Yes, you read the headline correctly. A lot has changed since 2021 (better research, better data, and the greening of Bitcoin mining itself). In fact, this thesis is now supported by the scientific consensus (14 of the last 16 papers on Bitcoin and energy suggest positive environmental impacts from Bitcoin mining), a conclusion shared by 90% of sustainability magazines who cover Bitcoin mining and even the majority (85.7%) of mainstream news coverage since 2023.

Yet despite these advances, to date there has not yet been an article that synthesizes the different ways Bitcoin helps climate action from the different research sources, case studies (contained below in this article) and Whitepapers, to come up with an overall thesis for Bitcoin’s importance to Climate Action. This article makes a first humble attempt to do so.

It is possible you may have heard about Bitcoin mining having negative environmental impacts such as excessive emissions, water use and e-waste “per transaction”. It’s important that as a reader you know that such claims have now been substantially debunked, both in and firsthand evidence to the contrary, and in numerous peer reviewed publications including Sai and Vranken, 2023. The studies and data debunking these claims are examined at length in our earlier piece “Is Bitcoin good or bad for the environment?“

But back to climate action, there are a myriad of technological challenges that those in the climate movement must resolve to enable faster climate action. As a climatetech investor, here are what I consider to be the top four climate issues that technology can play a part in solving in the near term:

1. Remove bottlenecks to getting more renewable energy onto the Grid

Accelerating the green energy transition means we must overcome these four sub-challenges:

- reduce interconnection queues

- reduce wasted solar and wind energy and cut curtailment fees

- reduce the 8.1 year payback period for solar and wind generation facilities

- raise flexible energy generation demand

2. Replace Fossil fuel based heat with electrically based heat

3. Increase the speed and profitability of R&D into new renewable energy projects

4. Urgently end three carbon-intensive practices: Use of Gas Peaker Plants, methane venting and methane flaring

This paper will examine, using existing case studies and research, how Bitcoin mining could be one of the most important catalysts for climate action in each category.

1. Remove bottlenecks to getting more renewable energy onto the Grid

Why resolving these four challenges is critical

Interconnection Queues Lengthy interconnection queues delay renewable projects from connecting to the grid. Reasons for delay include old transmission infrastructure, regulatory bottlenecks, limited grid capacity, lack of financing for the renewable project, and concern from the grid operator about the impact on the grid of more intermittent power sources. These delays can be as long as 10-15 years, slowing the renewable transition, and compromising our net zero emission goals.

Wasted Renewable Energy and Curtailment Intermittent renewable generation often exceeds grid demand, forcing renewable operators to curtail excess energy. Curtailment can have far-reaching consequences, impacting not only the financial viability of renewable projects but also grid stability. It also hurts economically, with added costs often being handed on to consumers, because the grid operator must often pay the renewable generator a fee for not being able to take their energy. Australia for example is currently wasting 25% of all renewable energy. Such waste not only hurts economically, it slows down the renewable transition both directly and indirectly: directly by reducing the profitability and therefore the expansion-speed of renewable operators, and indirectly by giving fuel to opponents of renewable energy to question the viability of the renewable transition itself.

Create more demand-side flexibility Variable Renewable Energy such as solar and wind generation require electrical grids to balance variable supply with adaptable demand. Lack of flexible demand (industries that can adjust usage) or demand response programs results in grid instability, making it harder to justify expanding renewables without risking grid reliability. Flexible consumers provide grid operators with the confidence to be able to increase the amount of variable renewable energy generation on a grid, knowing they have a demand-side shock-absorber in place.

Long Payback Periods for Solar/Wind Facilities High upfront costs and slow returns (often 8–10+ years) limit cash flow for reinvestment. Extended payback periods deter investors and slow the scaling of renewable projects, delaying the transition from fossil fuels.

How Bitcoin mining alleviates each renewable grid transition challenges

By acting as a flexible, location-agnostic energy buyer, Bitcoin mining can reduce bottlenecks in renewable energy deployment, cut waste, and incentivize the construction of new renewable energy infrastructure.

Let’s explore how Bitcoin mining achieves this through four key mechanisms: reducing interconnection queues, minimizing wasted energy, raising flexible energy demand, and shortening the payback period for renewable energy projects.

1.1 Reduce Renewable Energy Interconnection Queues

One of the biggest challenges in deploying renewable energy is the lengthy interconnection queue process. In the U.S. alone, there are over 2,000 gigawatts (GW) of renewable energy projects waiting to be connected to the grid, according to the Lawrence Berkeley National Laboratory. These projects often face delays of several years due to regulatory hurdles, grid capacity constraints, and the need for costly infrastructure upgrades.

Bitcoin mining can help alleviate this bottleneck by providing a flexible customer for renewable energy projects. Unlike other electricity consumers, miners can set up operations near renewable energy sites, bypassing the need for grid interconnection altogether. This allows energy producers to start generating revenue immediately, rather than waiting years for approval. For example, in West Texas, Bitcoin miners have partnered with wind farms to monetize excess energy that would otherwise be stranded due to grid constraints.

In Ethiopia, the Electric Power Agency has welcomed Bitcoin miners to buy excess energy from the Grand Ethiopian Renaissance Dam (GERD), in turn, powering growth and green energy and earning the country $55M in 10 months, which they are using to build out additional transmission capacity to deliver more renewable energy

The scientific community agrees: by reducing the financial and logistical barriers to renewable energy deployment, Bitcoin mining accelerates the adoption of clean energy, a finding that is supported by You et al, 2023 (Mining to Mitigation: How Bitcoin Can Support Renewable Energy Development and Climate Action) and Menati et al, 2023 (High resolution modeling and analysis of cryptocurrency mining’s impact on power grids)

1.2 Reduce Wasted Solar and Wind Energy Waste and Cut Curtailment Fees

Renewable energy sources like solar and wind are inherently intermittent, meaning they generate energy only when the sun shines or the wind blows. This intermittency often leads to overproduction during peak generation periods, forcing grid operators to curtail (waste) excess energy. In 2020, California curtailed over 1.5 million megawatt-hours (MWh) of solar and wind energy—enough to power 150,000 homes for a year. This wasted energy represents lost revenue for renewable energy producers and undermines the economic viability of clean energy projects.

