Introduction:

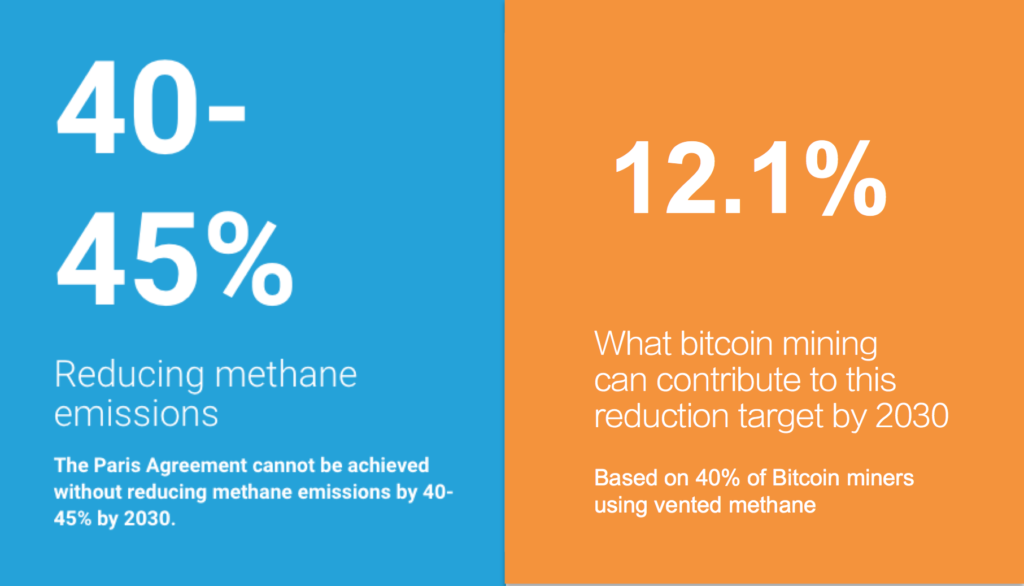

Previously, we published research showing that Bitcoin mining had the potential to reduce 0.15°C of global warming by 2045. This article is the sequel to that research. Because UNEP has declared that we must reduce methane levels 40-45% by 2030, we investigate how much Bitcoin mining can contribute to that goal.

UNEP also stated that reducing methane levels by 45% would avoid nearly 0.3°C in global warming by 2045. This paper reveals a scenario where Bitcoin mining can reduce methane levels by 5.445% (12.1% of the UNEP target) by 2030. Such a scenario would avoid 0.03°C in global warming by 2045.

Here, we look at the growth in Bitcoin hash power that we would need to achieve this level of methane abatement, using landfill gas as the predominant source of power. We also look at a number of scenarios where Bitcoin could make a meaningful contribution to the UNEP target based on different levels of vented-methane usage and Bitcoin hashrate growth.

We also look at how long it would take to mitigate 1/2 the UNEP’s targeted methane reduction if there is no increase in the rate of hash power growth.

Background:

Carboncredits.com explain it this way “Methane can simply be burned off to create CO2. Since methane is over 20 times more harmful to the atmosphere than CO2, converting one molecule of methane to one molecule of CO2 through combustion still reduces net emissions by more than 95%.”

Methane is an 84x more warming greenhouse gas than CO2 over a 20-year period. It is now contributing as much to climate change as CO2. Combusting methane that would have otherwise been released into the atmosphere is widely recognised as a simple and effective path to becoming carbon negative. Unlike using renewable power sources, which are carbon neutral, using methane as a power source has a much stronger environmental benefit because it actually reduces the net amount of greenhouse gasses that would have gone into the air.

