Setting the Scene

You have probably heard about Bitcoin by now. Whether what you have heard makes sense, or is accurate is less certain.

Whatever understanding you come with, I invite you to put that to one side so we can start at the bottom, to understand why Bitcoin was invented, what problem it solves that is potentially relevant to you, with research there is to back this up. First, who am I and why am I writing this? The long answer is to listen to my recent podcast.

The short answer is that: over the last 20 years I have been part of 3 communities: humanitarian work, founding/investing in technology companies and environmental activism. A year ago, one of my environmentalist friends and one of my technologist friends happened to tell me Bitcoin was a net positive for the environment as my environmentalist friend said it was a net negative. I decided to do my own research to answer the question “What is its impact on humanity and our environment?” What unfolded was an incredible story – untold in the media, and is something that I believe everyone should know. So I decided to write about it.

FIRST UP, What is Bitcoin?

Bitcoin is simply a form of digital cash. For the first time in history, someone smart worked out how to make something scarce and non-replicable on the Internet.

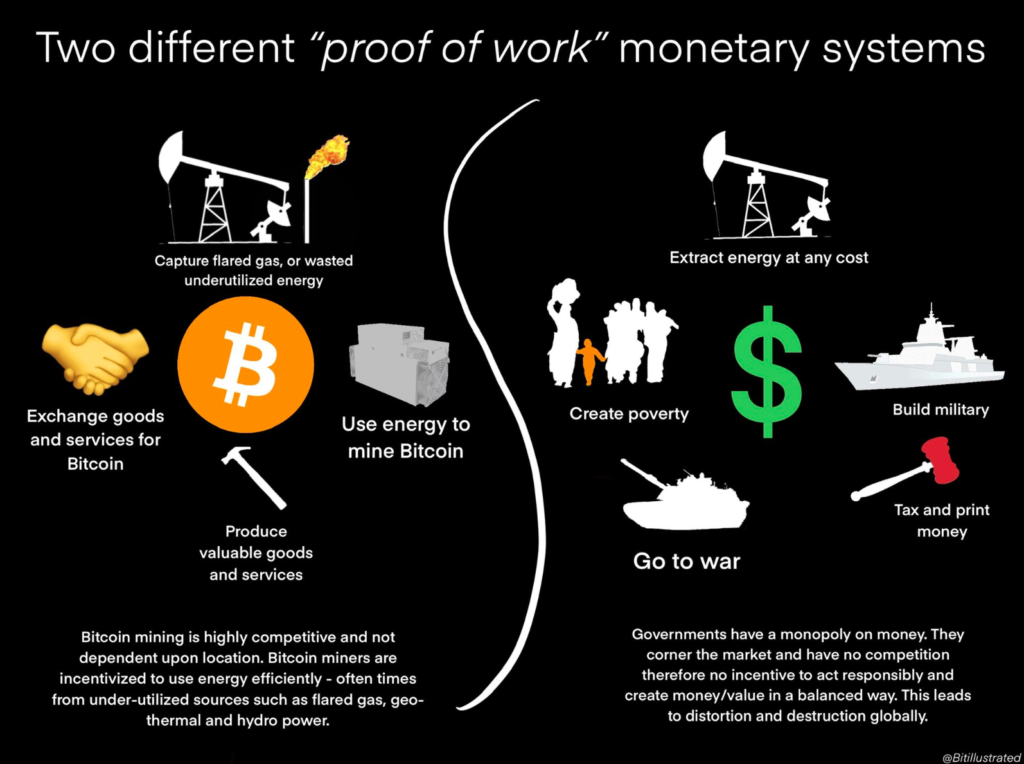

But it is not only digital money. It was designed to combat weaknesses in the existing monetary systems that caused social and moral injustice.

Satoshi Nakamoto invented Bitcoin in response to the Global Financial Crisis, and quantitative easing that saw the banks bailed out but the people and small businesses ignored.

Numerous studies have found that Quantitative easing (money printing by central bankers) increases wealth inequality. The rich and upper-middle class with investments in shares/real estate tend to prosper, at the expense of workers and small business owners.