In Texas, there have been many cases of underutilized solar or wind farms. For example In 2022 Compute North (Now US Bitcoin Corp) purchased a 280 wind farm in West Texas. The farm had been known for high curtailment fees rates when wind was produced that could not be utilized by the grid due to weak demand. By providing a guaranteed customer for that surplus wind energy, the Bitcoin facility reduced waste, ended curtailment fees, and helped stabilize the grid. Also on the ERCOT grid, when Bitcoin mining company Jiachi West began operating in Texas, they reported that renewable energy curtailment dropped by 4%, and renewable energy profitability increased by 12%.

By monetizing curtailed energy, Bitcoin mining not only reduces waste but also improves the financial sustainability of renewable energy projects.

1.3 Slash the Payback Period for Solar and Wind Generation Facilities

The high upfront costs of renewable energy projects often result in long payback periods, discouraging investment. According to a recent peer-reviewed study, the average payback period for solar and wind facilities is 8.1 years. However, Bitcoin mining can reduce this payback period to 3.5 years by providing a reliable and lucrative revenue stream for energy producers.

But these are not just academic theoretical possibilities. Indeed academia has lagged behind a large volume of real-world projects that have already integrated Bitcoin mining with renewable energy in order to increase the payback time.

For example, Deutsche Telecom, Germany’s largest telco has begun using Bitcoin mining to monetize its otherwise wasted wind and solar power. It hopes to use the increased revenue to make solar and wind production more profitable, and reinvest the profits into more renewable generation. Tepco, Japan’s largest Utility company also recently announced a project to begin using Bitcoin mining on its wasted renewable energy. It’s goal is to further reduce waste of renewable electricity by using Bitcoin mining’s time-of-day agnostic properties to use solar/wind that otherwise would have been curtailed.

1.4 Create More Demand Side Flexibility

Saul Griffiths, a leading energy expert and author of Electrify: An Optimist’s Playbook for Our Clean Energy Future, argues that flexible energy demand is essential for incentivizing the construction of new renewable energy infrastructure. Unlike traditional industries, which require a constant and predictable energy supply, Bitcoin mining is highly flexible. Miners can scale their operations up or down in response to energy availability, making them ideal partners for renewable energy producers.

This flexibility creates a symbiotic relationship between Bitcoin miners and renewable energy developers. For example, during periods of low energy demand (e.g., sunny afternoons or windy nights), miners can ramp up operations, providing a steady revenue stream for energy producers. Conversely, during peak demand periods, miners can power down, freeing up energy for the grid. This dynamic helps stabilize the grid and encourages the development of more renewable energy capacity. In places like Norway, where hydropower dominates the energy mix, Bitcoin miners have become key players in balancing supply and demand, ensuring that renewable energy remains profitable and scalable.

By improving the economics of renewable energy projects, Bitcoin mining helps unlock the capital needed to build more solar, wind, and hydropower facilities. These real-world examples highlight how Bitcoin mining is not just a consumer of energy but a strategic partner in the global transition to a sustainable energy future.

1.5 Summary

Bitcoin mining accelerates the green energy transition by helping both grid operators and renewable generators to overcome four challenges

- reduce interconnection queues

- reduce wasted solar and wind energy and cut curtailment fees

- reduce the 8.1-year payback period for solar and wind generation facilities

- raise flexible energy generation demand

While it is by no means the only technology required to solve the first two challenges, there is equally strong evidence that it is the most profitable way to reduce both solar/wind payback periods and increase the flexibility of energy consumption.

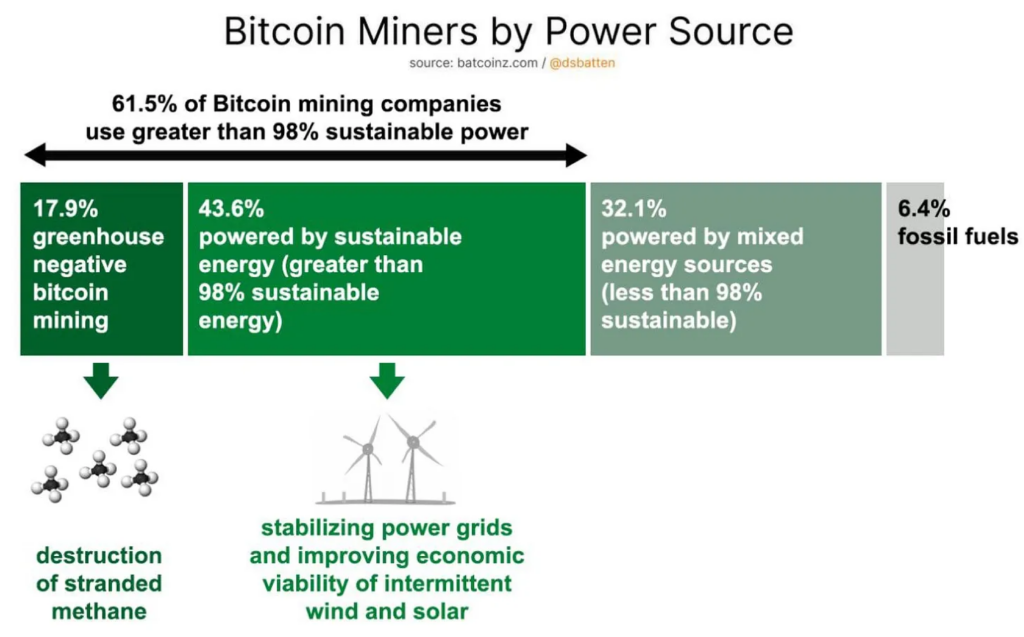

Additionally, it should be noted that sustainably-powered Bitcoin mining companies are not an anomaly, but rather they are an increasing norm. Currently there are 70 sustainably powered Bitcoin mining companies. 41 of these companies use 98%+ zero-emission power sources, and a further 29 using carbon-negative sources.

