I am an impact investor, more recently specializing in climatetech. Before that I was I ran a technology company. These experiences gave me some insights into the challenges that all new technologies face in achieving mainstream adoption.

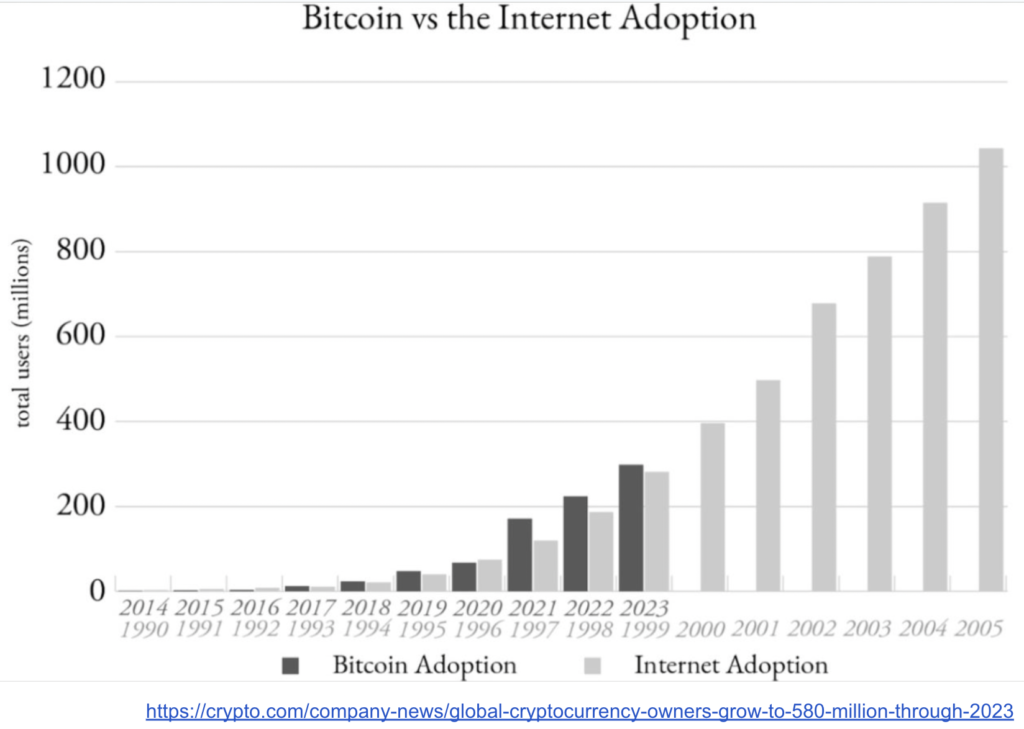

Bitcoin currently faces this same challenge. Let’s zoom in to where the chasm could be crossed, and what currently is holding it back.

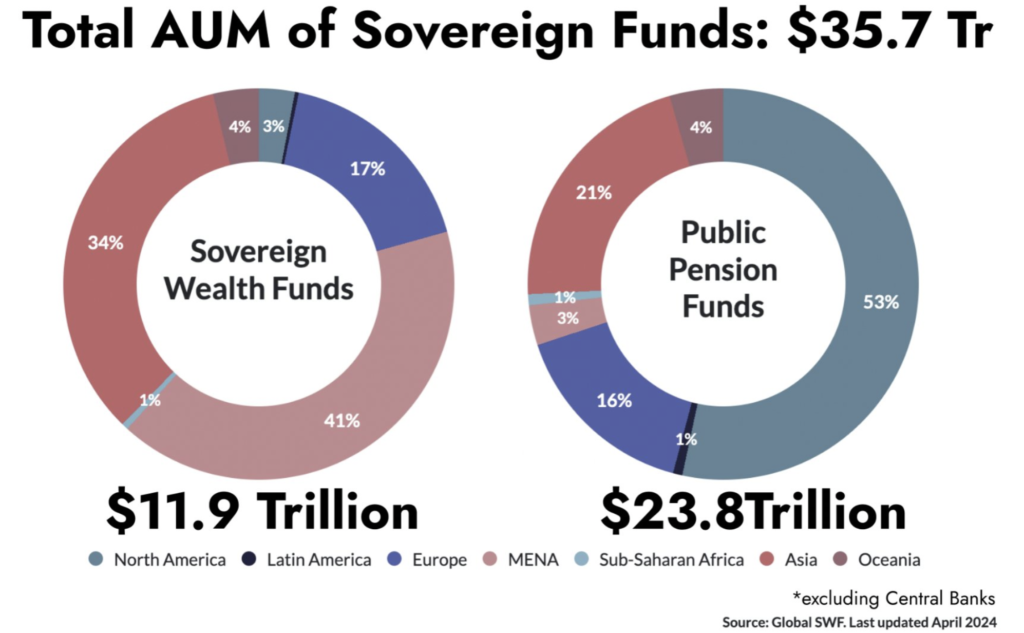

There is 65 Trillion of institutional investment that wants to invest in bitcoin but thinks they can’t (30 Trillion in impact funds, and another 35 Trillion in Sovereign Funds excluding Central Banks).

The reason they think they can’t is they believe Bitcoin is a bad ESG story. This article investigates this claim in depth, against the backdrop of other disruptive technologies, so we can better spot trends, and filter out likely good information from likely misinformation. When I first heard the claim that Bitcoin could be positive for the environment, as an environmental campaigner and climatetech investor I was skeptical. After considerable due diligence however, I realized that there was a strong evidential basis to this claim, which I outline here.

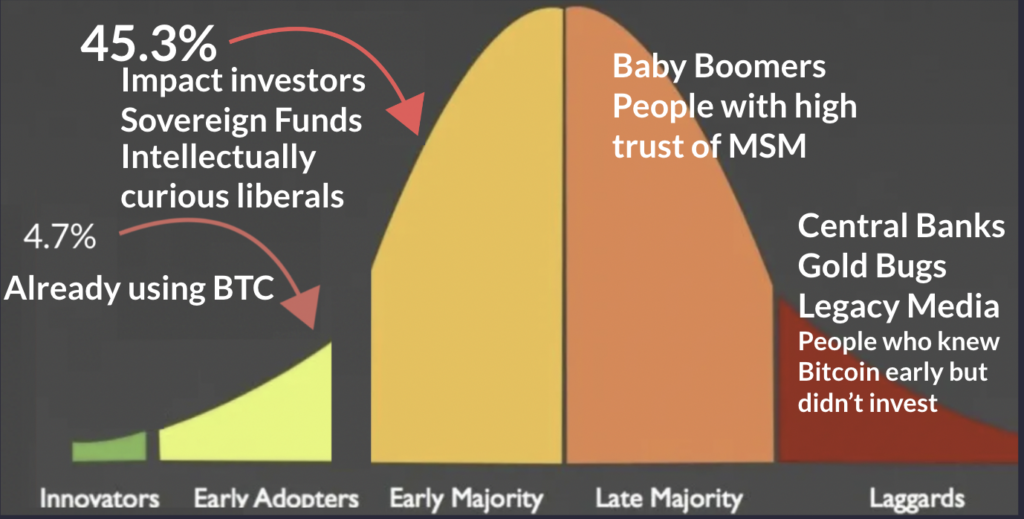

This question if very important, if not the most important question Bitcoin’s supporters must answer to the next group of potential Bitcoin adopters, because the “early majority” care deeply about environmental impact.

In order that Bitcoin “crosses the chasm” from early adopters to the early majority, addressing Bitcoin’s (true) environmental impact must be addressed. There is no bypass, no shortcut for this. Unless and until this issue is addressed, Bitcoin will not “cross the chasm”.

In Bitcoin’s adoption curve, the estimated 4.7% who hold Bitcoin are the early adopters. The next wave includes institutional investors, which in turn includes sovereign funds and ESG funds. They are the early majority. The early adopters tend to be highly suspicious of mainstream media. However the Early Majority are only somewhat skeptical. As a result, they have different beliefs about Bitcoin today.

Here is a sample of statements that people who interface with, or sit on the Compliance Divisions and ESG Investment Committees of Sovereign Wealth Funds shared with me recently about Bitcoin.

I have limited knowledge about Bitcoin other than “it’s bad for the environment, don’t touch.”