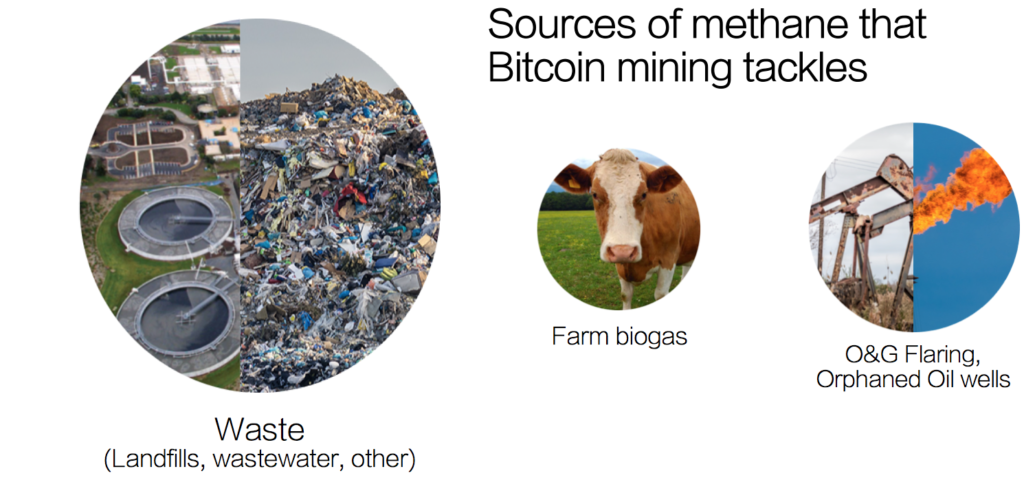

It’s a simplification of what happens, but the overall 95% net emission reduction that we achieve by combusting methane that would have gone directly into the air is accurate. In this article, I consider what would happen if we significantly ramp up our use of landfill gas (70% vented straight into the air) and flared gas from the oil&gas industry going forward.

Question:

How long would it take at current hash rate growth for us to combust all accessible methane emissions from Landfills and Flared gas?

Summary of Findings:

The most feasible way that Bitcoin can make a significant contribution to the UNEP’s methane reduction target is that 40% of new Bitcoin mining between 2023-2030 uses vented methane sources. It is not the purpose of the paper to calculate likely growth rate in detail, rather to show the level of methane mitigation that would be possible based on this percentage of the Bitcoin network using this power source. That said, having talked to over 40 bitcoin miners including 2 public companies and seen the speed of adoption, I regard this as an absolutely possible level of stretch. For example, the CEO of one large mining firm signalled that they see 40% of their mining operations moving to vented methane much earlier than 2030 (by Q4 2027).

Under the scenario where 40% of all new mining is powered by vented methane, and assuming hashrate remains on it current growth curve, Bitcoin mining would help the UNEP achieve 12.1% of its 40-45% methane reduction goal. In other words, Bitcoin mining would be reducing 5.45% of total global methane emissions by 2030.

In order to achieve half of the UNEP’s target of a 45% reduction in methane emissions, the Bitcoin network would need to grow (in hashrate) at a 40.2% higher rate than today’s 46.7 Exahash (EH) per year network growth and deploy 80% of all new mining to methane abatement programs. It would take until 2045 to achieve this target. It would also require an increased contribution from other Proof-of-Work (POW) based crypto-mining (Dogecoin, Litecoin, smaller POW coins, new POW cryptocurrency) from 5% to 20% of all POW mining to achieve this. We see this as an unlikely scenario.

Under the more conservative scenario that landfill gas powers 24% of the future Bitcoin network from 2030 forward, this would fall a long way short of meeting half of the UNEP’s methane emission targets. It would however provide sufficient carbon-negative hashpower to make the Bitcoin network carbon negative 6.8x over (in other words, reduce 6.8x more carbon than it produces). Because of the difficulty other technologies face in utilizing methane from landfills and other remote places far from a grid interconnection point, it is probably that this figure that is likely to exceed all other technologies, monetary networks and nation states.

