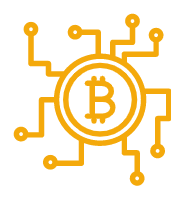

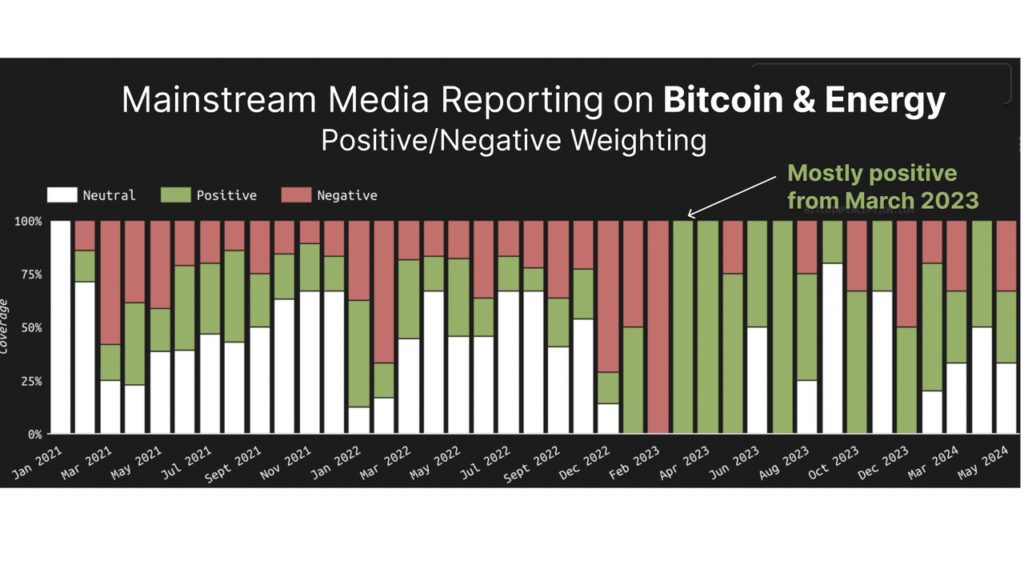

The media’s view of Bitcoin mining has changed markedly in just three years, as evidenced by the cover image, which uses empirical data to analyze every mainstream media article on Bitcoin and energy since 2021. Remarkably, the chart shows that mainstream media articles about Bitcoin and energy have been consistently more positive than negative since April ’23.

Given that Bitcoin & Energy had been a major attack vector, resulting in Telsa’s withdrawing support for Bitcoin payments and causing downward price pressure on the $1.3Trillion asset, this is a big moment in the history, and potential future, of the digital asset.

SourceSo why has the mainstream media largely abandoned their energy attacks on Bitcoin? Why have they not just stopped writing, but begun writing positively about Bitcoin and energy?

To answer this we must examine history. This “negative-to-positivity arc” is common for disruptive technologies. Initial media reporting on the Internet, the electrical grid, and even the bicycle was initially strongly negative. As better data emerged and the population became familiar with the value of the new technology, the narrative changed. The chart above tells us visually that Bitcoin mining’s evolution in the media has been no different.

This article looks at the data that underpinned this shift in media reporting, highlighting 10 key images that forever changed our perceptions about Bitcoin and the environment.