“It’s conflicting with the idea of a Central Digital Currency so it can be very confusing for someone who’s not in the space”

“We have other issues we have to solve before we think about Bitcoin”

“I’ve heard of a lot of backlash against Bitcoin because of criminal activity and the dark web”

“It’s using so much water. It’s using drinking water.”

While these messages are not anchored in fact, they do represent the current opinion-set. Existing Bitcoin proponents must meet these people where they are at if they are to have any hope of changing this opinion-set, no matter how good the data.

There are 3 stages to shifting these perspectives so that that early majority can invest in Bitcoin without value conflict

- Screening out noise

- Identifying false signal

- Reading pure signal

Let’s address each in turn.

1. Noise Reduction

The best way we can clear most of the noise around Bitcoin is not to start with Bitcoin, but to understand something I learnt while running my first technology company: if you’re going to bring a disruptive technology to the planet, you better be prepared for a lot of gaslighting from the people you disrupt.

This has happened to every disruptive tech since the telegraph in an unbroken chain of 21 technologies across 160 years.

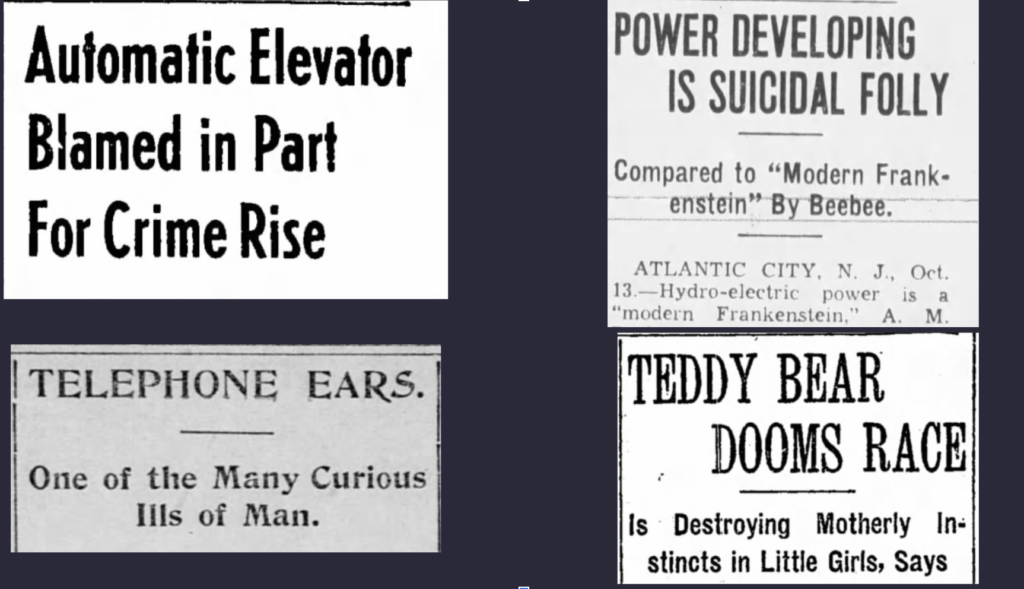

Let’s zoom in. Here’s some samples of how disruptive technologies and devices have been greeted through in the last 160 years.

As we can see, long before Bitcoin was labelled by the media as an existential threat to humanity, the teddy bear was!

Let’s zoom in a little more. I could have chosen anyone one of 21 industries but have chose two that like bitcoin disrupted multiple industries.

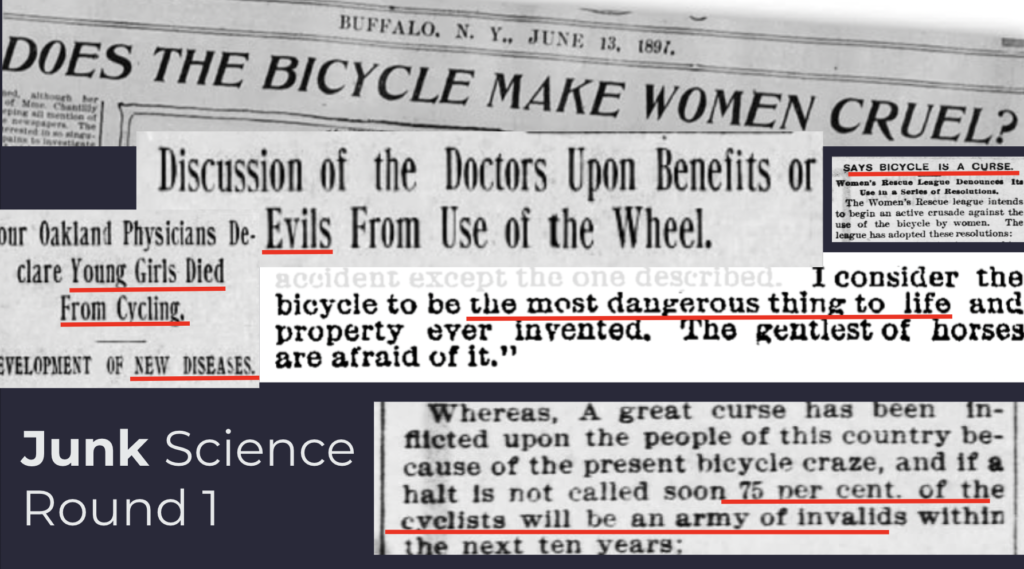

The first was the bicycle. When the bicycle first rose to prominence in the 1890s, it disrupted horse drawn transport, riding apparel, public transit and the railway industry.

As the disrupted industries launched their counteroffensive, new junk science came in almost immediately.

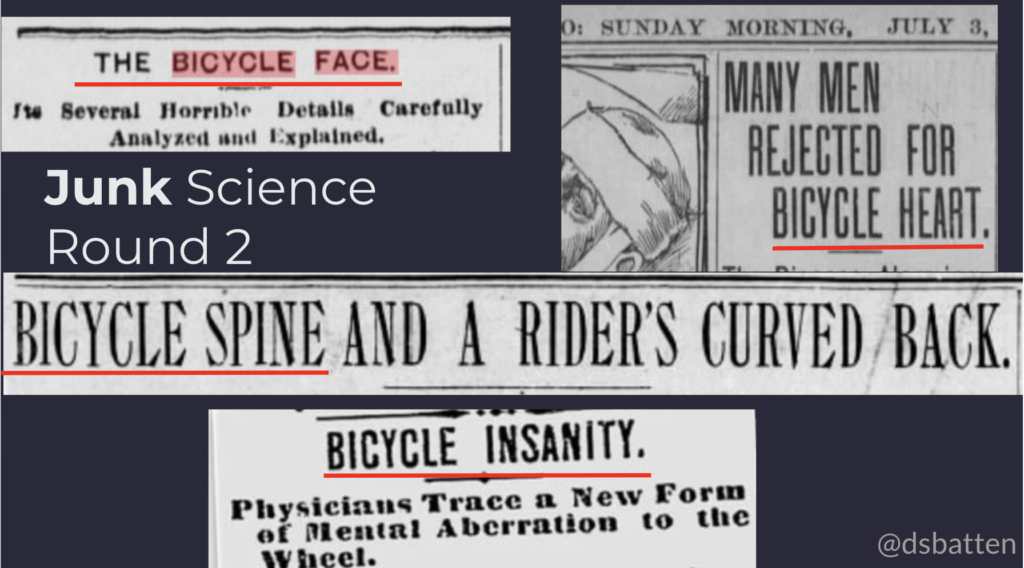

Next, without empirical evidence, medical experts and academics started referring to four invented conditions you that you could supposedly get by riding a bicycle

This created the environment of moral outrage where regulators and policymakers, who gained their information primarily from mainstream media, felt the right thing to do was to call for bans and restrictions.