Collectively these mining companies have helped make Bitcoin the world’s most sustainably powered global industry (56.7% as of Dec 2024).

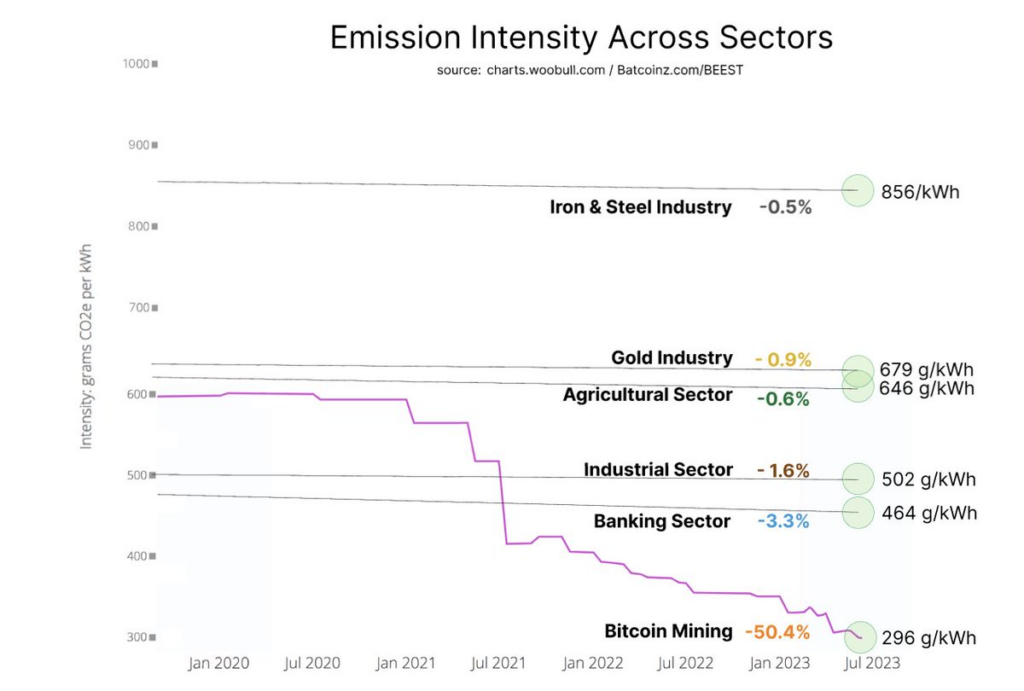

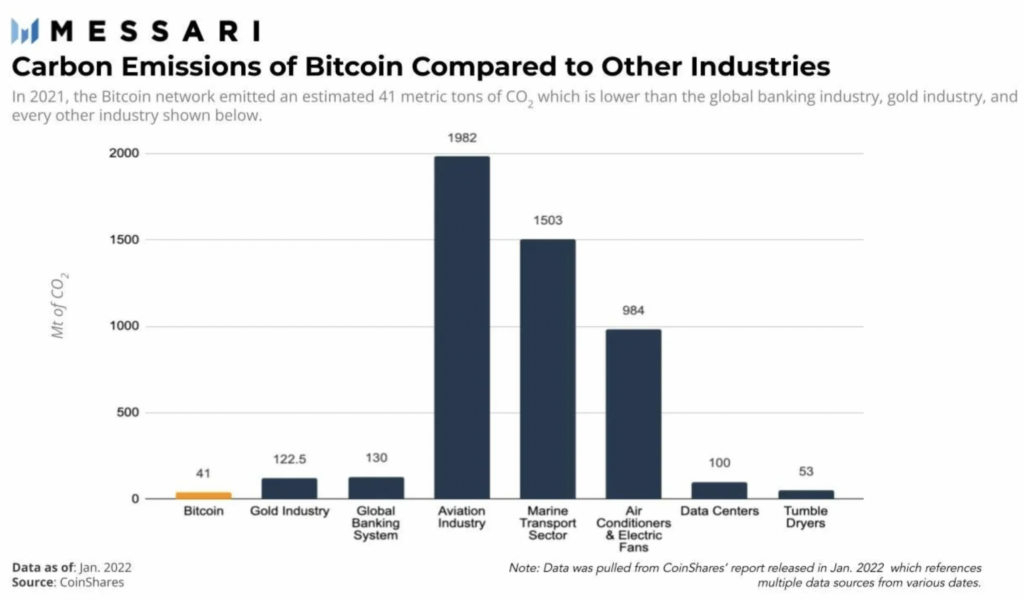

Like eVs, Bitcoin is a fully electrified technology with no direct emissions. Also like eVs, Bitcoin produces secondary emissions because a portion of the power used comes from fossil fuel sources. Also like eVs it is important to remember that this power obviates a more emission-intensive predecessor: petrol and diesel transport in the case of eVs; banking services and the extractive and fossil-fuel dependent gold industry in the case of Bitcoin.

2. Replace Fossil fuel based heat with electrically based Heat

Why it matters

According to the IEA, 50% of all the world’s energy is used for heating. Most of that heat is fossil fuel based.

In parallel to greening the grid, prominent environmental campaigners and energy experts such as Saul Griffiths in his book Electrify state that we must also electrify as many industrial processes as possible, with heating being the single largest candidate for rapid electrification.

While Bitcoin mining cannot replace the intense heat of a coal furnace, there are significant amounts of other heat forms that the exhaust heat of Bitcoin miners can replace and is now replacing. The potential uses for heat from Bitcoin mining are limited only by the imagination. Some of these are one-off applications, whereas others such as delivering district heating to 2% of Finland’s population are already operating at a significant scale.

