Rebuttal of GreenpeaceUSA report on “Bitcoin and Big Finance”, 06-14-2024.

Introduction

There are three chief angles of attack in this new report

“The top 5 financiers of carbon pollution from Bitcoin mining companies were Trinity Capital, Stone Ridge Holdings, BlackRock, Vanguard, and MassMutual, accounting for over 1.7 million metric tons CO2 in 2022”

and secondly the claim that a large body of new data, independent reports, and scientific publications can be dismissed because the authors “Work for Bitcoin mining companies” and “The Bitcoin industry is following the same tactics as the Tobacco industry”

The final claim is “neither financial companies nor Bitcoin mining companies are adequately disclosing carbon emissions.”

Let’s look at each of these three claims

Responses

- GreenpeaceUSA Claim: “Bitcoin is a carbon intensive industry, that should not be financed”

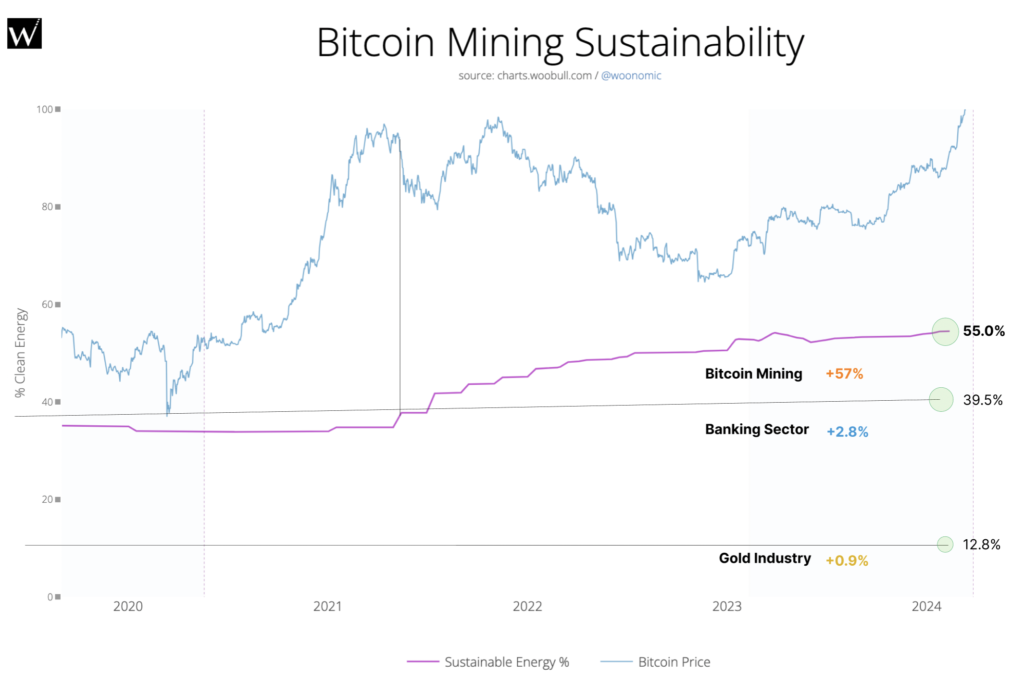

Firstly, its important to state that Bitcoin mining, like eVs, is a fully electrified technology that has no direct emissions. Like eVs, bitcoin mining also has indirect emissions that come from electricity that sometimes generated using fossil fuel as its source.

However, both Bitcoin mining and eVs, while both have a large carbon footprint due to secondary emissions, also obviate industries that have even larger emissions.

In the case of eVs, they replace more fossil-fuel intensive fossil fuel-powered cars. In the case of Bitcoin mining, as a currency it is obviating the need for more fossil fuel intensive banking industry, and as a store of value it is obviating the need to invest in more fossil fuel intensive assets such as gold.

In addition to the direct sustainable energy use of Bitcoin being significantly higher than the industries it is obviating, Banking has a secondary issue: it invests directly into fossil fuel exploration. Greenpeace International, who incidentally has not endorsed GreenpeaceUSA’s campaign to attack Bitcoin mining, has somewhat more accurately taken aim at the banking sector funding fossil fuel exploration. Ironically for GreenpeaceUSA, Bitcoin represents an alternative to the banking sector and a legitimate chance to obviate much of its power and wealth: a point GreenpeaceUSA have not yet considered.