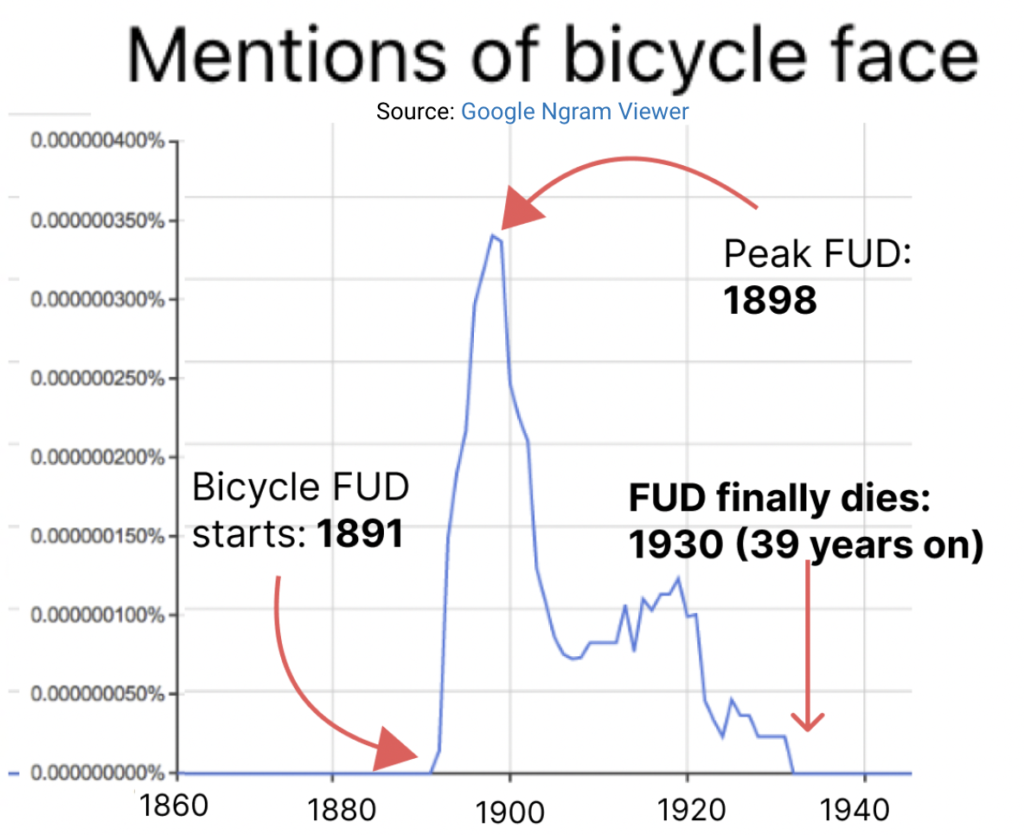

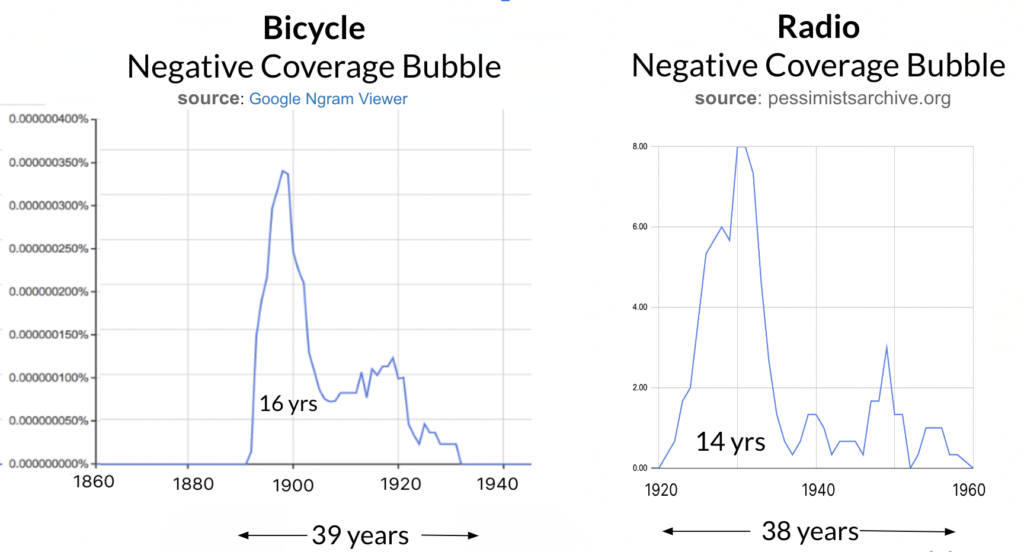

The prevalence of the term “bicycle face” serves as a guide as to when misinformation about the bicycle peaked, and how long it took to eventually die out.

source: Google Ngram Viewer

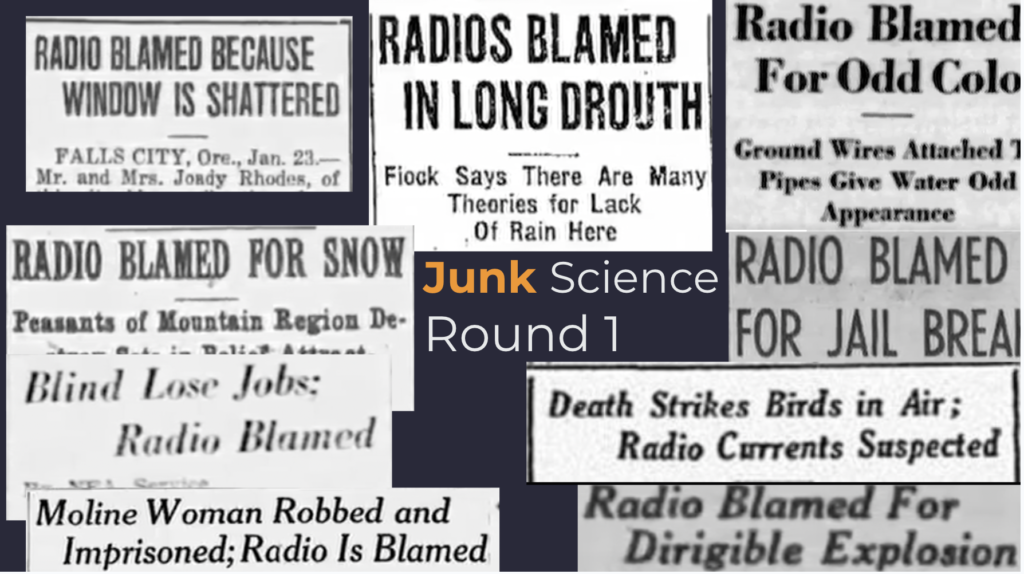

The bicycle was no one off event. The response to another technology that disrupt multiple industries, the radio, followed an almost identical pattern.

Immediately after the radio began rising to prominence in the 1920s, junk science about the radio was reported in the mainstream media. The radio was blamed for everything from jailbreaks to snowstorms.

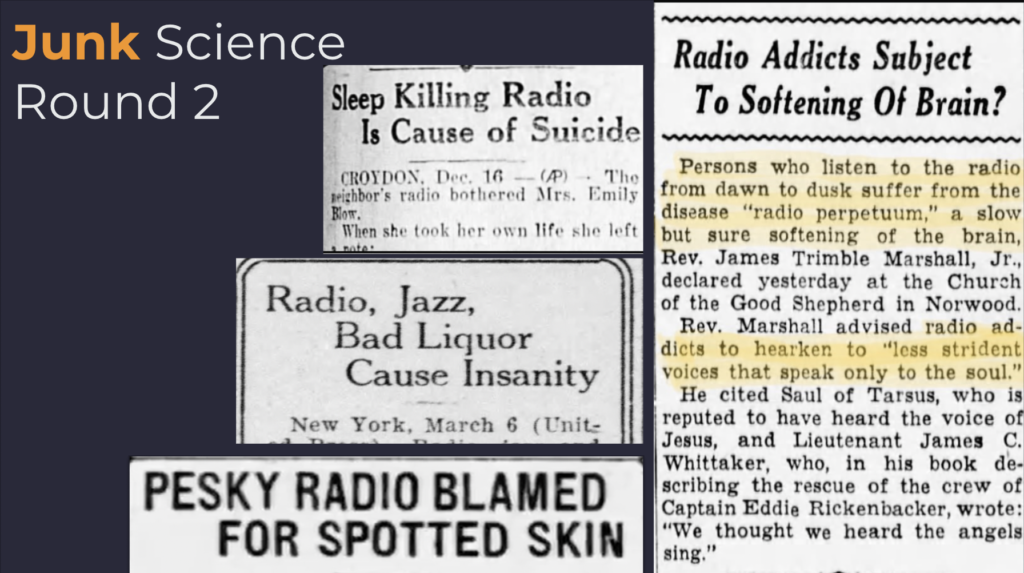

Next, without empirical evidence, medical experts and other authority figures started referring to four conditions that you could supposedly get by listening to the radio.

Once again, this created the environment of moral outrage where regulators and policymakers, who gained their information primarily from mainstream media, felt the right thing to do was to call for bans and restrictions.