The first reported example of a commercial operation using heat recycling from Bitcoin mining was Heatmine which started using Bitcoin heat for home heating in Canada in 2018. Since then, the use of heat recycling from Bitcoin mining has rapidly expanded.

2.1 Heat-recycling already occurring at scale

District heating and water heating: MARA is now warming a town of ~80,000 residents in Finland using heat generated from Bitcoin mining operations. This is possible through district heating which involves centrally heating water using Bitcoin mining-generated heat and distributing it through underground pipes to local buildings.

Residential space heating: Home heating has grown from a fledgling industry in 2021 to a competitive market in 2025 with multiple vendors offering options to heat homes using electric heaters that mine Bitcoin in parallel, including 21energy, Heatbit and D-Central.

Drying Lumber requires huge amounts of energy at a constant rate, but not so high as to “cook” the wood, making it a perfect candidate for Bitcoin mining exhaust heating. This started at scale in Norway, and is now being investigated in other countries.

Heating for Horticulture: Bitcoin Brabant, led by Bert de Groot, has been helping decarbonize the greenhouse industry in the Netherlands by using solar-powered Bitcoin mining to deliver heat for the greenhouses. This reduces the greenhouse industry’s reliance on natural gas. There are already many such greenhouses being heated by Bitcoin mining, and this use has the potential to scale to help industrial greenhouses wean themselves off the need for natural-gas based heating.

Fish farming: Meanwhile, in Germany, there’s the Green Bitcoin Farm which harvests solar energy and uses it to operate high-performance computers in the Bitcoin network. They then use the waste heat generated by the ASIC miners for drying medicinal herbs, indoor rearing of edible fish, and vertical farming. Using Bitcoin recycled heat to heat the water for fish farms is also a common use in China.

2.2 One-off applications with the potential to scale

In 2023, Shelter Point Distillery in Campbell River, Canada, created the ‘world’s first sustainable digital tumbler‘ by attaching a Bitcoin miner to provide heat for the whiskey aging process. Genesis Digital Assets (GDA) launched a Bitcoin mining heat repurposing project in Norsjö, Sweden, using renewable hydro-energy. The recycled heat is used to reduce the costs of preventing snow-cleaning trucks from freezing in an area prone to harsh winters.

Constellation Heating uses its Star Heater to repurpose heat to maintain pool temperatures, replacing more emission intensive techniques such as gas heating.

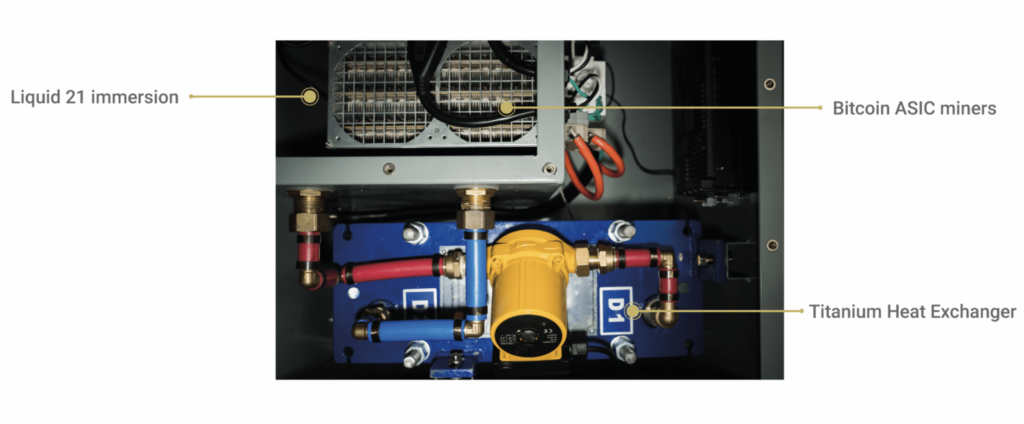

A car and truck wash in Idaho replaced its fossil-fuel based gas heating system with a Bitcoin mining heating system, using a Fog Hashing B6 immersion tank and Bitcoin ASIC miners to generate heat.

When this New York Bath House started using Bitcoin heat to heat its water, it drew attention to how common the practice of using Bitcoin mining to heat water is now becoming.

3. Lift speed and profitability of R&D into new renewable energy projects

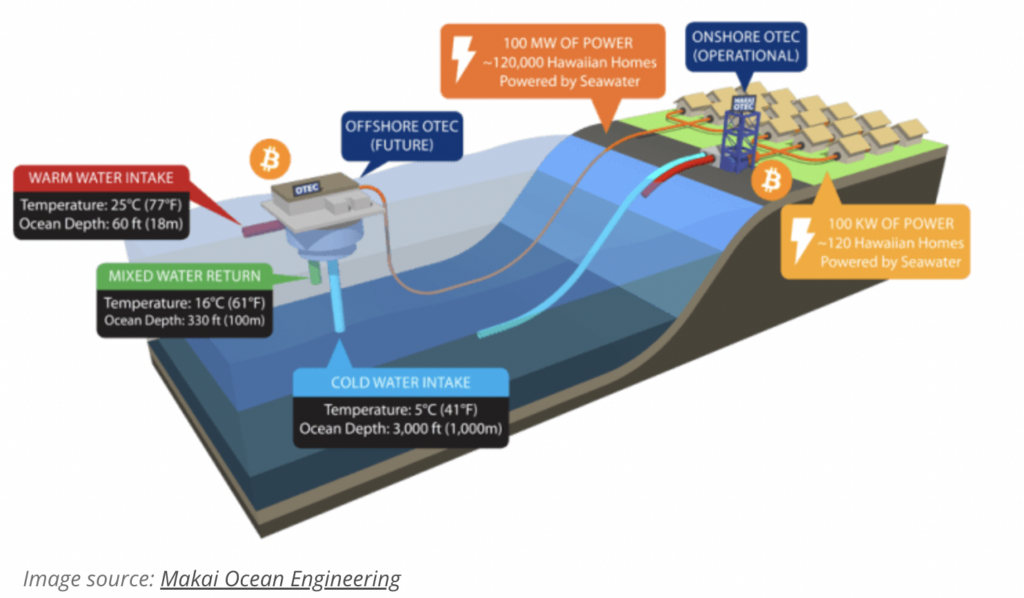

3.1 OTEC

Bitcoin mining has been responsible for reviving mothballed renewable energy technologies such as OTEC, that the Reagan administration stopped funding in the 1980s. Unlike Solar and Wind technologies which are intermittent, OTEC (Ocean Thermal Energy Technology) is able to deliver reliable baseload electricity.

