A detailed guide

I believe that the most important action that Bitcoiners can take, which is not currently being taken with enough focus/skill, is to improve the way we communicate the value of Bitcoin to the next wave of Bitcoin adopters. These people are the “early majority”. They care about different things to the early adopters. If we fail to do this, Bitcoin adoption will be top heavy insofar as Corporates and Nation States start building their Bitcoin reserve, but the everyday people are left behind, not seeing the value-alignment of Bitcoin with their own value-set. There’s also a risk that even institutional adoption will be slow across many nations, where the values of the investment fund are in apparent but not actual conflict with Bitcoin.

This paper lays out my first attempt at a remedy to address this.

Introduction

What are the blockers that could stop us moving from the early adopters into the early majority of Bitcoin adopters? There are many factors, and the answer often depends on the audience. For example, for pension funds the blockers have been “the fact that none of my peers are doing it” and ESG. For the general population, it’s often “I don’t know where to start”, or “It’s not straightforward to get Bitcoin in the first place, and how do I get it to and from my bank?” For liberals it is almost always, “It’s bad for the environment and/or it does nothing useful”.

Today I’m going to take a step back and look at an element of adoption that is critically important, yet not widely understood: how we pitch Bitcoin to a community of people.

Yes, what we say, and having the charts, data, information and education is important. But even more important is knowing how to present this information to skeptics.

My intention is that this document serves as a resource for others to help you orangepill more regulators, policymakers, boards, fund managers and, most importantly, retail investors to adopt Bitcoin, or at least adopt a friendly stance towards Bitcoin.

Why this; why now?

This document open sources a lot of the strategies that I’ve used to orangepill skeptics to Bitcoin. While this post focuses mostly on the environmental and humanitarian benefits to Bitcoin, the principles can be applied to any Bitcoin topic where you’re seeking to orangepill someone. When I look at the disparity between how the early adopters were convinced to embrace Bitcoin, and how the early majority need to be spoken to in order to come to Bitcoin, I see a danger that we will ostracize many potential future advocates through sloppy attempts at orangepilling that are not just ineffective but in many cases counter-productive. I believe that ending orangepilling naivety will be critical as ending regulatory hostility when it comes to the next wave of Bitcoin adoption.

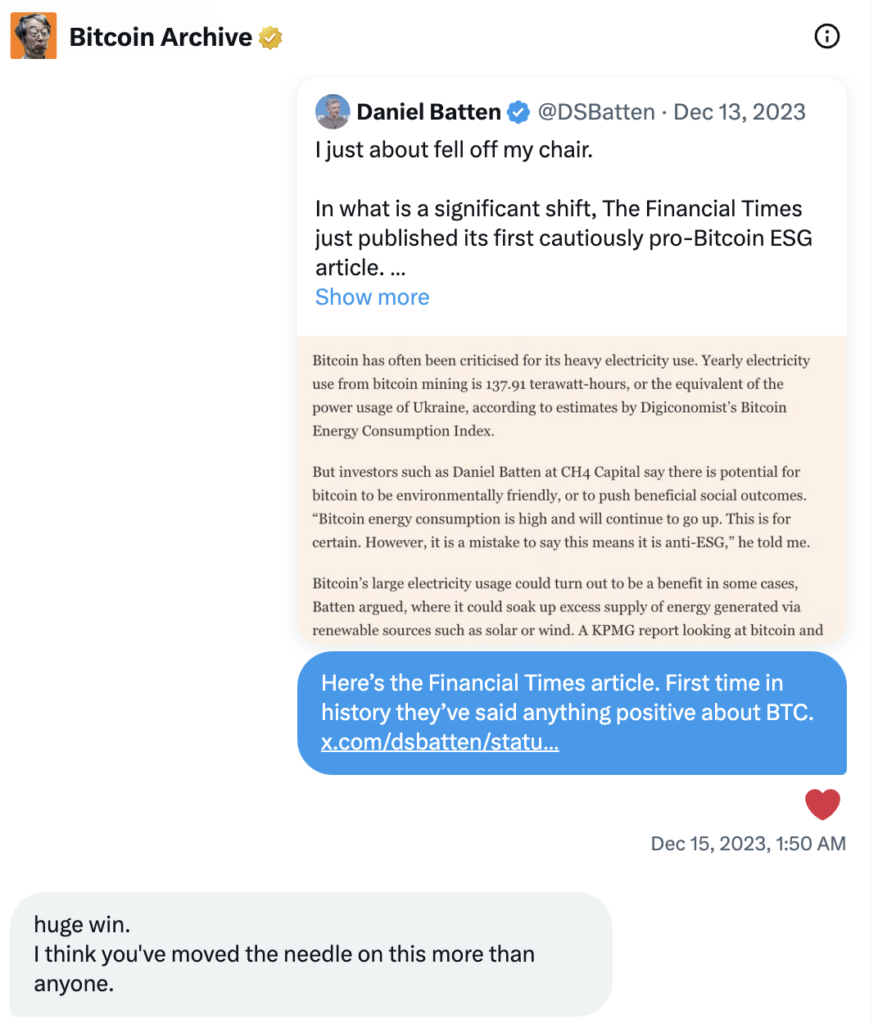

While some have said that I have changed the narrative on Bitcoin and energy, I am most definitely not the only person who has shifted the narrative, nor am I the most important person. There is at least one person who has objectively done more than me to orangepill key globally recognized figures on the ESG merits of Bitcoin (in many cases ESG was the blocker for them embracing Bitcoin). This person wishes to remain anonymous. In this post, I cite numerous examples of where people have gotten a positive outcome through adopted my orange-pilling techniques. My intention in sharing this is not to glorify anything I have done, but to evidence the effectiveness of certain ways of communicating that over time, and through the help of some great mentors, I have found to be effective.