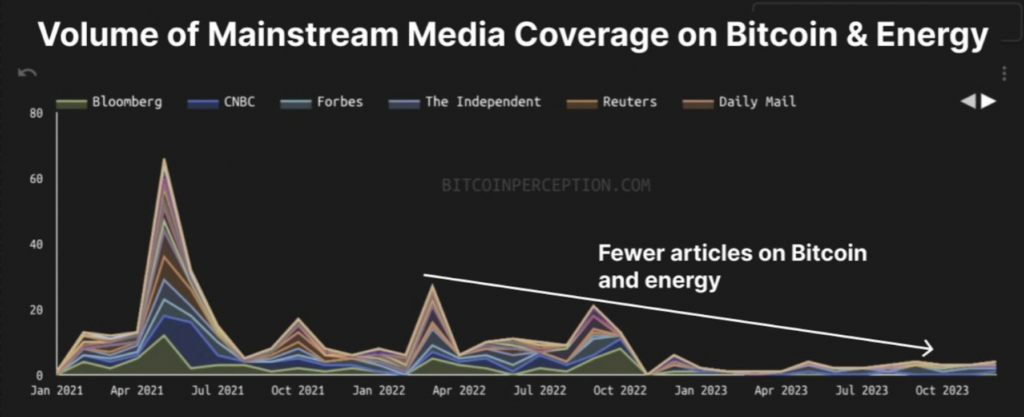

1. Bitcoin mining has a net decarbonizing impact on electrical grids

In late 2021, Joshua D. Rhodes, Thomas Deetjen, and Caitlin Smith showed something utterly different from the prevailing wisdom: flexible data centers like Bitcoin mining allow grid owners to add more intermittent renewable energy sources.

This is because variable renewable energy sources (i.e., solar, wind) are intermittent. That means, unless there are very flexible customers who can curtail their energy use when the sun doesn’t shine, or the wind doesn’t blow, grid operators must add more baseload (usually fossil fuel) energy to the grid as more renewables are added as an “insurance policy” against solar/wind variability. As a more flexible energy user, Bitcoin mining lets grid operators stack more solar/wind without more extra fossil fuel backup, and while reducing strain on the grid.

This was the first time independent evidence showed that Bitcoin mining could help nations meet their net-zero emission targets.

2. Bitcoin is likely net decarbonizing to the financial sector

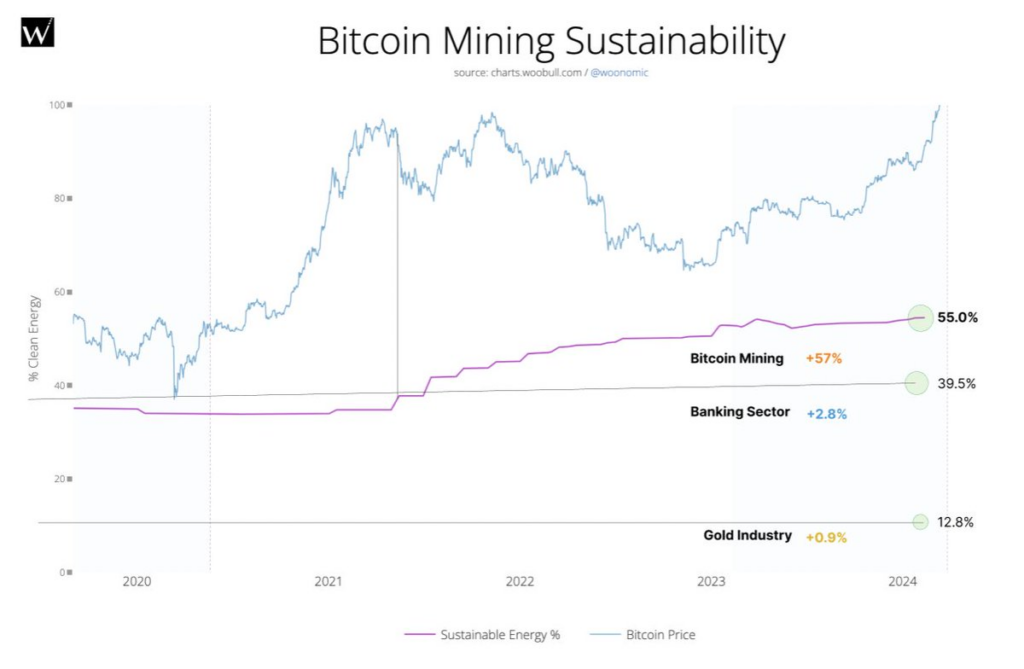

This chart from Woonomic showed that Bitcoin mining could have the same impact on the global finance system that Electric Vehicles have on the international transport system: becoming more sustainable than the old, fossil-fuel-intensive technologies they obviate.

Bitcoin’s two primary functions are

- A store of value

- A method of transaction

As a store of value, Bitcoin supersedes gold, an industry that uses significantly more fossil fuel-derived power. As a transaction method, Bitcoin obviates the need for specific banking and financial services that use much more fossil fuel.