OTEC however suffered from a lack of funding, because it is very expensive to develop novel offshore energy generation capacity in the tropics which is grid-tethererd. In addition to the challenge that offshore wind faces in supplying power back to the grid, OTEC must also develop hurricane resistance.

Bitcoin mining on sea barges removes these constraints by providing a consumer of OTEC energy in situ. This means that the next scale-up R&D effort for OTEC is suddenly economically viable, because the operation will not need the considerable cost of being grid-tethered and made hurricane-proof. While eventually the aim of OTEC is that it will deliver power back to the grid, Bitcoin mining is playing a critical role in catalyzing the economic viability of the scale-up phase of R&D that prior to Bitcoin mining had been mothballed since the 1980s.

OceanBit, which is developing OTEC (Ocean Thermal Energy Technology) was recently profiled in Forbes Magazine. OTEC was mothballed in the 1980s for political rather than technological reasons. OceanBit aims to produce abundant baseload renewable energy. Bitcoin mining is according to CEO Nate Harnon what enabled them to dust the mothballs off OTEC and start working on making OTEC economically viable.

3.2 Renewable Microgrids

Gridless Compute, a Nairobi-based startup, is tackling one of Africa’s most persistent challenges: bringing reliable, renewable energy to remote communities. Traditional microgrid projects often fail due to high upfront costs and lack of consistent demand. Gridless Compute’s innovation? Pairing solar and hydropower microgrids with Bitcoin mining to create a guaranteed, flexible energy buyer.

In this presentation, Erik Hersman, the founder of Gridless showcases how broken the energy model in Africa is, resulting in 600 Million African living without electricity, and demonstrated how Bitcoin mining is already starting to unlock untapped renewable energy resources to solve this issue.

Gridless says it’s sites have already powered 8,000 homes that were without electricity: 1,200 houses in Zambia, 1,800 in Malawi and 5,000 in Kenya.

Academic studies have long argued that demand flexibility is key to microgrid viability. Gridless proves this by using Bitcoin mining as a “digital battery,” monetizing surplus energy that would otherwise go unused. As CEO Erik Hersman notes, “Bitcoin mining turns stranded energy into economic lifelines.” With plans to deploy 20 microgrids across sub-Saharan Africa by 2025, Gridless is demonstrating how Bitcoin can democratize energy access while accelerating decarbonization.

3.3 Other climatetech endeavors

As humans adapt to Climate Change, the challenge of getting enough drinking water to arid countries becomes an increasing challenge. There is no one solution to this challenge, but part of the solution is to improve the cost-effectiveness of desalination, which is very energy intensive. MARA, who have also pioneered Landfill Gas powered Bitcoin mining, home heating, flare-gas mitigation and wind-powered Bitcoin mining, has begun investing in improving desalination technology while concurrently using Bitcoin mining heat, rather than natural gas, to desalinate water. This results in more water desalination per dollar of energy spent. This innovation if scaled, has the potential to increase water abundance in arid countries.

4. End carbon-intensive environmental practices

(Gas Peaker Plant utilization, methane venting and methane flaring)

4.1 Gas Peaker Plants

Gas peaker plants, notorious for high emissions and idle-time inefficiencies, are being obviated in Texas thanks to Bitcoin mining’s demand flexibility. Following Winter Storm Uri in 2021, ERCOT CEO Brad Jones integrated Bitcoin miners into grid stability programs. By 2024, 3 GW of mining capacity participated in demand response. In a recent report from the Digital Assets Research Institute (DARI,) the data shows that Bitcoin mining has now become a critical part of Texas’ ability to scale up the concentration of renewable energy on the electrical grid to meet the needs of their population growth. The ability for Bitcoin miners to curtail usage at peak times was sown to have saved Texas taxpayers $18 Billion because ERCOT did not need to purchase highly polluting peaker plants.

During extreme weather, miners power down within seconds, freeing electricity for critical needs. For instance, during the July 2023 heatwave, Texas miners curtailed 1.2 GW (equivalent to three peaker plants’ output). Peer-reviewed studies by Bruno et al. (2023) support Bitcoin mining’s ability to eliminate grid reliance on peaker plants. ERCOT’s success demonstrates that flexible load resources like Bitcoin mining are not just alternatives to peaker plants—they are superior, more cost-effective replacements that support a greater concentration of renewable energy on the grid.

4.2 Turning Landfill Methane into a Climate Asset

Landfills account for 17% of global methane emissions, a gas 84x more potent than CO2. Traditional solutions, like flaring or building gas pipelines, are often impractical because very few commercial operations can co-locate next to a landfill, or prohibitively expensive due to the cost required to upgrade the grid to handle additional electricity upload. Bitcoin mining offers a breakthrough: mobile mining units can convert vented methane into electricity on-site, eliminating emissions and generating revenue.

In 2023, Vespene launched its 1.6 MW landfill gas-powered Bitcoin mining operation in Marathon County, one of five Bitcoin mining companies to do so. The project will mitigate 20,000 tonnes of CO2e per year. A new study was released in 2024 demonstrating that using landfill gas (LFG) for Bitcoin mining is economically viable, sustainable, and environmentally beneficial. Meanwhile, NodalPower now conduct landfill gas powered Bitcoin mining on two separate sites.