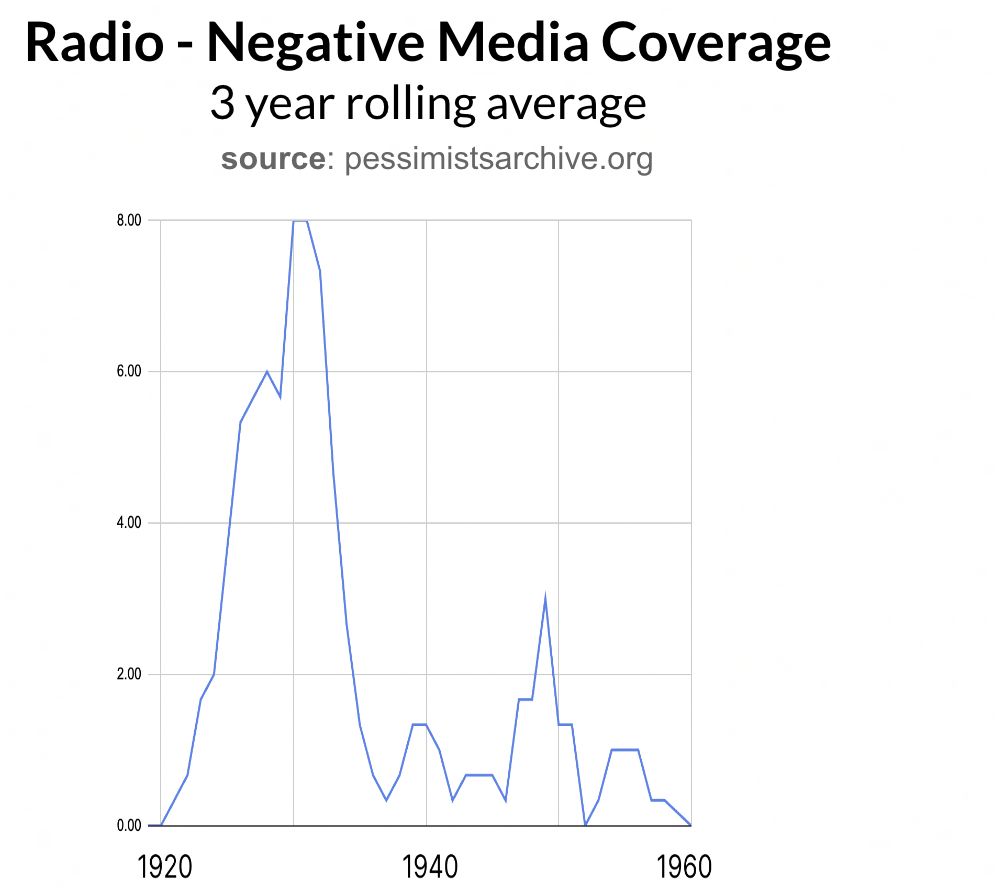

source: pessimistsarchive.org

The chart on radio misinformation in mainstream media took on an uncannily similar shape to the earlier bicycle misinformation chart: an initial peak around 7 years after inception, but then a long tail with several smaller peaks within that tail. The similarity is even more striking when we view the charts side by side.

Bitcoin’s journey has been almost identical to that of the bicycle and the radio. Bitcoin disrupts (at least) four industries: Central Banks, Banking, The Gold Industry and Remittance Payments.

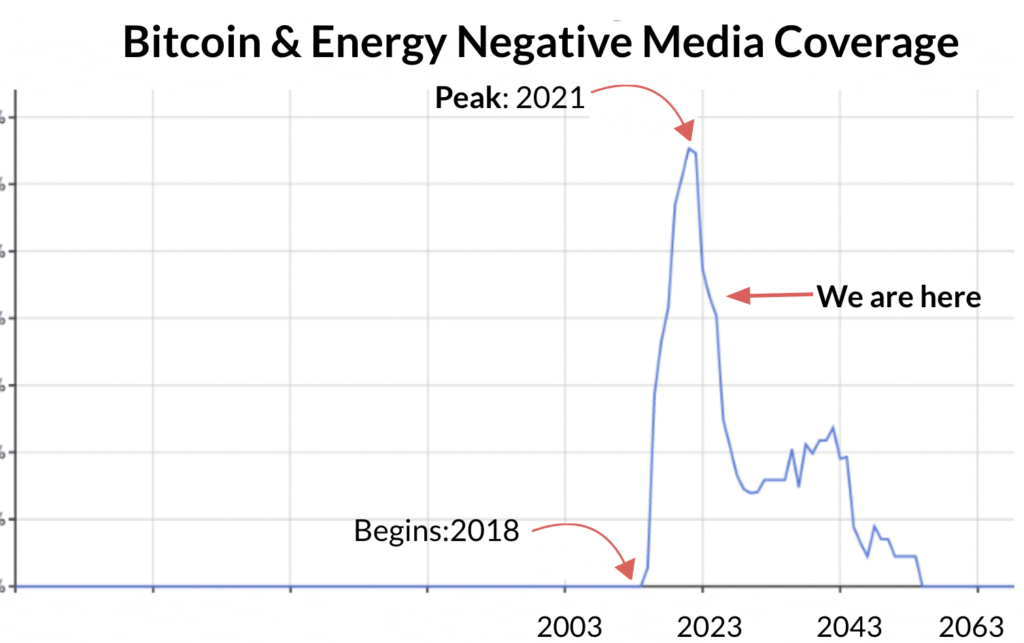

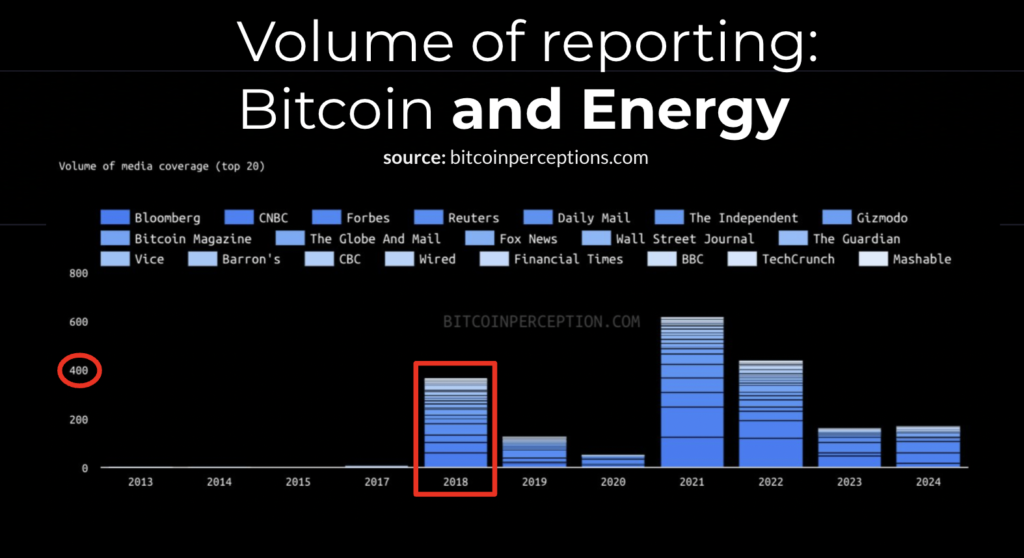

Bitcoin has been met with similar junk science, as we will investigate in the next section “false signal”, which has again created the environment where policy-makers and regulators who rely heavily on mainstream news sources for information have felt it appropriate to call for bans and restrictions. We are currently about here in the media cycle around Bitcoin and energy.

The key takeout is this, the early majority does not have to suddenly trust the media as little as the early adopters. They simply need to see that trusting mainstream media sources for accurate reporting on a disruptive technology during the first 16 years is, based on history, an extremely risky approach.

Seeing Bitcoin as just another disruptive technology, which inevitably follows the same “rite of passage” towards eventual acceptable after an elongated baptism of misinformation fire can help the early majority screen out 80% of the noise about Bitcoin, and regain the intellectual curiosity to take an objective look at Bitcoin.