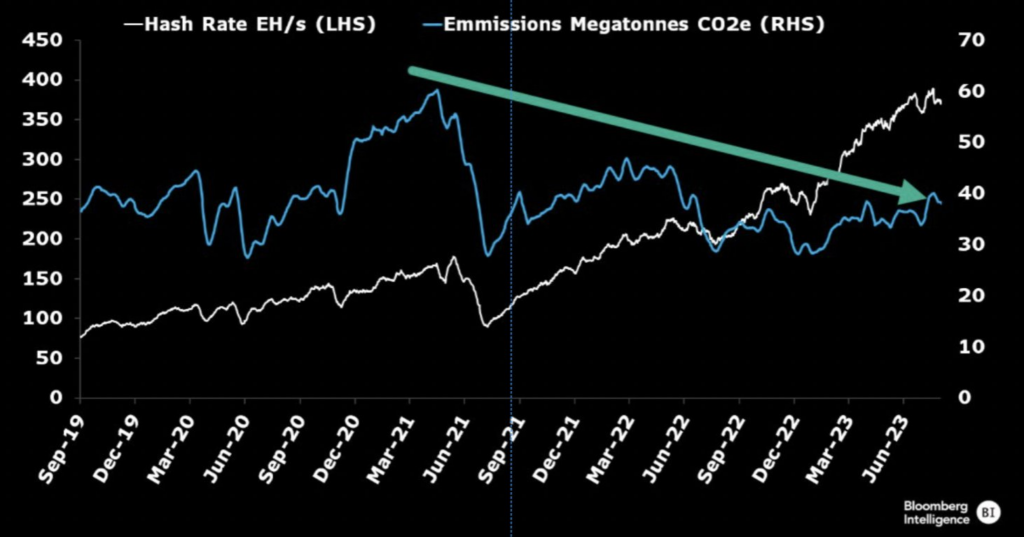

3. Bitcoin has decoupled economic growth from emission growth

Historically, there has been a positive correlation between economic growth and emission growth. This caused some analysts to fear that as Bitcoin grew, so would its emissions.

This chart from Bloomberg Intelligence addressed these analysts’ concerns.

The chart showed that over a four-year cycle, the Bitcoin hash rate (a measure of computational power) increased more than fivefold, yet due to increased machine efficiency and migration to sustainable energy sources, emissions did not grow.

4. The previous gold standard loses its heartbeat

The Cambridge Centre for Alternative Finance pioneered the measurement of Bitcoin energy and emissions. Their reports were once widely cited. Failure to update data and models for 31 months caused Cambridge’s calculations to lose integrity in three areas:

- Overstating energy consumption by ~20% for 3 years. Fixed in Aug 2023

- An out-of-date mining map caused a further 25% emissions overestimate (acknowledged but not yet fixed)

- Failure to report on off-grid Bitcoin mining, which is much more likely to use sustainable energy (because it is cheaper) than standard grid mix. (acknowledged, but not yet fixed)

These omissions, which caused an approximate 31.1% overestimate of energy consumption and a 106.1% overestimation of emissions, were cited by Elon Musk as a basis for Tesla’s suspension of Bitcoin payments. They also caused media outlets in 2021-22 to report what we now know is the incorrect conclusions that Bitcoin

- predominantly used fossil fuels

- has emissions that are large and likely to grow

- has growing emission intensity

- Is powered mainly by coal

In the gap left by Cambridge, Bloomberg Intelligence, Real Vision, and the Digital Assets Research Institute (DARI) filled the void, building on the Cambridge model but adding off-grid mining and updating the mining map to create a more accurate picture of the network.

The image below captures why this action was necessary: the heartbeat of a dynamic system such as a political poll or bitcoin mining map is living data. With no new miner data since Jan 2022, 31 months and counting, Cambridge’s model had flatlined.