One of Bitcoin’s core features is that it does not require a trusted intermediary, because Satoshi observed that these intermediaries were not always faithful custodians of the trust placed in them. Bankers for example have the power to freeze assets, or de-platform individuals, and are vulnerable to political pressure. While these vulnerabilities of the financial system are more regularly problematic in developing nations, the recent Truckers Protest in Canada where donors had their bank accounts frozen, and the freezing of account of Wikileaks author Julian Assange by Paypal demonstrated that the West is not immune to government pressure, and private citizen de-platforming.

In contrast to all national currencies in the world today, Bitcoin has a fixed monetary supply of 21 Million bitcoin. This protects it against the debasement of traditional currencies through quantitative easing.

Instead of intermediaries, Bitcoin adopts a “Don’t trust – Verify” mantra. The verification of authenticity of transactions is done programmatically. It is not possible to de-platform, censor or freeze assets of any individual who holds differing views to the State. The other core feature is fixed monetary supply (only 21M created) which means you can’t print more and cause wealth transfer from the poor to the rich. Bitcoin bypasses the need for Central bankers. most in the developing world where there is intense economic and political instability.

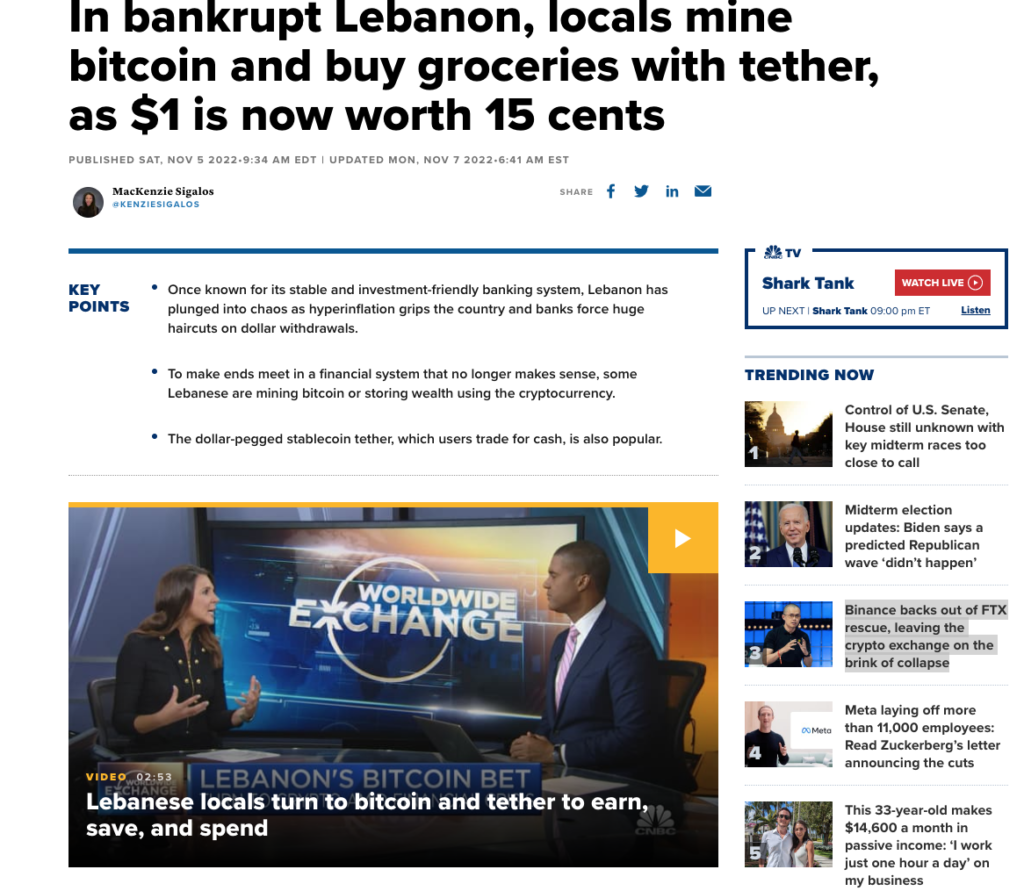

Major users of bitcoin are countries such as Nigeria, Vietnam, Turkey, Lebanon, Argentina, Ukraine: nations where hyperinflation, war, authoritarian or semi-authoritarian rule is the norm. To millions of people in these countries, bitcoin has been life-changing. Human rights activists around the world have shared stories of how bitcoin has been a key part in their fight for human rights and financial sovereignty.