Bitcoin mining companies like NodalPower and Vespene Energy deploy modular data centers at landfills, using methane to power miners. Over the duration of a project, Municipalities earn millions in power which can be reinvested into community programs, while saving millions in flare maintenance costs. Meanwhile, the methane becomes a climate asset rather than a liability. There are currently five Bitcoin mining operations operating on landfills, who are turning trash into digital gold. It would only take 35 mid-sized venting landfills with Bitcoin-mining power-generation operations on them to take the entire Bitcoin network carbon-negative.

4.3 Ending Oilfield Flaring

Gas flaring, which wastes energy while emitting the climate super-warmer methane, persists globally despite World Bank efforts to stop almost all flaring by 2030. To date we have found few ways to make good that intention, with flaring in regions including the Middle East having recently been shown to cause more toxic gases than previously feared.

Bitcoin mining is proving to be the most scalable solution.

In North Dakota for example, Crusoe’s projects reduced flaring by 99% at partnered sites. Similarly, Upstream Data’s Canadian operations have been cutting flaring since 2017. In another example, climate tech company Unblock Global has achieved 15MW of flare gas powered bitcoin mining in Argentina. The company has a mission to eliminate flaring in Latin America and raised $15 million to use flared gas from Argentina’s Vaca Muerta, to power its operations. These are three of the 29 Bitcoin mining companies that have found a way to solve the 160-year old problem of wasted flare gas. Collectively, they mitigate 3.2 MT CO2e per year. It is for this reason that the World Economic Forum recently praised Crusoe’s Bitcoin mining operation for helping the UN in its efforts to reduce methane emissions.

Yet NGOs like Sierra Club continue to reflexively dismiss measurable progress such as this as “greenwashing”, saying that any company partnering with Oil&Gas to reduce flaring is “perpetuating the profits of oil companies.”

As our earlier article on Gas Flaring highlights, this argument is not only flawed, but it has arguably led to the elongation of the practice of gas flaring. Without Bitcoin mining, the alternative is continued flaring. However, by monetizing waste gas, Bitcoin mining uniquely aligns economic incentives with environmental progress.

4.4 Summary: How Bitcoin Mining helps cut methane emissions and end environmentally harmful gas dependencies

These Bitcoin mining projects are neither one-offs, not small. There are 29 Bitcoin mining companies who are carbon negative that we know of (using methane emissions as their fuel source), and 3 GW of gas peaker plants (that we know of) that have been obviated as a direct result of Bitcoin mining.

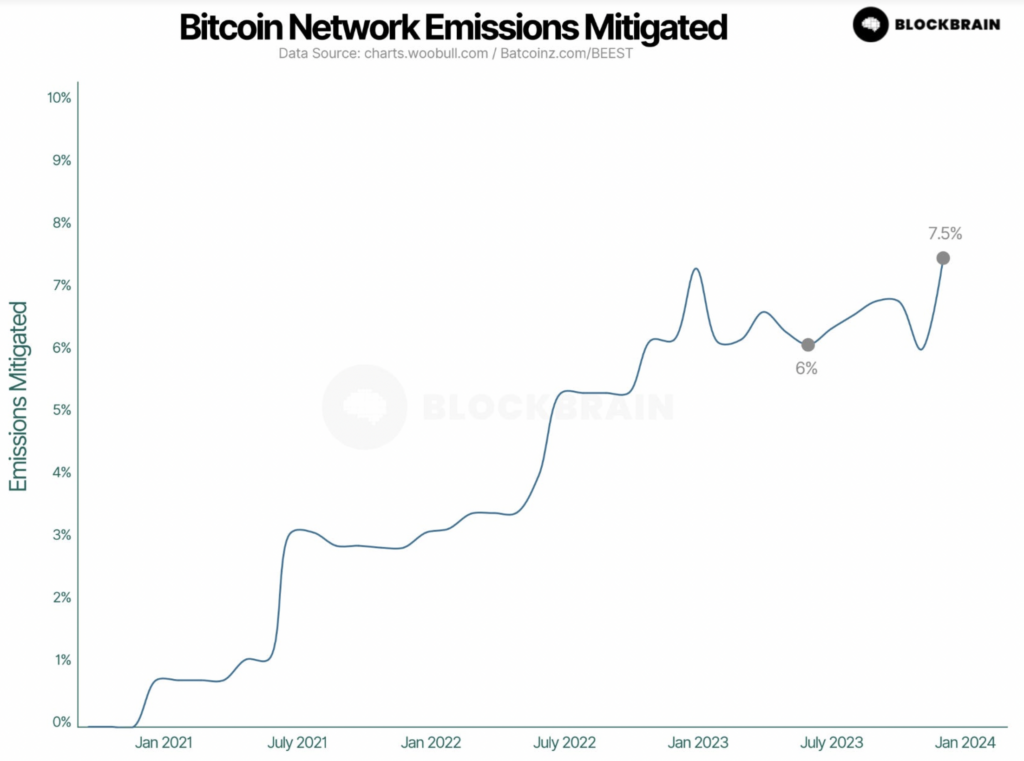

The combined impact of carbon-negative Bitcoin mining is that mitigation has already reached 7% of the Bitcoin network’s emissions. As mentioned above, according to the Digital Assets Research Institute, and another 35 mid-sized venting landfills is all it will take for the entire Bitcoin network to become carbon negative.

Remarkable, Bitcoin mining has in the last three years demonstrated an ability to profitably and scaleably tackle all three of these thorny environmental challenges where other technologies have proven either unprofitable, unscalable or both.

Remarkable, Bitcoin mining has in the last three years demonstrated an ability to profitably and scaleably tackle all three of these thorny environmental challenges where other technologies have proven either unprofitable, unscalable or both.

5. Preserving nature

Monetizing wasted renewable energy not only accelerates the energy transition but also helps save nature. For example, in East Congo, lies Virunga National Park, a 7,800 Km2 terrain that’s home to half of Africa’s terrestrial species. During COVID the park was threatened with closure, having lost most of its income, and having no way to pay its staff that protected the park from poachers, and militias who cut down trees to use as charcoal for fuel due to energy shortages in the region.