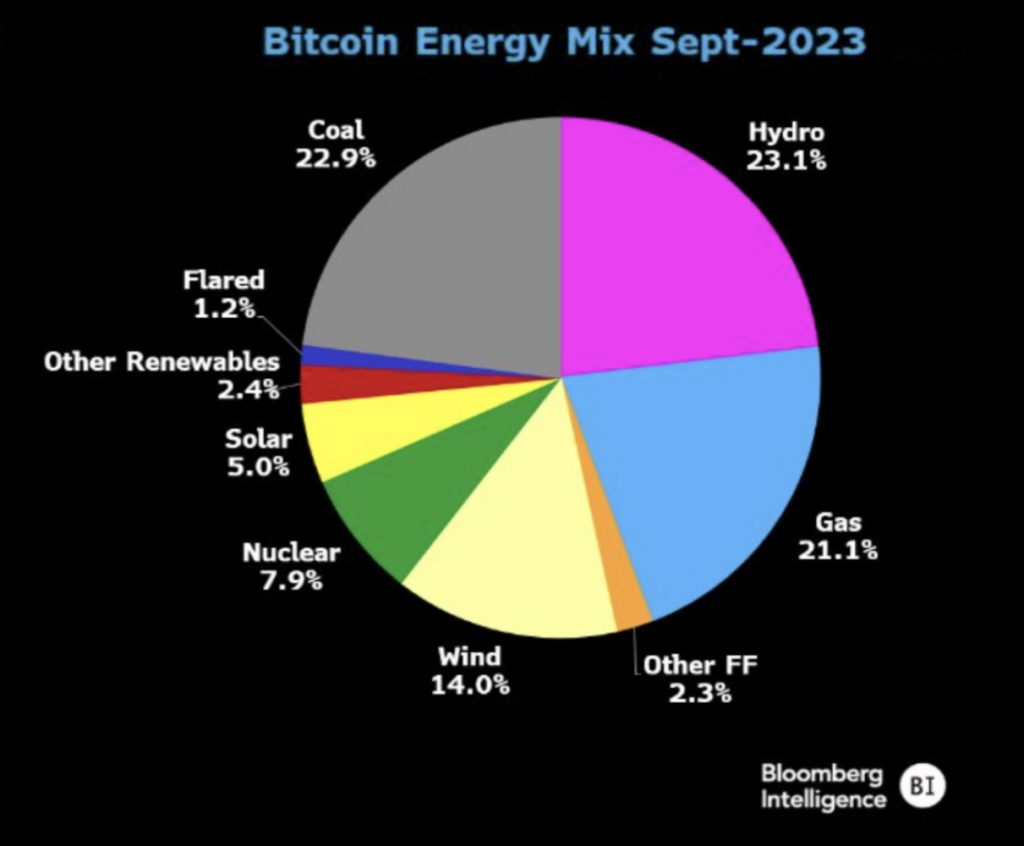

5. Bitcoin is powered by falling water

This 2023 Bloomberg Intelligence Chart, which addressed the omissions in the Cambridge model, showed for the first time what Bitcoin was predominantly powered by. The answer was surprising: Bitcoin had become the first global industry to be predominantly powered by renewable energy: hydropower.

6. Scalable, real-world uses emerge

Bitcoin proved helpful as a potentially net-decarbonizing store of value and method of transaction, and Bitcoin mining was then shown to have measurable value.

One well-researched application was on microgrid development. The Tikula Research Network found that 600 microgrid developments across Africa were previously unprofitable and depended on charity but could become “operational quickly and profitably” by using Bitcoin mining to monetize the other wasted renewable energy. At the same time, Gridless proved the foundation right, with three microgrid developments using Bitcoin mining, each delivering renewable energy to ~1800 villagers. Based on these pilots, Gridless plans to continue fostering microgrid development in several hundred African villages.

Finally, a research paper quantified the significant difference that Bitcoin mining made to Microgrid development, finding that adding Bitcoin mining reduced renewable waste to near zero while reducing microgrid operating costs by 46.5%. Gridshare’s story was covered on mainstream channels, including CNBC.

But it was a short video that went viral on Twitter, made by an Indie filmmaker who goes by the name “Shooter”, which brought forward the heartwarming visual story behind the data of the transformation of an entire village. Shooter tweeted

“Last year, I traveled 90k miles and visited 7 countries.

The happiest people I met were Kenyans who got electricity for the first time.”