This recent story from Lebanon for example shows how everyday people in these countries use bitcoin to combat one of the results of poor governance – hyperinflation.

As recently as last fortnight I met four people whose lives could have been positively impacted by Bitcoin. They had saved for a whole year to attend a meditation course in India that I was attending. They said that their savings had been whittled away to 20% of its value against the Indian rupee because of the loss of value of their currency. Had they had bitcoin, this would not have been possible. These are the first people that bitcoin protects and empowers.

The data behind these stories has been captured in a LinkedIn post I put up recently on the social utility of Bitcoin which at the time of writing has 122,460 views, and convincingly evidenced in a letter to Congress from 21 human rights activists spanning 20 nations.

At the time of writing, Bitcoin has 19 humanitarian benefits that have been documented.

Does Bitcoin have any other benefits?

Providing a scarce, secure, digital, censorship-resistant form of money for the world which could not be debased by central banks was the only intentional benefit of bitcoin that we know of.

But there was another purely accidental benefit that was created by bitcoin: its environmental benefit. Yes – when we look at the data, it turns out bitcoin is net positive to our environment. So again put aside whatever you think you know and let’s examine why.

Bitcoin’s 3 environmental benefit

A. Immediate

B. Systemic, societal (petro-dollar):

C. Systemic, individual

A. Immediate:

Because of the way Bitcoin works, it requires a network of validators (called miners) who use cryptographic processes to make sure that bitcoin transactions are valid, and the network cannot be attacked.

The accidental benefit of this is that a new user of energy has been created who it turns out can assist with two very important missions for our climate

- Accelerate the adoption of solar & wind energy.

- Remove atmospheric methane emissions.

Here’s how:

1. Building out the renewable grid

Unlike hospitals, steel mills or residential housing, Bitcoin mobile mining units can be placed anywhere. All they need is an internet connection. They can be next to a landfill, in a desert, or on a flat bit of land between glaciers. That feature is called “location agnostic”, and it’s very rare. It’s also very good for renewable energy because most solar and wind projects struggle to get financing and struggle to get approval to get onto the grid.

They struggle to get financing because it costs too much money ($2M/mile) to build out pylons to a renewable energy farm, which means that solar or wind farms are often stranded. But with a Bitcoin mining customer, they can start earning money for their electricity even before they get connected to the grid, then use that money to expand their facility, or get grid connected.

One wind operator recently told a Bitcoin miner I was talking to “Never in my wildest dreams would I have imagined such a perfect customer for wind”

There are many other advantages. Bitcoin mining can also stabilize the grid, meaning that more variable renewable energy can be placed on it, displacing millions of tonnes of old fossil fuel based generation every year.

For a more in depth analysis, you can refer to this article I wrote in early 2022.