Park Director Emanuel de Mode stated that Virunga “would have gone bust as a national park if not for Bitcoin mining.”

The jobs created through the Bitcoin mining operation also provide an alternative income for the militias currently burning down rainforest to sell charcoal.

Also, within Virunga National Park lies a chocolate factory that the exhaust heat from Bitcoin mining is providing the drying for, reducing costs and helping to pay those who work there a living wage.

This is not a one-off example. In Costa Rica, Bitcoin mining prevented the loss of a 60Ha of land which had been in Eduardo Kopper’s family for 5 generations, and financed its transformation into an eco-sanctuary. The model used was identical to Virunga: utilize the otherwise stranded and wasted surplus hydropower to do Bitcoin mining onsite, and reinvest that into saving the land.

Critics often assume, without research, “they could have done something else with that stranded energy”. Such a view is not only naive, it also diminishes the environmental contributions of stewards of the land such as de Mode in Virunga Kenya, and Kopper in Poaz Costa Rica, neither of whom were Bitcoiners, and both who spent years researching what to do with that stranded energy before realizing that Bitcoin mining was their one available option due to its unique location-agnostic, time-of-day agnostic features.

6. The unintended consequence of uninformed criticism

While in some cases Bitcoin mining companies have looked for opportunities that enhance nature, it is equally true that sometimes they have neglected it. Before late-2021, a lot of Bitcoin mining was coal-based, A Bitcoin mining operation stole considerable electricity from the grid, while another in Niagara Falls was fined for being being an excessively noisy neighbor. There have been other instances of such noise complaints also. Critics and journalists should expose genuine bad actors.

When it comes to this reporting, three glaring problems stand out.

Firstly, for every genuinely bad actor, there have been misreported reports of bad actors that weren’t. For example, Greenidge Generation was misreported both as opening a gas plant for Bitcoin mining, which caused toxic algal blooms in an adjacent lake (it didn’t, it opened to provide power back to the grid, and there was no elevated lake temperature). Other reports have falsely accused Bitcoin mining companies of raising Texas electricity prices, destabilizing the grid and using excessive water. These claims all turned out to be not only baseless or based on very poor data, but contradicted by studies which reveal Bitcoin mining in fact has stabilized the grid (see claim 21) and helped lower electricity prices (see claim 22) by reducing curtailment fees while raising grid operator revenues. An anti-Bitcoin reporting bias only antagonizes those in the Bitcoin mining industry towards reporters, and deflects the attention that should be given to genuinely bad actors.

The second issue is that those reporting on one off examples where Bitcoin mining operations are alleged to have negatively impacted a community have tended to also take a subjective side-swipe at the entire industry. Time Magazine did this in their Feb 2024 coverage of a Bitcoin mining company’s noise levels. More recently, the Cooldown used this same recipe by adding to an otherwise accurate piece of reporting on the Thai Bitcoin operation a wholly inaccurate statement “Whether done legally or illegally, the environmental impact of cryptocurrency mining cannot be understated.” The comment is an example of a side-swipe that ignores the scientific consensus. In this instance, the article cited a comprehensively debunked outlier study on Bitcoin mining to back up the statement. Again, such statements antagonize the industry against the reporting organization, rather than keeping the focus on what may be a genuine issue worthy of examination.

But the third issue is the most severe, because it doesn’t just hurt Bitcoin mining but the wider climate movement. Criticism, particularly from Environmental NGOs, without understanding of Bitcoin’s ability to end gas peaker plant reliance and substantially reduce flaring has directly contributed to the elongation of both the need for gas peaker plants, and the practice of natural gas flaring. (See linked studies for evidence of how NGO criticism of Bitcoin mining has backfired for the Climate movement).