Step two: identify false signal

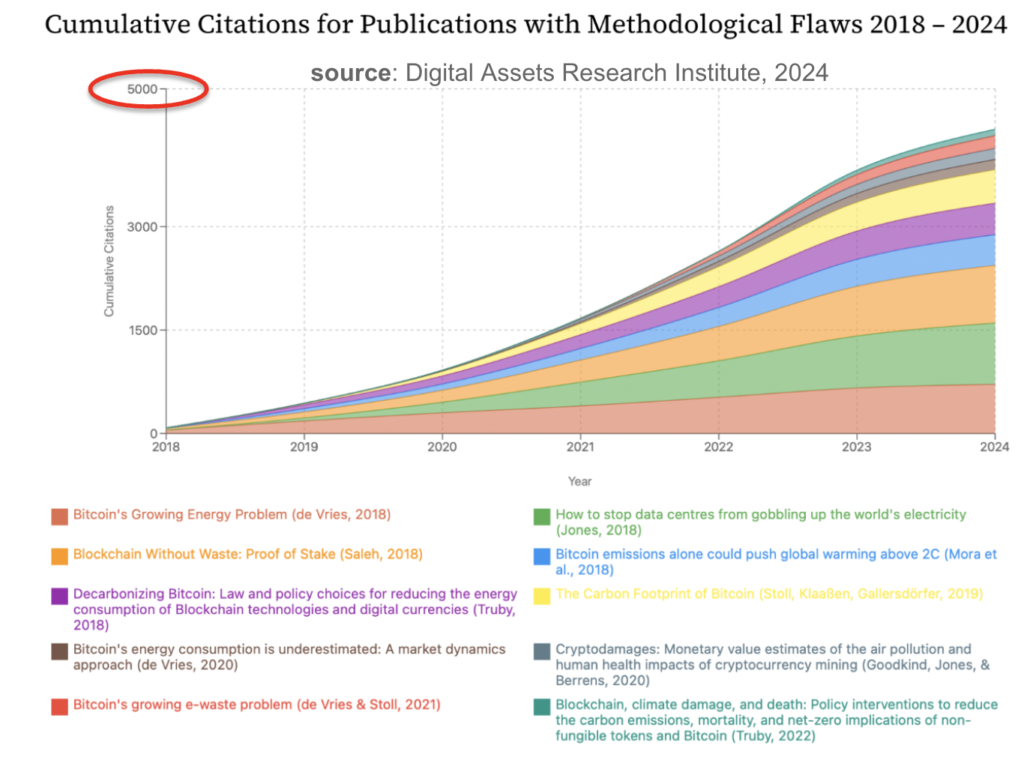

In Radio and the Bicycle’s case the false signal was supplied by medics. In Bitcoin’s case it was a data a see scientist named Alex de Vries who in May 2018 wrote a five-page commentary called Bitcoin’s Growing Energy Problem

The word commentary is important. According to Nature, commentaries are shorter, have a lighter review process and generally reflect the author’s perspective, rather than reporting new empirical data.

De Vries’s article was a commentary, and the perspective he put forward was “We can measure Bitcoin’s use of energy per transaction to show that the Bitcoin network cannot scale without vastly increasing emissions.

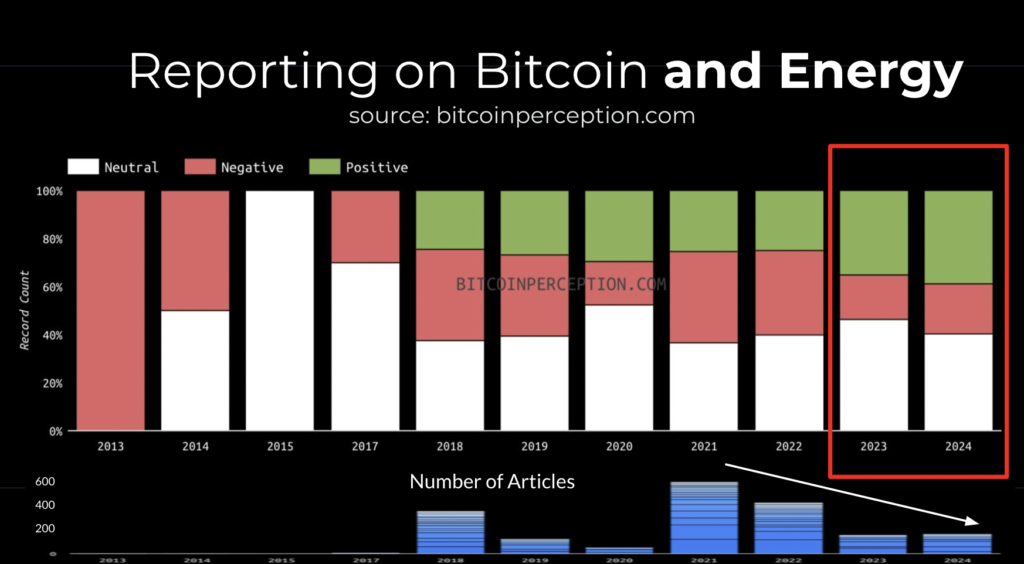

His commentary was a hit. In 2017 there was 1 article on Bitcoin’s energy usage. In 2018, the year of de Vries’ commentary, there were more than 400.

The problem is that his perspective was invalid because Bitcoin’s energy use does not come from its transactions, meaning it could handle 1000 times more transactions, yet use no more energy.

Cambridge University called the per transaction measure “not a meaningful metric”. But the media and other authors kept citing it anyway. Then the regulators, Central Banks, and NGOs joined them.

The per transaction metric was refuted a further four times, this time in academic journals (Masenet et al, Dittmar et al, Sedlmeir et al and Sai & Vranken).

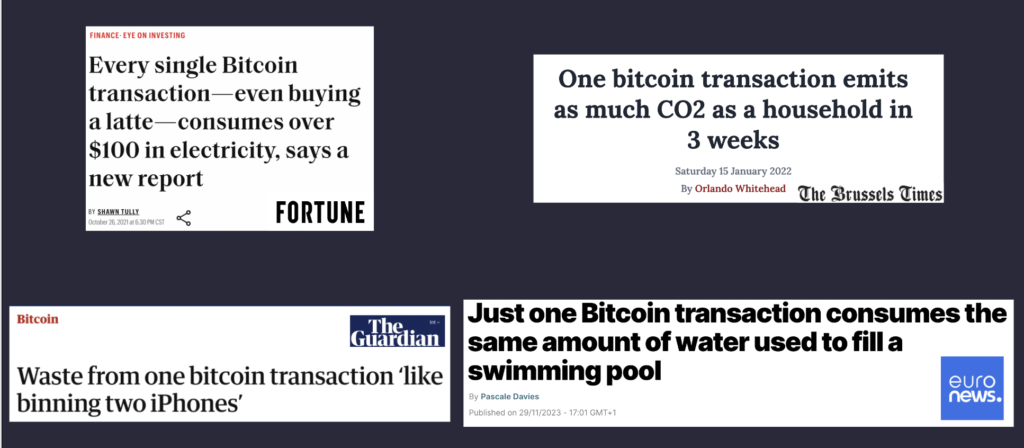

But the metric not only kept on spreading, it mutated. Specifically, energy per transaction mutated into three other variants.

- Emissions per transaction

- eWaste per transaction

- Water use per transaction

All three were new variants of the original strain stemmed directly from new commentaries or papers authored by Alex de Vries.

De Vries under his own name or that of his blog Digiconomist, became the most frequently cited researcher in the media. His commentary was the origin point for every academic article on Bitcoin’s environmental impact over the next five years, which have now amassed collectively over 4500 citations.

In the Whitehouse’s 2022 report on cryptomining, de Vries/digiconomist was referenced not just more than, but four times more than anyone else. He was also the most cited author in GreenpeaceUSAs ChangeTheCode campaign.

There are two fundamental issues with metric upon which this narrative was built.

