If you’re a fund manager who is establishing an ESG policy, failure to consider Bitcoin in the mix is tantamount to gross negligence on your ESG obligations.

*Not investment advice, this thread is my opinion on the ESG case for Bitcoin after 2 months of due diligence.

If you’re a private investor, not investing in Bitcoin because it “uses energy” is like not investing in solar panel technologies because it “uses energy” (coal in solar’s case) in their manufacture: a 101 level cost-accounting error that fails to look at both cost and benefit, in order to establish a net ESG position.

First some background. I’m a fund manager for an ESG fund. I’ve been investing in novel technologies since 2000. Our tech investment funds have focused on deep-tech solutions that remove carbon from industrial processes. The impact of those technologies will be felt from 2035 onwards.

Reading the latest IPCC and UNEP reports made us realise that we, and by extension, any ESG fund, have an urgent obligation to look at technologies that can have a more immediate impact on climate change.

The result of our research: we’re now looking at making ESG Fund-3 a special-purpose Bitcoin mining fund. We’re also looking at how we help other ESG funds show their wholesale investors that Bitcoin’s ESG story justifies large capital allocations!)

Here’s why:

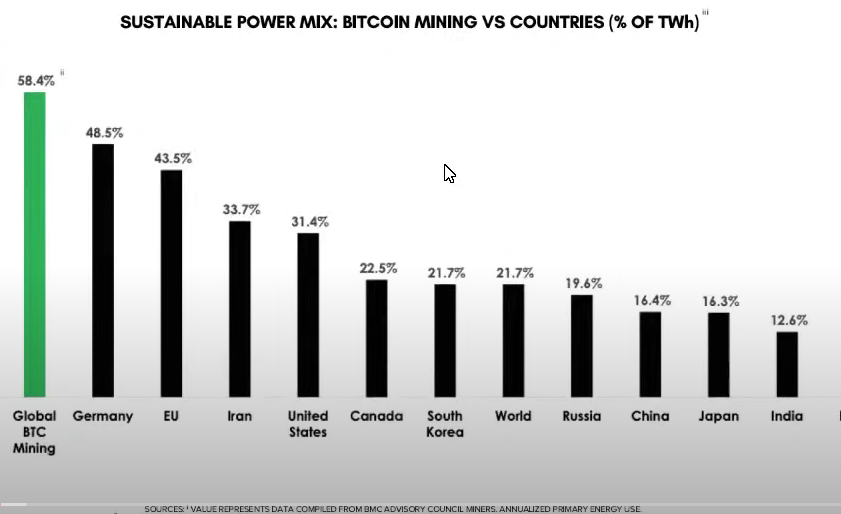

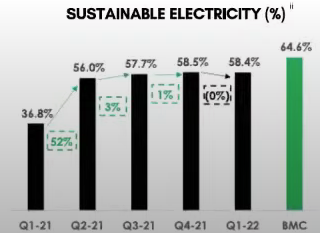

We are particularly impressed that Bitcoin has reached 58.4% renewable energy usage. This is not only higher than any other industry sector, but it is also higher than any other large industrialised country.

It has achieved this in just 14 years, and our research revealed a renewable growth rate of 59% since Q1 2021, and ~383% from 2013. This matters because it can be a “Roger Bannister” to other industries by showing a seemingly impossible speed is in fact possible.

Bitcoin mining’s renewable adoption story can inspire other progressive industry sectors as to what’s possible, and remove the excuse from laggard industries that a rapid transition to renewables is impossible.

More importantly though from an ESG cost accounting viewpoint, we are interested in the net environmental benefits of Bitcoin mining. That means looking at how Bitcoin mining can accelerate rapid measures to reduce climate change

We see two use-cases here:

- Using BTC’s unique time-of-day agnostic features to facilitate a faster build-out of the renewable grid.

- Using BTC’s location-agnostic features to slash methane emissions from both flared/vented gas and landfills

These I’ve covered in separate Twitter threads.

Accelerating the renewable grid build-out

(We’ll be sharing models and calculations over the coming months).

In driving ESG innovations now used elsewhere, Bitcoin Mining again impresses. Eg: Lancium’s “suspended animation” software, which tasks when grid demand is high. The software has attracted the attention of traditional data centres seeking CO2 emission reduction https://bit.ly/39Ln1Ey

We also looked for evidence that the ESG case for Bitcoin can grow exponentially. We again found plenty of evidence. A year ago, there was 1 Bitcoin mining company helping remove flared methane gas. At the time of writing there are 10 (7 removing methane in oil&gas), 1 removing methane from landfills, and 2 using biogas).

Most importantly, we asked ourselves whether other technologies or processes could do the job that Bitcoin does. For example, could flared methane be used for other goods? Could flaring be reduced by better regulation?

We found that no technology other than Bitcoin mining could economically use flared gas, as that would require the build-out of high-voltage pylons @ $2M/mile, or gas pipelines @ $5M+/mile. Further, government regulation of flaring had in some cases caused more venting: a far worse climate problem.

This is a quick summary of a 2-month DD (due diligence process). We realise that not everyone has time for that level of DD, which is why we’re happy to share our models and research with other funds, fund managers and private investors who are looking to make sensible ESG decisions regarding Bitcoin.

Original Twitter Post: 8 May 2022