2. Methane mitigation

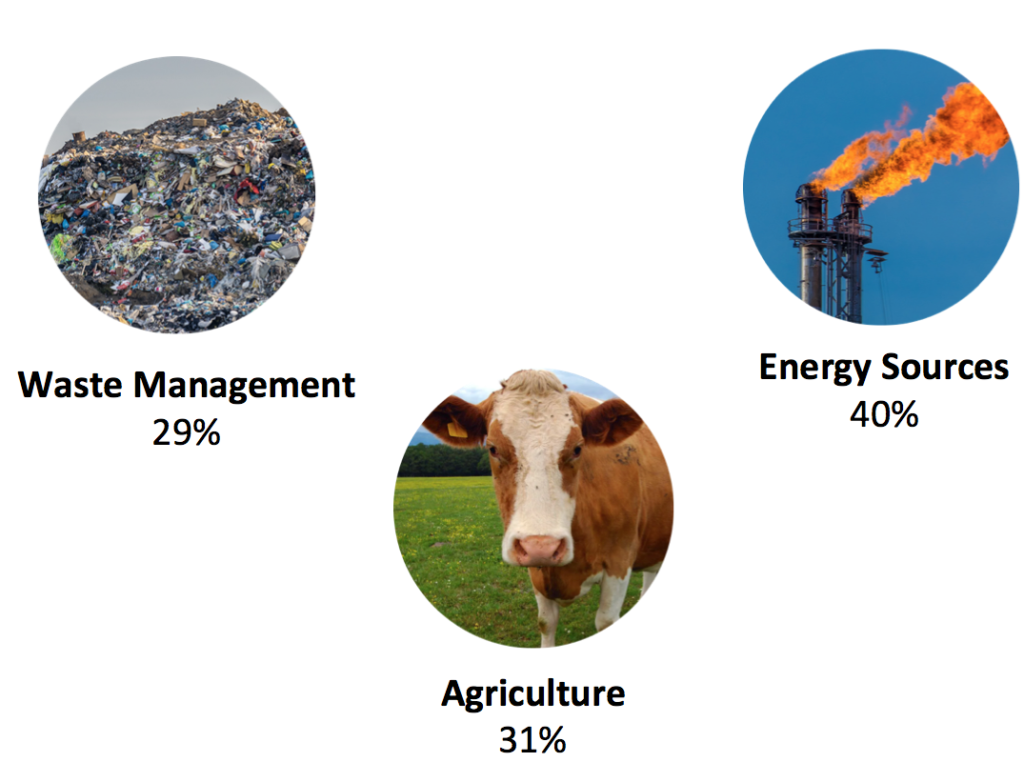

As exciting as catalyzing an increased rate of renewable-buildout is, an arguably even more critical application of Bitcoin mining is in helping to reduce our global methane emissions. The UN recently announced that mitigating methane was “the strongest lever we have to reduce climate change”. That’s because large quantities of methane are emitted from farms, wastewater, landfills and the oil and gas industry every year. Methane is 84x more warming than CO2 as a greenhouse gas.

To date, one of the hardest problems to solve has been landfill emissions. When organic waste in landfills decays, it releases methane – a powerful greenhouse gas. Landfill-based methane is responsible for 15% of all human-caused methane, but recent satellite imagery from NASA suggest that it’s twice as bad as this.

To date, there has simply been no economic, scalable way to deal with that methane.

Bitcoin mining changes everything. Again, because Bitcoin is location-agnostic, it doesn’t mind sitting inside a landfill. So it’s relatively straightforward to put a generator onsite that captures the methane that would have gone into the air, combusts it, and uses the heat to spin a turbine that creates electricity to power Bitcoin mining.

The benefit of this is huge: it could result in the reduction of 2% of all global emissions by 2030.

Bitcoin landfill gas projects and biogas projects from farms are already underway, and poised to grow rapidly in 2023.

To put into context just how lucky we are to have bitcoin: of all climate tech investment, only 2% of it goes into methane mitigation (even though methane reduction is our strongest lever to reduce climate change), and of that, most gets invested in technologies that will only be available after 2030.

In other words: too little, too late.

Bitcoin is one of the very few climate technologies that is available today, and is both economical, and able to scale quickly to meet our most urgent climate needs.

For a detailed account of how bitcoin mining can reduce climate change through methane mitigation, you can refer to this paper (peer reviewed by 2 climate scientists)

Common questions:

Should Bitcoin follow Ethereum’s lead and find a way to use less energy?

Answer: There are several reasons this would be a net negative to humanity. I’ll focus on the environmental reason though. Environmentally, it is critical that Bitcoin does not follow Ethereum’s lead, because Bitcoin is only able to help solar/wind become profitable and reduce atmospheric methane because it uses a lot of energy. Reduce that energy consumption: and both renewables and landfills lose their dream customer: in other words you lose the very user who could have accelerated the renewable buildout and is a powerful instrument to pull the strongest lever we have to reduce climate change (methane reduction).