While in a tech-centric industry such as Bitcoin, it is easy to think this is because of the BEEST data model of sustainable energy usage and other long form research I conducted, I would say that the data model was 30% of what mattered, but the other 70% was how I put together messages differently using other people’s research. This is something that can be learnt and replicated using many of the seven principals of effective orangepilling described below.

Finally, to those who wonder “Isn’t there a chance that by open-sourcing these strategies, these can be weaponized against Bitcoin?” No. Because everything I describe here only works if you have truth and fact on your side, have domain knowledge in the area you are speaking, and are communicating as an act of service to others without agenda or attachment. Why am I qualified to write about this? Results are the only qualification. But in case you are interested, it’s an area I did some work in before in my pre-Bitcoin days. Orangepilling is a truncated way of saying “successfully pitching Bitcoin” and pitching is something a little bit about having written a book on it. Before that, I coached tech entrepreneurs in pitching. Before that, I also led a technology company through three cap raises, where

I had to learn a lot about pitching in a hurry! Those pre-Bitcoin experiences gave me a sense of what needed to be done between 2022-2023 to start to change the mainstream narrative around Bitcoin & Energy. This post looks at lessons we can all pull from what worked, when it comes to orangepilling the next wave of Bitcoin adopters.

Your lived experience makes you uniquely qualified to talk to your tribe

I first became aware of this watching Michael Saylor talk about the energy consumption of Bitcoin during a quarterly Bitcoin Mining Council update. Michael Saylor is one of Bitcoin’s most gifted communicators. He inspires me to improve my own communication. He is inspiring, lucid, visionary, yet at the same time able to back up his statements with solid data and examples. I will never forget the brilliant way he cut across a podcaster who suggested that it was risky being “all in on Bitcoin”, with the question “Are you all in on the chair you’re sitting on?”

So it was with intrigue that on the question of why Bitcoin is a strong ESG asset, he was the least compelling I’d seen him. The reason was simple: the environment is “not his thing”. He is absolutely the right person to convince billionaires, millionaires, boards of corporations, and a large number of early adopters to get into Bitcoin. He is not the right person to convince the early majority of liberal retail investors, ESG investment committees at Sovereign Funds and Pension Funds why Bitcoin is a great ESG asset. This is true for the simple reason that this isn’t who he is. Each of us have a community of people we will vibe with, who we understand deeply. This gives us a special and unique responsibility to orange-pill this community of people. It is quite probable that there are certain people who can only come to understand and use Bitcoin through you.

That said, there are some universal principles we can apply that will make us more effective at orange-pilling people who are adjacent to our community, even if they are not exactly “our tribe”.

Seven principles of effective orange-pilling

1. Meet people where they are

This sounds simple, so simple that it is often skipped over. Yet it is 50% of how influence occurs.

Let’s look at a real example. How do you feel as a Bitcoin supporter when you read this tweet?

My bet it is is some combination of frustrated, exasperated or bored and irate.

Yes, the comment is ignorant. Yes, the comment is also arguably arrogant, because the writer has assumed that s/he knows Bitcoin’s utility without having investigated bitcoin’s utility. It is also flawed, because the vast majority of contemporary research on Bitcoin mining shows that Bitcoin is an important part of climate action. However, neither the emotions you feel, nor the facts you know have any relevance to the other person, if your intention is to help them look at other perspectives.

What it comes down to is the question “what do I want?” If what you want is a chance to offload and give this person a piece of your mind, then you will respond the way that most people do on Twitter, get a quick endorphin hit of saying your piece. But what did you achieve? Very little. If anything, all you’ve done is help calcify a belief in the other party that Bitcoiners are obnoxious.

But what if your intention was different. What if your intention was to plant a seed that blows the person’s mind, that speaks to their latent intellectual curiosity. What if your intention was to invite dialog, or even to invite them in a non-confronting way to help them see the gaps in their knowledge? Then you’d choose a different response.

I optimize for “what response is most likely to orange-pill them?” There is no spin, no manipulation at play. My intention is to help the person learn, but only if they are curious. If they are not, then I respect that too. For that reason, I also test whether they are open to learning, and if not to politely move on. That’s more efficient with my time, it avoids squandering my emotional energy, and it’s more respectful of the other person.

How I responded on that occasion was like this.

Why is this an effective response?