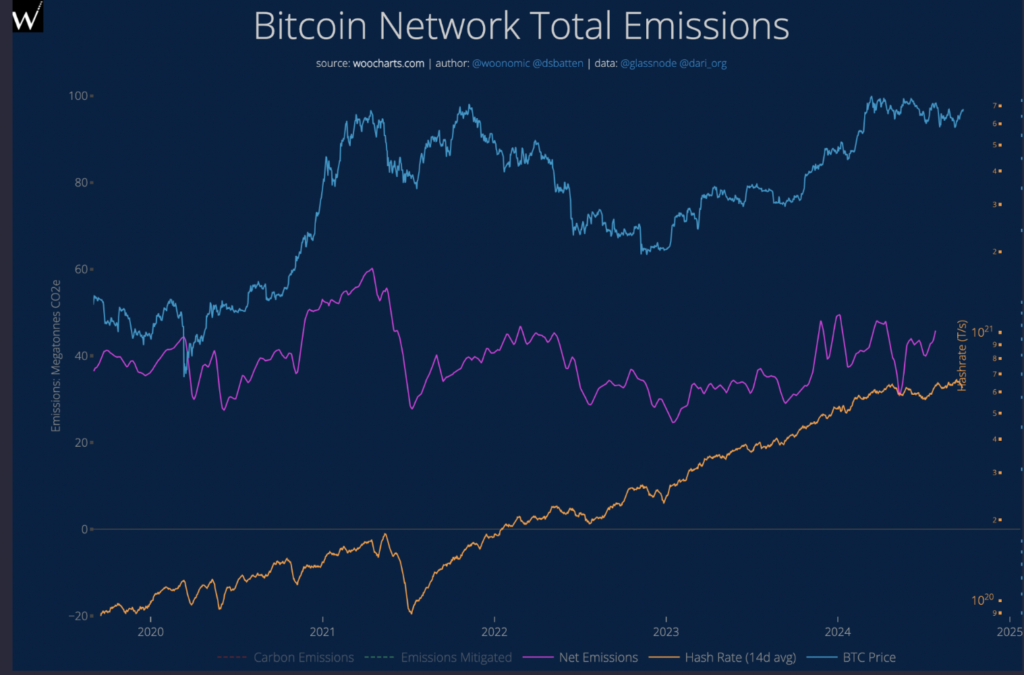

The first is as we have said that there is actually no causal connection between transactions and Bitcoin’s energy consumption, meaning the network can easily scale its transaction volume without adding to emissions. Just as it’s been doing over the last 4 years already, as we can see from tracking the pink emissions line in the chart below, where hashrate (orange) has increased eight-fold and price (blue) has increased six-fold, but emissions have remained static over a full four year cycle.

The second issue is “semantic ambiguity”. Here’s an everyday example of how semantic ambiguity can mislead.

Imagine I agree to pay you one million dollars for a job.

You finish the job, ask for payment and I send you one million Zimbabwean dollars. You would probably feel aggrieved.

Just as “one million dollars” has a very different meaning based on location, so does the word “transaction”. In the traditional finance world, a transaction means a ledger entry.

In the Bitcoin world, a single blockchain transaction can contain over 2000 traditional transactions, and using the layer-2 network (Lightning network) billions of traditional financial transactions.

Just as the idea that radio waves could shatter windows, kill birds or trigger snowstorms is now viewed as absurd, ten years from now people will be looking back at us, and these news reports that a single Bitcoin transaction could cost $100 in electricity, create two cellphones of ewaste, drain a swimming pool, emit 3 households of co2, and and say “those crazy people in the 20s, did they really believe that junk science about Bitcoin & Energy in the media? Surely not.”

Yet this false signal has helped persuade a large number of impact investors, regulators and environmentalists away from adopting Bitcoin. I was almost a casualty.

Part 3: Pure Signal

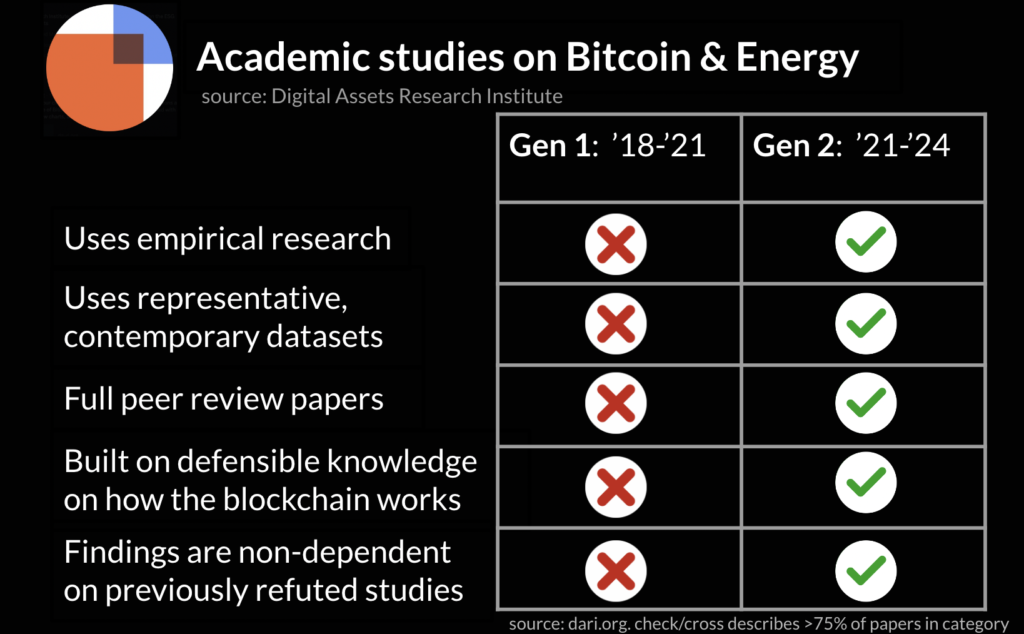

In the last 2 years, something unexpected and remarkable happened.

The quality of academic reporting on Bitcoin has now improved not just a little bit, but beyond all recognition, across a range of metrics – articles replaced commentaries, datasets are no longer anecdotal, and methodologies are now anchored in how the blockchain works.

