The 2 biggest problems with Solar & Wind are that they “don’t match where” and “don’t match when” most customers want it.

These two problems lead to a plethora of other problems: curtailment, load balancing, voltage regulation, power wasted in transmission, stranded power, and grid on-ramping rate. I’ll cover the details in a separate piece of research for those who like to dig in the weeds. For those who prefer an overview, it’s enough to say they make it almost impossible to build out an entire grid using solar&wind, even when batteries are added to the mix. But if we can solve these problems, we can make the renewable grid dream a reality.

Problem 1: Where the power is produced isn’t where it’s used

Electricity travels down high voltage cables as cars travel down a highway.

Unlike Gas and Coal Plants, which can be located close to a population, wind and solar farms need lots of lands, and that means they’ll likely be in remote rural locations.

Getting that power to users has 2 problems

1. There is a loss of power in transferring it (officially around 5% loss – but like inflation, many in the sector believe the real number is much higher)

2. Congestion. Pylons get congested with electricity just like highways get congested with vehicles. This means not all power produced by solar&wind can be used, and it gets wasted.

The solar energy that is produced in the country for users in the city is like a long-distance commuter: they contribute to gridlock. Putting Bitcoin mining into a solar farm is like adding a remote worker: they don’t travel and reduce congestion – meaning renewable energy can flow freely for other grid users

New Zealand tells us the future of what will happen when we have 80%+ renewables because New Zealand already faces this “where” problem with renewables, albeit hydro, not solar&wind. In New Zealand, almost all the generation happens on the South Island. But almost all the consumption of that electricity happens on the North Island.

Because of this, it is becoming hard to regulate voltage, so hard that the Commerce Commission has just mandated that Transpower, the state-owned company responsible for electricity transmission, must solve this before it becomes an issue. The likely solution: a $100M “STATCOM”: which serves no other useful purpose other than to regulate voltage for the 1% of the year when voltage could need to be regulated due to the issue of moving a lot of power from one part of the country to another. The other 99% of the time, this widget serves no useful purpose. It doesn’t generate electricity, nor does it help in any way with demand response (see 2. below).

A statcom (What $100Million gets you).

So this isn’t the real solution. The real solution is to do a lot of power generation in the middle of the North Island. This location has no large industry, no large population base and no rivers suitable for hydro-power. There is however a lot of land, sun and wind. So the only suitable solution would most likely be solar and wind generation. But this new generation would need a location-agnostic customer. A 50MW solar farm with a data centre mining Bitcoin would provide the perfect solution: balancing voltage, while also generating more power and helping the “when” problem. In the next section, we’ll look at why having a big battery isn’t enough.

Problem 2: When the power is produced isn’t when it’s needed

The most obvious issue with solar&wind is that solar produces power during the day, but most power is needed for a short morning and evening peak when the sun is either mostly or completely absent. Wind can produce throughout the day but is very unpredictable.

These issues provide genuine headaches for grid operators.

Many have assumed that the problem can be solved simply by using batteries to store that excess solar&wind capacity. At first glance this seems feasible: battery costs are reducing exponentially, and the technology is becoming more and more efficient. Batteries are part of the solution. However, singlehanded, they are also completely ill-equipped to handle the variable load and stabilize the grid, for a number of reasons.

1. Beyond limited capacity

When the battery is full, the battery is full! You can’t continue charging it. Batteries are like a reserve tank on the motorcycles: they can only provide a 2nd-tier of support to store an excess supply for solar and wind generation, but their capacity is finite. Batteries therefore cannot stop the wasted-power issue with solar&wind, although they can limit the waste.

When a Bitcoin miner stands alongside that battery, however, spare power can be bought by Bitcoin miners. Older “S9” miners are perfect for this, as they cost around $200 so can be inactive most of the day, then fired up for a few hours in the middle of the day when demand is low and that power would otherwise have been wasted.