Because I had no attachment to how or whether s/he responded. Everything I said was true. I’m meeting the person where they are at. I’m not making them wrong for holding their beliefs. I’m suggesting, without accusing, that their beliefs may be held in ignorance (as mine were), I’m not assuming interest in taking the conversation further, and I’m placing a fork in the road which implicitly says “If you want to continue the conversation, it’s to learn, not to debate.” It’s also effective because it challenges a probable belief the person has (judging from their tweet) which is: “It’s not possible to be both an environmentalist and a bitcoin supporter.”

So while it was a spontaneous response that I took perhaps 30 seconds to type, there is a lot going on “under the hood”.

Meeting people where they are at is not an “optional extra” to orange pilling the skeptical, but an essential stage. To understand the essential nature of this is not just my opinion, but something with a scientific basis, lets go into the weeds briefly on what is happening neurobiologically which makes this stage essential.

Neuropsychology research suggests that responding in a way that shows empathy and understanding of the other person’s position, even if we do not agree with it, aids Emotional Regulation, Social Cohesion, Cognitive Flexibility, Diminishing Threat Response, and even the Mirror Neuron System between two individuals. This response also stops the negative neurobiological chain reaction that occurs when a person is faced with disagreement, or the threat of disagreement.

Disagreement, or even the threat of disagreement, causes fight of flight hormones to be released, as the other party is preparing for a fight, albeit a verbal one. This triggers the release of cortisol which increases the blood flow to the extremities ready to take evasive action (either aggressive or defensive), at the cost of where it is deemed less necessary; the cerebral cortex. Even though the threat is a verbal fight, not a physical one, our internal neurobiology is not sophisticated enough to know the difference: it perceives a threat and so responds to that threat with the hormones necessary to preserve life, cortisol, so we can “run faster”.

What is the cerebral cortex responsible for? Reasoning and logic, as well as creative thinking. What faculties need to be receptive in order for your logic to be received? Reasoning and logic, and creative thinking. By identifying with the person’s right to hold their view, and empathy for why they would have come to that conclusion, we are sending a verbal signal to their fight or flight response “hey, it’s OK, I’m not here to fight.” The other person takes a deep breath and relaxes, the stress response eases, and the cerebral cortex becomes capable of hearing your logic, and thinking creatively again. Now, your logic stands a chance of being heard. But until then, you have as much chance of having your thought-seeds germinate as you do of getting literal seeds to germinate by scattering them on barren soil. Empathy waters the soil of consciousness in which thought seeds can germinate.

Interestingly, it is not agreement the other person is looking for but understanding of their position. This is how leaders are able to challenge people while remaining in empathy. A weak leader will capitulate, or partially capitulate, to the demands or perspective of the other in an attempt to maintain rapport. A tough leader will stand firm, at the cost of rapport. A strong leader will stand strong in their conviction and in their rapport with the other person.

This is not just theory, this is something I put to practice on a regular basis. As well as meaning I can be more influential, it also makes life less stressful. Another time I used this approach was when I was meeting with one of our wholesale investors into my second climatetech fund. He started the conversation by asking what I’d been up to in the months since we last met. I responded “I’ve been researching bitcoin mining.” His entire body language stiffened. “I thought you were a climatetech investor” he said as he unconsciously crossed his arms without any softening hint of irony or tease in his tone.

I paused, looked him in the eye, and smiled. “Well, I can understand why you would respond like that” I offered. “That was what I thought when I first looked at it.” He softened his stance a little. I continued. “And this is an area I’ve spent some time researching now. It sounds as though you have some perspectives on mining yourself. If you’d like to, you can share them and I can shed light on them if I’m able.”

He completely changed his demeanour and started speaking in a calm voice again, mentioning three fundamental reasons why he felt bitcoin mining was bad for the environment.

I checked I’d heard correctly, then said “Well, these are areas I have looked in to, would you like me to share what I’ve found out?”

“Go ahead” he replied with more curiosity than skepticism now in his voice.

I responded to each of the points in turn. He asked one clarifying question about one of the areas. Then there was silence. It was the silence of someone who is rewiring their neurons for a completely different belief system, and almost perplexed that it could have happened so fast, especially when they were half-expecting a fight.

“Well, have you thought about making your third climatetech fund a Bitcoin mining fund?” He asked, again without a hint of tease or irony.

The conversation isn’t always as immediately transformative as that, but that serves as an example of what is possible through empathy, and understanding. Equally, if I didn’t have the domain knowledge to answer his specific objections, I could not have completed the orangepilling.

2. Mindset matters

Particularly, your intention matters.

The second and equally important part of the initial response is “mindset”. If you are still feeling any residual emotions of frustration, anger or exasperation when you speak, or even write, this is a virtual guarantee that your message will betray those emotions. In betraying those emotions, you have again made your communication about yourself, not the other person: ie. what you want to say, not what the other person is in a position to receive from you. Information is like water. You can hand someone a glass of water, or you can throw the contents of the glass over them. Same water (information), but different manner of delivery. Adjusting the mindset is akin to adjusting the angle you hold the glass at, so that it is balanced and that they can benefit from the content, not tilted so that it spills over them and they are aggrieved.

Notice that in talking about the most important aspects of orange-pilling people, I haven’t even mentioned Bitcoin other than to use examples, which could have been non-Bitcoin examples, to illustrate a Bitcoin-independent point. Read that last sentence again slowly. That means that influence has more to do with how you communicate than what you actually say. Yep. As I say, a great delivery, framing and mindset without domain knowledge wont work either. But it is often better than intimate domain knowledge with a rough delivery and aggrieved mindset, which is often counter-productive and only serves to entrench a person’s original position.