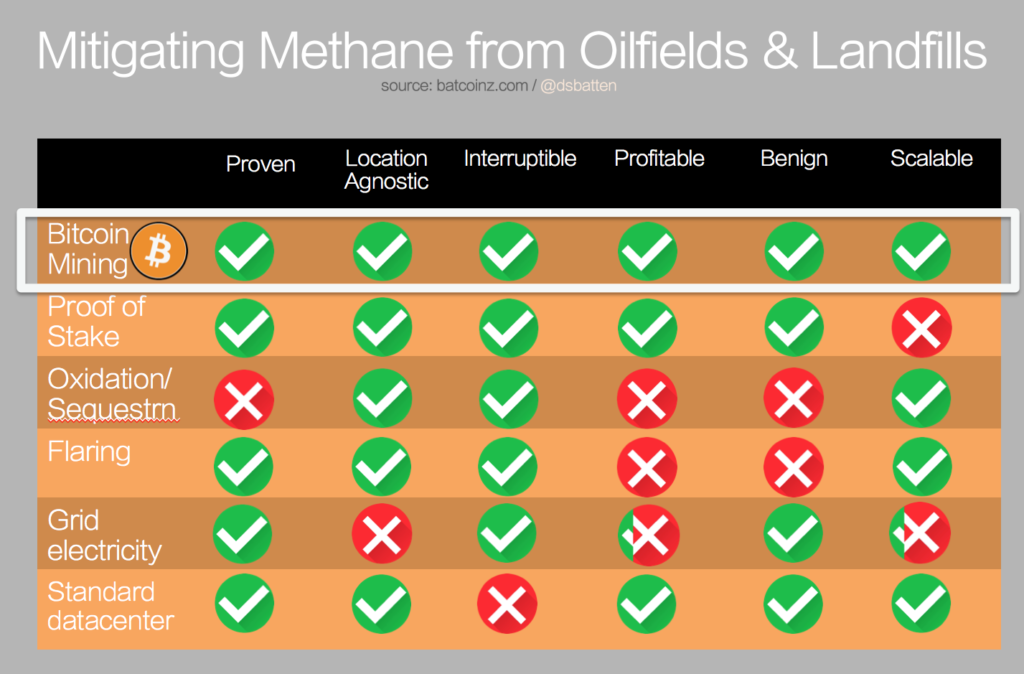

This points to the need for other consumers of waste energy, such as interruptible datacenters to also move into the area of methane abatement in order to accelerate the rate at which we can achieve UNEP’s target.

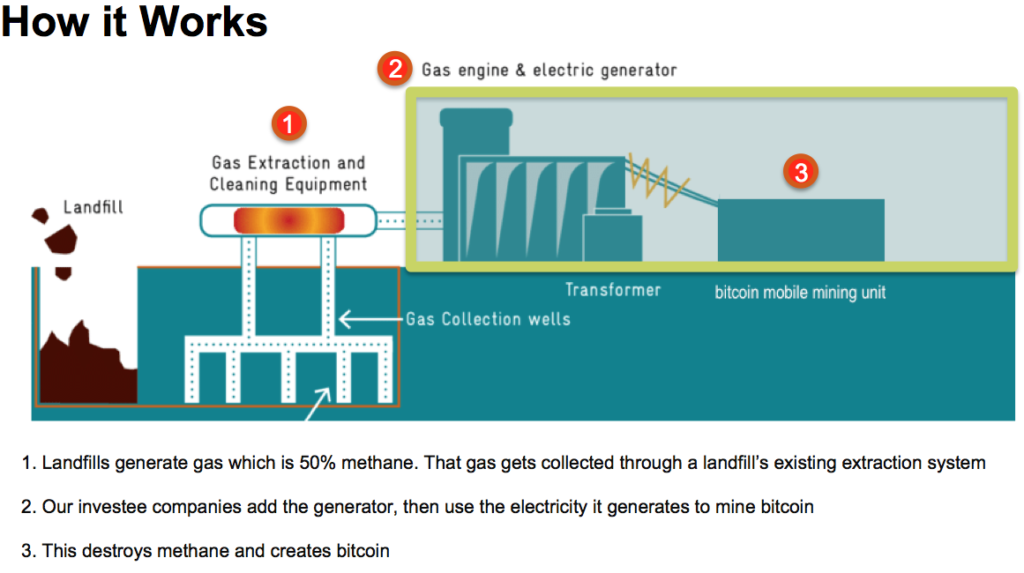

Proof of Work based crypto mining (currently dominated by Bitcoin) remains the current best method of methane abatement of landfill gas and natural gas emissions from the Oil&Gas industry due to its unique location-agnostic features and low set-up costs relative to traditional datacenters.

Assumptions:

These calculations make reasonable estimates using a simplified model.

- 20% of methane mitigation comes from other POW-based crypto-mining for the next decade, ie: 80% of all crypto-mining based methane mitigation comes from Bitcoin.