But isn’t Bitcoin taking energy away from other users?

Bitcoin uses mostly stranded and wasted energy that no-one else could have used because it was in the wrong place and/or produced at the wrong time (like solar at midday, or wind at midnight).

Or to put it another way:

Imagine a global network of ants that scuttle around eating up all the crumbs and discarded scraps of food each day. It probably totals up to tens of millions of calories. To critique “that food should be used for something else?” is misguided.

~ Twitter user, Matt Hart

B. Systemic, individual

As an environmentalist, I had long had an issue with rampant consumerism: a movement which from my perspective promises us happiness but instead leaves us with plastic-polluted oceans, smog-polluted air and petrochemical-polluted soil. You need not share my perspective, but I’m sure you’d agree that not all of what we consume is necessary and there is some degree of environmental cost to our excess consumption.

Reigning back consumption leads to less pollution of our water, earth and sky (not to mention reducing the methane emissions from landfills).

But how do we incentivize treasuring rather than consuming? Bitcoin solves this problem financially. Nakamoto observed that when there is monetary inflation, you are incentivized to spend it before it loses value. However, when the value of that money goes up (as Bitcoin has for any holder for more than four years, for any period of time since inception), then you are incentivized to hold and not consume. Research is just beginning in this area, but already anecdotal accounts are suggesting that Bitcoiners do not consume nearly as much as their non-Bitcoiner peers.

C. Systemic, societal (petro-dollar):

Being brought up by two hippie parents who instilled in me the value of social justice and environmental activism, I also inherited a suspicion of anyone in business. In adult life I would overcome that suspicion, but it stayed with me for some time and caused me to be largely financially illiterate.

As well as leading to some poor choices with my finances, it also meant I could not see the connection between financial empowerment and environmental/social empowerment. It really took a financially literate friend of mine to remove the scales from my eyes and point out the connection.

Simply put: without financial justice, the world cannot achieve climate justice and social justice to the extent that many of us would wish.

When you have developing nations brought to their knees by IMF repayments, or African nations whose economy has been crippled by France’s devaluing of the Central African Franc, or wars waged and paid for on credit that were/are not in the interests of the citizens- how can you systematically change this without non-violent revolution in our financial system? The answer is it is impossible.

We currently live in a system called the petro-dollar, where oil drives the international economy. It is paid for in US dollars, which gives the US a huge economic advantage. In return for this favor that Saudi Arabia affords the US, the US defends its corridors of transit using the power of the US military, one of the world’s biggest greenhouse gas emitters. In that sense, the US dollar is in fact backed by the US military.

In a world where the growth of the economy is dependent upon the production of oil, how can a thriving global economy be possible? The answer is that it is only possible once the dollar and oil have been decoupled. Bitcoin represents the world’s first pragmatic candidate for achieving this decoupling. It is not a theory discussed by academics: it is a monetary system that exists, is growing, and has already demonstrated its ability to decouple finance from oil, to decouple finance from state control, and to decouple finance from Central Bankers who can print money and devalue currencies.

Bitcoin represents the laying of the fiscal rails for a world where both environmental progress and economic progress can structurally co-exist.

So if it’s so good, why do I hear different things in some newspapers and from some environmental organizations?

Gaslighting: why it happens, where its from, and how its been very effective

To answer that we must go back to earlier point: “Bitcoin bypasses the need for Central Bankers.”

Every disruptive technology will, well, disrupt. Cars disrupted the horse and cart industry. The Internet disrupted the print media. Bitcoin disrupts Central Bankers.

Like the print industry and the horse-and-cart industry before them, Central Bankers are not peacefully consigning themselves to history. Like the disrupted before them, they will do everything they can to remain relevant. Part of this strategy requires them to attack the disruptive technology. Whether the messages are true or not is irrelevant. Whether they are effective is what matters.