3. Quantify, quantify, quantify

When you are pitching an idea, you are telling a story. What do all stories have in common? A narrative arc, and … details. We tend to forget the second part. Stories paint a detailed picture with sharp edges that we can visualize. JK Rowling didn’t say “Harry Potter lived in a house in England”, she painted the visual picture of the details of Number 4 Privet Drive and the suburban surrounds, so we can picture it. When we are pitching an idea, these details matter more, not less.

Why?

Neurobiological facts about all humans

Negativity bias

Humans, in the presence of a lack of clarity, must assume in the negative. Early in our evolution if you saw a large animal on the horizon, and it was unclear whether it was your food or you were its food, negativity bias dictates that you run away from it, not towards it because the negative consequence if you are wrong is that you go hungry, whereas if you assume in the positive and you are wrong, you get eaten. Humans therefore are hardwired neurobiologically to take evasive action in the presence of unclear data.

So when you say “Bitcoin is using more sustainable energy now”, or “Bitcoin helps refugees migrate with their life savings intact”, or “even “there are a number of peer reviewed articles on Bitcoin that say it has positive environmental benefits” – you have not given the other person clear data.

These are examples of the statements I used to hear a lot in 2022 when I was first trying to understand whether Bitcoin was net-positive or net-negative to the environment.

The problem is, without quantified details, the other person will interpret the first statement as “According to you, Bitcoin uses marginally more sustainable energy, but it’s still less than other industries and is still mostly fossil fuel based”.

They will interpret the second statement as “There has been the odd isolated case of refugees taking Bitcoin across the border and using it in a new country, but it could have been any type of digital currency”.

They will read the third statement as “The vast bulk of peer reviewed articles say Bitcoin is an environmental disaster, but this pro-Bitcoiner standing in front of me has cherrypicked two counter-examples, probably written by bag-holders.”

Sharp details bring the big animal into focus.

Instead say “We now have four years of data showing that Bitcoin has reached 56.7% sustainable energy use, more than any other industry.”

Say “It is estimated that Bitcoin has already helped 329,000 refugees set up financially and preserved their wealth in a new country.” For good measure you could add “over the next ten years, there will be an estimated 9.2 Million refugees who use Bitcoin to help re-establish themselves financially in their new country”

Say “The majority of contemporary academic research on Bitcoin and energy show, 12 of the last 14 peer reviewed papers, show that Bitcoin has strong, quantifiable environmental benefits that can help counteract climate change and decarbonize the grid.”

In 2022, a lot of the sustainability data I needed to orangepill people who had ESG objections to Bitcoin didn’t exist, so I set about building a model to measure Bitcoin’s sustainable energy use. That took a long time, and I don’t recommend that as a strategy unless you have a lot of time, a strong calling, and really like building data models! But definitely use the data that other people have created, just use it in a well quantified form so you do not squander the effectiveness of their proof of work through a hazily quantified delivery.

Based on the results, which included the Financial times picking up a number of my quantified messages, this seems to work.

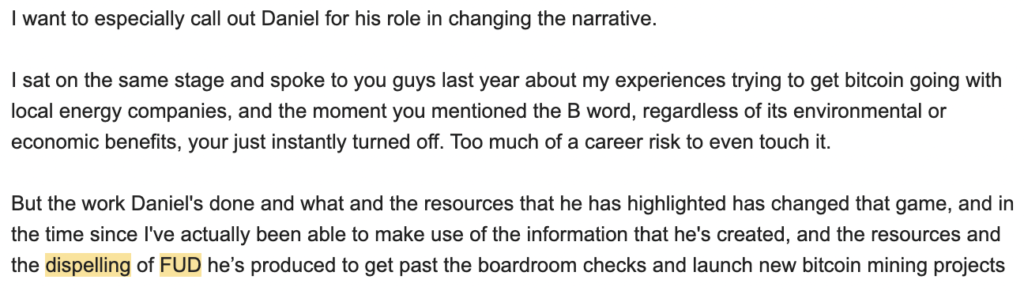

Many plebs and mining companies over the past two years thanked me for my work, but I didn’t create most of the data apart from the BEEST model. The bulk of my work involved creating better qualified messages that reflected existing work. For example, apart from a co-author role on one paper, I didn’t write any of the peer reviewed research on Bitcoin, I was simply the first one to add up how many recent papers described environmental benefits. The “majority of contemporary research on Bitcoin and energy cites environmental benefits”, and “10 of the last 11 papers on Bitcoin and energy shows strong environmental benefits” soundbite are simple, powerful, and easy for other people to share with others. It stops critics in their tracks because they probably didn’t know that, and it’s hard to argue with. The other thing I did was summarize a one-two sentence synopsis of the key findings of each paper, with references to the original paper. This I have found stops critics in their tracks. Such is the power of quantifying a message. At a Bitcoin mining conference in Australia I got this feedback from the CEO of a Bitcoin mining company, not for the first time.