- Assuming using the latest currently available ASIC technology (S19Pro).

- Scenario E uses the assumption that all exahash will come from Bitcoin mining (reason: ETH is no longer using POW, and few new cryptocurrencies have a need to use POW as they do not require the same level of security. Scenario E also assumes a hashrate growth per year 56.04 EH (20% higher). This assumption is predicated on the observation that hashgrowth has now broken significantly above the 46.7 EH/year resistance line that has been in place since 2017. While these adjustments effectively cancel eachother out, the calculations will be different.

Calculations:

Step 1: Work out how much energy 1 t (1 metric tonne) of natural gas produces

- Convert natural gas volume to mass

50000 cubic feet of natural gas = 2636.4 lb = 1.32 tons = 1.2 t.

=> 1 t = 50,000/1.2 = 41667 cubic feet

- Find KWh generated by combustion a given mass of natural gas

Natural gas generates 0.14 KWh per cubic foot.

=> 1 t generates 41667x 0.14KWh = 5833 KWh = 5.83 MWh. (1MWh requires 0.1715 t)

Step 2: Calculate energy generated by bitcoin-mining based methane mitigation

Total methane available for bitcoin mining (oil&gas + landfills only) =

12.27 MT Methane/year (from flared gas in oilfields) +

59.714 M t (landfill gas) that are accessible to Bitcoin miners.

= 71.984 MT/year

- energy provided is 71.984M t x 5.83MWh/t = 419.67 TWh per year

Step 3: Estimate when Bitcoin mining reaches this annual consumption rate

Each S19Pro

- uses 3.5KW = 30.66 MWh in a year

- has hashrate = 110 TH (terahash)

So if would take 419.67 M/30.66 = 13.69M S19Pros to use that energy

= 13.69M x110 TH = additional 1506 EH (per year)*

* EH =exohash. 1 EH = 1 million TH

Step 4: Investigate different scenarios to achieve additional 1506 EH/ year

Current hashrate growth = 46.7 EH/year.

Source: Glassnode

Scenario A:

80% of all future crypto-mining is allocated to methane mitigation (Not improbable, as methane mitigation is both the most pressing environmental issue, and the most economical energy source as crypto-mining margins decrease and cheap energy sources become paramount).

If this growth rate remains linear, then each year, 46.7×80% = 37.36 EH will come from Bitcoin mining, the remaining EH from other POW-based crypto mining.

At this rate it would take 1506/46.7 = 32.2 years for Bitcoin and other POW-based crypto-mining to mitigate available landfill and oilfield methane (half of the UNEP methane mitigation target).

Scenario B:

As for scenario A, but global hashrate grows at an average of double the current rate

Under this scenario, it would take 16.1 years to achieve ½ of the UNEP’s 45% methane mitigation target.

Scenario C:

We achieve the UNEP methane reduction targets by 2030 using a variety of means. Calculate the contribution possible through Bitcoin and other POW-based crypto-mining, assuming hashrate does not increase, and 80% of future mining over that time is allocated to methane mitigation

Total annual methane mitigation required to hit UNEP target: 141 Million t

Total that would come from POW-based crypto-mining by 2030 =

(46.7×8)/1506×22.9/45 = 12.6%. (10.08% from the Bitcoin network)

Note: 10.08% by 2030 represents 564.48 MT CO2-eq. Current Bitcoin network emits 27.02 MT CO2-eq/year (2022 figure). So this is enough to offset today’s Bitcoin network 20.9x over, making the network climate-positive 20.9x over.

Under a more conservative scenario where LFG is not 80% but 24% of the future Bitcoin network, then emission reduction = 24/80×564.48 MT CO2-eq => 169.34 MT CO2-eq. This is enough to offset the Bitcoin network 6.3 times based on today’s hashrate.

Let’s see what happens if we factor in hashrate growth.