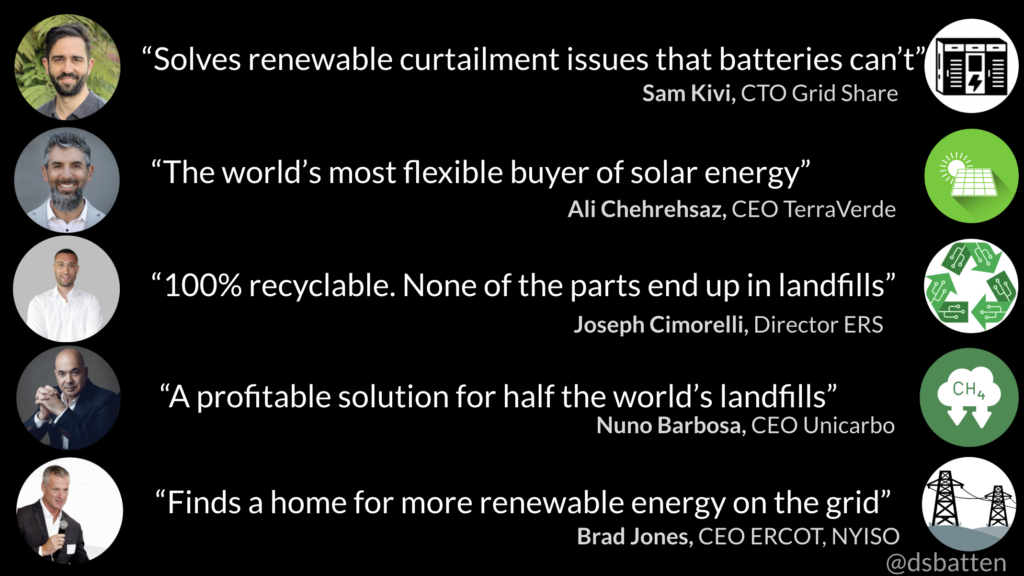

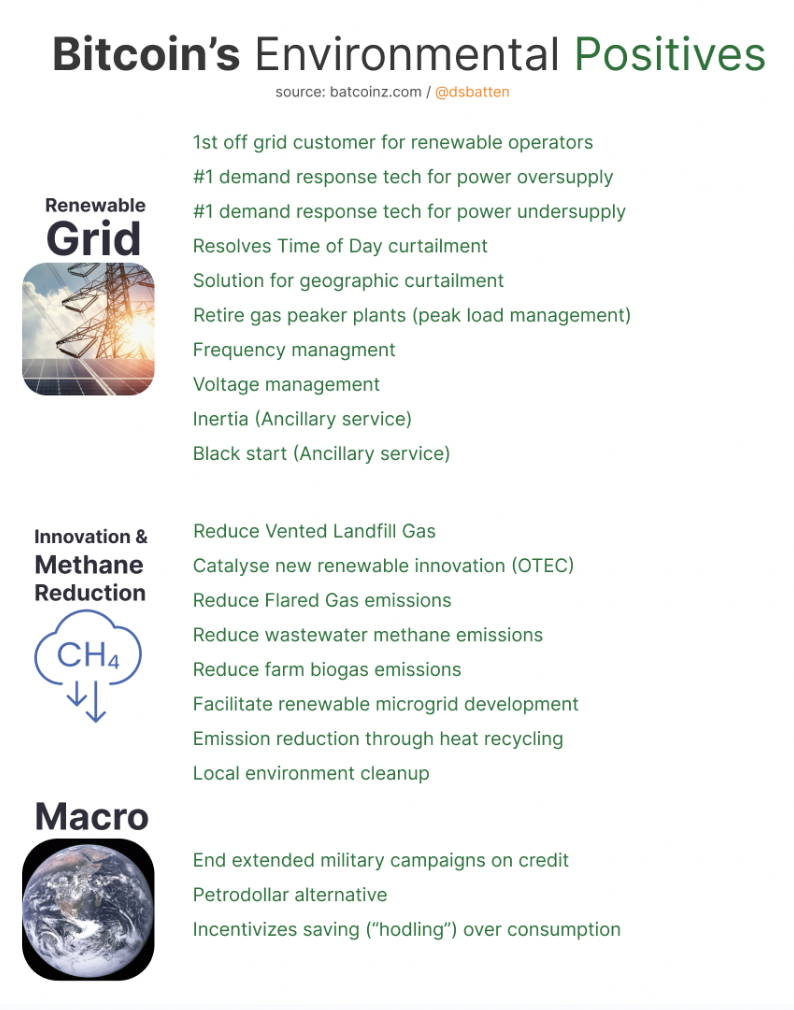

As a result, we are now getting a pure signal in stereo, both from academic consensus(10 of the last 11 papers on bitcoin and energy) and those in the field who’ve observed bitcoin firsthand. And the signal we are hearing is that Bitcoin solves major environmental problems, stabilizes the grid while providing a rare profitable path to destroy one of our most potent greenhouse gases.

And the media is catching on and catching up. Media coverage on Bitcoin and energy has dropped away. And the remaining articles are now mostly picking up on the pure signal.

At the same time, the eWaste issue was debunked with ERS, one of the world’s top electronics recyclers stating that Bitcoin mining units are “100% recyclable. None of the parts go into a landfill. They are easier than other electronics to recycle because they don’t have the same toxic metals”.

We also discovered that far from creating water scarcity, Bitcoin was helping to resolve it in dry countries including UAE, where Bitcoin mining company MARA is recycling heat from Bitcoin mining units to run water desalination plants more efficiently, one of just 8 examples of how Bitcoin heat gets recycled.

The concept that Bitcoin was only used by criminals … was laid to rest by the US Treasury, who in their 2024 National Money Laundering Report stated “the use of virtual assets for money laundering continues to remain far below that of fiat currency”

So who is using Bitcoin? Alex Gladstein, Chief Strategy Officer at the Human Rights Foundation showed 19 humanitarian use cases for bitcoin, already likely positively impacting over 100M people, most of whom are unbanked, in energy poverty, refugees, or experiencing hyperinflation. He documented these humanitarian benefits in a recent conference address.

There are now 21 documented environmental benefits to Bitcoin.

We won’t go into all 21 here, but here are a few highlights.

Building on the Cambridge model, the Digital Assets Research Institute showed that Since 2021, Bitcoin has become the world’s most sustainably powered industry. As of Nov 2024, Bitcoin Mining has risen to 56.75% sustainable energy powered.

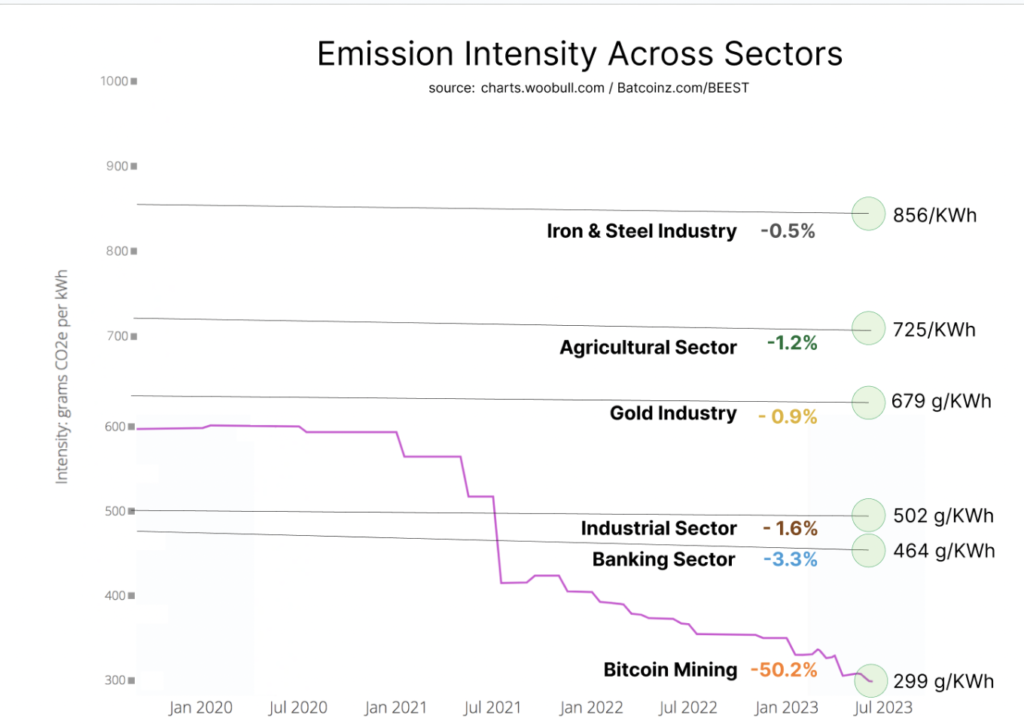

It is also the industry with the lowest emission intensity. That means that Bitcoin is now likely reducing net emissions by replacing their fossil fuel dependent prequels: banking as a medium of exchange, and gold as a store of value.

Numerous studies, including this Cornell study from decorated scientist Fengqi You, found the same thing the grid owners found, that Bitcoin mining is a buyer for wasted renewable energy generated at a time or in a place other consumers cannot use it, making the renewable generator more profitable. The profit is reinvested to build more solar and wind power faster, accelerating the renewable transition.

Carbon Debt and Payback Period

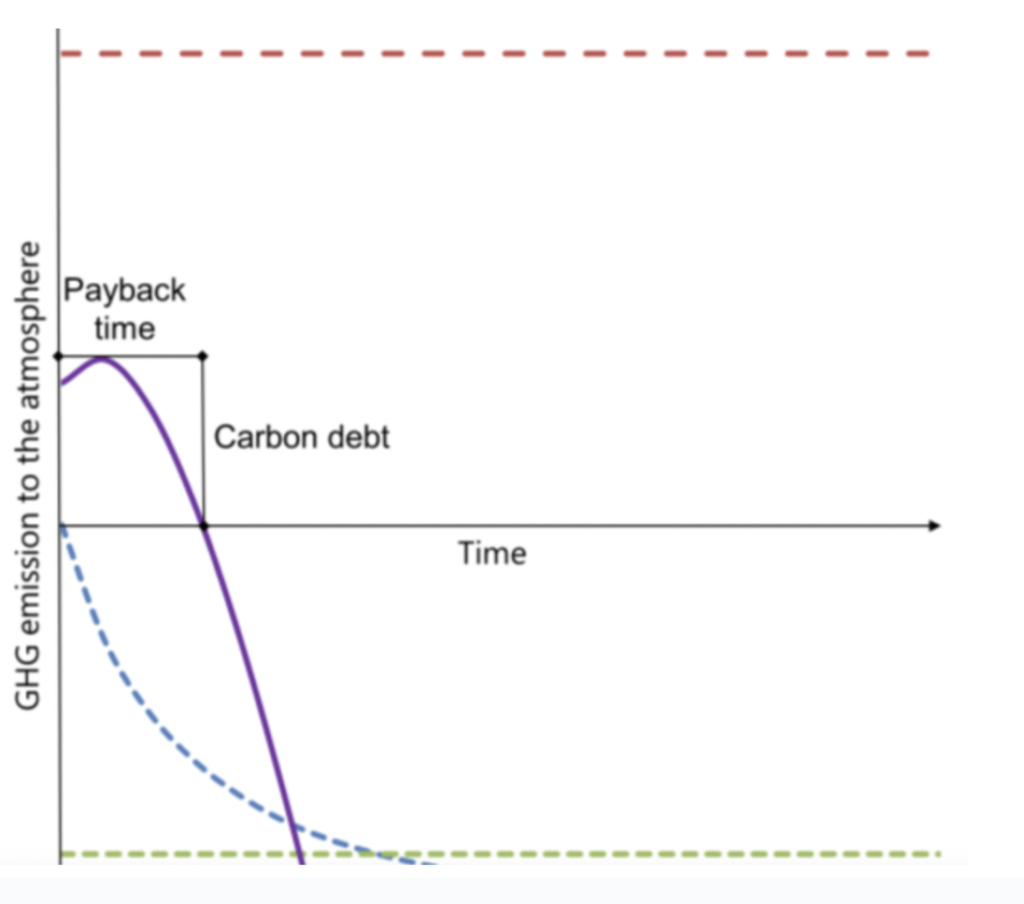

Outside the climatetech sector, most people don’t realize that all climatetech starts off emitting more than it offsets. So as a climatetech investor, I’m interested in the net emission reduction potential and the payback period. Solar had a carbon debt for 57 years. Carbon sequestration’s carbon debt looks on track to be similar.