Other tactics I employed

In sport, offensive strength draws the adulation of the crowd, but defence often wins the game, especially at the highest level. For this reason, I decided to find and rebut FUD articles, sometimes on a daily basis. I believe this has made it increasingly uncomfortable for journalists to write misinformation about Bitcoin and energy. I’ve called out Bitcoin misinformation repeat-offenders, but only ever criticising their work, never them as people (mindset matters). 80% of these journalists are no longer writing about Bitcoin and energy at all. When a new journalist writes some nonsense, I make sure that on every social media platform possible their errors are called out, with supporting evidence. I also spoke to journalists as they started to show cautious interest in the emerging truth. My intention was to arm many Bitcoiners with as many well quantified facts as possible.

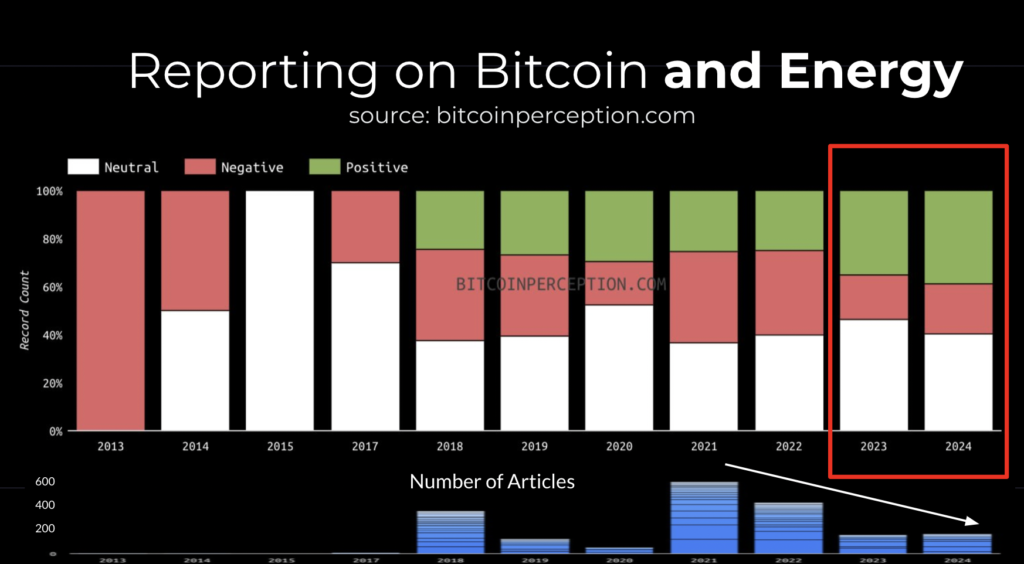

Knowing that we lacked the resources, the reach and the megphone of mainstream media and GreenpeaceUSA’s $5M of funding, we had one thing going for us: truth. But truth is not enough, we had to win by being more sharp and more clear with the conveyance of this truth. Consistent, repeatable, quantified messages started to pay off as other Bitcoiners recycled these messages and used them to overwhelm misinformation with facts. You can do this too. Many of you already are. We’ve made outstanding progress on changing the Bitcoin & Energy narrative as we can see from this chart.

source: Bitcoin Perceptions

However, there is still a plethora of “it’s a ponzi”, “no inherent value”, “not scaleable” misinformation that persists. If you take these same principals and tactics I’ve applied to Bitcoin & energy FUD and apply them to countering other types of Bitcoin misinformation, we will start to see Bitcoin misinformation atrophy across the board.

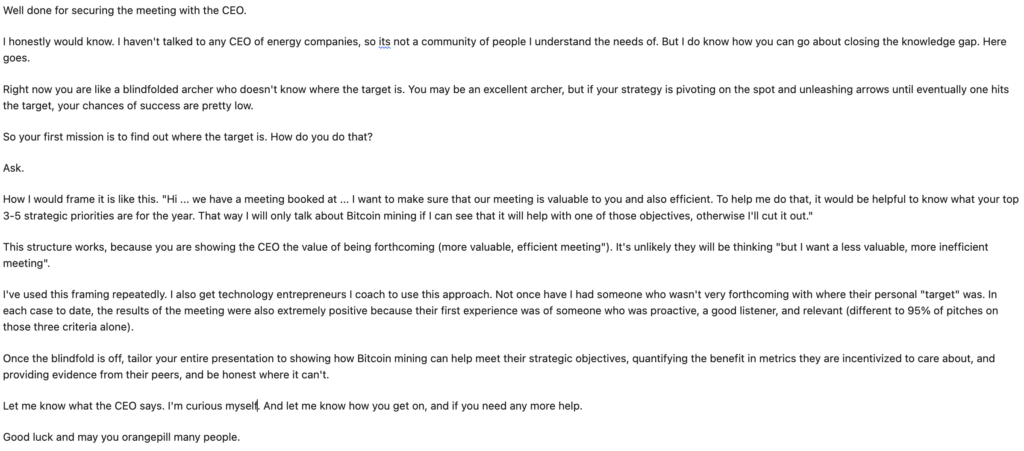

3. Avoid blindfolded archer syndrome

Today, someone messaged me, excited that they had secured a meeting with the CEO of an energy company to discuss Bitcoin mining, and asking me for advice on how to orangepill him. Here’s how I responded.

