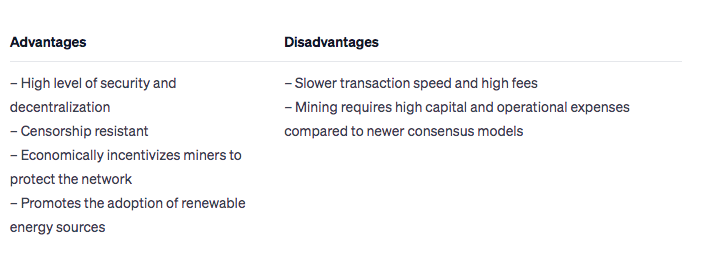

PoW advantages and disadvantages

As we can see, the advantages or PoW precisely align to the original design brief for Bitcoin (censorship resistance and high degree of security and decentralization) that Satoshi Nakamoto outlined in the Bitcoin whitepaper. To put it another way, without PoW, Bitcoin would no longer be Bitcoin, it would simply be another altcoin.

By contrast, rather than investigate the connection between algorithm and use, Cambridge through omission imply that the Bitcoin community has an attachment to proof of work that is driven by ideological belief rather than technological imperative.

No contemporary discussion on the usecase for Bitcoin and the reason for its PoW is complete without acknowledging that the majority of both user growth and utility is currently felt in the Global South where autocratic rule is an unfortunate reality for the majority. For these people, decentralization of one’s means of exchange is an issue of quality-of-life, not ideology. A centralizable PoS based Bitcoin would no longer provide protection against central capture, surveillance, changing rules around issuance and deplatforming.

2. Acknowledgement that there are multiple paths towards sustainability, not one

Cambridge’s article is also notable for not having contemplated whether there could be other paths towards sustainability for a Blockchain other than a fundamental code change. Nor does the article mention the numerous, and increasing, number of well documented positive environmental externalities that are only possible as a direct result of having a proof of work algorithm

These benefits include but are not limited to, the ability to stabilize grids through demand response services, being a first offtaker for renewable suppliers and greenhouse negative cryptocurrency mining using sources such as previously vented, or flared, methane.

The world has many examples of technologies, such as solar, that took many years of generating a carbon footprint before they paid off their carbon debt and started becoming net emission reducing. These are already-realised benefits, not theoretical benefits which have been the subject of multiple independent reports as well as peer-reviewed research, so not acknowledging these benefits is a notable omission.

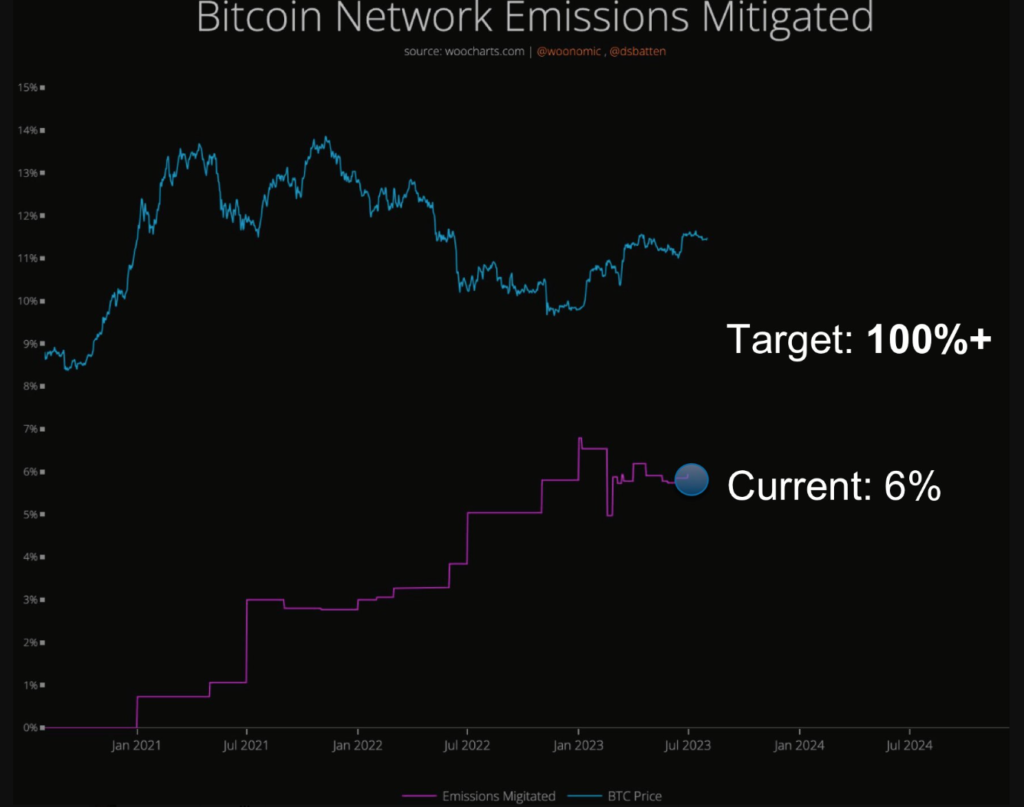

Cambridge’s analysis also does not entertain the possibility that Bitcoin mining could have the potential to follow a trajectory akin to the photovoltaic industry. This is another noteworthy omission, particularly as provisional data has already suggested that the Bitcoin network has already achieved 6% emission mitigation through use of flare-gas as a power source (not possible under PoS).

Conversely, Ethereum has mitigated emissions short-term. This is no doubt true. However mid and long term, Ethereum has also rendered itself unable to participate in any of the positive environmental endevors that Bitcoin’s proof of work algorithm allows it to. in this context, it is unclear whether Ethereum’s merge is net positive or net negative to the environment.

Summary

Cambridge should be complimented for the rigor of its analysis on Ethereum environmental impact, and for their acknowledgement of some of the nuances that distinguish Bitcoin vs Ethereum, PoS vs PoW. Objective, acting in good faith, and actively debunking faux-metrics such as resource use per transaction, they remain one of the better groups commenting on Bitcoin. However, by not investigating the usecase for Bitcoin outside the West which is only technologically possible to maintain with a proof of work algorithm, and by not acknowledging the positive environmental potential of PoW blockchains, the same rigor is missing from its presentation of the environmental impact of each Blockchain. The result is an incomplete and indeed skewed presentation of each Blockchain’s path to sustainability.