Image credit: @BitcoinShooter

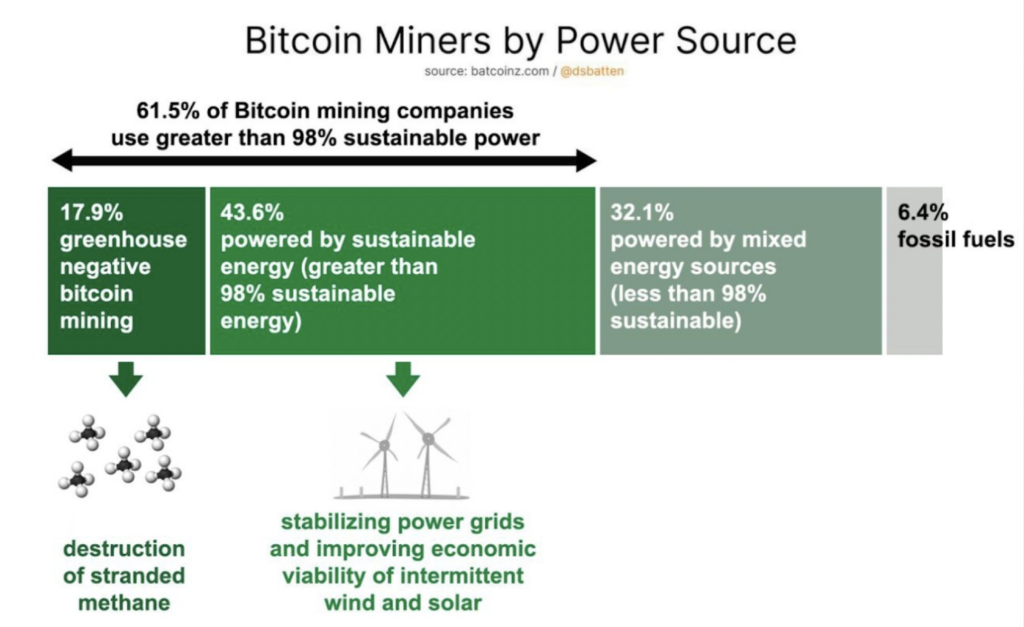

7. Sustainable Bitcoin mining outnumbers fossil fuel mining by 9:1

In 2021, numerous media articles stated that Bitcoin mining companies were “reopening fossil fuel plants”, citing the Lake Seneca site. This was misreported, as the site had re-opened to supply power back to the grid. But it omitted some important context: the quiet yet rapid growth in sustainably powered operations.

This image from Dr Rian Dewhurst showed that unlike other industries, over 61.5% of all known Bitcoin mining companies use sustainable energy or emission-negative energy sources: 41 sustainably-powered and 29 emission-negative bitcoin mining companies.

This high adoption rate helped create more demand for renewable energy, as seen in the following image.