We can apply this numerous ways. For example, when someone approaches me and says “I’m thinking about getting into Bitcoin, but I want to know a bit more. Can we chat?” my answer is generally “Sure. There’s a lot I could say, so I want to make sure I do not overwhelm you. Tell me what’s important to you?” I might follow up with a couple more questions first to understand the person’s values. How? Let’s not overcomplicate this: I ask “Tell me a bit about your values.” What I will say to a liberal, environmentally minded person who values social justice is very different from what I’ll highlight to an economics student trained in Keynesian economics. Both replies will be true, but only one will be relevant to each person. It’s also worth digging into the nuances. I would follow up the former person by asking “what forms of social justice do you care about most in the world?” Again, “Children working on open dumps in Cambodia” means a different response to “reducing income inequality in my home city”. And yes, Bitcoin can help both communities.

The big idea is this: most of the successful strategies we can use to influence other people are not some complex super-move, they come down to consistent execution of the basics. Asking, framed well, is often the most important conversation you can have.

Get used to discussing what they need to hear, not what you like to say.

4. Questions > statements

If someone quotes energy consumption and/or emission numbers at you that are out of date, pause and respond “Yes I am aware of those numbers. <Pause>. Are you aware that those are old numbers and that Bitcoin’s energy consumption figures and emission numbers have now been revised down?”

If someone says “Bitcoin uses too much energy”, do not say “But have you looked at other industries? Bitcoin’s energy is just a rounding error (what Michael Saylor said). Instead say “You are right. Bitcoin mining uses a huge amount of energy. Are you aware that most environmentalists say that we need more of the right type of energy consumption at least in the short term to achieve net zero emissions? <pause> And it turns out Bitcoin is the right type of energy we need more of, for five reasons. Would you like me to take you through them?”

Alternatively you could say. “Yes, Bitcoin uses a huge amount of energy. Are you aware that prominent environmentalists such as Saul Griffiths in his book Electrify have argued that a base condition for the renewable transition occurring is that we need more energy demand? <pause> And did you know that the type of energy demand most needed is flexible demand, which is exactly what bitcoin mining provides?”

Did you know that bitcoin mining is the only industry in the world that mitigates 7% of its entire emissions without offsets?

If someone says “Well, even if it’s using more sustainable energy and creating fewer emissions, that only proves that it’s less bad for the environment.” Say “You are right. The fact that it generates fewer emissions does not in itself mean it’s good for the environment. <pause> Equally, we’ve only looked at negative environmental externalities so far. Do you think as a principle that when evaluating any new technology we should consider both its drawbacks and its potential benefits, or do you think we should only look at its drawbacks?

They will respond words to the effect “Well of course we should look at both?” or “Well of course both, but there are no positive benefits”

in which case you could simply ask “How do you know?”

Whatever they respond, you could continue, did you know that out of the last 11 peer reviewed papers on Bitcoin and energy, 10 of them discovered environmental benefits? Not theoretical benefits, but actual measurable benefits that are helping decarbonization goals today?

Alternatively you could say “Are you aware of the benefits of bitcoin?” then “Would you like to know? then “Did you know that there are 21 environmental benefits from bitcoin?”

If someone quotes the Whitehouse’s 2022 report on cryptomining, don’t reply “That’s propoganda, put out as part of Operation Chokepoint 2.0” (while probably true, its also likely to be dismissed as your non-evidence based opinion by the person you’re speaking to.

Similarly, if someone quotes some mainstream media article who has reference an Alex de Vries article, don’t say “He’s a central bank employee who’s got a vested interest in attacking Bitcoin.” Instead, respond by asking

“Yes they did say that. <pause>. Do you know who was the major source used for that report?”

And you know that the models he used have now been debunked on 4 separate occasions in academic journals?

Don’t quote them, it’ll make you look like your intention is to be right, not to help the other person close a knowledge-gap, but for your reference they are (Masanet et al. 2019, Dittmar et al. 2019, Sedlmeir et al. 2020 Sai & Vranken 2023)

Case Study: orange-pilling a pension fund

Firstly, I would recommend that you find someone highly knowledgeable about dealing with pension funds, to accompany you. Once you’ve done that, be curious and ask a lot of questions about what they are seeking to achieve on behalf of their investors into the fund. Don’t presuppose Bitcoin is right for them. It might not be. State this, so they can see you are there to educate not evalgenize. One of the key questions is the time horizon. At some point you pass the whole fund over to the insurer. How long does the fund have to run? If it is one year or less, that’s too short a timeframe for Bitcoin to be the right solution for them given its volatility. But if it’s closer to ten years, it would be risky not to hold Bitcoin.

- Model different percentage allocations to Bitcoin including 3% allocation and see how it met their overall fund objectives. What this will show is that in the Worst case (Bitcoin goes to zero), it will take an extra 3 months to reach their investment return objectives over a 10 year period. But in the best case it will take 8 years, rather than 10 years. So it will either go Really well or a bit bad.