The attack vector that Central Bankers have predominantly chosen is bitcoin’s energy usage. This has been a good choice for them for two reasons

- It is a highly emotive issue (and rightly so)

- Bitcoin’s energy usage is very transparent. So its easy to attack, should one wish to

Looking at it objectively, without the constant media backdrop of anti-bitcoin rhetoric, the attack makes no logical sense. Bitcoin is not only a tiny user of energy on the global scale (less than Christmas lights). It is also by one measure the #1 user of zero emission energy in the world. But again, logic is not what matters here, effectiveness of the attack is what matters.

Attacking Bitcoin for its environmental track record is analogous to singling out New Zealand for its corruption track record. Does there exist corruption in New Zealand? Absolutely. Should New Zealanders be aiming to become less corrupt? Undoubtedly. However, just as bitcoin is the #1 user of zero-emission energy, New Zealand is by one measure the #1 least corrupt country in the world. So it would be not only unfair to single this one nation out, but it would be the least logical nation to single out.

But that doesn’t matter. If you have a vested interest in attacking New Zealand’s record on corruption and you have the power to control the media narrative, you could quite easily over time cause the bulk of the world’s population to believe that New Zealand has a corruption problem, irrespective of data or evidence to the contrary, which would simply go unreported in newspapers and media channels.

This is exactly what has occurred with the anti-bitcoin narrative.

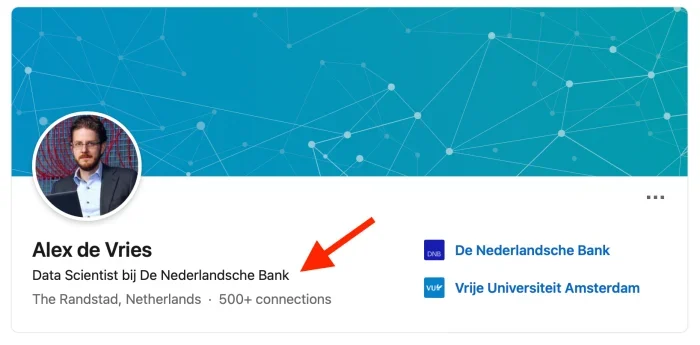

The leading example of Central Banker misinformation is a website Digiconomist, authored by Dutch Central Bank employee Alex de Vries

Data Scientist at the Central Bank of the Netherlands

This website has become the most commonly cited source for enrivonment-related articles on Bitcoin by news media sources including The Guardian, The Independent and reports such as the Whitehouse’s own OTSP report on Cryptomining. In fact, de Vries/Digiconomist was cited 4 times as often as the neutral Cambridge Institute of Alternative Finance in the OTSP report.

The site itself has been widely criticised within the Bitcoin community. The reliability of the website, and the conflict of interest has to my knowledge been questioned not once. Imagine that the most common information source on climate change was a single website from a hobbyist who was a paid employee of Exxon, with no qualification in climate science. Imagine also that the media never called to question the validity of conflict of interest of this information source: this is how total the Central Bankers’ victory has been in shutting out all data-based discussion on bitcoin and putting in its place its own narrative.

So the reason environmental organizations have formed anti-bitcoin beliefs is that Central Banks understand very well that environmentalists are a powerful lobby-group and if they can be mobilized against bitcoin, then they can get on with creative their own CBDCs (Central Bank Digital Currencies), and promoting them as “good for the environment”, even though CBDCs give Central Bankers more control, and people less control, than ever before.

Thus far, mainstream media and Central banks have worked in lock-step to:

- Minimize reporting on bitcoin’s positive impact on humanity while publishing many articles portraying it as a speculative asset with no real value.

- Cherry-pick examples of where Bitcoin miners have behaved differently to the norm (just like cherry-picking examples of corruption within New Zealand). The mainstream media has played this tactic to extreme levels: a single case where Bitcoin mining used an off-grid natural gas plant has been amplified by continual regurgitation, but the 31 cases where Bitcoin mining operations use zero-emission power have gone unreported.