8. Many Bitcoin mining companies are net emission-reducing

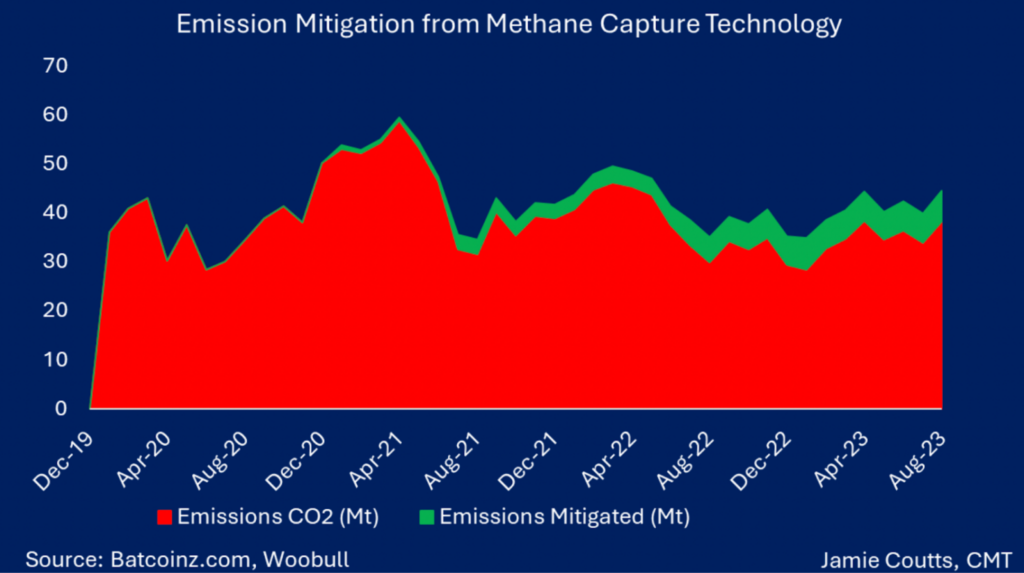

This chart from Jamie Coutts of CMT Research uses Digital Assets Research Institute (DARI) data to show that Bitcoin mining offsets 3 Megatonnes of CO2e emissions by methane mitigation, over 7% of the entire network’s emissions.

While other technologies and industries have the potential to mitigate methane in the future, Bitcoin mining was shown to be doing it to a meaningful degree.

9. At the current rate, Bitcoin will be emission-negative by 2030

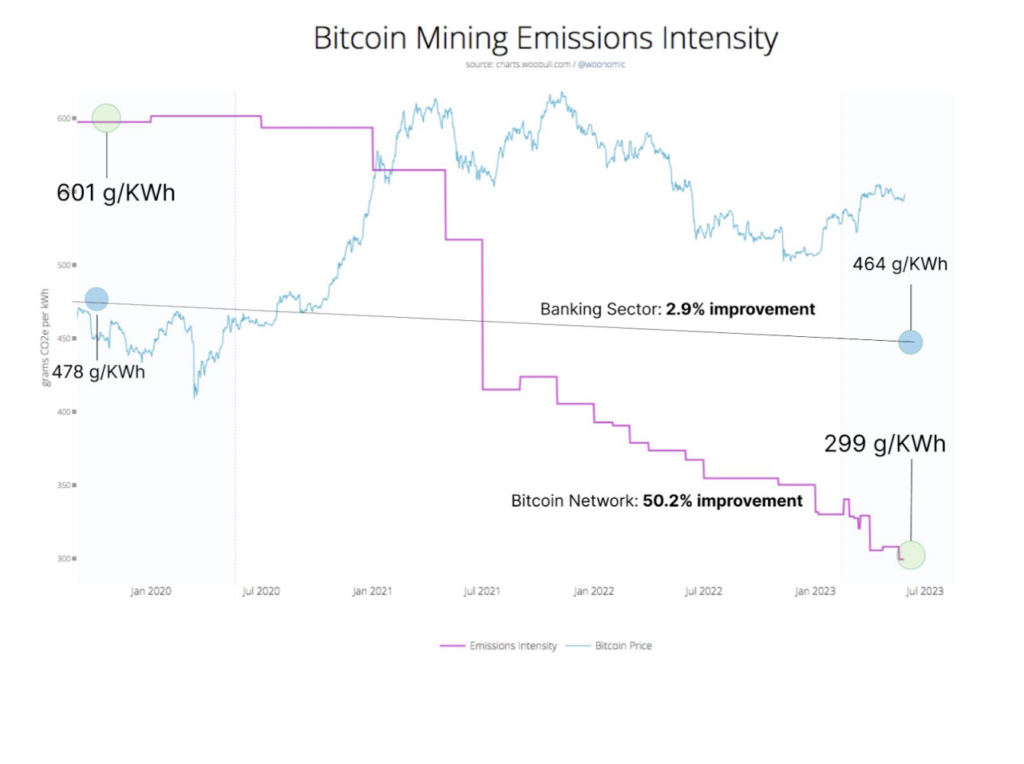

While Bitcoin emissions are much lower than those of the banking sector, some critics rightly pointed out that this is not an apples-to-apples comparison since Bitcoin is much smaller than the banking sector. It’s like comparing Monaco’s GDP to Venezuela’s GDP and concluding that “Venezuela is a richer country,” a misleading conclusion.

A better metric is GDP per capita. In the case of emissions, the apples-for-apples comparison to the banking sector is to measure emissions per unit of energy, which factors in Bitcoin’s much smaller energy use.