Bitcoin mining by contrast invests in very different areas, none of which are fossil fuel exploration. Bitcoin mining companies investments to date have been in areas such as renewable microgrid expansion, OTEC (a form of renewable baseload energy), Landfill gas mitigation, desalination research, renewable energy expansion, and R&D into novel forms of heat recycling and interruptible datacenters which help decarbonize other industries.

Above, some of the 1600 villagers in Kenya who recently received renewable-power due to a bitcoin mining operation: one of the 21 positive environmental externalities of Bitcoin

There is therefore no case to criticize Bitcoin based on carbon emissions alone, without considering the positive environmental externalities of the technology, and the obviation effect. GreenpeaceUSA’s report takes neither of these factors into consideration, and as a general comment lacks the sophistication of proper carbon accounting and ESG analysis.

One could use their arguments with equal valor to rally against the fossil fuel use of eVs (failure to consider the obviation effect, or the fossil fuel use in the production of solar panels (failure to consider positive environmental externalities).

The positive environmental externalities of Bitcoin mining are well documented by independent researchers, and can be found here and on the DARI website.

Claim 2: Bitcoin mining companies are engaging in greenwash to defend themselves

This point is ostensibly an attempt to invalidate a swathe of research coming out in support of Bitcoin, rather than handle each argument based on merits.

GreenpeaceUSA claims that proponents of Bitcoin mining have pushed controversial research about Bitcoin mining through academic journals with a weak peer review process, then passed them off as legitimate research. The two journal articles they are referring to are

Bitcoin and Its Energy, Environmental, and Social Impacts and

Bitcoin’s Carbon Footprint Revisited

which were published in MDPI. GreenpeaceUSA’s issue with these papers is that MDPI is considered in academic circles to have a less robust peer review process. It also has an impact factor of 3, which is considered quite low. Their other issue is that Murray Rudd, who is affiliated with Satoshi Action Fund, was the author of the first paper, and a reviewer of the second.

There is some truth to these claims. MPDI is considered by academics an easier journal to get published in, and Rudd was affiliated with both studies, as were other figures from the Bitcoin mining industry. However, this affiliation was transparently disclosed, and this does not necessarily disqualify the rigor of the work.

It could equally be argued that Satoshi Action Fund felt it needed to take urgent action to stop misleading narratives influencing policymakers, so needed to publish something as soon as possible, therefore favoring MPDI as a choice. Secondly, Rudd’s affiliation with Satoshi Action does not necessarily mean that his work is not worthy of intellectual engagement.

Further, there is nothing controversial about the claims the papers make, that Bitcoin mining stabilizes grids and helps to accelerate the renewable transition, because this mirrors what grid operators such as Brad Jones, renewable operators such as Ali Chehrehsah and other peer reviewed research, completely unaffiliated with the Bitcoin mining industry, has concluded. In fact, only GreenpeaceUSA seem to dispute these claims and find them controversial. This could be interpreted by their own confirmation bias which renders them unable to concede a single possible positive feature of Bitcoin, or by their stated intention to “Take an extreme position, in an attempt to shift the overton window”, which a GreenpeaceUSA insider informed us was part of the logic behind their campaign.

But here’s where the “Greenwash” and “tobacco industry tactics” truly fall down: even if Satoshi Action were pushing false narratives and everything written in those two papers was false, they are not the only papers, reports and articles that have come out in support of the positive environmental externalities associated with Bitcoin mining.

I

In fact, excluding the two MDPI papers, there are now four independent reports, four sustainability magazines, and five scientific publications unaffiliated with industry in high quality academic journals, who have profiled the positive environmental externalities of Bitcoin. Further, The World Economic forum has on three separate occasions published articles highlighting the environmental need for Bitcoin mining, including being a potentially essential part of the renewable transition, mitigating methane and saving an endangered national park. As if that wasn’t enough, Five new charts have been created which clearly show Bitcoin mining to have become more sustainable energy based than any other industry or major industrialized country, charts which have now been adopted by both Bloomberg Intelligence and Realvision in preference to Cambridge. On the other hand Cambridge, upon whom GreenpeaceUSA has relied for its data, has now admitted that their estimates of both energy and emissions were significantly over-reported (though GreenpeaceUSA continue to use old estimates).