- Remind them that you’re helping them shortcut their learning curve, because a private individual will take longer. They will make mistakes, buy NFTs and alt coins and trade them and Bitcoin using leverage, get rekt, and then return to what they were told to do in the first place: Hold and don’t sell.

- Part of what gives them comfort is that others are doing it, so let them know which peers are doing it.

- Show them how increasingly for institutional investors including Blackrock, this is considered part of normal portfolio allocation

- “In five years it will be normal. So very exciting to be at the front of this”

- Because they care about risk, show them how it is risky not to hold Bitcoin, because, if money premium comes out of other assets which the pension fund is holding (real estate and equities) they are essentially unhedged in the event that Bitcoin moons. This means that not only do they miss out on Bitcoin, but they see the value of their other assets reduce, because the investment into Bitcoin will directly come out of other asset classes they hold (black hole theory). Therefore having 0 bitcoin is the riskiest position, and the question becomes not “should you hold Bitcoin” but “how much bitcoin do you have.”

- One of the biggest challenges is “how do you custody?”

- Show them how the ability to hold an asset outside the current financial system and without counterparty risk is therefore diversification of risk that may happen in the world in the next 10 years (war, unwinding of US dollar dominance, rising fear of US debt levels, money printing). If they want to allocate to Bitcoin through an ETF, point out “Given that this is one of the few bearer assets that you can hold, why would you not want to reduce your counterparty risk by doing it?”

If you are thinking, “Daniel knows a lot about pension funds, I don’t have the domain knowledge to even know where to start” – not so. Yes I know a reasonable amount about sovereign wealth funds, a little more about family offices, and a more again about impact investment and ESG funds. But I know perhaps 45 minutes more than you about pension funds, because I spent 45 minutes listening to the right podcast, which was by Jordan Walker, interviewing Sam Roberts, director of Cartwright, who orange-pilled UK’s first Pension Fund.

5. Highest probability of deepest impact

Once I asked my coach what means of communication I should use, when I was seeking to change the mind and heart of someone in the technology industry. His reply has stayed with me to this day “What form of communication has the highest probability of the deepest impact?” It was clear that I had to talk to this person, not email him. Often we use the weakest medium of communication when seeking to influence someone, public online exchange. Why do we do this? Because it is convenient. I’ve fallen into this trap of convenience myself, despite the fact I know better. Asking the question “what has the highest probability of the deepest impact” makes doing what’s comfortable and convenient, uncomfortable. Private text message is more powerful than public online exchange. Spoken one-on-one is more powerful than text one-on-one. One-to-many is more powerful than one-to-one (generally).

That’s one of the reasons I speak at a lot of events. There are upwards of several hundred people, in an undistracted setting, who for 20 minutes get to hear me speak on a topic I’ve been working hard to present as effectively as I can, after some person has introduced me as having expertise in the domain I’m talking about. Not only is this more efficient, it creates a vibe in the room that is hard to create one-on-one. That vibe, that energy, is part of what influences people.

Recently, someone messaged me who had used this approach himself. He reflected on exactly the same phenomenon.

6. Framing is everything

My coach also once told me “There is no conversation you cannot have, as long as you frame it right.” This one truth caused me to lean into many courageous conversations I otherwise would have avoided. It’s why I had multiple conversations with Josh Archer, who at the time was head of GreenpeaceUSA’s Change the Code campaign. It helped me to stay in rapport with him while pointing out numerous factual errors in the campaign. It’s why I felt able to suggest they drop the campaign. Josh ended up leaving the campaign shortly after our second meeting, and GreenpeaceUSA suspended the entire campaign (from what I can see) on 14 June 2024.

The framing I now use when talking about the ESG merits of Bitcoin to skeptics is to show them the non-obvious truth: that New technology negativity bias is a rite of passage

On a recent podcast, I joked “It took me two months to work out that Bitcoin was net positive for the environment, two years to work out how to explain that to others.

This was somewhat true. While I’d had some successes orange-pilling people, it wasn’t happening at the speed or the volume I knew was possible. I saw others having the same struggles. When I asked those who had given talks to groups of non-Bitcoins about Bitcoin and ESG for example, the typical answer was “It went well. People were open to what we had to say, and we’ve opened up a good dialog. It will take time to change minds, but the work has started on a good footing.”

Let’s be clear: this is a very bad outcome. Of course, while you have an hour of people’s time, you can expect a temporary softening of their position. However, history tells us that if the response is this lukewarm, there is a high likelihood they will quickly revert to their original position once surrounded by their tribe, their old information sources.

Coming back to intention, what if we set a bolder intention? What if we set the intention that skeptics were not just “more open” at the end of our talk, but had fundamentally and permanently flipped their position? Why should this be an unreasonable goal to have? In my book “on pitching”One Pitch“, I write about the importance of setting a bold intention, giving the example of when in my third capital raise for my first technology company, I had the intention not only to gain investment but to inspire the audience, and how this intention caused me to do deliver my pitch in a way that was well outside my comfort zone. At the end of the talk, the most frequently occurring piece of feedback was “inspiring”.

So when I was invited to pitch Bitcoin to a group consisting of the principals of Family Offices in EU recently, I set this intention in mind that they would flip completely and permanently by the end of the meeting.