At the time of writing, global hashpower is 205 EH/s. Over the long term, emissions is closely correlated to growth in hashpower. By 2030, at the current rate of hashpower growth (46.7 EH/year), we can expect the Bitcoin network to by 205+373.6 = 578.6 EH/s. this is an increase of 578.6/205 = 2.822. Therefore we can expect the Bitcoin network to be consuming 2.822x more power. (Michael Saylor argues that miner efficiency will lower this power consumption. However, in a series of discussions with onchain analyst Willy Woo, I have been persuaded by his thesis that miner efficiency only affects energy consumption short term: in the long term, mining operations will simply use that extra efficiency to buy more ASICS and consume more power).

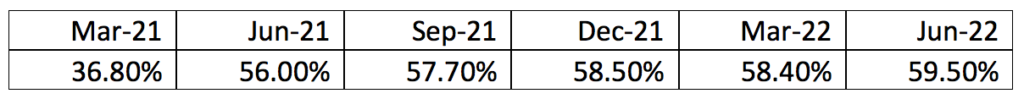

With 2.822 more hashrate, we expect emissions to climb to 76.25M t if the renewable percentage does not increase and total yearly energy consumption to climb from 93.46 TWh (at time of writing) to 263.71 TWh . However this is not a valid assumption. Renewable percentage has been increasing measurably from Q1 2021-Q3 2022. According to the Bitcoin Mining Council, renewable percentage have been:

Taking a conservative view that the Mar-June ’21 increase was an outlier and the trendline is a steady 3.5% increase year-on-year, we would have a 89.25% renewable-based network by Dec 2030. So this would have a carbon intensity not of 76.25 M t, but 76.25x(1-0.58/(1-0.8925) = 19.51M t CO2-e.

In the meantime, 24% vented methane as an energy source would be 24% of 263.71 TWh/year = 63.29 TWh/year = 63.29 M/8760 MW = 7224 MW.

From previous research we know that 183.6 MW mitigates 27.02 t CO2-eq emissions, and requires the power of roughly 50 landfills.

=> 7224 MW mitigates (7224/183.6)x27.02 = 39.34×27.02 = 1063 M t CO2-emissions.

1.063 Billion t CO2-eq mitigated vs 19.51 M t CO2-eq produced represents a Bitcoin network that is carbon negative 54x over by 2030

It is also starting to become a very significant number. As currently emissions are 50 Billion t CO2-eq/year, this is 2% of all global emissions.

Even if we use the more conservative GWP100 for methane, ignoring the fact that the short term focus of the GWP20 is arguably becoming more important since the UNEPs declaration that methane mitigation represents the “strongest lever we have to reduce climate change in the next 25 years”, and ignoring the fact that methane GWPs are now likely to be higher than previously calculated values, and use the lowest GWP100 for methane, which excludes feedback of only 25 – we would still have a Bitcoin network that is on course for being carbon negative 10x over by 2030 at just 24% of mining operators using vented methane.

As we have no idea what the price of Bitcoin will be in 2030, critics can label any attempt to calculate potential emissions in 2030 as speculative. While true, there is an in-build “accuracy hedge” in our methodology which ties future carbon negative status to hashrate rather than price (by physics, I would argue a more reliable correlation to draw than price). The accuracy hedge is this: if hashrate increases at a faster rate, so will the absolute value of the amount of carbon negative energy (that 24% will count for more). Provided that the Bitcoin network achieves ~24% energy use coming from vented methane, the only scenario where Bitcoin cannot become become carbon negative 6.8x over by 2030 is where hashpower declines below the current growth rate.

Scenario D:

We hit the UNEP methane reduction target (45% reduction) by 2045, and POW-based crypto mining achieves half of this. How much does Bitcoin hashrate need to grow in order to achieve this?

That would mean achieving Hashrate growth of

1506 EH in (2045-2022) years

= 1506/23 = 65.48 EH/year

Current rate = 46.7, so hashrate growth would need to be 65.48/46.7 = 40.2% total increase in growth, or 1.5% increase to current hash growth rate each year.

1506 EH represents 13.6 Million S19Pro equivalents = ~$46.5 Billion (in ASICS alone)

= 416,976,000 MWh -> mitigating 72 MT methane/year = 2160 MT CO2-eq (using 100 year GWP) or 6048 MT CO2-eq using the 20-year GWP

Scenario E:

Achieve 1/2 the UNEP target. Current hashrate growth, 42% of all future crypto-mining is allocated to methane mitigation, and POW-based crypto mining achieves this either directly, or through catalyzing the initial infrastructure that would otherwise have been unprofitable, then sharing the overall energy at an ongoing 2:5 Bitcoin Mining:Others ratio.