Alex de Vries, upon who’s work GreenpeaceUSA has also largely depended, has had his work formally debunked both for inconsistencies in his methodology and inaccuracies in his data (GreenpeaceUSA continue to reference de Vries’ methods despite this). Last month, Bitcoin mining proponents appeared at their first climate conference, where they were warmly greeted.

In response to the slew of new evidence, the media including past Bitcoin-critics such as the Financial Times, Bloomberg, The Independent, Forbes and the International Business Times have now flipped and begun publishing articles acknowledging the well-documented environmental benefits of Bitcoin mining. The rapid transition to majority sustainable energy based power sources has also been well documented.

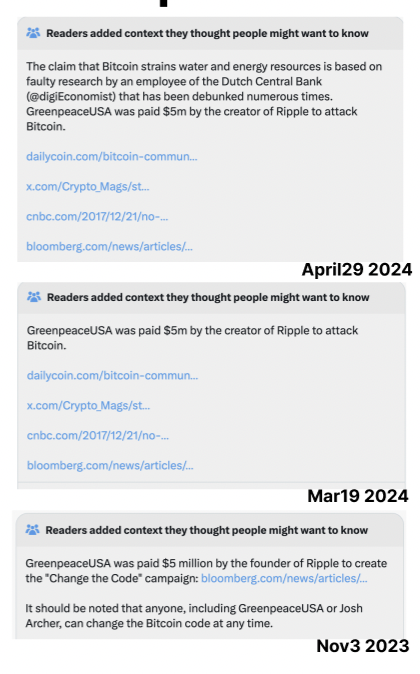

Meanwhile, previous allies Elizabeth Warren, Earthjustice and SierraClub have stopped criticizing Bitcoin mining on environmental grounds. GreenpeaceUSA attempts to malign Bitcoin meanwhile continue to get community noted.

feel some level of compassion for GreenpeaceUSA. Their campaign has the acknowledgment by sources within GreenpeaceUSA to have “been “failed to have achieved anything except antagonizing the entire Bitcoin community against us.” They have been publicly and rightfully criticized for taking on $5M of funding from altcoin Billionaire Chris Larsen to fund their campaign, and since the campaign began the tide has turned against them

It’s tough to keep up a campaign when the tide is against you so strongly. Inside sources tell us that they considered abandoning the campaign at the start of 2024, but ultimately continued.

GreenpeaceUSA have responded the way a cornered animal would respond: by lashing out. Rather than engage with the sea of evidence on merits, they have attempted to discredit every chart, every report, every peer reviewed journal and every sustainability magazine as “greenwash” and “tobacco industry tactics”.

Ultimately this is a desparate, last-gasp ad hominum argument which fails at the first breath of intellectual scrutiny.

For example, of the 5 peer reviewed articles cited above, none of them are affiliated to the Bitcoin mining industry in any way. In fact, the co-author of two, Fengqii You, is a decorated scientist who has been respected for his work at the intersection of climate science, engineering and digital assets for many years. By stark contrast, GreenpeaceUSA’s own chief source of information, Alex de Vries, is affiliated industry: the Central Bank industry, as an employee of the Dutch Central Bank.

It is not factually incorrect, but hypocritical for GreenpeaceUSA to suggest that the research pinpointing the positive environmental externalities of Bitcoin mining is all “industry affiliated” whereas in fact both their chief funder (Chris Larsen) and their chief information source (Alex de Vries) both have a clear conflict of interest in participating with GreenpeaceUSA in an attack on Bitcoin, Larsen is chair of rival altcoin Ripple, and de Vries’ is employee of an industry which Bitcoin was designed to remove the need for.

Collectively, the recent high quality of research on Bitcoin mining has superseded the first generation the less robust research which often accompanies a nascent technology (Sai and Vranken)

Claim 3: “neither financial companies nor Bitcoin mining companies are adequately disclosing carbon emissions.”

This is quite easily rebutted, as it is factually incorrect. Bitcoin mining companies have publicly disclosed hashrate, power consumption, and energy mix, and using these data, emissions can be derived. This data is available here (Bitcoin Mining tab).

Summary

Three years ago, the Bitcoin mining community was seriously threatened by GreenpeaceUSA’s campaign. Now, GreenpeaceUSA are an increasingly lone voice, even within the environmental movement, and there are increasingly few people who treat their opinions about Bitcoin as credible any more.