The brief I was given was a typical brief I hear from institutional investors and Impact Funds, “They all want to invest in Bitcoin. They all believe they can’t because of the ESG story.” I decided that I had to use a new approach. There had been so much misinformation about Bitcoin and energy, that tackling it point by point would take too long. I know, I’ve tried, here. My document is informative, but it is not persuasive. It serves only as a follow-on to answer specific objections, once someone already believes that Bitcoin is net positive for the environment, but it cannot flip their belief-system.

A new approach was called for. So I went back to an intuition I had way back in 2022 which I hadn’t explored because I knew it would take a lot of time and research. I went back to researching the history of how all disruptive technologies are appraised by experts and the media during the first 10-20 years of their emergence.

This approach proved to be the game-changer. You can see the framing at the start of this keynote I gave in Frankfurt and Amsterdam.

Now, rather than combat media misinformation from the media article by article, I had a truth-hammer that could show why even someone who generally had high trust in mainstream media should disregard everything the media had ever written about Bitcoin & Energy.

You can tell how well a pitch has gone from the quality of the questions afterwards. “So, what was the point about Bitcoin being able to obviate gas peaker plants, sorry I don’t know much about grids so I didn’t quite get that, could you explain” is a very bad question to get. It says you haven’t succeeded in explaining ideas in language that laypeople can understand, let alone influence them of their value.

“How do we know that it was Bitcoin that was responsible for Texas not needing gas peaker plants?” is a better question, but still bad, because it means you did not show the evidence why it is certain that Bitcoin mining was the reason for this pivot in strategy from the grid operator. “You make the point about gas peaker plants, but I’m wondering “Can this work on every grid, or is it only a solution for Texas’ grid?” is better again, but still bad, because it means you failed to say “this is not just a solution for Texas, but every grid in the world. In fact, here’s how Bitcoin mining could obviate the need for gas peaker plants worldwide.” “It sounds so good. Are there any problems with Bitcoin mining”, “So what’s the best way to invest?”, and “Can you tell us more about Microstrategy’s corporate playbook?” are the right type of question, because it means they have fully accepted your information as fact, modified their belief system completely on the basis of the new information, and are now looking to build upon this understanding by taking actions that align with their new world-view.

When I heard those questions, I knew that finally after two years I had found the way to orange-pill people, particularly ESG-skeptics, in a way that had the highest probability of the deepest impact. Happily, its also proven reproducable, with two people writing back that they have used this specific framing to excellent effect.

As we speak, the originator of the message above is talking to the ministers of a mid-large sized nation-state about a Bitcoin strategic reserve, and nation-state bitcoin mining to stabilize their grid / monetize stranded renewable energy.

We’ve also heard that one of the Family Office principals who sits on the board of a major airline is now proposing to her board why they should adopt MSTR’s Bitcoin treasury strategy.

7. Apply feedback and iterations, calmly

Orange-pilling is not something you are either good at or not. It is like playing tennis. You get better at it if you play the game more. You get better faster if you not only play the game, but review your performance.

So review your own game footage, whether that’s a talk, a podcast, or a zoom session. If you’re not sure it’ll be recorded, ask. If you’re not sure how to ask, frame it. For example, you could say “I’m wanting to make sure that each time I explain Bitcoin to people I improve, so would it be OK if I record this, for my own learning?”

When reviewing, I ask myself two very simple questions

- What went well (things I can re-use, that I otherwise might have not re-used)

- What would I do differently next time?

When I look back on how I used to explain the benefits of bitcoin, to how I do it now, I’ve improved a lot over the last two years, and that is in part due to going through my game footage with these two questions in mind.

All of this could fail however, if you don’t remain in a calm state-of-mind while doing this and applying the other points above. You’ve proabably notice that the people whose voices you trust are capable of discussing ideas while maintaining respect for the other person’s position. This is easy to say, but hard to do! It’s particularly hard to do when it’s a subject you care about passionately. Toxic maximalism may help existing bitcoin Hodlers to keep the faith during a bearmarket, or help others steer clear of an altcoin scam, but it’s not the vibe that will enamor the early majority to Bitcoin. The single best way to keep the state of mind necessary to remain objective, respectful and focused is meditation. It’s the one thing that has enabled me to remain resilient when my own work and motives have been questioned in some pretty ad ad hominem way, and its as legitimate a tool of your orangepilling toolkit as any in this post. (More on that here).

Appendix: Additional resources

To find out more about pitching…

Grab the book —> How to change the world with one pitch

Resources to help orangepill people

- Keynote talk in Amsterdam, Frankfurt in video form, and in written form. This contains the latest and best version of my energy FUD busting. It is a close variant of the talk that turned around the perspectives of 21 impact investors in an evening.

- How to handle common ESG objections to Bitcoin, with evidence and supporting data.

- List of all articles I’ve published in Bitcoin magazine, many of which have background references and examples of how to orangepill people.

- Sustainable energy charts on Bitcoin (5 charts, co-developed with Willy Woo.

- 1-4 minute sound bites – handling common questions about Bitcoin (taken from panel discussion, main stage, Bitcoin Amsterdam.

link to video (1.52 mins)

link to video (1.40mins)

link to video (3.51mins)