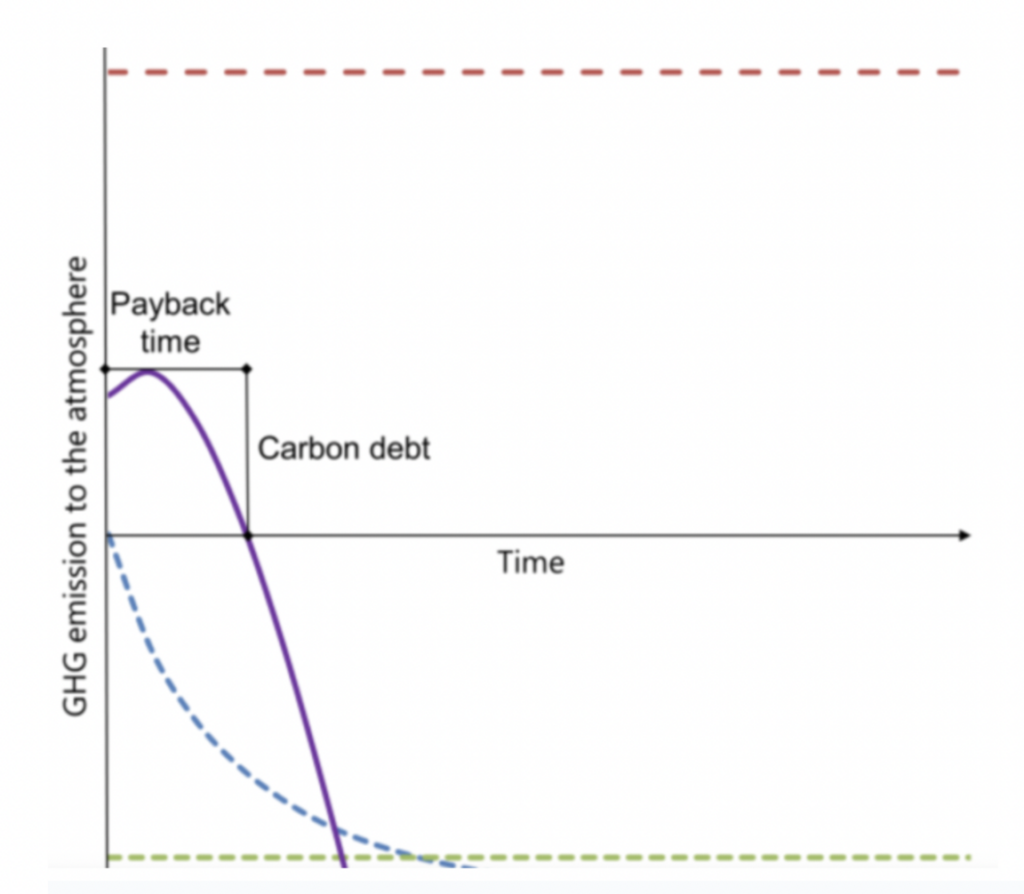

7. The Carbon Payback Time of Climatetech

It should not be trivialized that Bitcoin mining currently emits 46 Mt CO2-eq of emissions annually according to the Digital Assets Research Institute (up from the already significant 41 MT CO2e in 2021). The habit of some in the Bitcoin ecosystem of saying “But other industries omit much more” has earned the ire of some in the environmental movement and rightly so; every industry must take steps to reduce its environmental footprint. Equally, context matters: the photovoltaic (PV) industry, despite its critical role in decarbonizing energy systems, did not achieve a net-positive carbon balance until 2011—57 years after the first solar cell was invented in 1954. PV manufacturing continues to this day to rely on energy-intensive processes and coal furnaces to melt silicon during the manufacture process, however it is widely accepted that the photovoliatic industry is net emission producing, because it now reduces many times more emissions than it creates.

Similarly, Bitcoin’s emissions must be considered alongside its proven role in cutting methane (84x more potent than CO2), scaling renewables and other factors mentioned in this article.

More importantly, like EVs, those emissions are not “additional”. By using the Bitcoin network, one is utilizing a fully electrified technology in preference to two substantially more emission intensive industries, The Banking system (as a method of transacting), and the Gold mining (as a store of value).

The combination of much more careful research by critics and less trivializing of the real current-day emissions of Bitcoin mining will go a long way to ensuring Bitcoin mining realizes its full potential as a key tool of climate action.

A balanced evaluation of Bitcoin mining, as with any emerging climate technology, requires assessing both its current footprint and its future potential. Just as early solar investments paved the way for today’s carbon-negative PV industry, Bitcoin mining’s ability to fund renewable infrastructure, eliminate methane emissions, and stabilize grids may ultimately yield net reductions far exceeding its operational emissions. Policymakers and environmental stakeholders must adopt this balanced lens, looking not only at current emissions but future potential. A good rule of thumb is this: if our rubric for evaluating a nascent technology’s climate impact would have resulted in solar panels being banned in the 1990s (when the photovoltaic industry created considerably more emissions than it abated), then it is likely to be a bad methodology.

Conclusion: Bitcoin Mining is Tier 1 Climate Action

Bitcoin mining has emerged as a linchpin for addressing four systemic barriers to climate progress, as demonstrated by both real-world data and case studies.

First, Bitcoin mining directly tackles renewable energy bottlenecks. It does this by monetizing stranded power, miners reduced interconnection queues in Texas and Ethiopia, enabling wind farms like US Bitcoin Corp’s 280 MW Texas project, while cutting curtailment fees. Jaichi West for example found that just a 4% reduction of curtailment led to a 12% increase in profitability. Solar and wind payback periods, once 8.1 years, now fall to 3.5 years when paired with mining, which has led Germany’s largest Telco, Deutsche Telekom and Japan’s largest Utility, Tepco, to start utilizing Bitcoin mining for their previously wasted renewable energy.

Second, Bitcoin mining replaces fossil-based heat at scale. MARA’s district heating system now warms 80,000 residents in Finland. Collectively, Bitcoin mining in Finland supplies district heat to 2% of the country’s population. Similar projects, from drying lumber in Norway to decarbonizing Dutch greenhouses (Bitcoin Brabant), prove that waste heat can displace gas-dependent processes.

Third, Bitcoin mining accelerates R&D for neglected climatetech. OceanBit revived OTEC, a previously mothballed baseload renewable energy source, by using Bitcoin mining as a catalyst to bypass otherwise prohibitive R&D costs. Gridless Compute’s Kenya-based microgrids, powered by biomass and hydro paired with mining, electrified 8,000 homes across Africa and aim to deploy 20 grids by the end of 2025.

Fourth, Bitcoin mining curtails methane emissions with measurable impact. Bitcoin mining collectively mitigates 3.2 million tons of CO2e annually, while Texas’ ERCOT saved taxpayers $18 billion by using 3 GW of mining demand flexibility to avoid building new fossil-fuel intensive gas peaker plants.

Critics who dismiss these efforts as “greenwashing” overlook not only the sheer volume and scale at which Bitcoin mining is now measurably enabling climate action across multiple areas, but also the hard data: 61.5% of Bitcoin mining now uses >98% sustainable energy, and carbon-negative mining (29 companies) already offsets 7% of the network’s emissions. Projects like Virunga National Park—which credits Bitcoin mining for saving its 7,800 km² rainforest and funding anti-poaching and deforestation efforts—show that Bitcoin mining’s value extends beyond energy systems to biodiversity preservation.

To policymakers and NGOs: the evidence is clear. Bitcoin mining is no longer a hypothetical solution—it is already resolving the grid instability issues at scale that accompany higher concentrations of solar/wind energy, electrifying parts of rural Africa, and funding OTEC breakthroughs. Rejecting Bitcoin mining’s contribution to climate action risks prolonging reliance on gas peakers, methane flaring, and methane venting. In the race to net-zero, Bitcoin mining is not optional—it’s operational. Let’s embrace it, research it, and leverage its unique ability to solve some of the toughest roadblocks en route to our Net Zero Emission goals.

Footnote: Bitcoin achieves these climate outcomes while providing a number of equally numerous humanitarian benefits at an increasing scale. But that is a subject for another article.