It’s not that Central Bankers are bad people, in the same way that people in print media are not bad people. For the most part they are simply people playing their part in society, who like any of us would probably want to preserve something that they have grown comfortable and familiar with. However, it is essential that we do not fall victim to their tactics of disinformation.

To do so runs the risk that the world could be deprived of potentially its most realistic hope of accelerating the renewable grid buildout and reducing methane emissions, whilst simultaneously reducing consumption and creating the conditions for a world where positive economics and negative emissions can co-exist.

Other key facts about Bitcoin

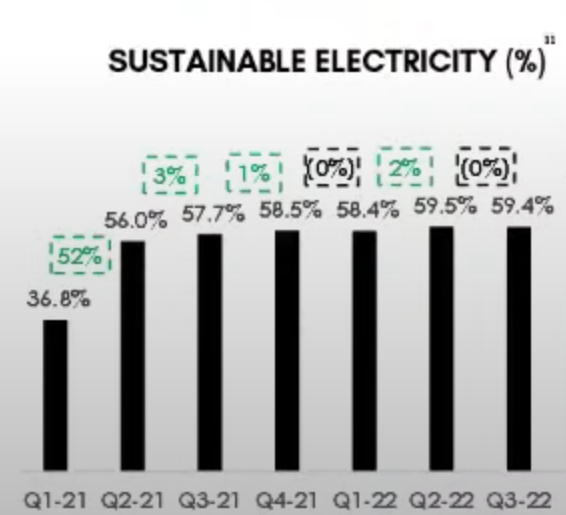

- The Bitcoin network is now using over 59% zero-emission power sources according to the Bitcoin Mining Council, making it the cleanest energy user of any industry in the world.

2. The scientific consensus now supports the positive environmental benefits of Bitcoin, with 13 of the last 15 peer reviewed articles on Bitcoin and energy showing Bitcoin mining is able to help decarbonize grids, accelerate renewable development, mitigate methane and help retire the need for gas peaker plants.

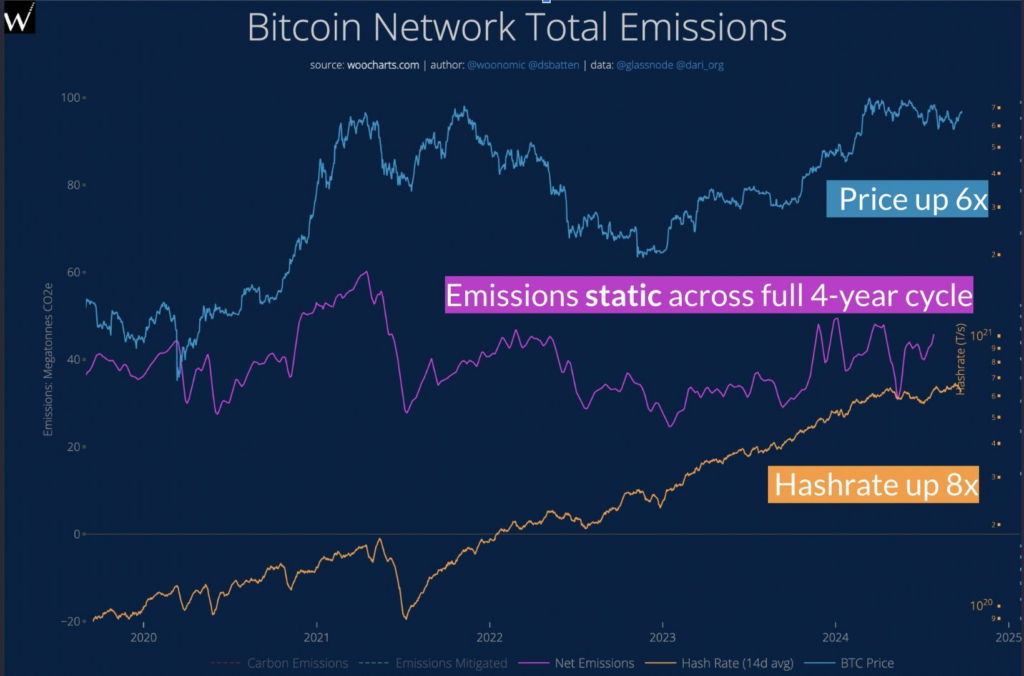

3. Over the last four years, despite rising Bitcoin price and hashrate (the combined computational power of the Bitcoin mining network), emissions have not increased.