The companies we invest in, we aim for under 30 years. Bitcoin, we estimate will be ~ 23yrs, less than half the time it took solar.

But this is what excites me the most. Bitcoin mining can do something that other industries cannot do at scale, it can profitably use stranded methane as a fuel source that would otherwise have vented into the air. By destroying methane, a potent gas 84x more warming over a 20-year period than carbon dioxide, Bitcoin mining helps meet the UNs methane reduction goals without need for government incentives.

The UN has called methane reduction our strongest lever to reduce climate change in the next 25 years. Unlike any other technologies, Bitcoin can profitably mitigate methane in any jurisdiction without waiting for political will. One of our 3 major storehouses of climate-change causing methane is landfills.

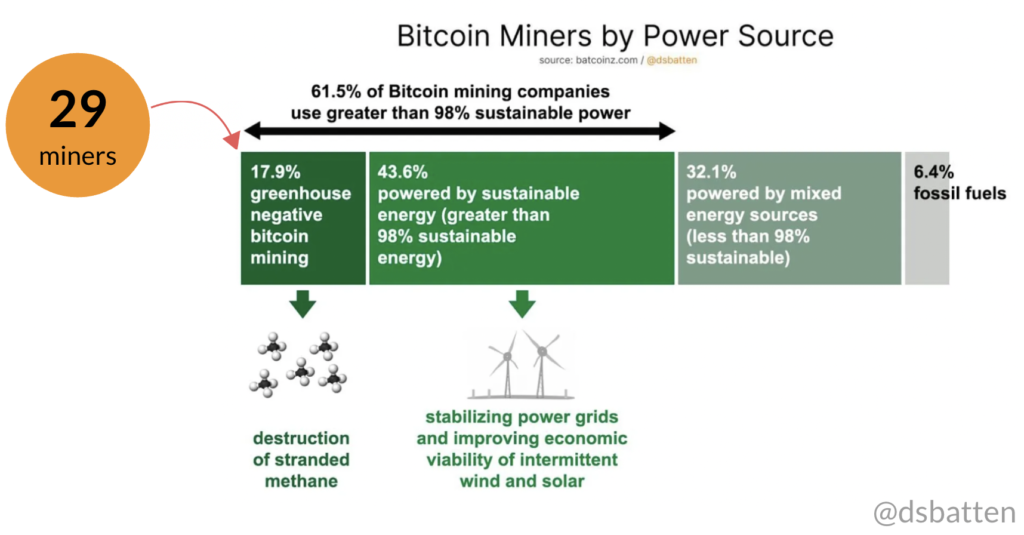

Unreported by the media, there are now 5 Bitcoin mining companies on landfills and a total of 29 Bitcoin mining companies overall profitably carbon negative destroying methane emissions from landfills, oil fields and farms. Collectively they already mitigate 7% of the bitcoin network’s emissions.

When will it reach 100%? 35 mid-sized venting landfills is all it takes to take the entire Bitcoin network carbon negative. This is something no industry has ever achieved without offsets.

Bitcoin Mining and Landfills

Peter Drucker once said “the best way to predict the future is to create it. So my third climatetech fund is an infrastructure fund that invests in Bitcoin mining companies using landfill gas for power. They are literally turning trash into digital gold. And because they destroy a greenhouse gas, they also generate carbon credits, which improves everyone’s returns.

The landfill owner turns an environmental hazard into money.

The Bitcoin mining company gets power at the bottom third of the cost curve.

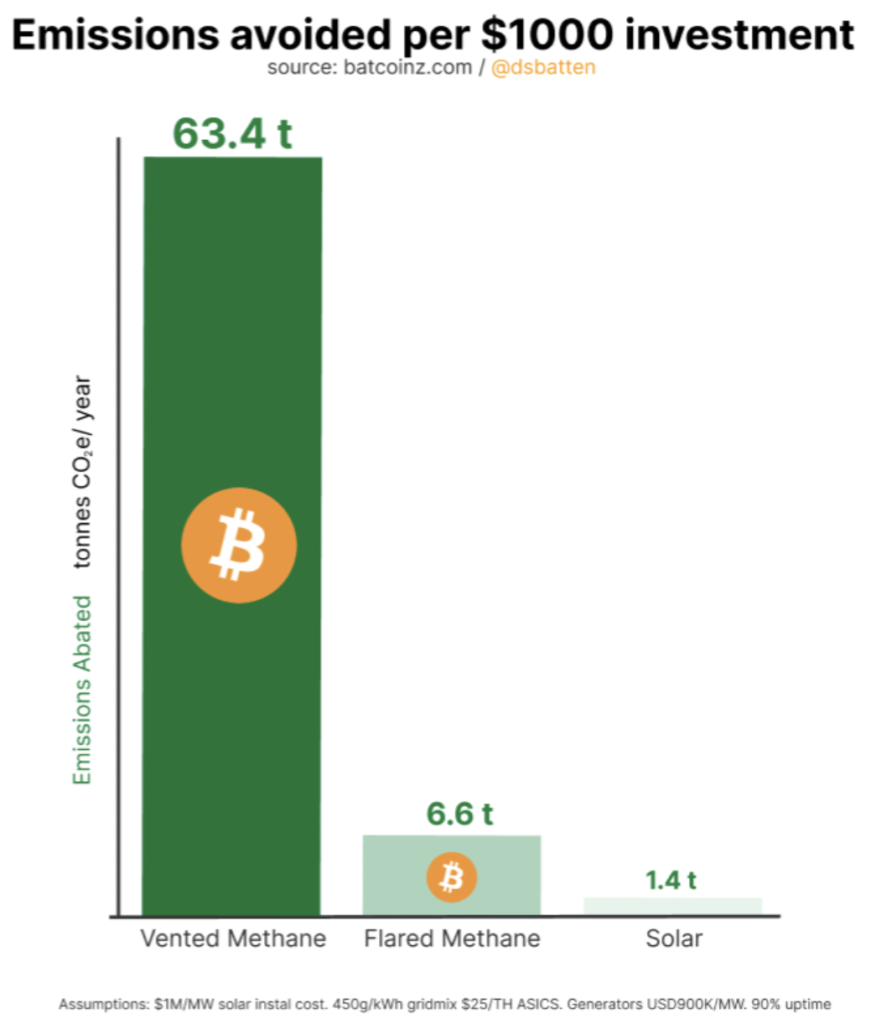

And as the infrastructure financiers, we get the returns of a CCC-rated asset class with the risk profile of a BB-rated one. But more importantly, this mitigates 45 times more emissions per dollar invested than the equivalent investment into photovoltaics.

Summary

Misunderstanding and misinformation is not new, it is the price you pay for being a very disruptive technology. Bitcoin, like all nascent disruptive technologies has followed the same rite of passage of initially being misunderstood by the masses, understood by the few. Eventually, this information asymmetry will be corrected and the masses will wish they saw Bitcoin unencumbered by the noise and false signal earlier.

Bitcoin has been the best performing asset of the last 10 years by far, and for the reasons outlined above, I expect it to be the best ESG asset of the next 10 years.

If it can achieve this, it will not only have “crossed the chasm”, it will be approaching the ubiquity of the Internet; something entirely possible given its current growth rate.