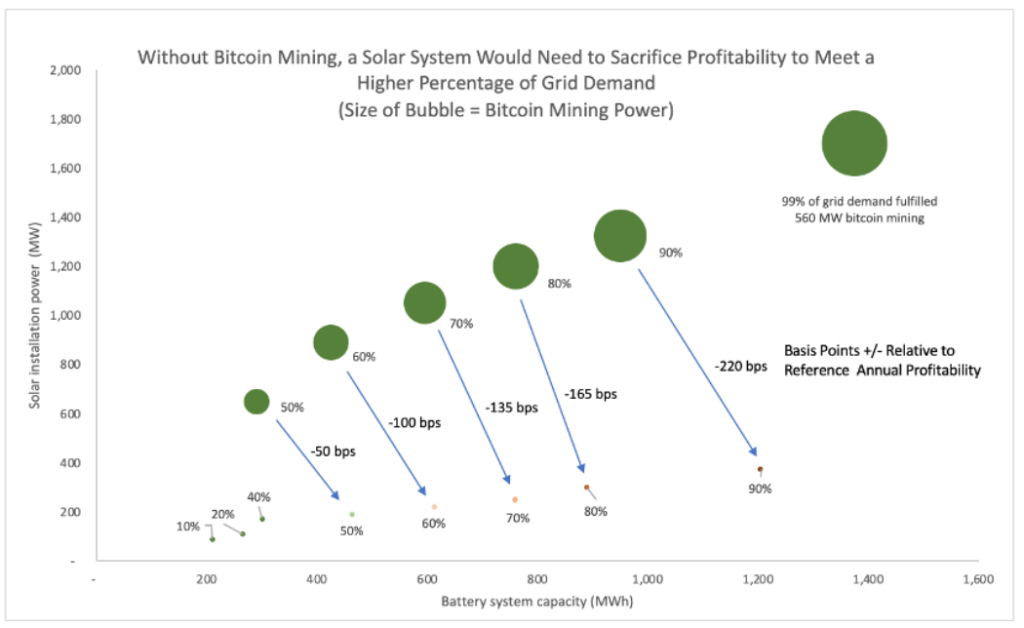

2. Improving Solar/Wind Profitability

These batteries will then need to discharge that power back to the grid as soon as possible, so they can be re-used. But what if the wholesale electricity prices have dipped when the battery is full? The cost of absorbing that power could conceivably be more than the money the battery makes selling it back to the grid. The process of buying power for solar&wind farms and selling it back to the grid is known as “simple arbitrage”, and as we can see: it is economically risky.

With Bitcoin miners in the mix, however, the solar&wind operator can be constantly optimizing profitability. When wholesale electricity prices begin to spike, they can charge up batteries and sell that power back to the grid. When wholesale electricity prices dip, they can sell that power to Bitcoin miners, and wait until prices rise again before selling battery power.

This also helps the grid operator with demand response. With Bitcoin miners + battery storage: the grid operator is much more likely to get extra power when they need it and less likely to get it when they don’t

For the technically minded, ARKInvest has done an excellent model-based analysis of the economic advantages of how Battery+Bitcoin mining makes solar generation more profitable than battery alone.

3. Scalability

Batteries use not one but a number of rare metals in their construction (lithium, cobalt, nickel). With most of these minerals being mined for EV batteries, many energy engineers are now highly doubtful that the volume of utility-scale batteries can be built to satisfy the enormous load-balancing and demand-response requirements that a solar&wind based grid will require.

By contrast, Bitcoin mining machines use fewer rare materials, and their only main constraint to scalability is the number, and speed, of chips that can be manufactured.

4. Responsiveness when it matters most

One of the big advantages of batteries is that they help make sure the grid doesn’t have an under-demand (meaning plants need to be shut off, and often paid by the grid to do under their power purchase agreements), or an over-demand for power.

99% of the year, the grid has no issues with meeting demand. But the remaining 1% of the time demand spikes and grid operators are left urgently trying to balance the supply of, and the demand for, electricity. In the past, they’ve done this using “peaker plants” – a fossil fuel plant using a gas turbine that comes on when the extra capacity is needed. The problem is that this gas turbine needs to be idling 24×7 (emitting CO2 and wasting gas the whole time) just for these rare events so that it is hot enough to quickly ramp up energy production.

There have been calls from various environmental groups to phase out peaker plants. However, this intention requires a carefully thought-out strategy so as not to expose users of the grid to the blackouts and lack of grid stability that peaker plants help prevent

With batteries, they can dump their power into the grid to lessen the grid’s need for this peaker plant. With Bitcoin miners operating as well, the grid gets 2x the benefit however: Batteries dump power and Bitcoin miners shut off and stop using power at the same time. The additional advantage of Bitcoin mining is that whilst batteries cannot dispatch all their power to the grid immediately, Bitcoin miners can be shut off immediately, allowing grid operators more flexibility in dealing with peak demand.

Final words:

According to one energy engineer I spoke to, it “becomes progressively harder” to get more and more variable renewable energy onto the grid. That’s because the imbalance in where and when the power is generated becomes harder and harder to manage.

Solar and wind adoption rates have fallen in recent years, reinforcing his view. Solar adoption for example was growing at 54% per year in 2012, which had fallen to 23% by 2021.

Over the 10 years pre-covid, new gas plants were twice as likely to be approved as solar/wind farms. The reasons were largely to do with the “when/where” issues with solar and wind that battery storage + Bitcoin mining can largely, if not completely, resolve.

Conclusion:

Solar & Wind “don’t match where” and “don’t match when” most customers want it.

Bitcoin mining “doesn’t care where” and “doesn’t care when” power is produced.

This makes Bitcoin the catalytic customer that solar and wind have been waiting for to make the renewable grid dream a reality.

When batteries and Bitcoin mining are used in conjunction with solar/wind generation – they can solve almost all of the “where” and “when” issues that threaten to limit the amount of renewable energy the grid can allow.

By largely overcoming the “when and where” issues of solar&wind, Bitcoin mining together with batteries should in theory be able to

a. Return solar/wind adoption rates to the 2012 adoption rates

b. At least match the rate at which gas plants are approved to go on to the grid

Such an outcome would see an almost doubling of wind/solar adoption. The net effect of this would be the removal of the biggest constraints to renewable adoption. Extrapolating a doubling of solar/wind adoption onto the grid until 2030, we would have the capacity to build grids that would be

- An order of magnitude larger than the current size

- Able to retire old fossil fuel plants off the grid

- More than 90% renewable.

This shift has the capacity to lift global renewable energy use to 70% of all our energy. Such an outcome is of course dependent on enough of our current fossil-fuel-based heating, industrial processes and vehicles being electrified.

Critically, this is not an outcome that battery technology can achieve alone, but it is an outcome that is possible with the twin support of Battery and Bitcoin mining to power the widespread adoption of solar & wind power.