This chart from the BEEST model confirmed that even if Bitcoin became as big as banking because it could replace certain banking services and had lower emission intensity, the impact of this would likely be net decarbonizing

But the chart shows a second, arguably more important, thing. At the current rate of emission intensity drop, the network will become emission-negative before 2030. This cannot be achieved using sustainable energy alone, requiring significantly more methane mitigation.

10. Women were the first to report the shift in Bitcoin data

The work of these four women in mainstream media deserves recognition. When they started reporting the positive environmental benefits of Bitcoin, mainstream journalists did not receive editorial support to write positive Bitcoin energy stories.

Top left to bottom right: Susie Violet Ward (Forbes), Marvie Basilan (International Business Times), Kaori Yoshida (Financial Times), MacKenzie Sigalos (CNBC)

Also noteworthy were the four sustainability magazines and a climate conference that started sharing research on the environmental benefits of Bitcoin mining. Even the World Economic Forum, which in 2017 infamously declared, “In 2020, Bitcoin will consume more power than the world does today,” began writing more carefully researched articles on Bitcoin mining. On the three subsequent occasions, they covered the topic of Bitcoin and energy and highlighted Bitcoin’s environmental benefits.

The shift in media reporting was foreshaddowed and enabled by a one-year-earlier change in both the academic community and the consultancy sector, which found that Bitcoin had meaningful positive environmental externalities. These included grid stabilization methane mitigation, leading to a “more than doubling wind capacity”, helping nations meet their climate goals, and improving the economic viability of green hydrogen.

At the same time, another paper critically reviewed pre-2023 analysis on Bitcoin environmental impacts, finding significant flaws in the work of Alex de Vries, the prime source for most pre-2023 media reports on Bitcoin environmental impact.

By contrast, only one peer-reviewed paper, a paper from UN University, showed negative environmental externalities. This paper was later criticized for using a historical dataset from 2020-21, which did not reflect Bitcoin’s subsequent transition to sustainable power usage. In total the are now nine peer reviewed publications released since June 2022 that show environmental benefits arising from Bitcoin mining.

Conclusion

Some commentators have suggested that the shift in the media was not based on Blackrock’s impact. This presumption fails to value the work of those who worked hard over two years to correct data, debunk myths, and conduct deep research. The evidence above tells us that a shifting narrative predated the January 2024 Blackrock ETF launch, beginning in late 2022, when better research and more sustainable mining practices helped catalyze more objective reporting.

As the media changed their tune, so did many past critics end their environmental campaigns against Bitcoin. Of the 65 environmental NGOs who once vocally opposed Bitcoin, only one (Greenpeace USA) openly opposes Bitcoin mining.

There are still occasional negative articles on Bitcoin and energy. These articles sometimes rely on outdated data or methodologies that have since been updated or revised. Such articles have become increasingly uncommon.

However, the damage from those early inaccurate articles on Bitcoin has been done. Cumulatively, since 2020, there have still been more positive than negative mainstream media articles about Bitcoin and energy. Many regulators and ESG investment committees remain unaware of any post-2022 research presented in this article.

As we reflect on the passage from less robust to more robust reporting on Bitcoin, a similar rite of passage that the Internet had to undergo and AI now looks set to undergo, it is worth asking, “Does it have to be like this?” Can we not learn from this experience and thoroughly investigate a disruptive technology’s environmental impact from its inception?

I see the headlines have already started to critique AI using what appear to be some of the same flawed assumption sets used to critique Bitcoin energy use, with headlines designed to create moral outrage, not thoughtful inquiry. In some cases, this research stems from the same researcher whose Bitcoin methodologies have now been widely discredited. Perhaps it is naïve of me to expect the media to behave differently. Maybe the only solution is for the AI industry to lean in and learn lessons early from their cousins in Bitcoin mining so they can counter false narratives more quickly than the Bitcoin mining industry did.

Still, let’s focus on the positive: a group of people worked hard to do robust research, which formed the foundations for a more realistic media narrative about Bitcoin and energy. Now, the work begins to re-educate those whose opinions were forged from a diet of unsound data and models so that the empirically validated potential for Bitcoin mining to solve climate issues can be adequately explored.