Notes on the viability of this option. Through conversations with Nate Harmon, founder OceanBits; Adam Wright, CEO Vespene; Sam Kivi CTO Gridshare; and Mark Morton CEO Scilling Mining, it became apparent that Bitcoin was:

a. consistently playing the role of catalyzing infrastructure build that would otherwise have been unprofitable

b. once the original investment had paid back the capital, it was suddenly possible to use that power infrastructure for other purposes.

For example, NodalPower built bitcoin mining infrastructure in landfills, but now also sell that power back to the grid. Vespene intend something similar, but with a more diverse set of options including not only sale back to the grid but also charging of onsite EVs.

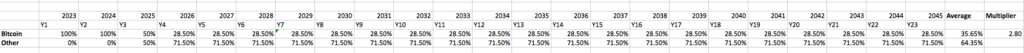

Under this scenario, Bitcoin mining can use 100% of the energy initially (for 3 years), but then for the next 20 years pare back to a 2:5 power-sharing ratio with other users. This ratio is in line with what happens for example at Scilling mining where 5/7 of the power is sold back to the grid, with the Bitcoin mining providing 2/7 of power consumption (soaking up power that would have otherwise been curtailed due to insufficient bandwidth on transmission lines, or because it provided a better arbitrage opportunity when wholesale electricity prices were low).

If this growth rate remains linear, then

- Over the total period 2023-2045, an average of 35.65% of power is used by Bitcoin mining => Bitcoin mining is catalyzing a 2.81x multiplier of methane mitigation (through other uses it renders profitable, that would not otherwise have been mitigating methane).

- =>each year, 56.04×40% = 22.42 EH will come from Vented Methane Bitcoin mining

At this rate it would take (1506/22.42)/2.81 = 23.9 years for Bitcoin to catalyze the mitigation of available landfill and other atmosphere-borne methane (half of the UNEP methane mitigation target).

Scenario F:

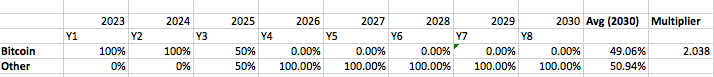

As with Scenario E, but achieve half the UNEP target based on a 2030 time horizon, how much of a percentage of the methane reduction could bitcoin mining?

Using the same 2:5 ratio as scenario E, the 2030-chart looks like this

=> each year, (1506/x)/2.038 = 8 (full years from start of 2023 until end of 2030)

=> 1506/x = 2.038*8 = 16.304

=> x = 1506/16.304 = 92.37

But only 22.42 EH can come from Bitcoin mining under this scenario (40% of Bitcoin network using vented methane) => If the UNEP methane reduction target is hit, Bitcoin mining can feasibly be responsible for 22.42/92.37 of 1/2 the UNEP methane reduction target, in other words: 12.1% of the UNEP target by 2030.

Other calculations:

- 1506 EH represents 13.6 Million S19Pro equivalents = ~$27.2 Billion (in ASICS alone, based on late November ’22 ASICS CAPEX cost)

= 416,976,000 MWh -> mitigating 72 MT methane/year = 2160 MT CO2-eq (using 100 year GWP) or 6048 M t CO2-eq using the 20-year GWP

2. Quantifying the Potential Impact of Bitcoin Mining on Global Methane Emissions documented a way to reduce the impact of climate change by 0.15°C using vented methane based bitcoin mining. This was predicated on helping UNEP achieve 1/2 of their 45% methane reduction target. Scenario F above achieves 12.1% of this target. To achieve 25% of the target, and a 0.075°C reduction of climate change would therefore require (25/12.1)*40% = 82.6% of the Bitcoin network to be using Vented Methane as its power source by 2030.

Document Revisions:

5 Sept 2022: Added to the future projections segment of section C

12 Sept 2022: Minor refactoring of calculations based on more accurate calculation of Bitcoin network carbon emissions as 27.02 M t

27 Nov 2022: Added Scenario E, F. Updated executive summary to reflect additional scenario. Revised down ASICS CAPEX cost