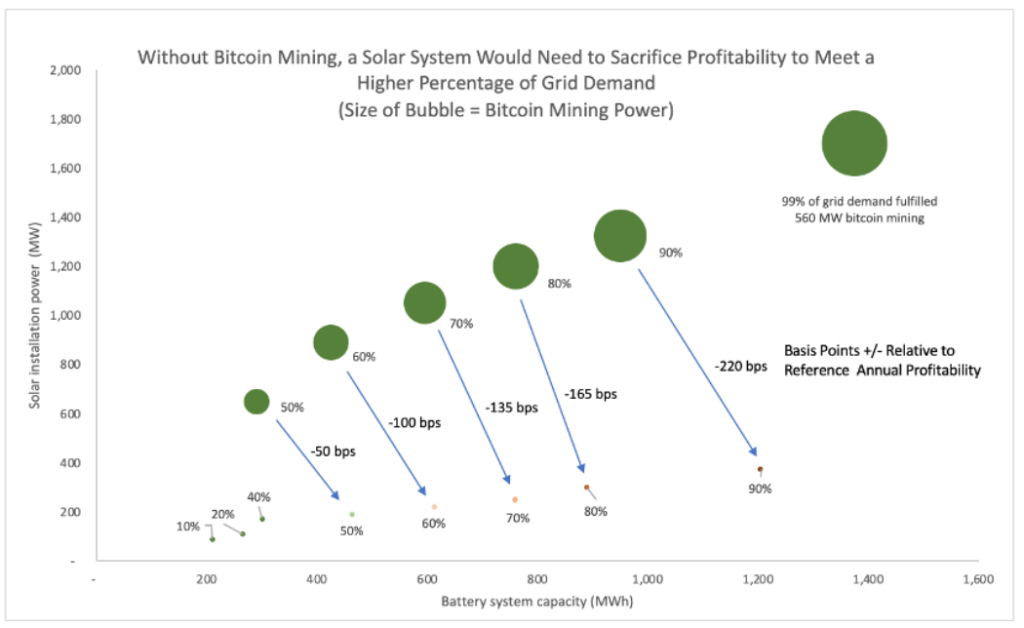

4. Battery technology alone does not solve the intermittency problems with solar and wind energy. The IEA say that a combination of battery and demand response (customers that are very flexible, of which bitcoin miners are most flexible) is needed. The solar and battery engineers say that battery technology combined with bitcoin mining is needed. ARK Invest agree that battery + bitcoin mining is needed (see graphic below)

SUMMARY

Bitcoin is an incredibly useful technology that impacts people in developing nations first. Its impact has already been felt by 100s of millions around the globe. In addition to this intentional benefit, there was an unintended benefit that arose from the unique location-agnostic feature of bitcoin mining: it helps the renewables build-out and mitigates our most urgent greenhouse gas where other technologies have failed.

As with any disruptive technology, the disrupted will fight the adoption of a superior system. This should not distract the truth-finders from an objective look at history in the making and the promise of contributing to a world where economics and environmental prosperity can coexist. This world requires a lot of effort by all humanity. Bitcoin is not a panacea, but it is part of the solution, and there is a strong case that it is an essential part of the solution.

Further resources

- Example of how Bitcoin fosters innovation in the renewable sector

- How Bitcoin stabilizes the grid, and increases grid operator capacity to increase renewable-based generation

- Podcast with 4 Environmentalists discussing how Bitcoin is a boon for the environment

- More information on the eight sustainability magazines who have come out in support of Bitcoin mining’s climate action benefits.

- Recent positive press on the environmental benefits of Bitcoin mining

The author receives no funding for this work: it’s intended as a resource for the community with the intent to educate and inform.

Acknowledgment: @SimplestBTCBook for editorial assistance